Tax Preparer Templates

Documents:

1288

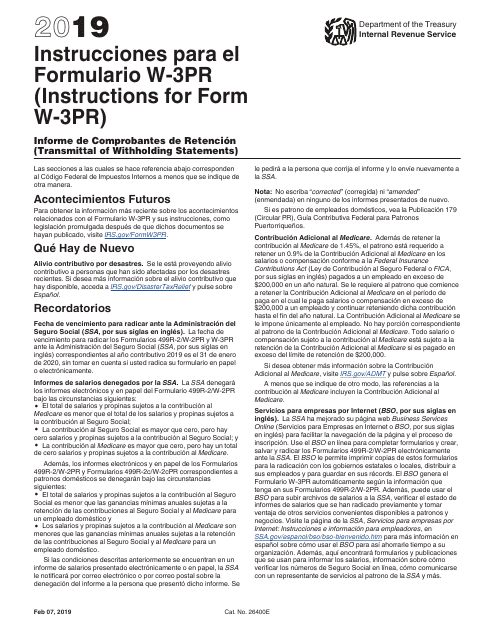

This document provides instructions for completing the IRS Form W-3PR, which is used to transmit withholding statements. The instructions are available in both English and Spanish.

This document is a test for volunteers who assist with tax preparation through the IRS Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) programs.

This form is used for requesting information from taxpayers in New Jersey during a tax investigation. It contains standard questions that the taxpayer must answer under oath.

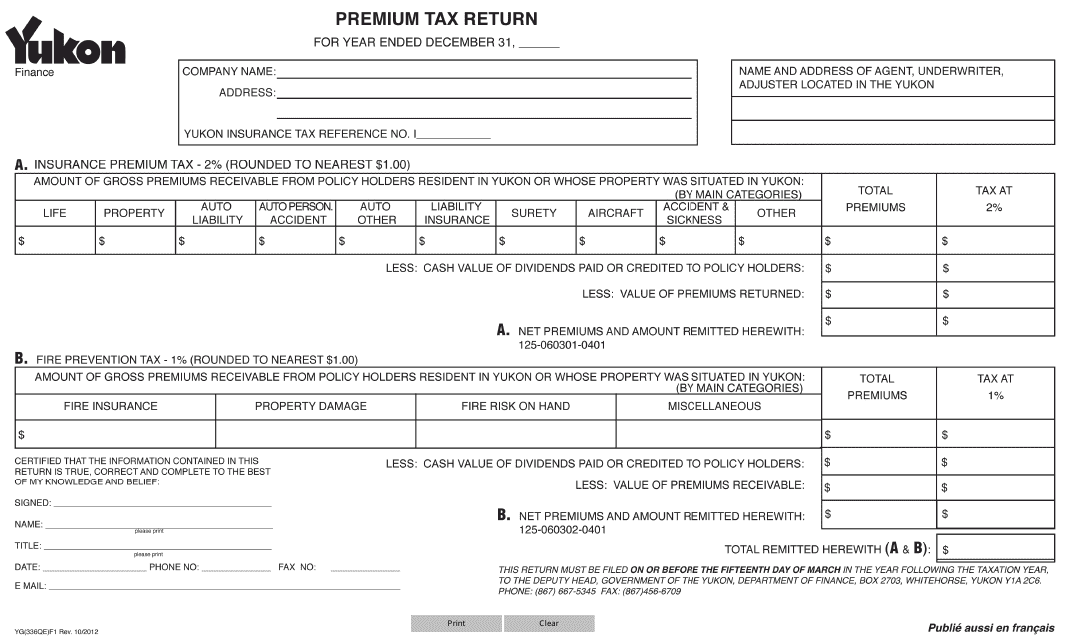

This form is used for filing premium tax returns in Yukon, Canada.

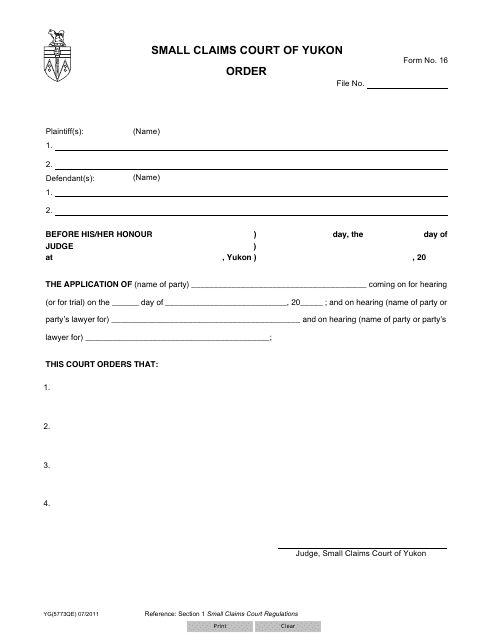

This Form is used for ordering a Form 16 (YG5773) in Yukon, Canada.

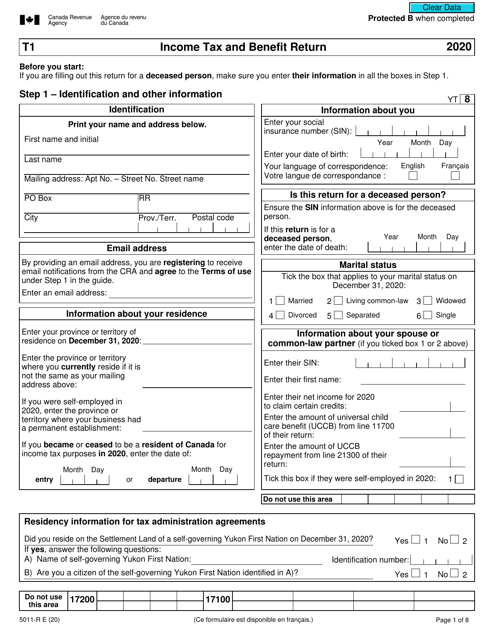

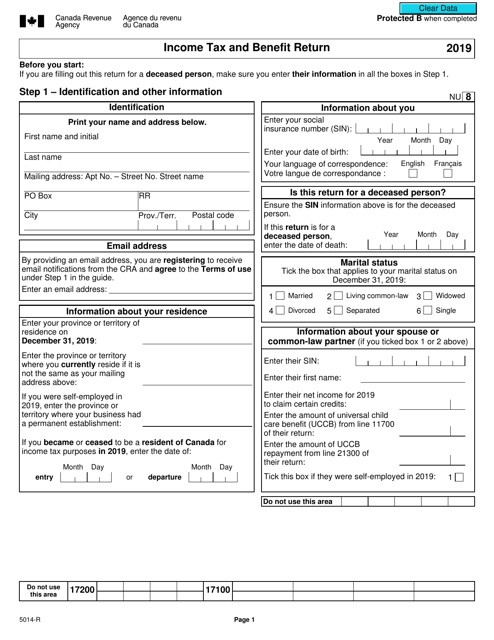

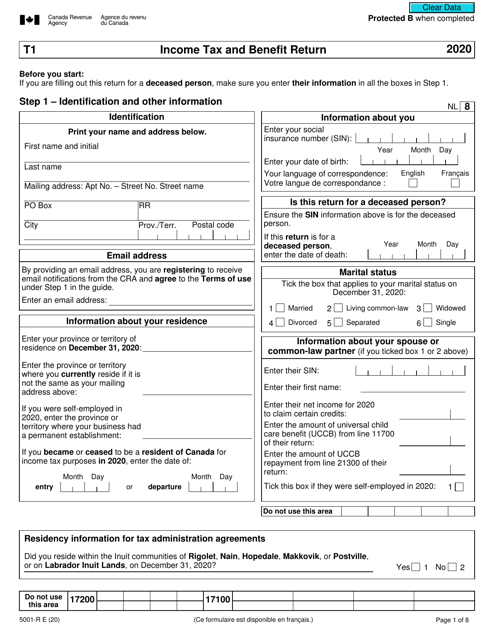

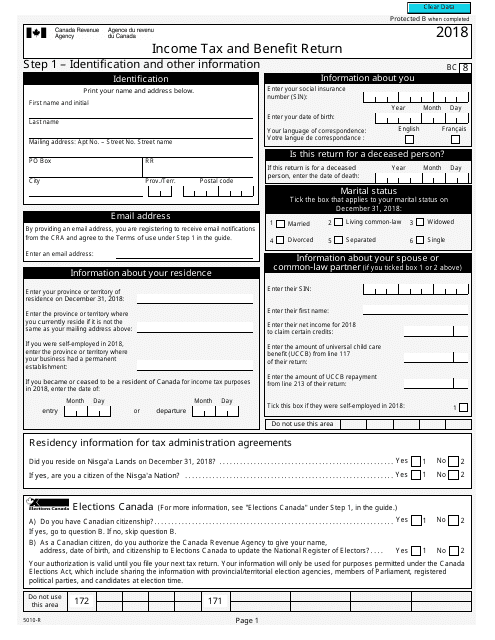

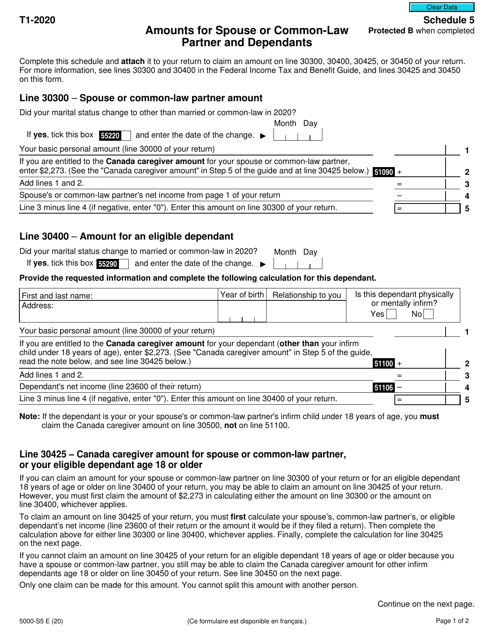

This Form is used for filing your annual income tax and benefit return in Canada. It helps you report your income, claim deductions and credits, and calculate your tax payable or refund.

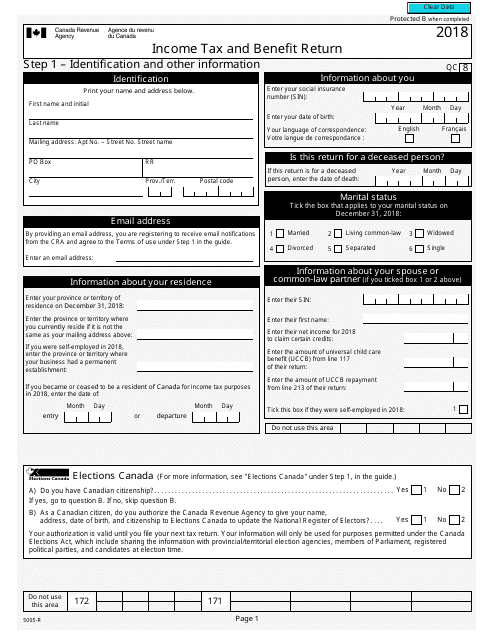

This form is used for filing income taxes and reporting benefits in Canada.

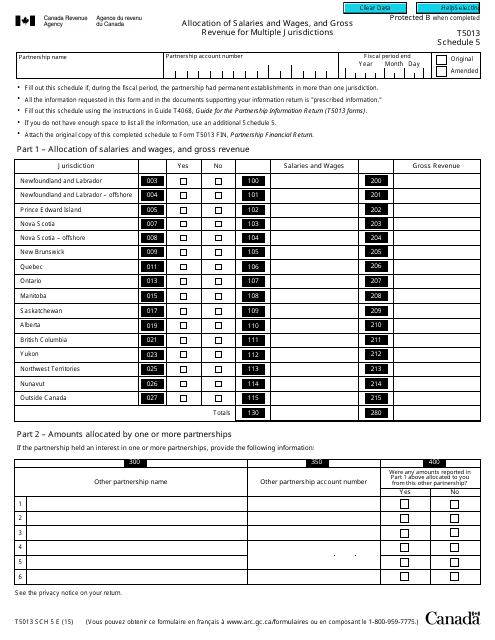

This form is used for allocating salaries, wages, and gross revenue for multiple jurisdictions in Canada.

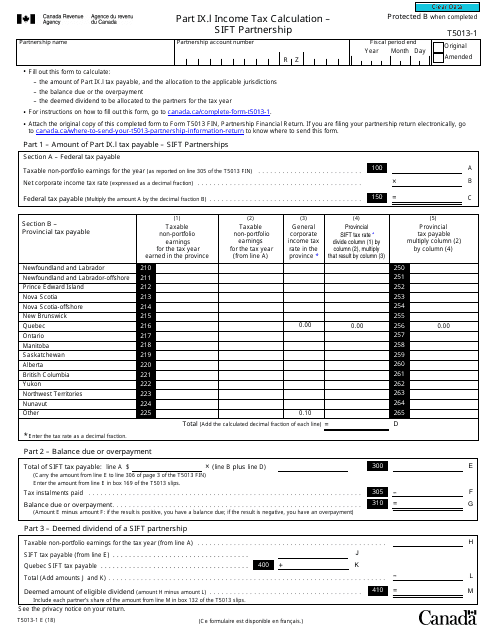

This form is used for calculating the income tax for a Sift Partnership in Canada.

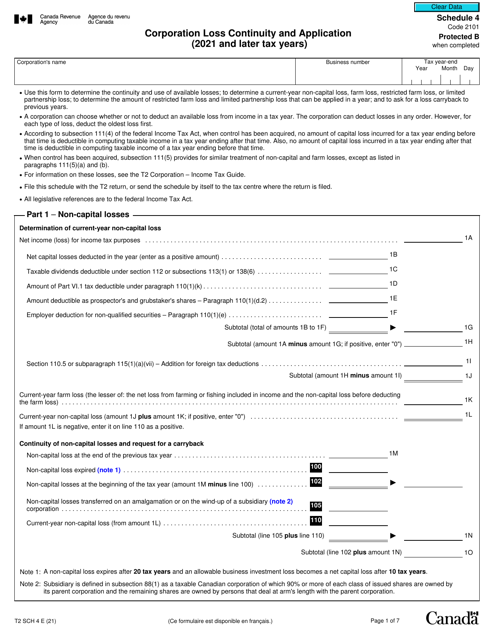

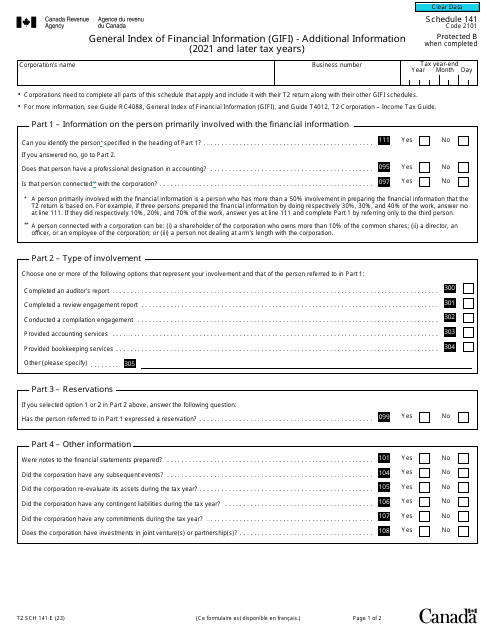

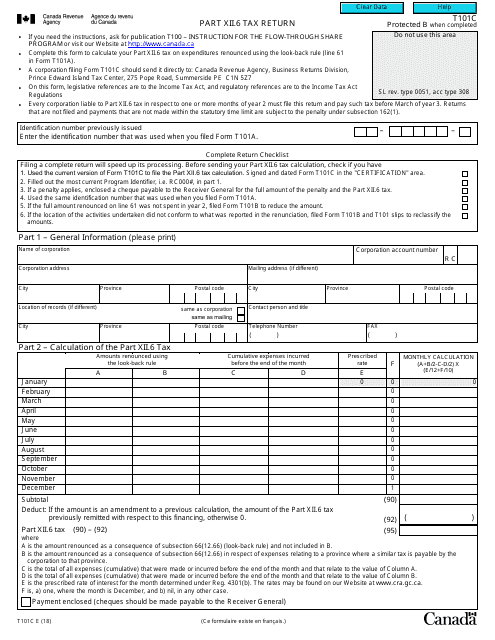

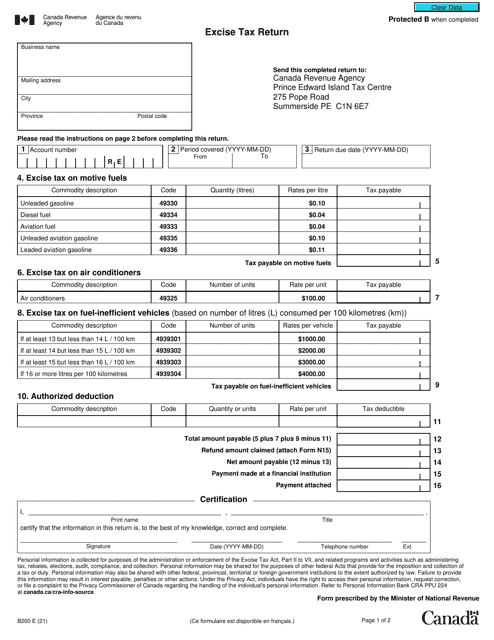

This Form is used for reporting tax returns in Canada.

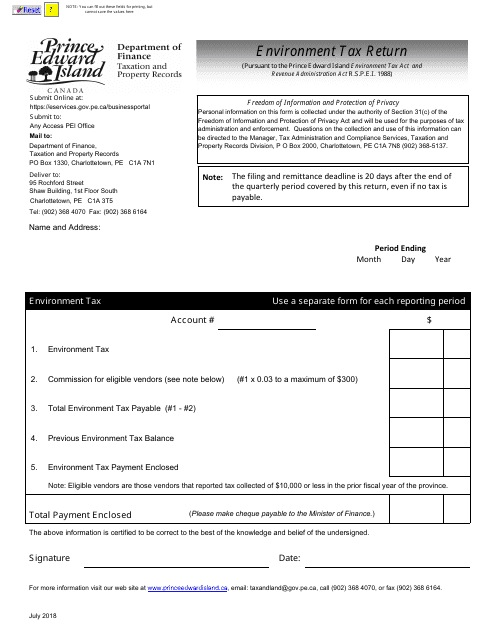

This tax return form is used by residents of Prince Edward Island, Canada to report and pay their taxes related to the environment.

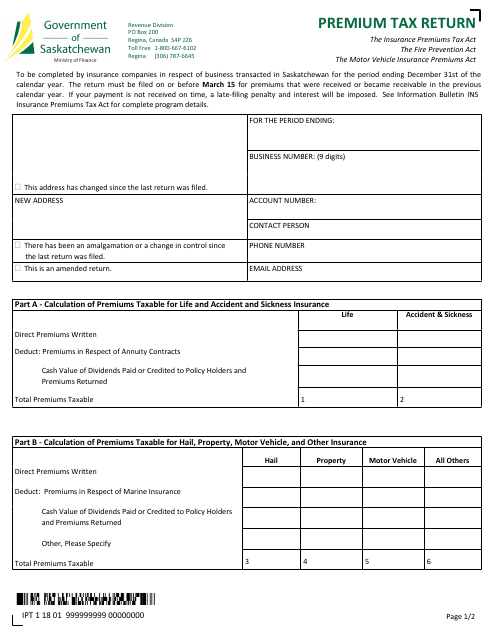

This document is used for filing your premium tax return in the province of Saskatchewan, Canada.

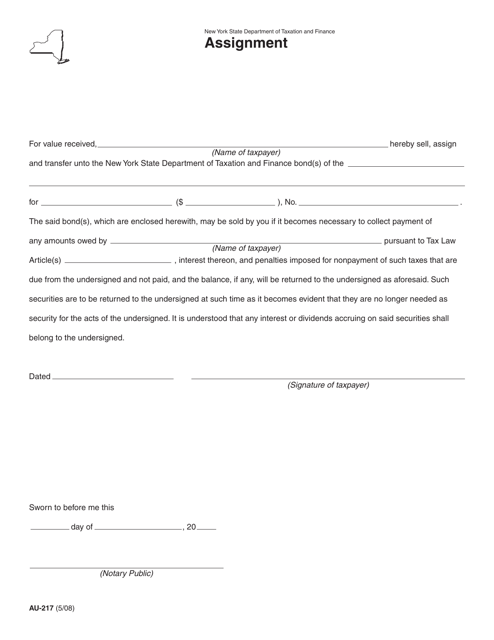

This document is used for assigning a tax lien certificate in New York.

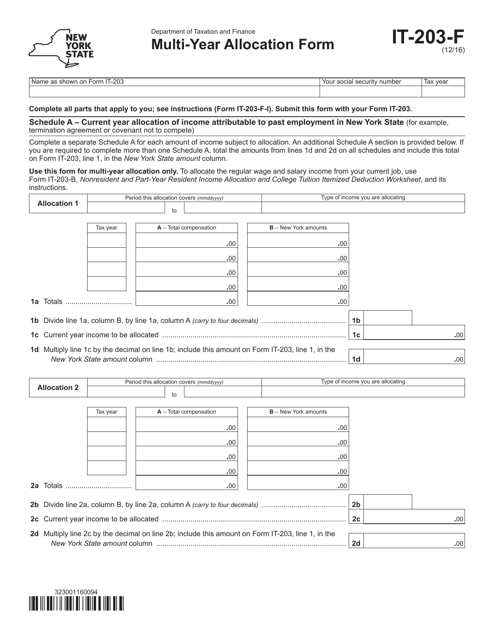

This Form is used for allocating income and deductions for multiple years in New York.

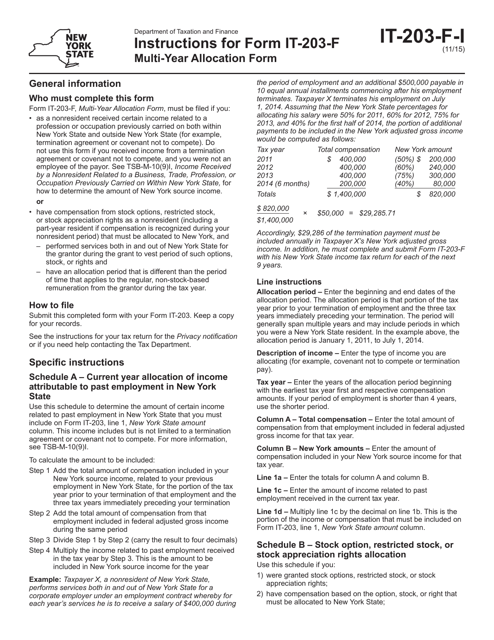

This document is used to provide instructions for completing Form IT-203-F Multi-Year Allocation Form in New York. It guides taxpayers on how to properly allocate income, deductions, and credits over multiple tax years.