Tax Preparer Templates

Documents:

1288

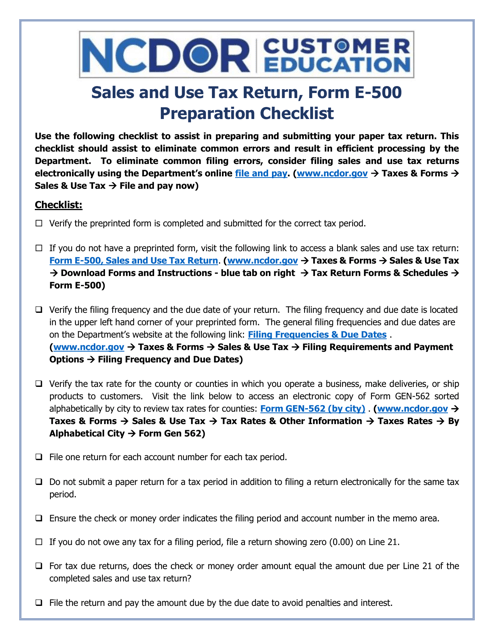

This form is used for preparing and ensuring accuracy of the E-500 tax form in North Carolina.

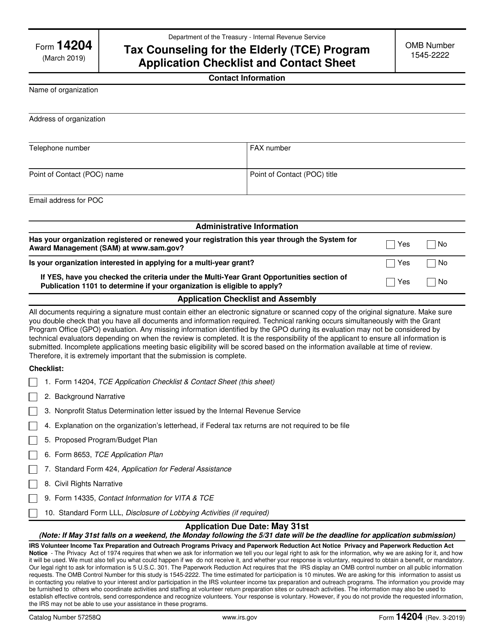

This document is a checklist for applying to the Tax Counseling for the Elderly (TCE) program. It includes a contact sheet for additional information.

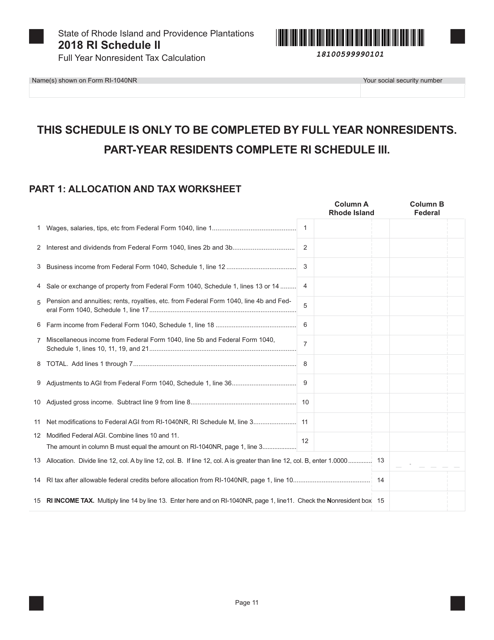

This document is used for calculating the full-year nonresident tax for Schedule II in Rhode Island.

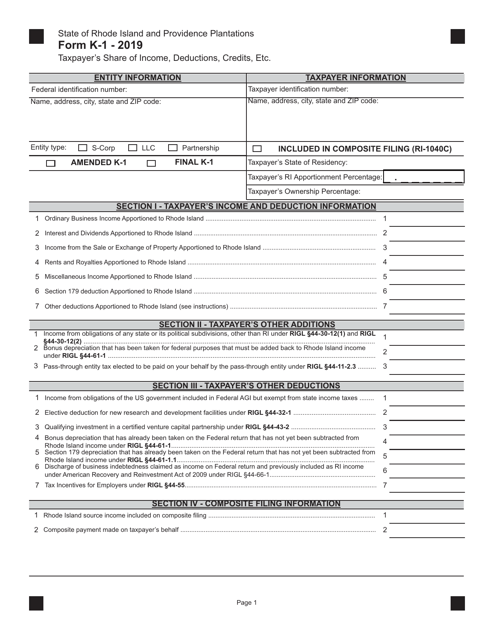

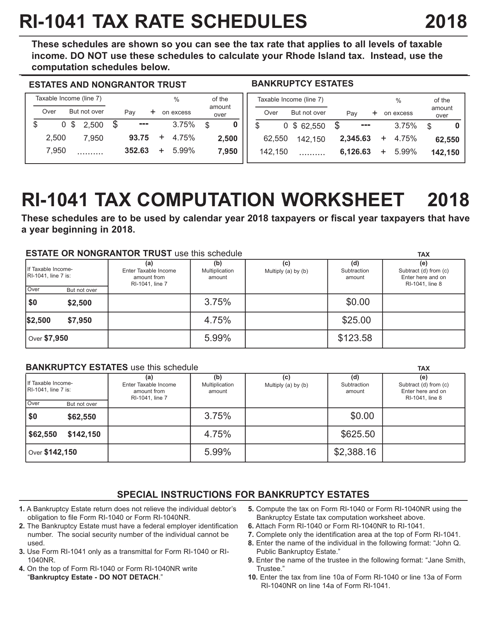

This form is used for calculating the tax rates and liabilities for fiduciaries in Rhode Island.

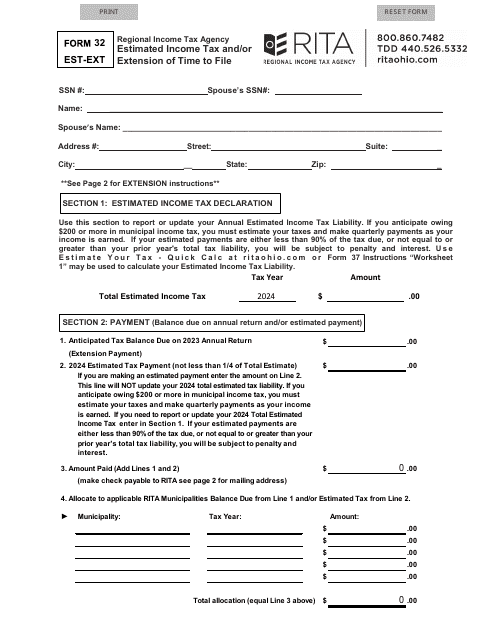

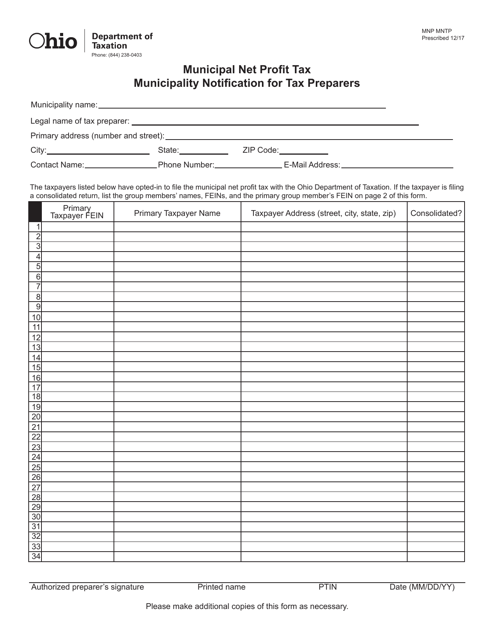

This form is used for tax preparers in Ohio to notify municipalities about the Municipal Net Profit Tax (MNPT) owed by their clients.

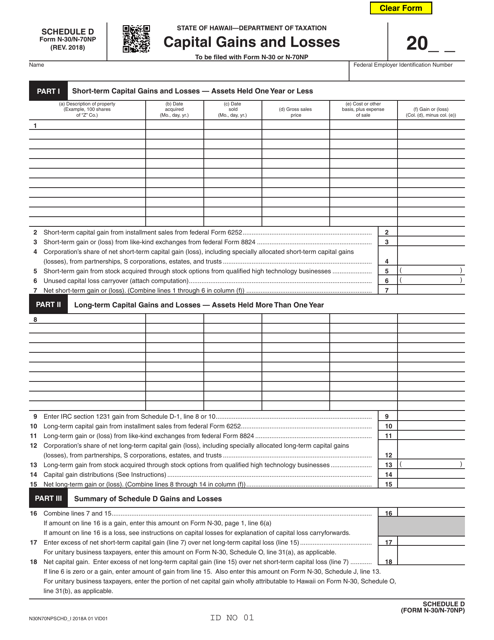

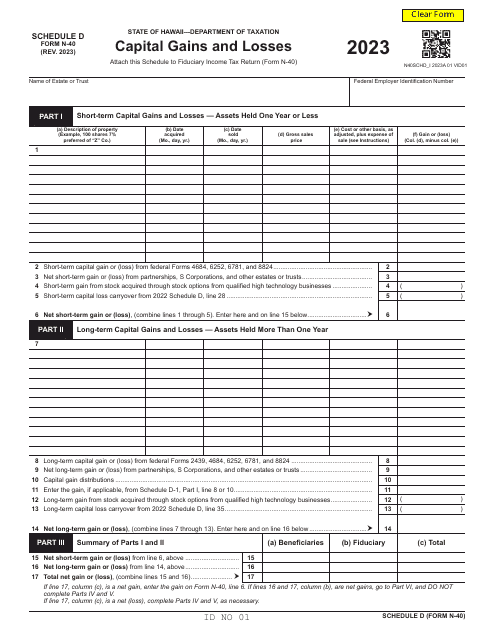

This form is used for reporting capital gains and losses in Hawaii for tax purposes.

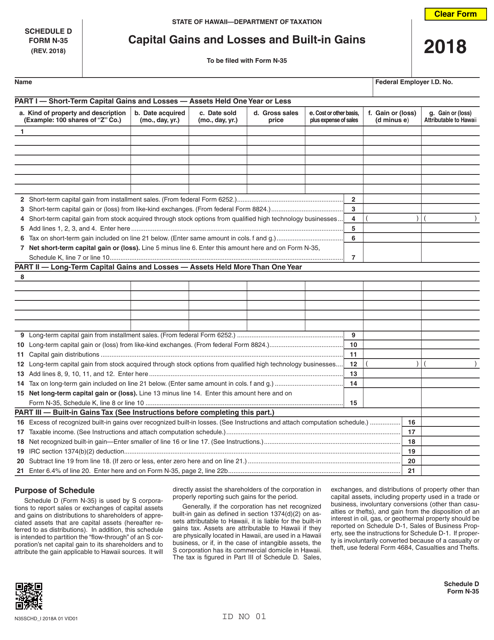

This form is used for reporting capital gains and losses and built-in gains specifically for Hawaii residents. It is a schedule that accompanies Form N-35 for state tax purposes.