Tax Preparer Templates

Documents:

1288

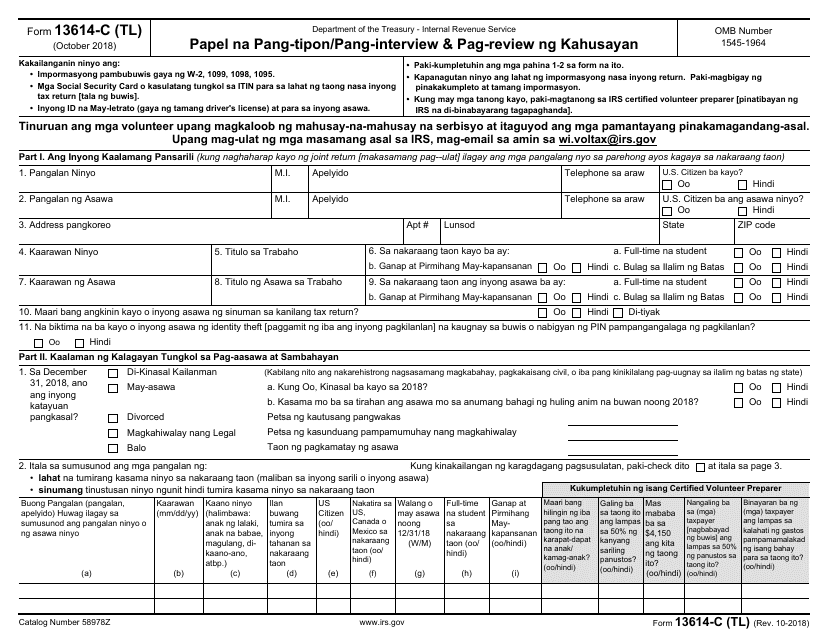

This document is for individuals who speak Tagalog and need assistance with their tax intake process. It is used to gather information about the taxpayer's financial situation for the IRS.

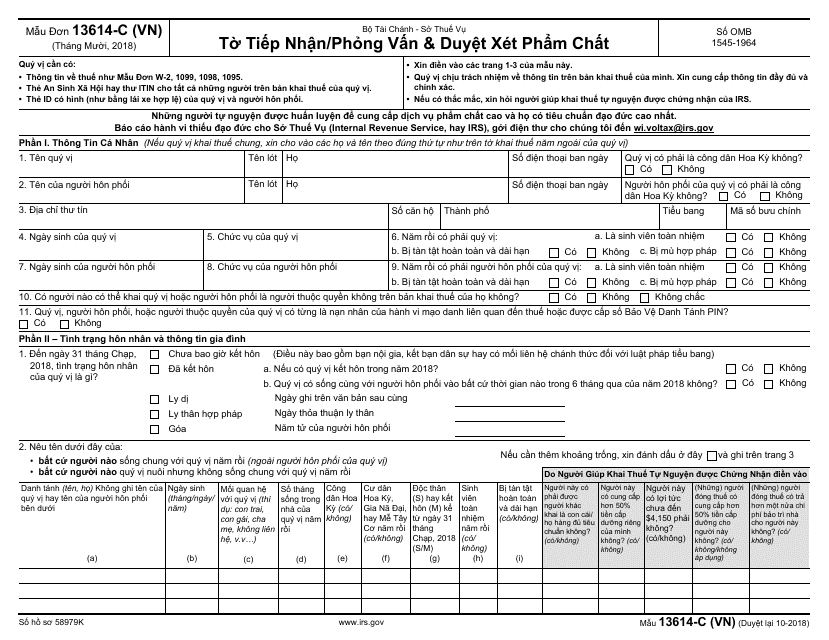

This document is used for gathering information and conducting interviews with taxpayers who speak Vietnamese. It is also used for quality review purposes by the IRS.

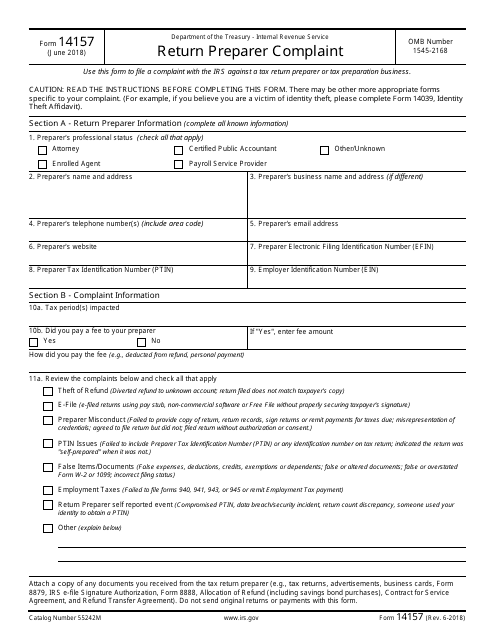

This form is used for filing a complaint against a return preparer who has engaged in fraudulent or unethical behavior.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

This Form is used for reporting the Generation-Skipping Transfer Tax for terminations on the IRS Form 706-GS (T). It provides instructions on how to fill out the form and report any transfers subject to the tax.

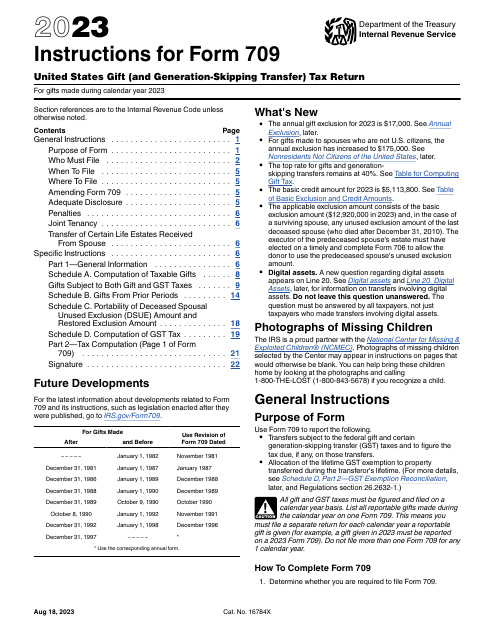

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return, 2023

This document is for nonresident aliens with no dependents who need to file their U.S. income tax return. It provides instructions on how to complete IRS Form 1040NR-EZ.

This form is used for reporting miscellaneous income received, such as freelance work or rental income. It provides instructions on how to fill out Form 1099-MISC accurately.

This form is used for submitting a consent plan and apportionment schedule for a controlled group for tax purposes. It provides instructions on how to allocate and apportion income, deductions, and taxes among the members of the controlled group.

This document provides instructions for various IRS forms including 1096, 1097, 1098, 1099, 3821, 3822, 5498, and W-2G. The instructions guide individuals or organizations on how to fill out these specific information returns required by the IRS.

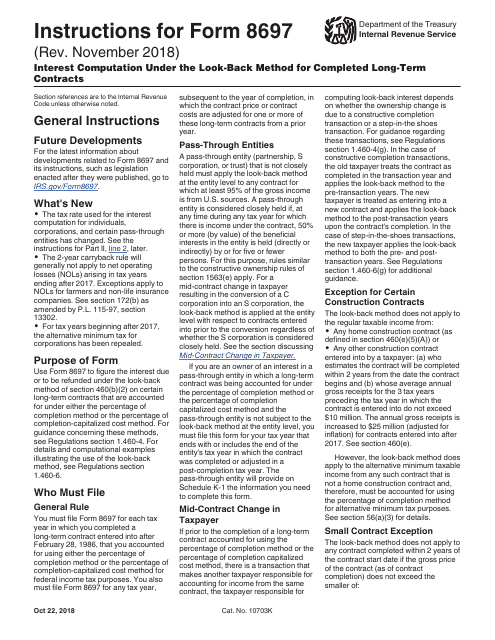

This Form is used for calculating interest under the look-back method for long-term contracts completed by the IRS. It provides instructions on how to determine the interest amount and report it accurately on your tax return.