Tax Preparer Templates

Documents:

1288

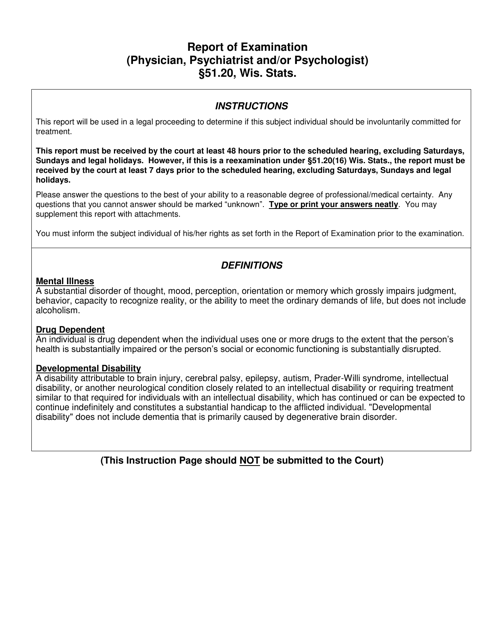

This form is used for reporting the results of an examination conducted under Section 51.20 of the Wisconsin Statutes in Wisconsin.

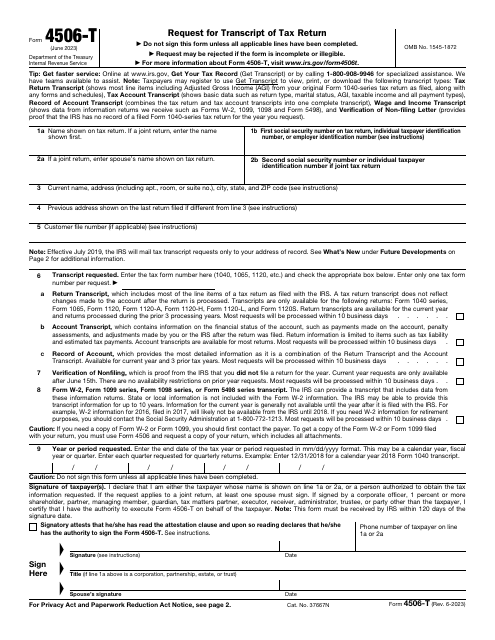

Fill in this form if you would like to request tax return information, such as different types of transcripts, a record of an account, and/or verification of nonfiling.

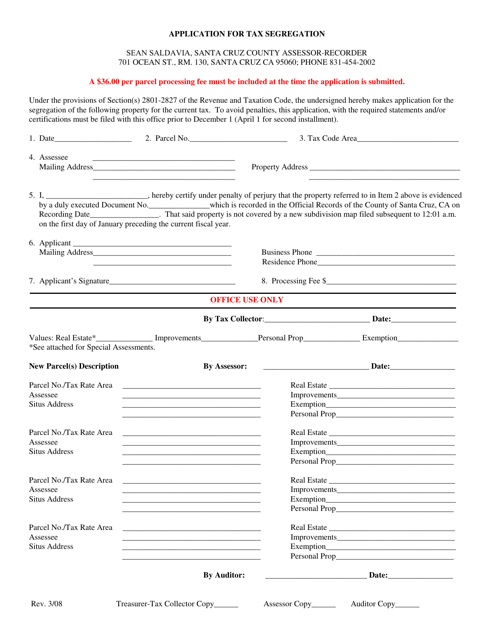

This document is an application form used in Santa Cruz County, California for requesting tax segregation. Tax segregation is a method of allocating costs of real property between different asset classes to optimize tax deductions.

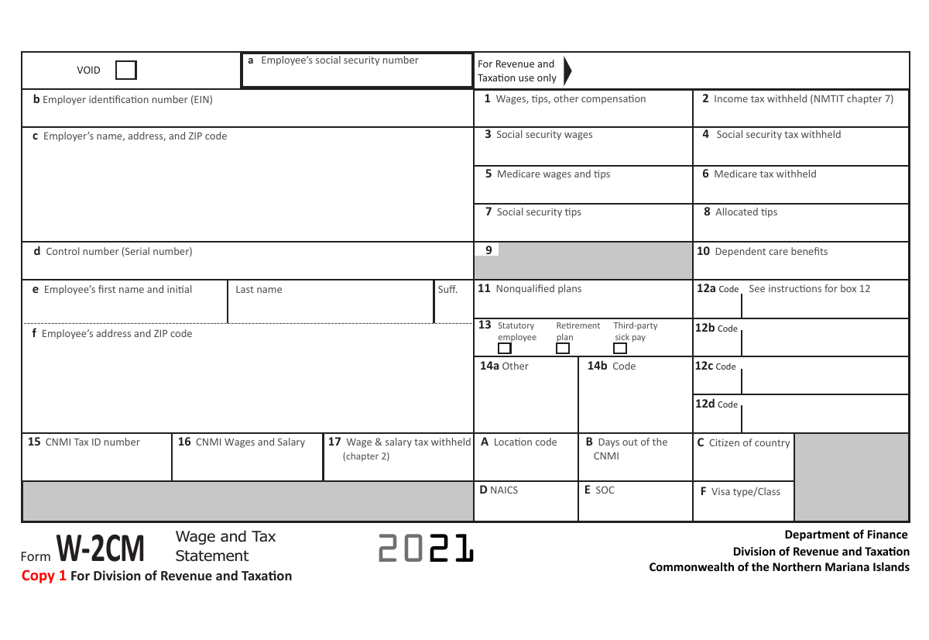

This Form is used for reporting wages and taxes in the Northern Mariana Islands.

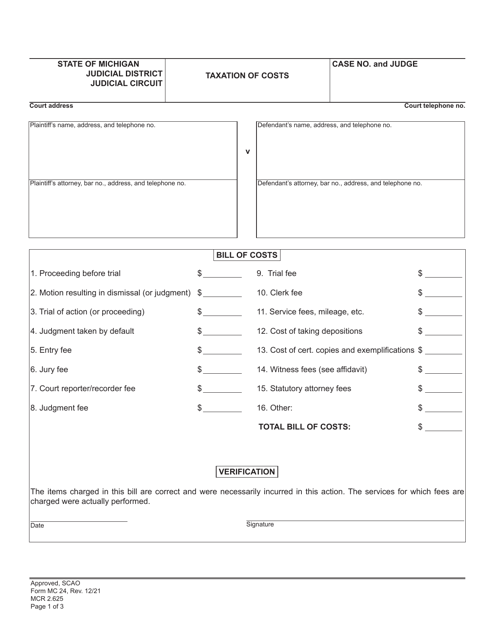

This form is used for determining the taxation of costs in Michigan. It provides a detailed breakdown of the costs that can be taxed in a legal case.

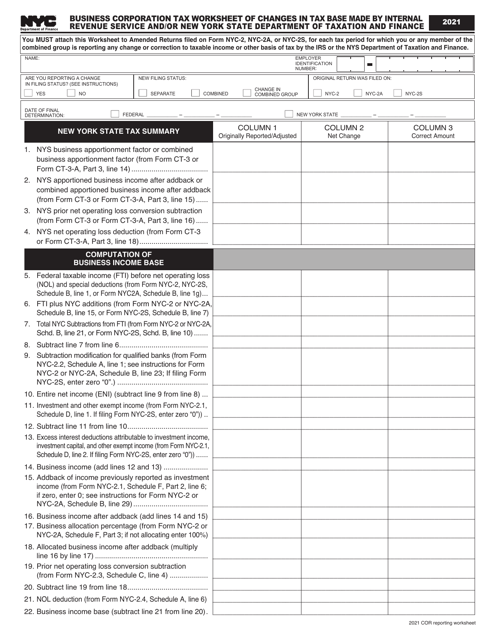

This document provides a worksheet to calculate changes in tax base made by the Internal Revenue Service and/or the New York State Department of Taxation and Finance for businesses in New York City. It helps businesses track and calculate any adjustments to their tax obligations.

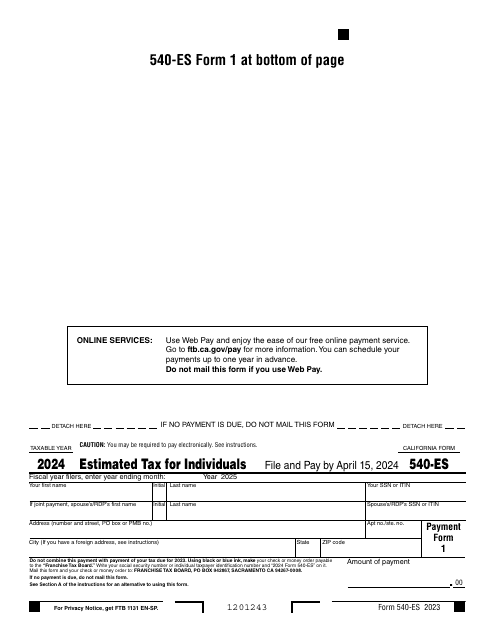

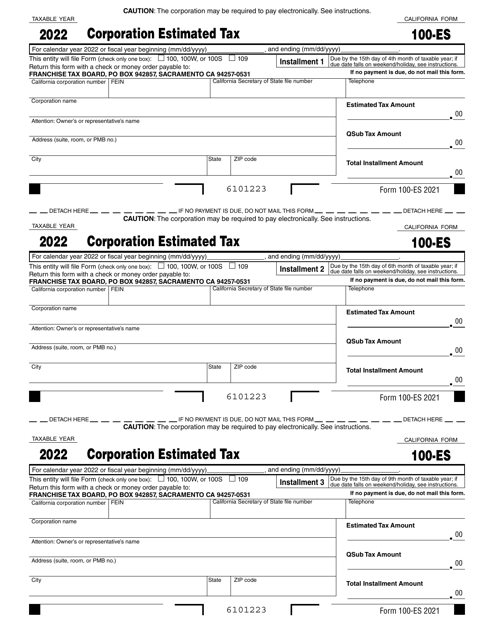

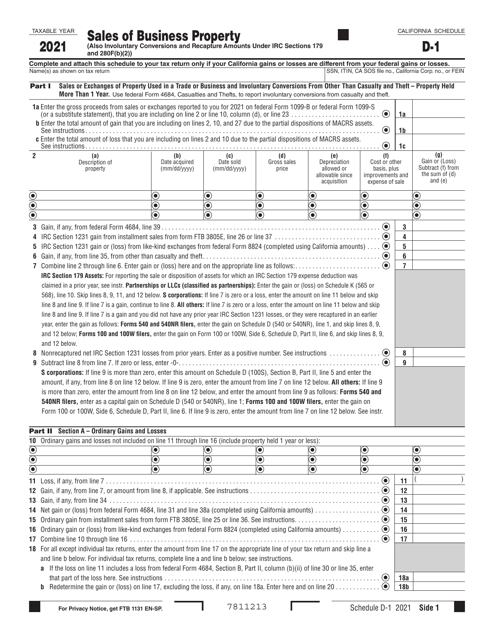

Fill out this form over the course of a year to pay your taxes in the state of California.

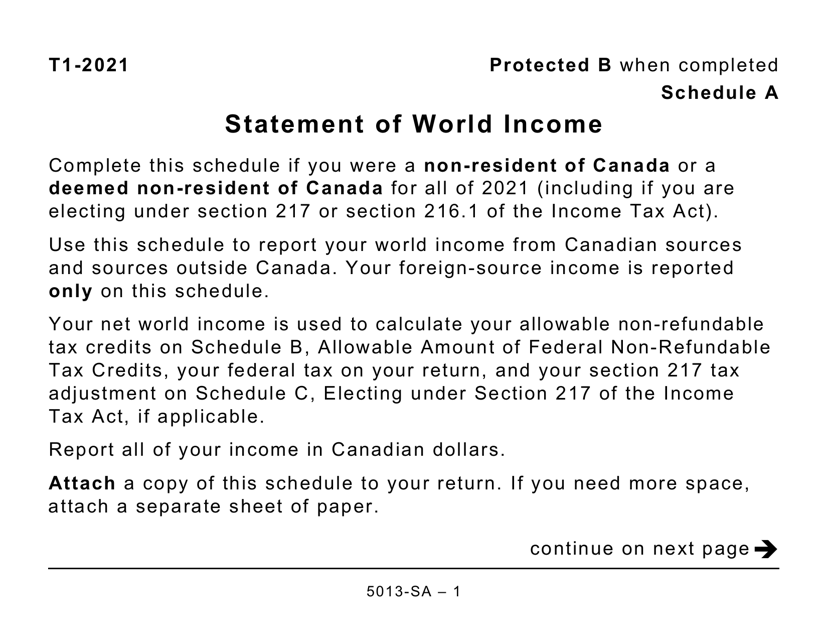

This form is used for reporting world income for Canadian taxpayers who are visually impaired and require a large print format. It is specifically for Schedule A of Form 5013-SA.

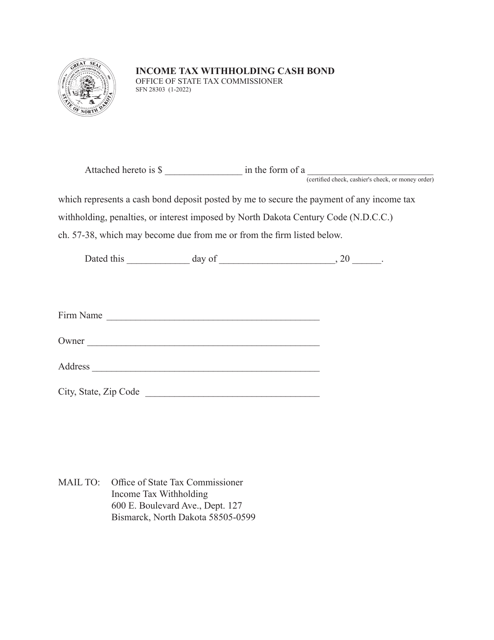

This form is used for individuals or businesses in North Dakota to provide a cash bond as a guarantee for their income tax withholding.

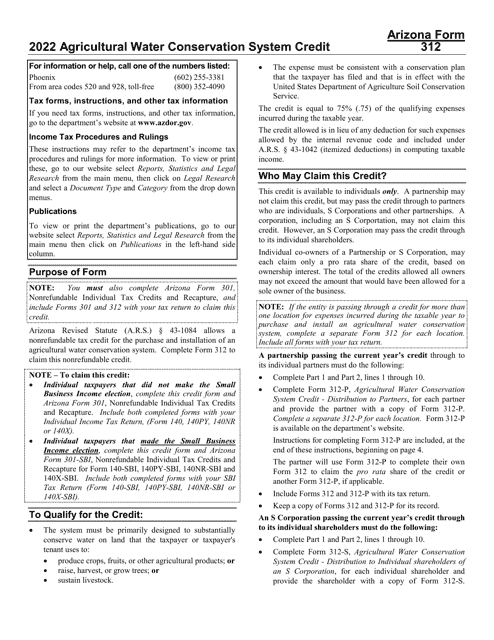

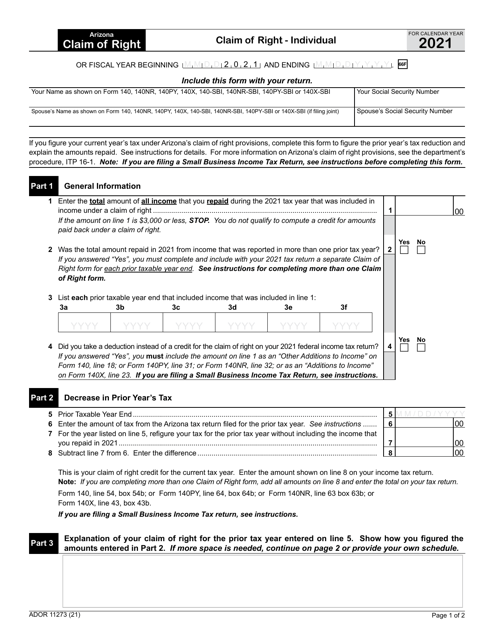

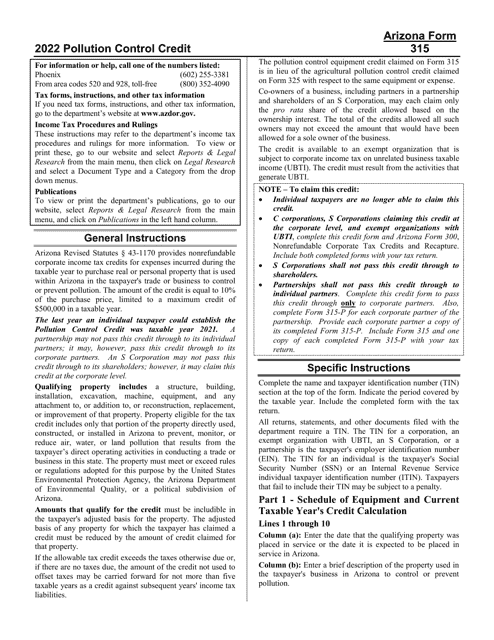

This form is used for individuals in Arizona to make a Claim of Right. It provides a way for individuals to express their claim to certain funds or property.

This is a legal document that various financial corporations based in California use to figure estimated tax for a corporation and then mail to the Franchise Tax Board to pay corporate income tax.

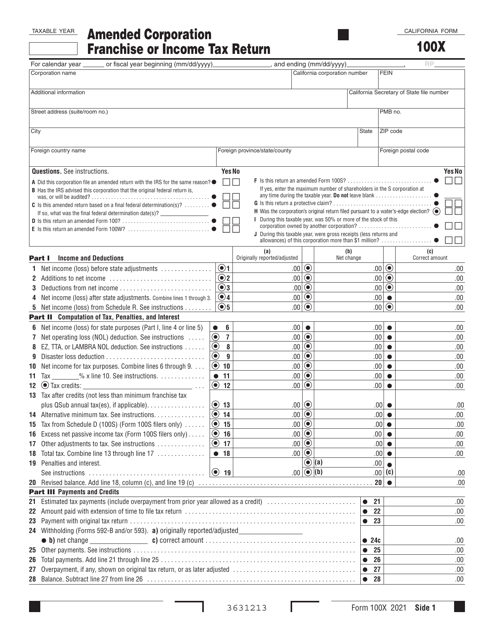

This Form is used for filing an amended corporation franchise or income tax return in California. It allows corporations to correct errors or make changes to their original tax return.

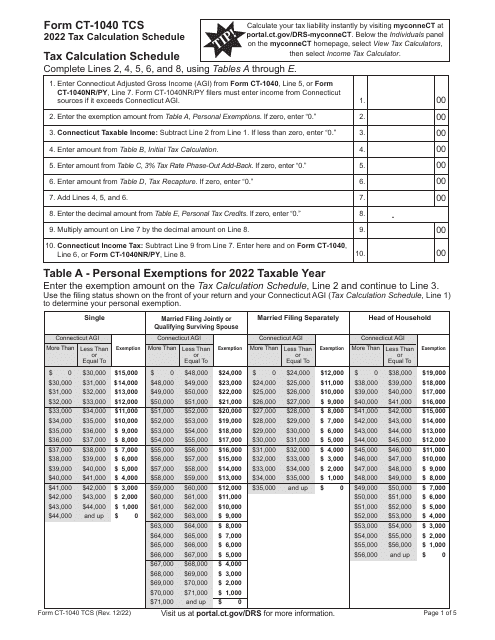

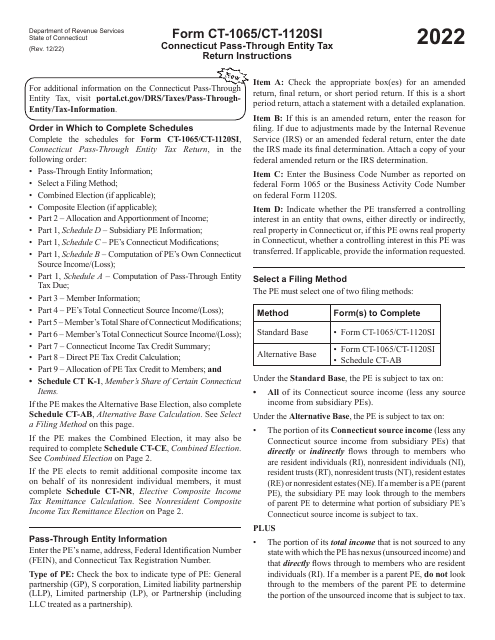

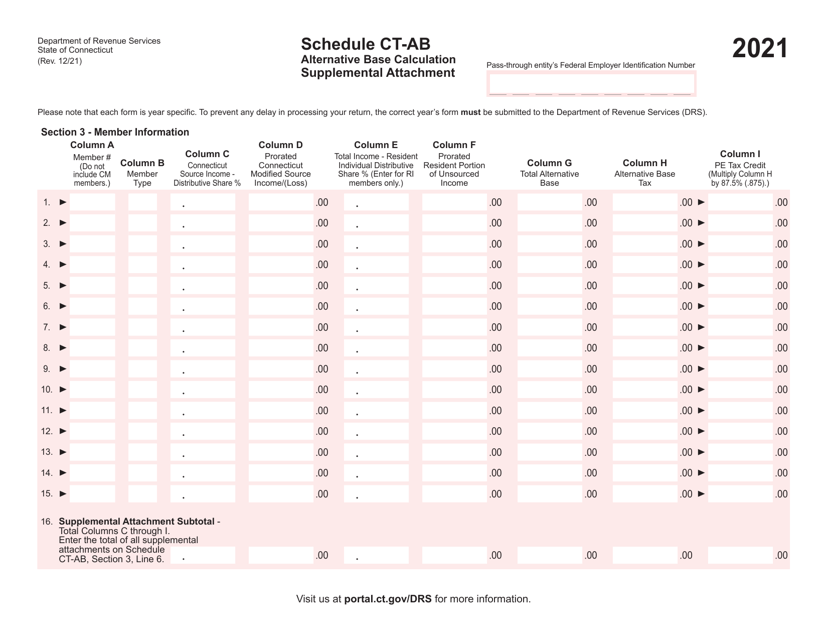

This form is used for providing a supplemental attachment for the alternative base calculation on Schedule CT-AB in Connecticut.

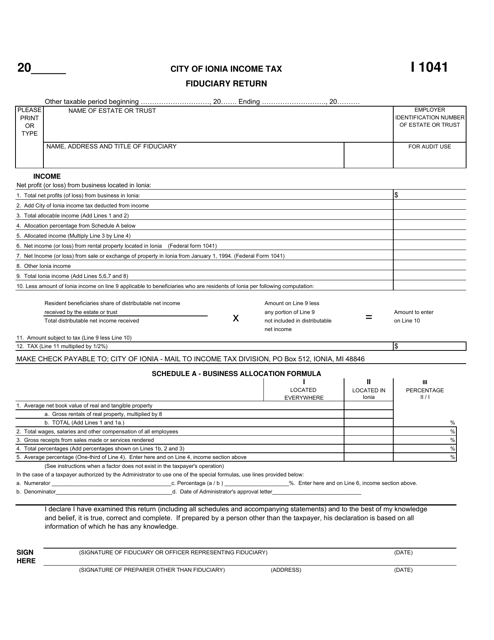

This form is used for filing the Fiduciary Return for the City of Ionia, Michigan. It is specifically for individuals who are acting as fiduciaries for an estate or trust in the city of Ionia, Michigan.

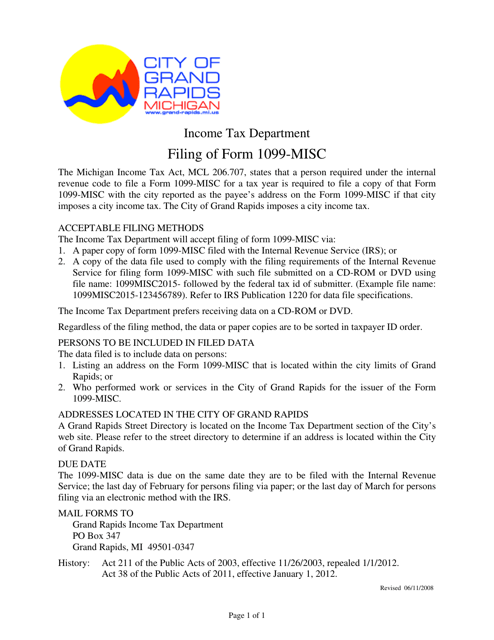

This Form is used for reporting miscellaneous income, such as freelance earnings or rental income, to the IRS.

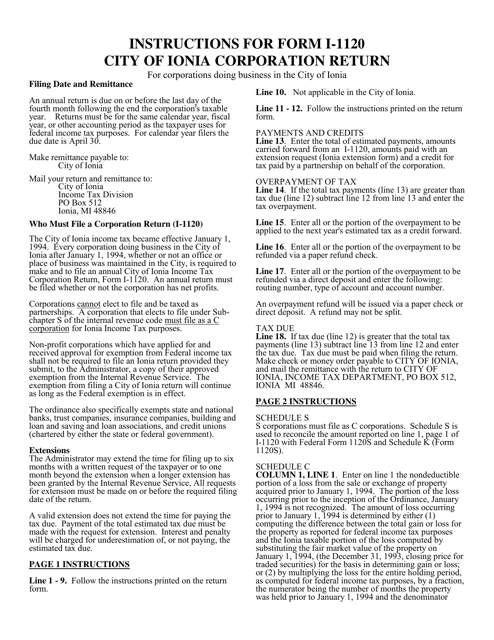

This Form is used for filing the Corporation Income Tax Return for businesses in the City of Ionia, Michigan. It includes instructions on how to accurately report income, deductions, and credits for the tax year.

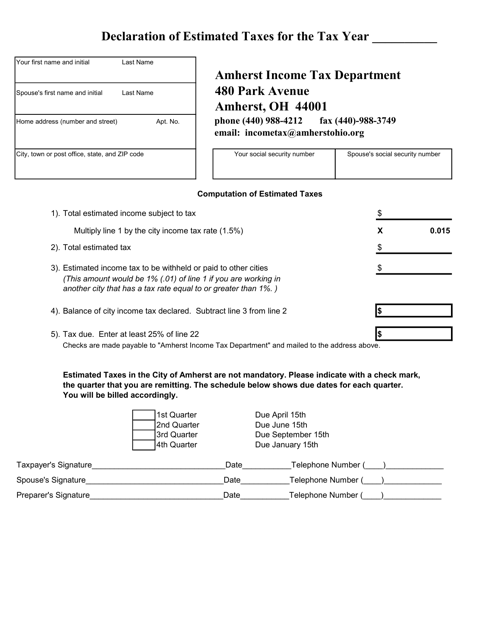

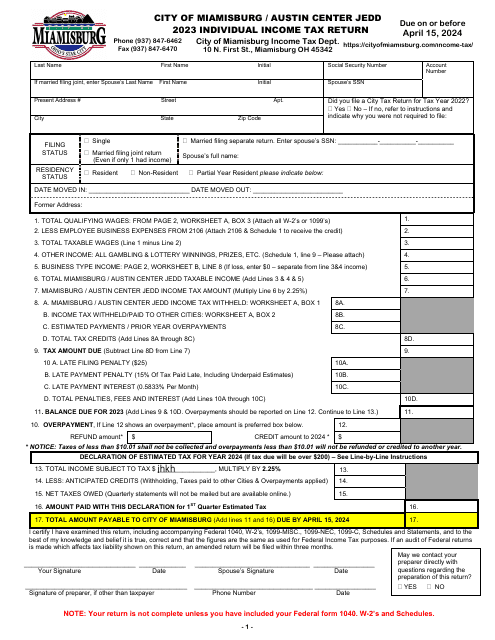

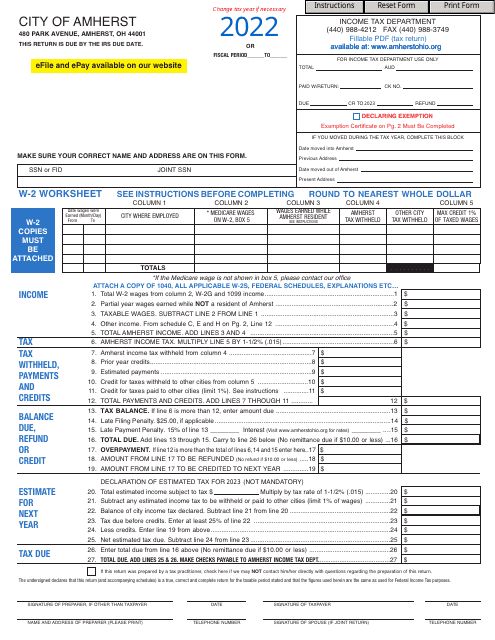

This document is used for declaring estimated taxes in Amherst, Ohio.

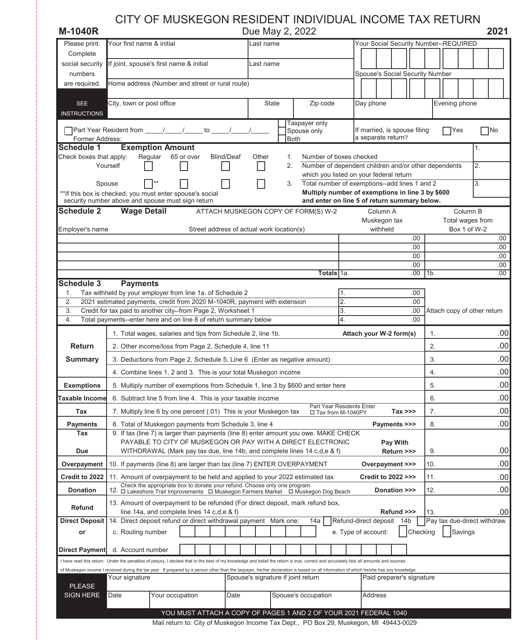

This form is used for reporting and filing resident individual income taxes for residents of Muskegon, Michigan.

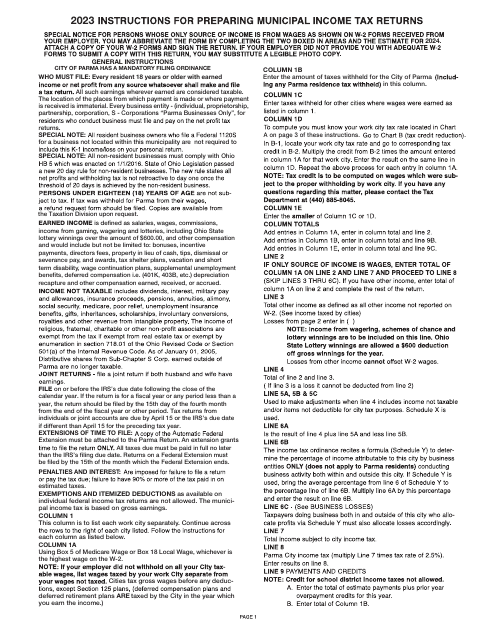

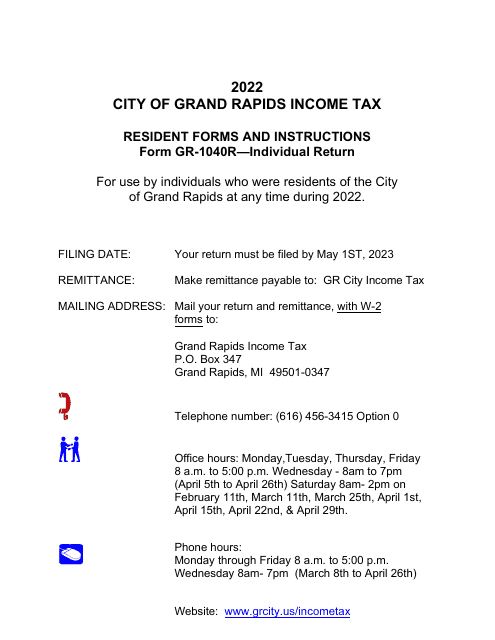

This document provides instructions for filing the Corporation Income Tax Return specifically for businesses located in the City of Grand Rapids, Michigan. It explains how to report and calculate corporate income tax owed to the city.

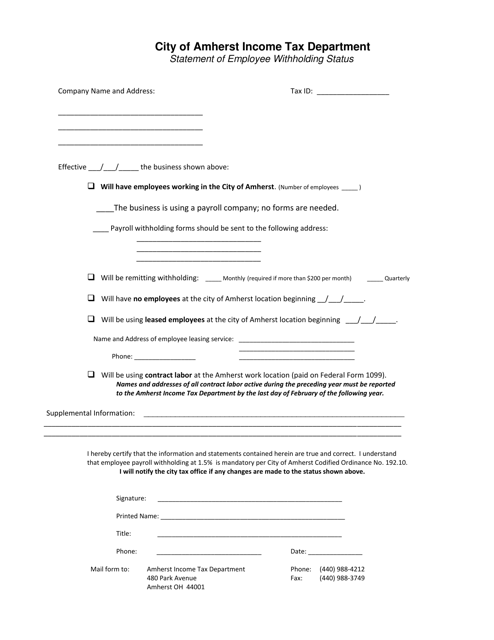

This document is for employees in the City of Amherst, Ohio to declare their withholding status for tax purposes.

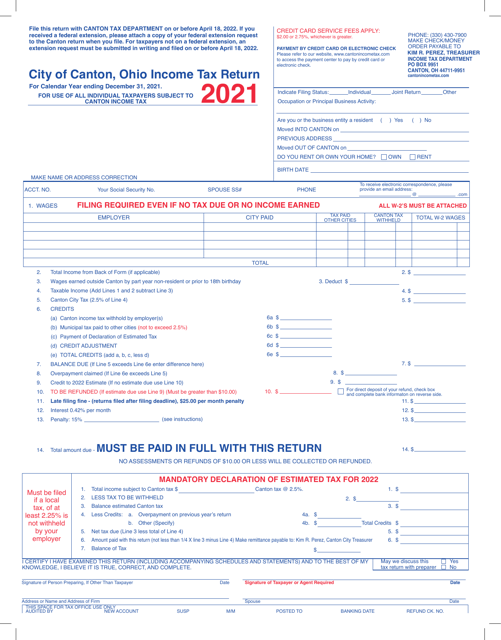

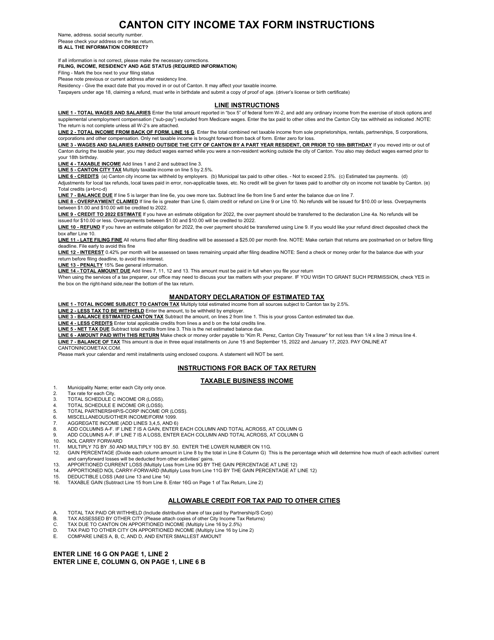

This form is used for filing the individual income tax return for residents of the city of Canton, Ohio.

This Form is used for filing your Individual Income Tax Return with the City of Canton, Ohio. It provides step-by-step instructions for completing your tax return and ensures that you accurately report your income and claim any applicable deductions and credits.

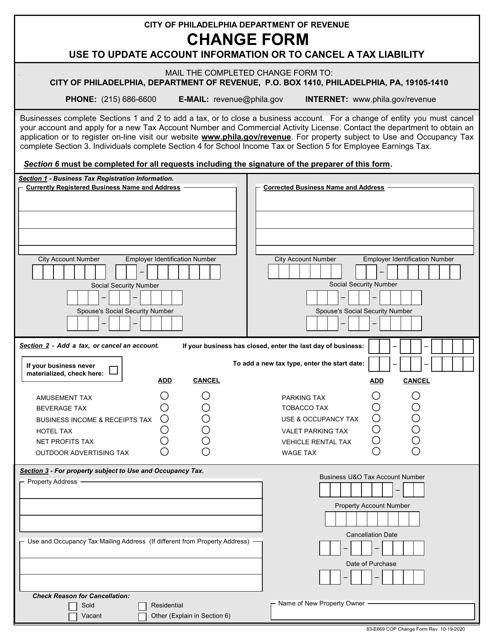

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.