Tax Preparer Templates

Documents:

1288

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

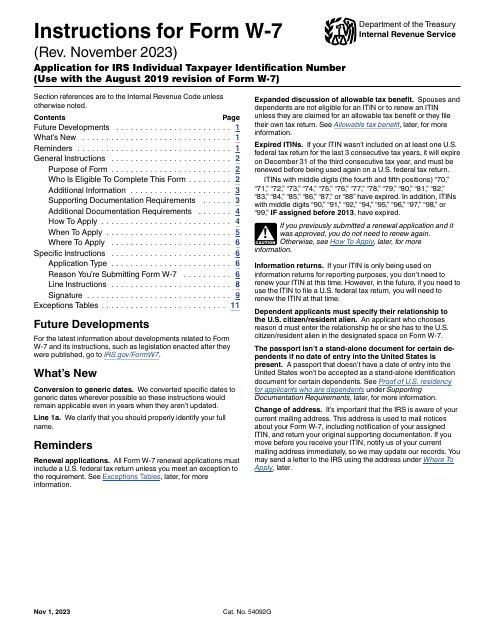

These are the IRS-issued Instructions for the IRS Form W-7, Application for IRS Individual Taxpayer Identification Number - also known as the individual tax identification number application.

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

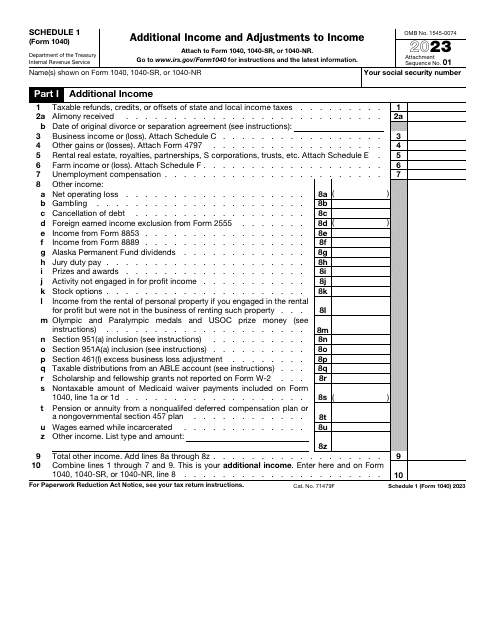

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

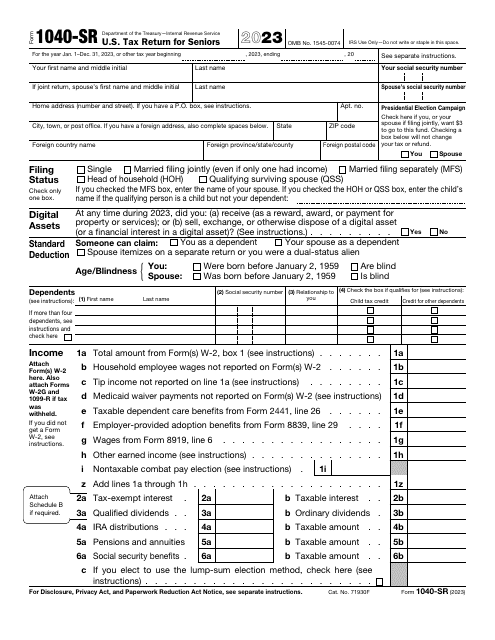

The purpose of this IRS application is to make the process of filing a federal income tax return easier for seniors - the document features larger print, but contains the standard deduction charts.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.