Tax Preparer Templates

Documents:

1288

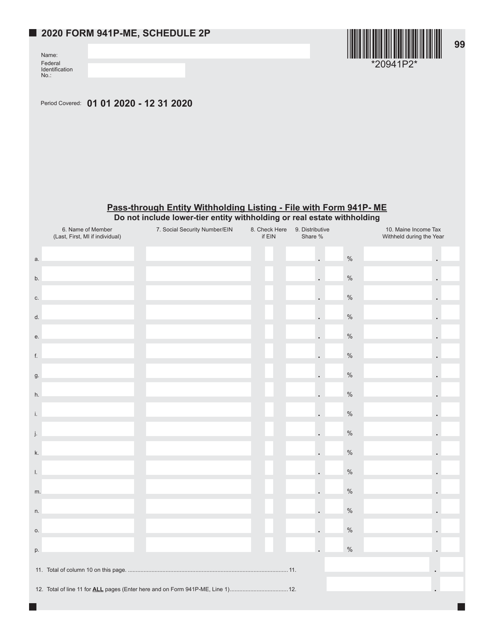

This type of document is used for listing withholding information for Maine state taxes on Form 941P-ME Schedule 2P.

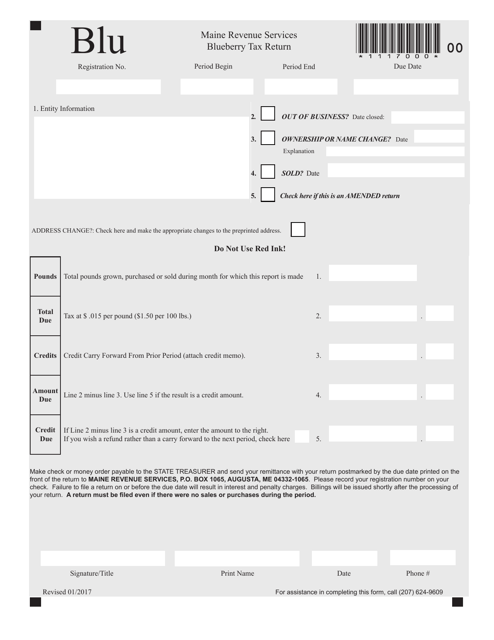

This form is used for the annual tax return specific to blueberry farmers in Maine. It includes information on income, expenses, and deductions related to blueberry farming.

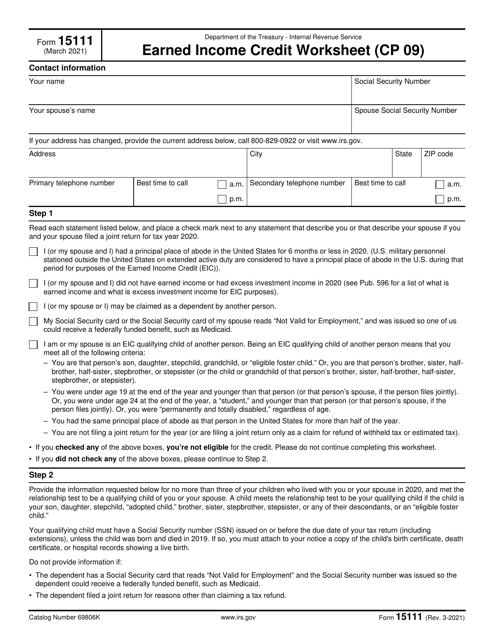

This form is used to calculate the Earned Income Credit for eligible taxpayers.

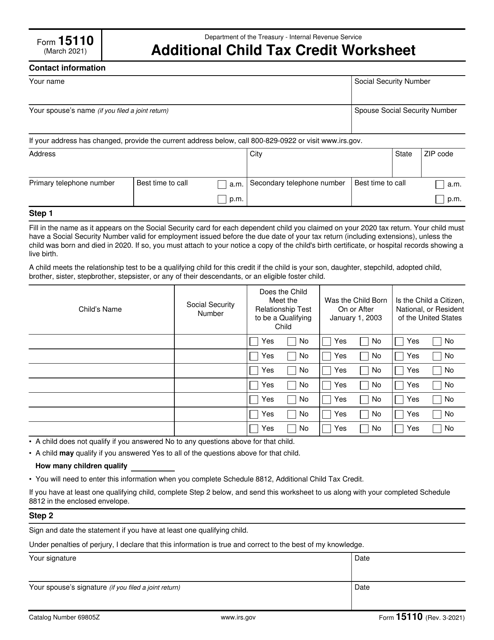

This form is used for calculating the additional child tax credit.

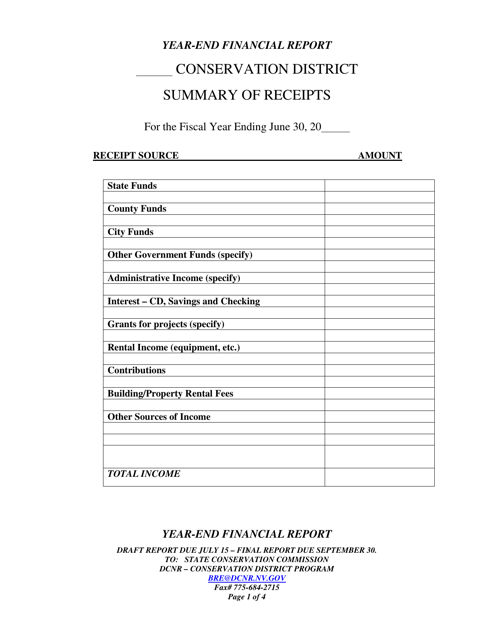

This document provides a summary of the financial activities and performance of a company or organization in Nevada at the end of the year. It includes details about revenue, expenses, profits, and other financial metrics.

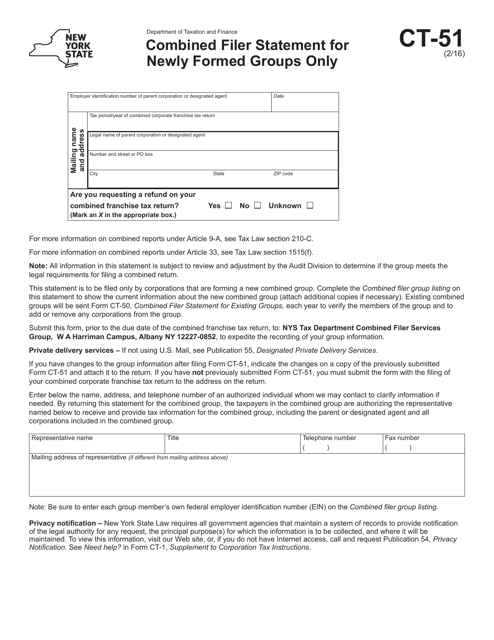

This form is used for newly formed groups in New York to provide a combined filer statement.

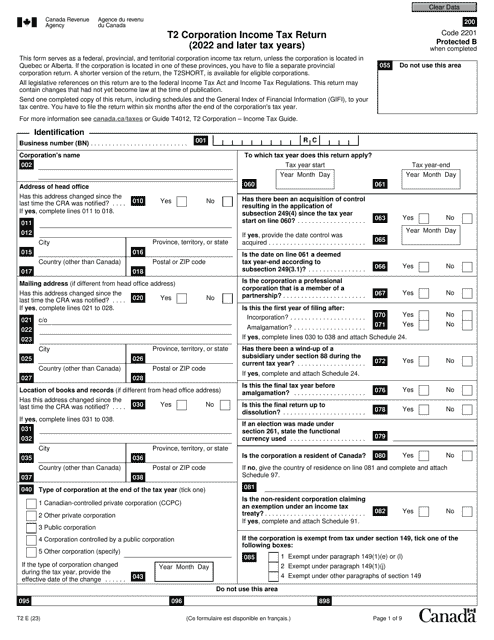

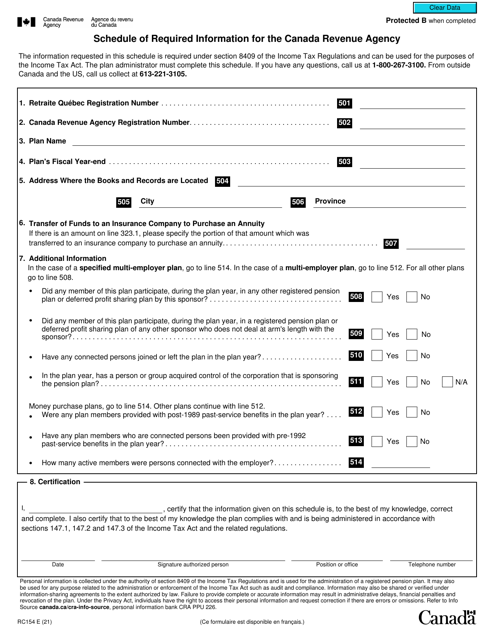

Canadian corporations must complete this main statement every year to report their income even if they eventually do not pay any tax.

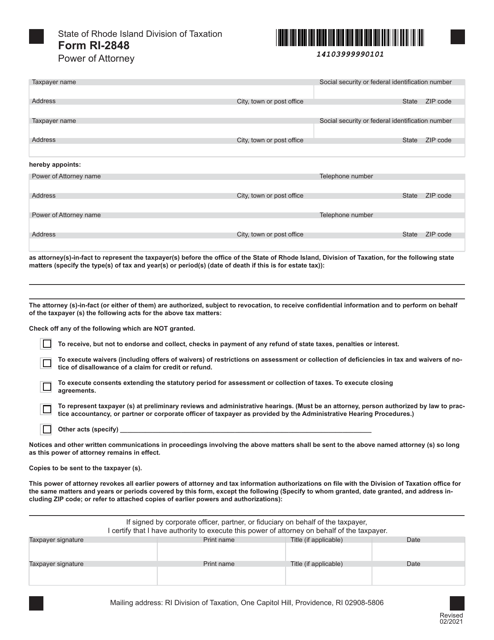

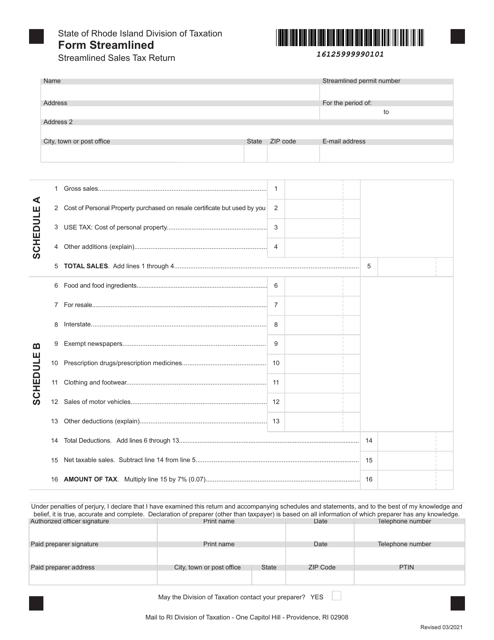

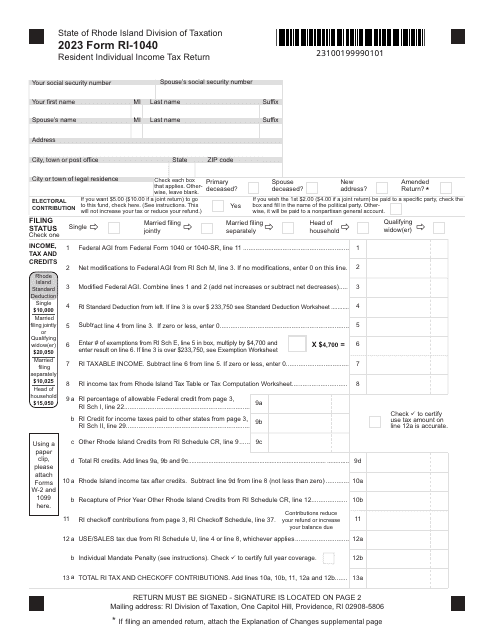

This document is for filing the Streamlined Sales Tax return in the state of Rhode Island. It is used by businesses to report their sales tax collections and remit the taxes owed to the state.

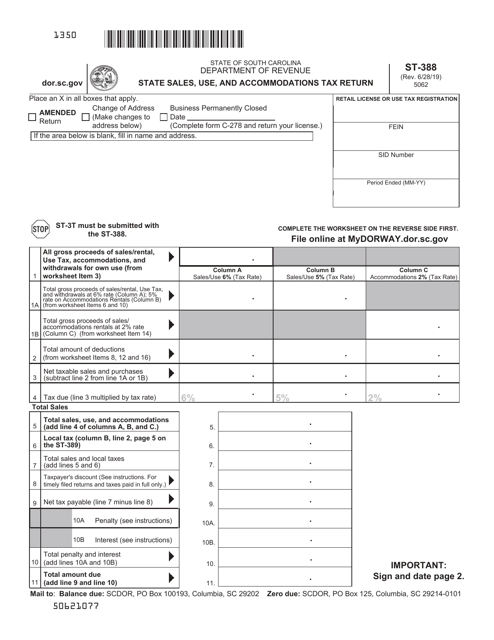

This form is used for reporting State Sales and Use and Accommodations Tax in South Carolina.

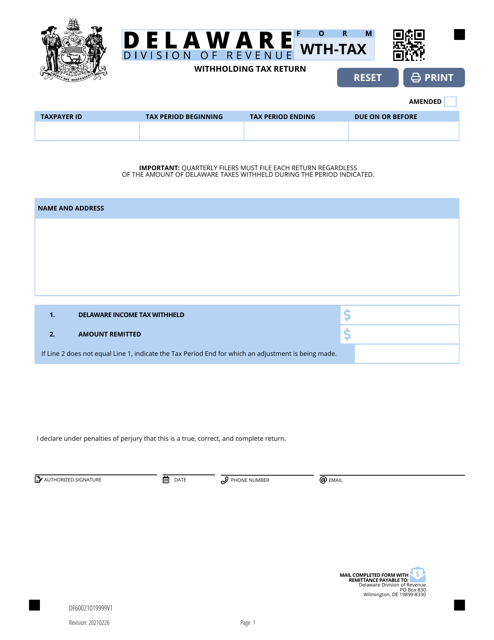

This form is used for reporting and paying withholding taxes for the state of Delaware.

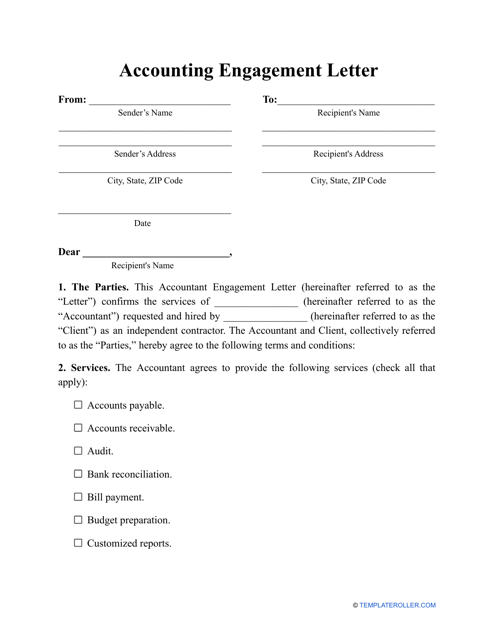

An accounting firm or a private accountant may prepare a letter such as this and send it to a client to showcase the services they are able to provide and set expectations for the upcoming working relationship with the client.

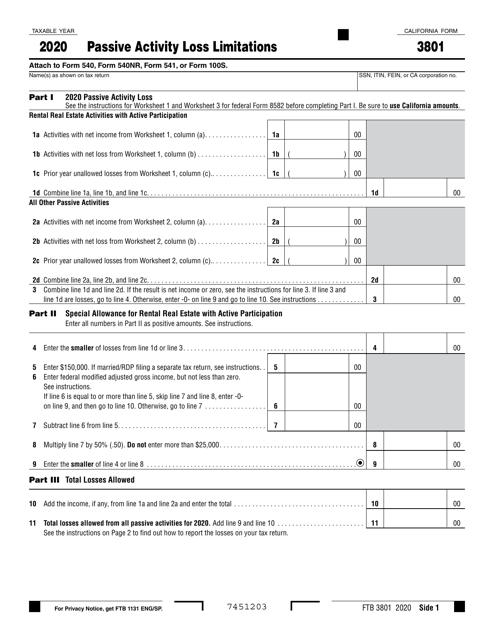

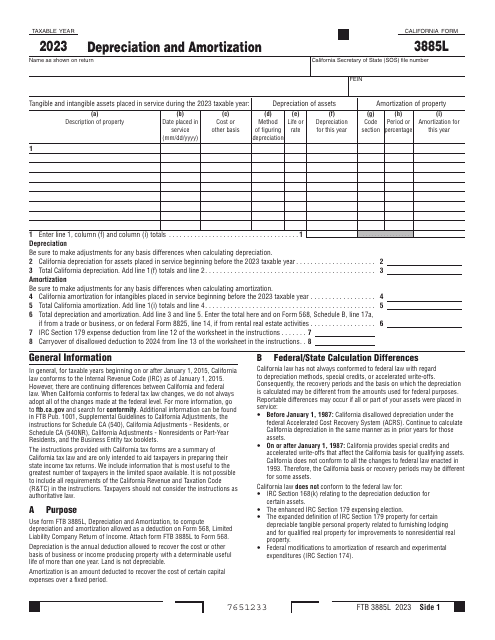

This form is used for reporting passive activity loss limitations in California.

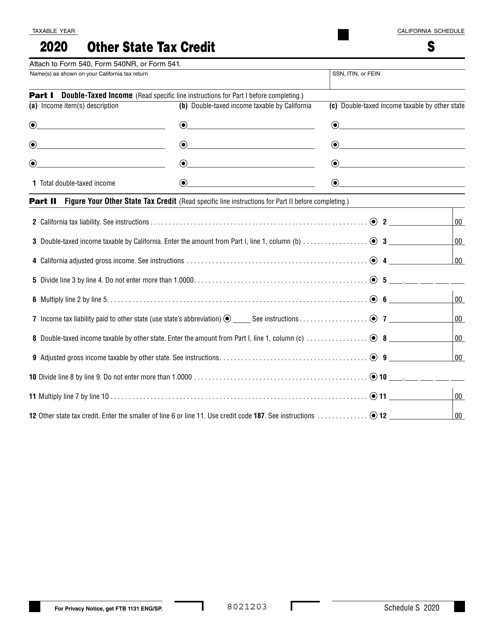

This document is used for claiming a tax credit for taxes paid to another state while being a resident of California.