Tax Preparer Templates

Documents:

1288

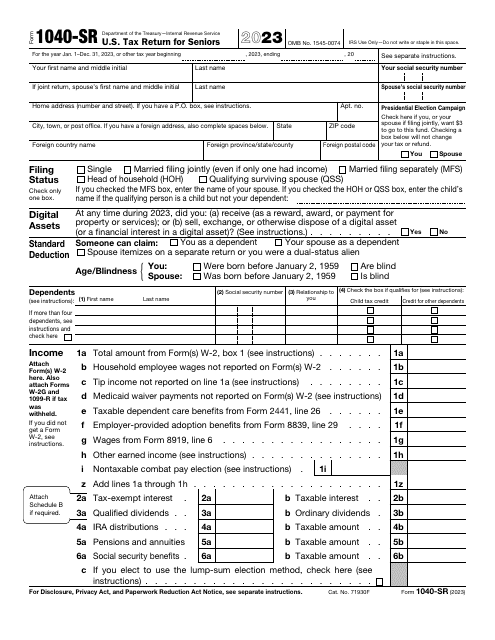

The purpose of this IRS application is to make the process of filing a federal income tax return easier for seniors - the document features larger print, but contains the standard deduction charts.

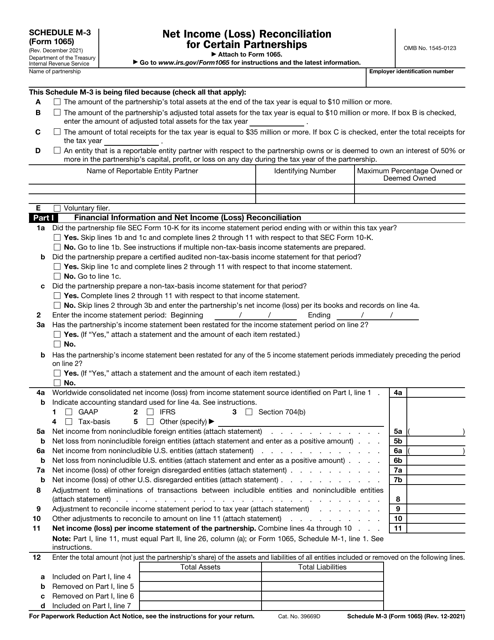

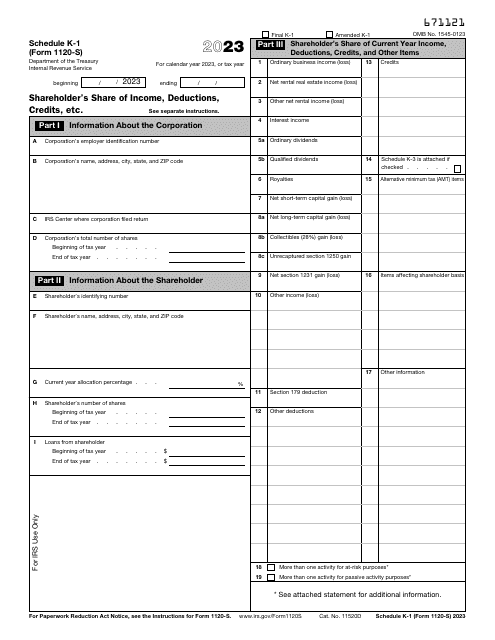

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

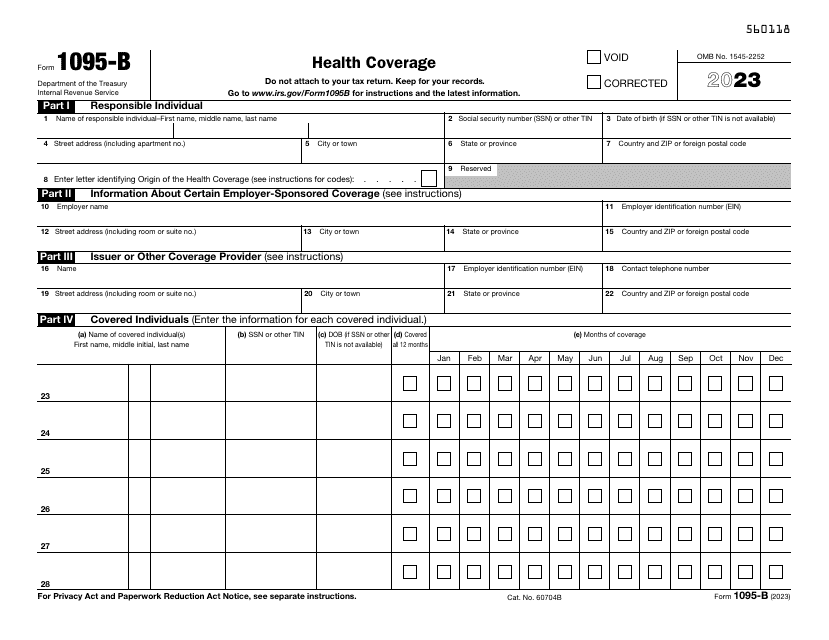

Use this document, otherwise known as the IRS Health Coverage Form, for submitting a report to the Internal Revenue Service (IRS) and to taxpayers about individuals with minimum essential coverage who are not liable for the individual shared responsibility payment.

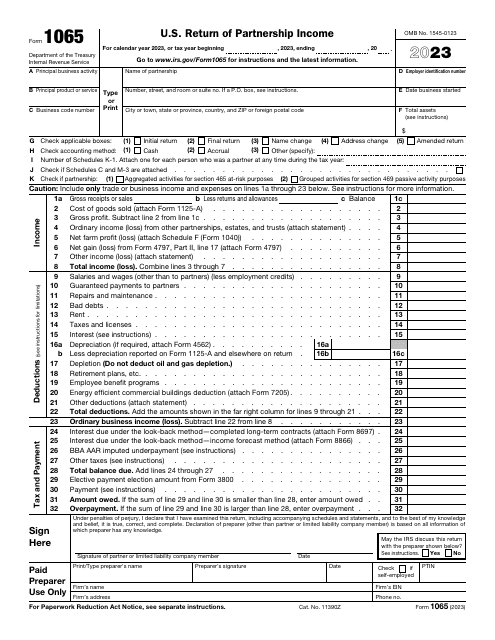

Use this form to report information on deductions, credits, and income relevant to the operation of a partnership to the Internal Revenue Service (IRS).

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

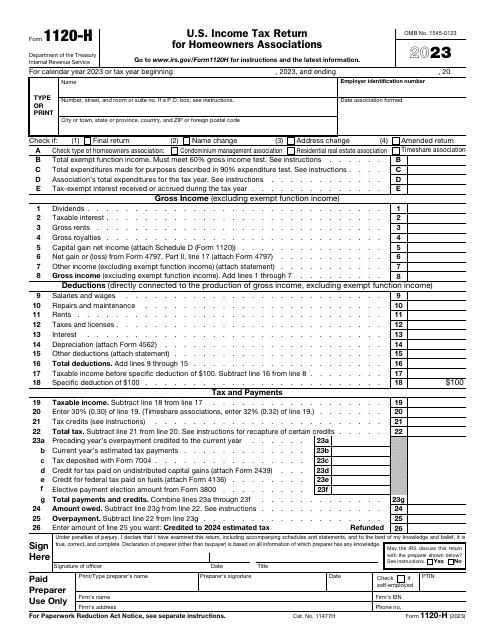

Fill out this form if you represent a homeowner's association in order to make use of certain tax benefits. That means, that the association can exclude the Exempt Function Income from its gross income.

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

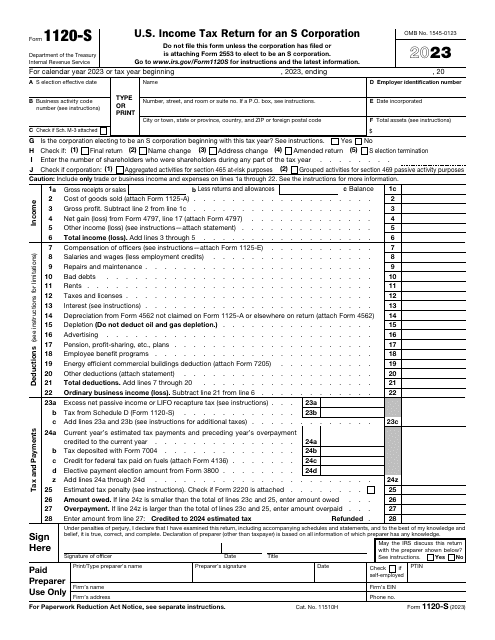

This form is used for reporting income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. The information is sent to the Internal Revenue Service (IRS).

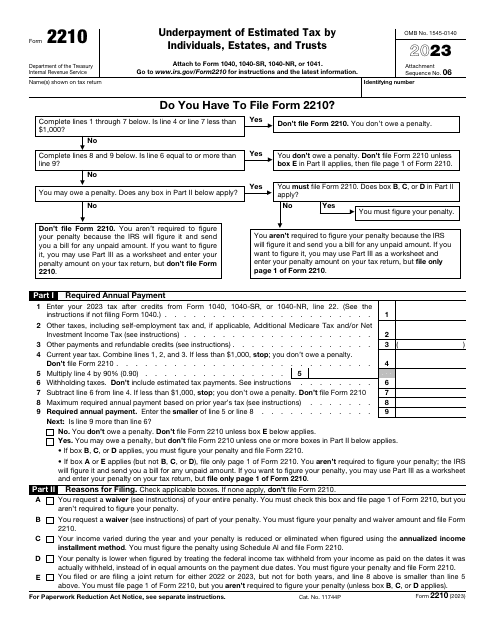

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

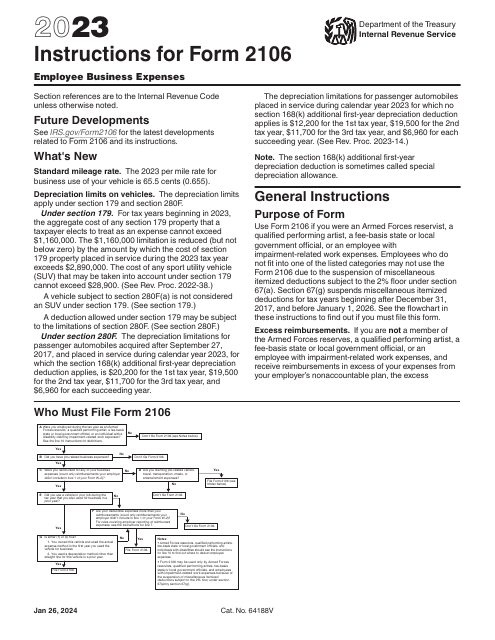

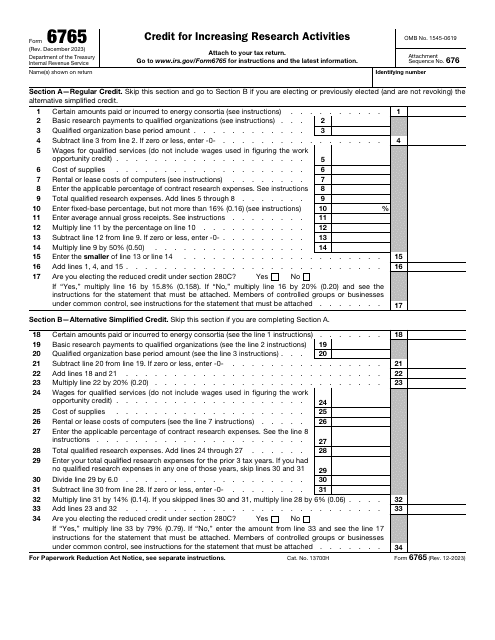

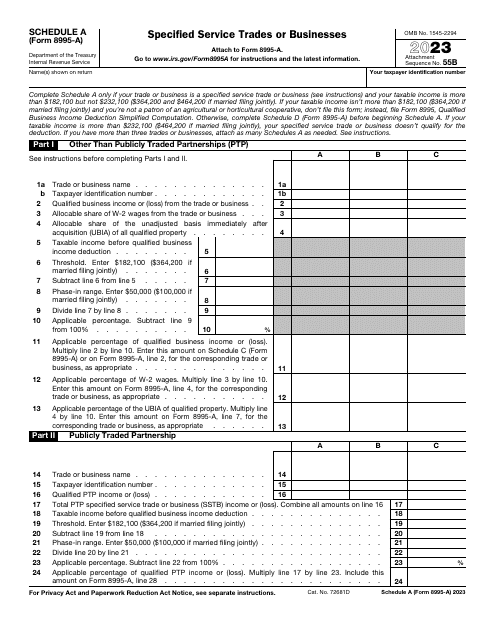

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

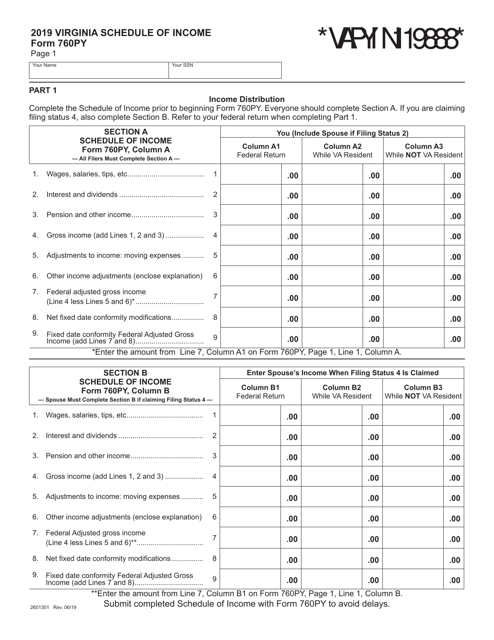

This Form is used for reporting income in the state of Virginia for taxpayers who are required to file a nonresident or part-year resident return.

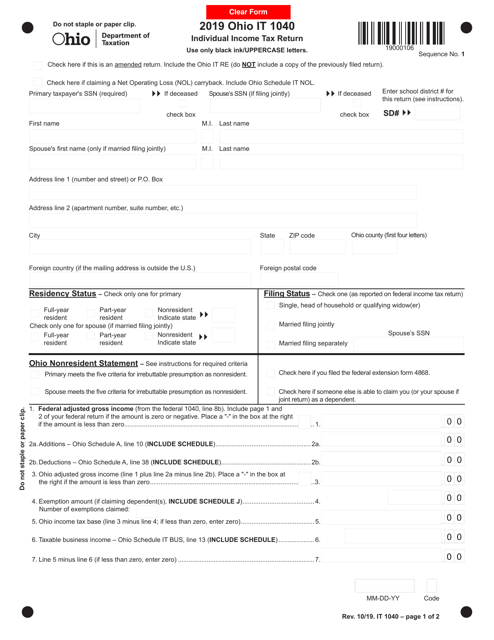

This Form is used for filing the Individual Income Tax Return in the state of Ohio. It is used to report and pay the taxes owed on your income for the tax year.

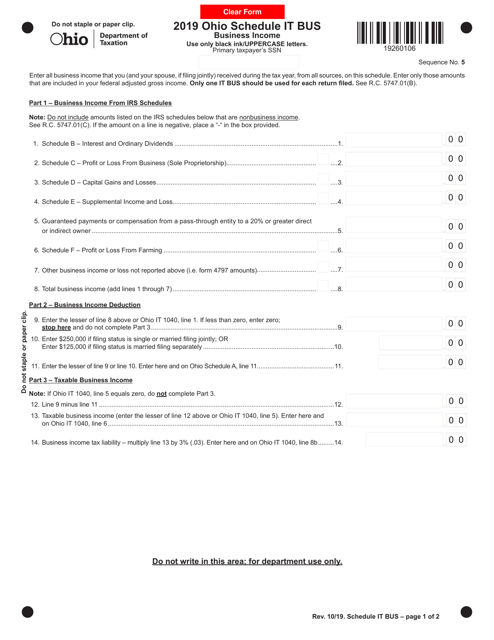

This document is used for reporting the business income of an IT company in the state of Ohio. It is necessary for tax purposes and helps the company accurately calculate their taxable income.

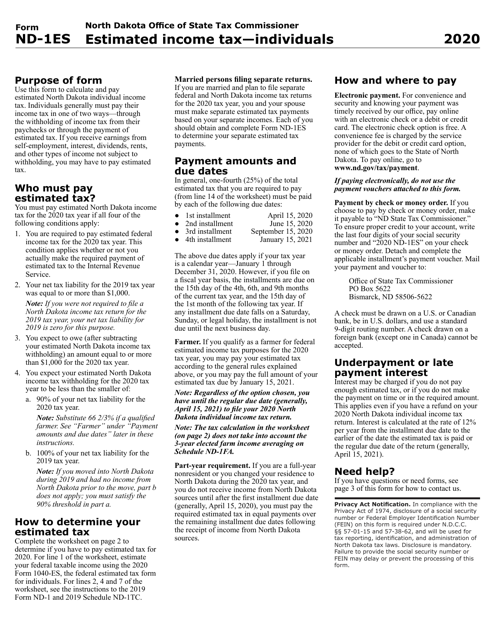

This Form is used for individuals in North Dakota to calculate and pay their estimated state income taxes.

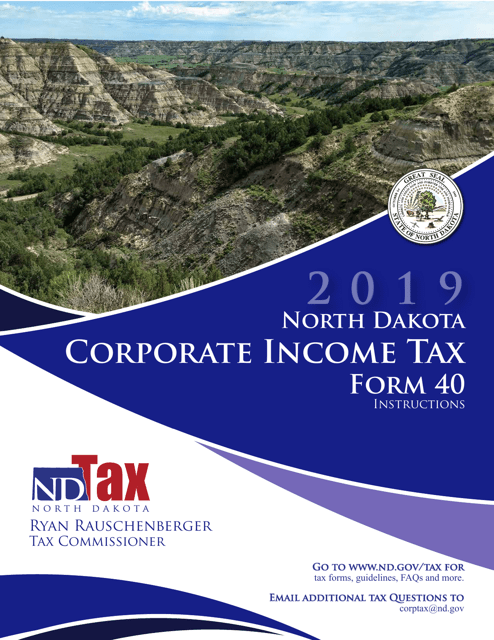

This Form is used for filing the Corporation Income Tax Return for businesses operating in North Dakota. It provides instructions and guidelines on how to accurately report income, deductions, and credits to calculate the tax liability for the corporation.