Tax Preparer Templates

Documents:

1288

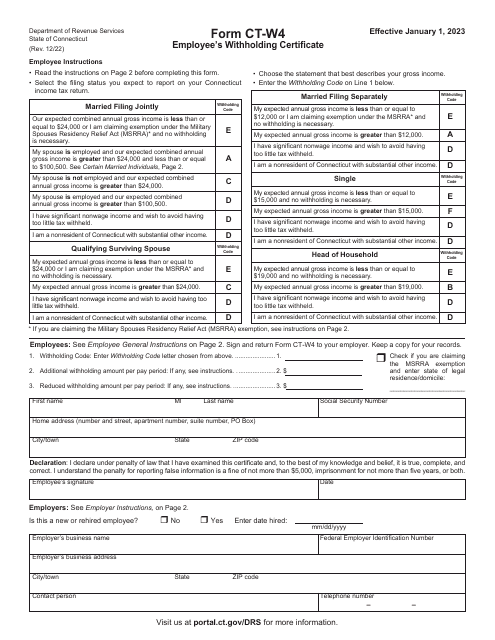

Use this form to withhold the proper amount of taxes when being employed in the state of Connecticut.

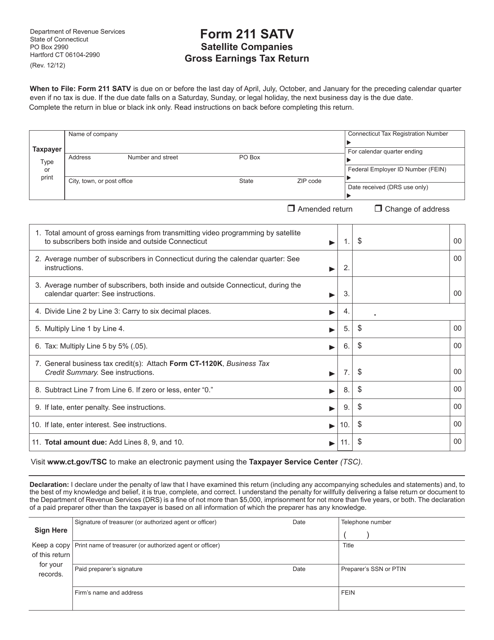

This Form is used for satellite companies in Connecticut to report their gross earnings for tax purposes.

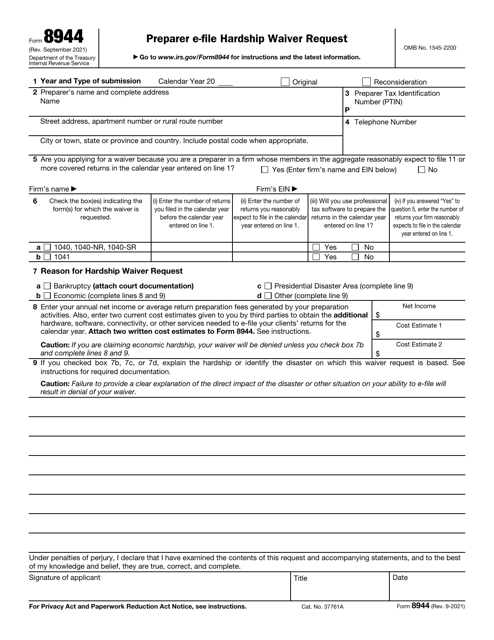

This is a formal statement completed by specified tax return preparers that cannot e-file income tax returns because of economic hardship, bankruptcy, or presidentially declared disaster.

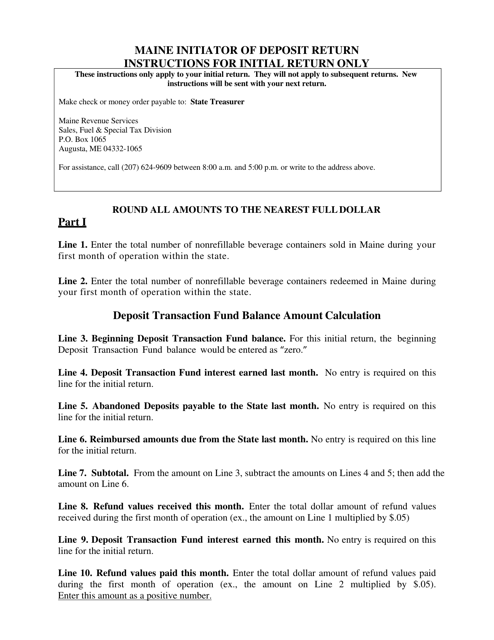

This document provides instructions for individuals in Maine who are initiating their initial deposit tax return. It outlines the requirements and steps for completing the return accurately.

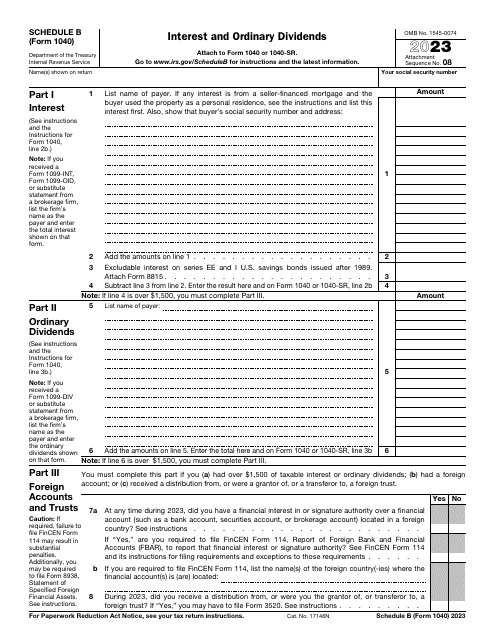

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

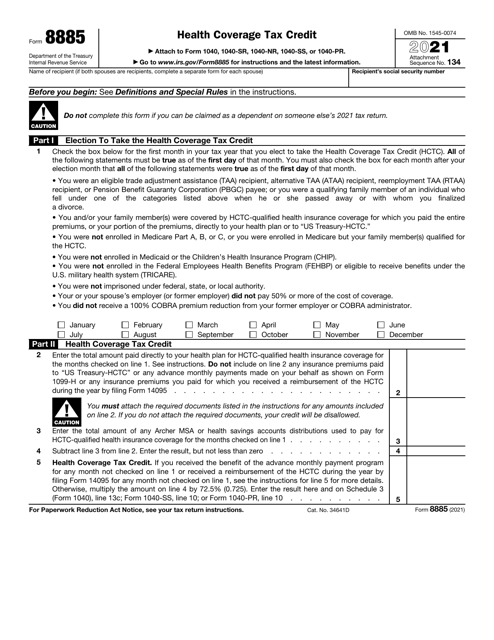

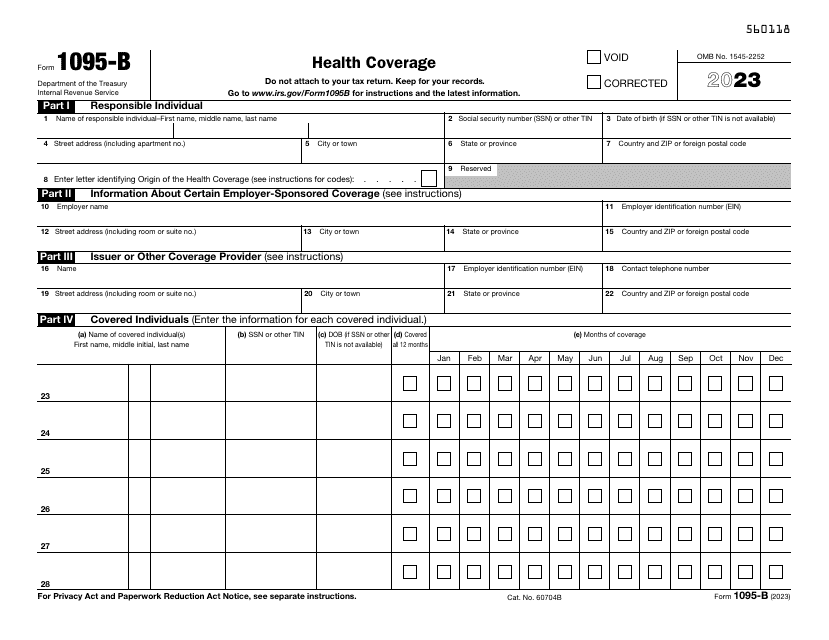

Use this document, otherwise known as the IRS Health Coverage Form, for submitting a report to the Internal Revenue Service (IRS) and to taxpayers about individuals with minimum essential coverage who are not liable for the individual shared responsibility payment.

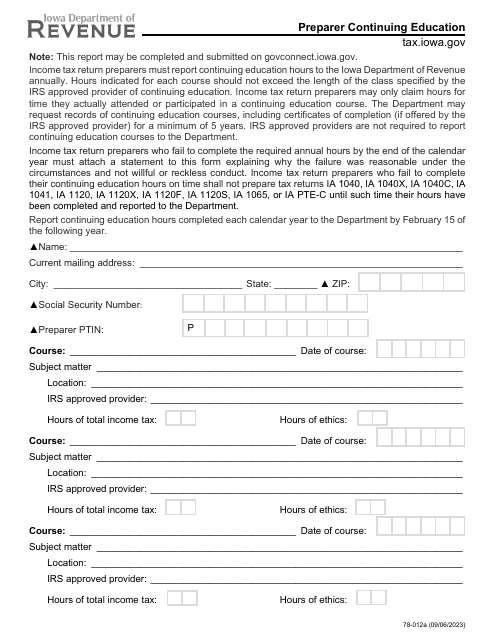

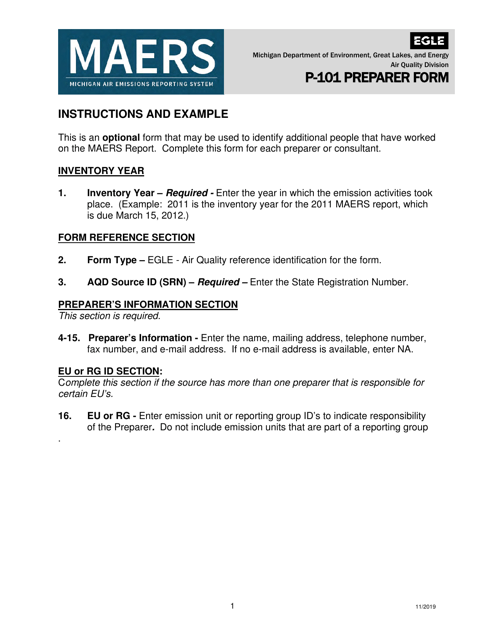

This document provides instructions for completing Form P-101, which is used by EQP5754 preparers in the state of Michigan. The form is used for... (provide specific purpose of the form).

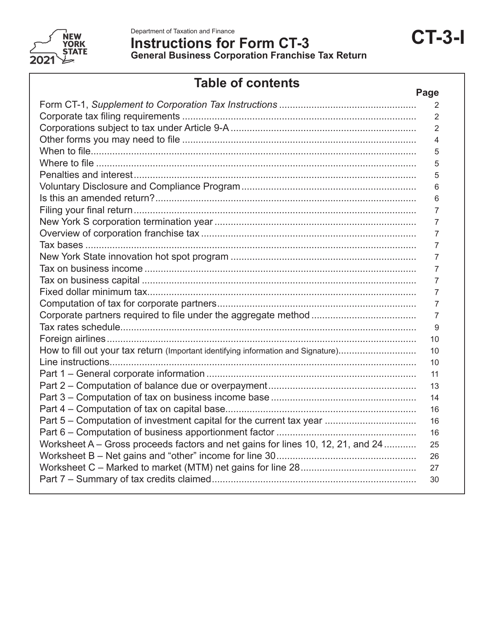

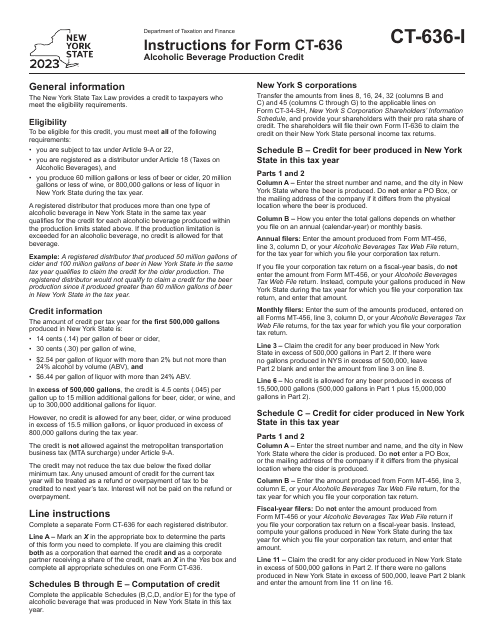

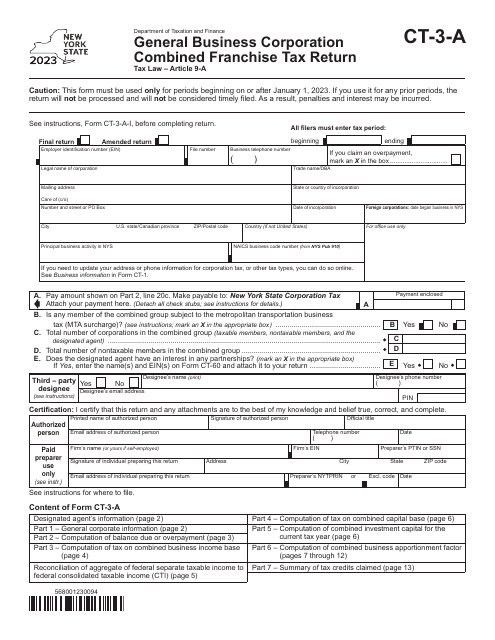

This form is used for filing the General Business Corporation Franchise Tax Return in the state of New York. It provides instructions on how to correctly complete and submit the form.