Tax Preparer Templates

Documents:

1288

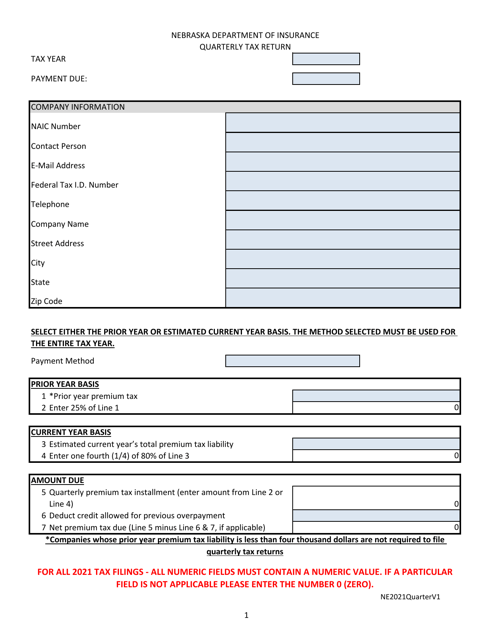

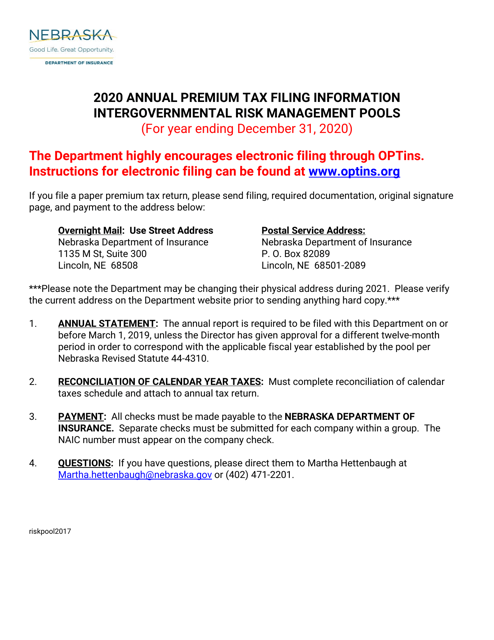

This document is used for reconciling calendar year taxes in Nebraska. It helps taxpayers ensure that their tax payments and credits are accurately recorded for the previous year.

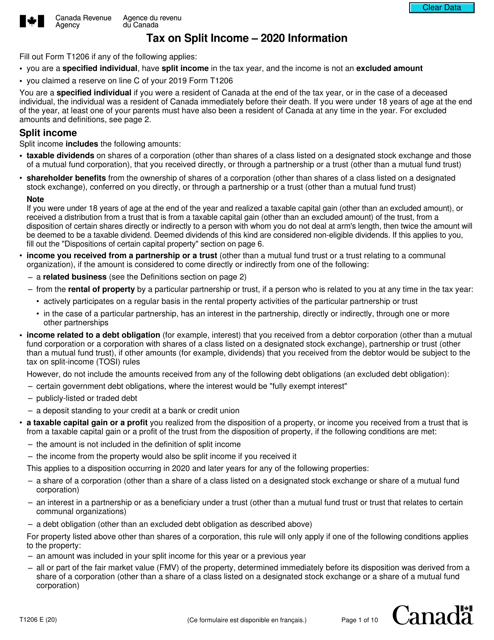

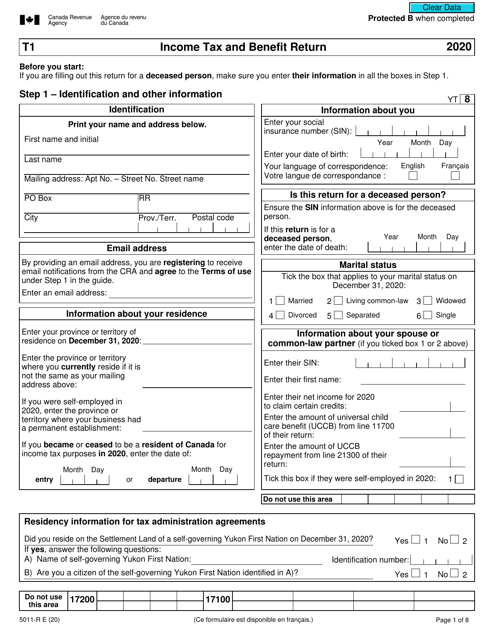

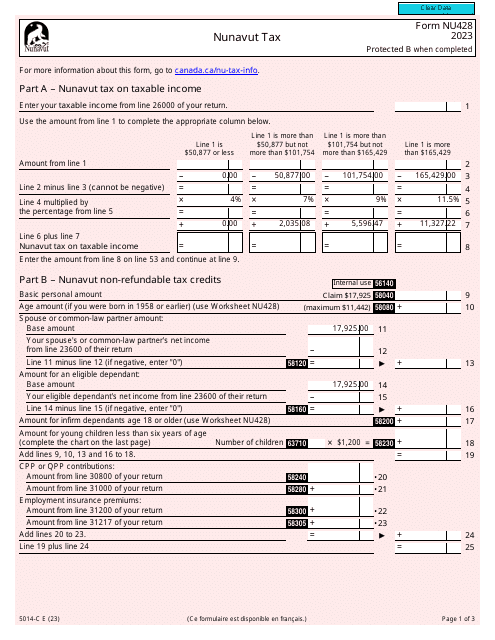

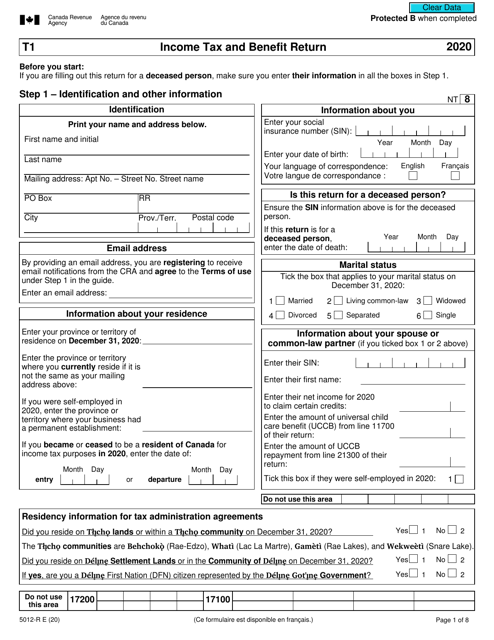

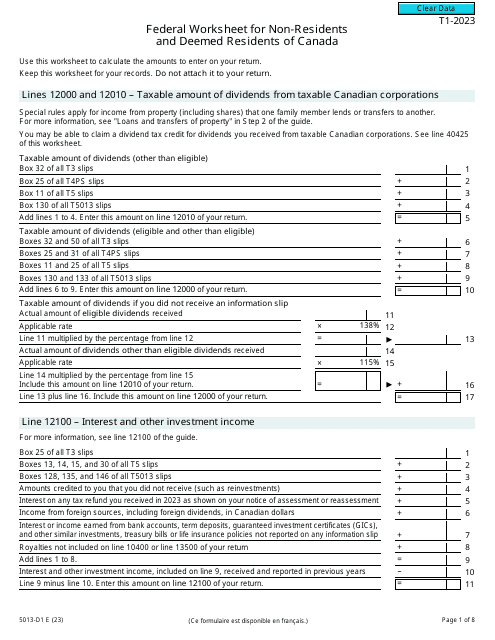

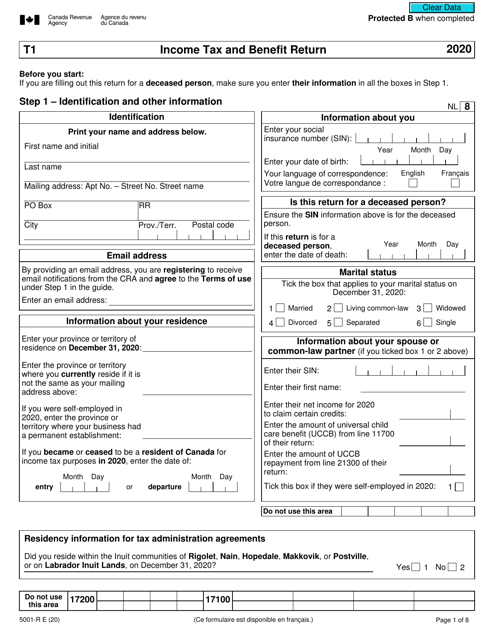

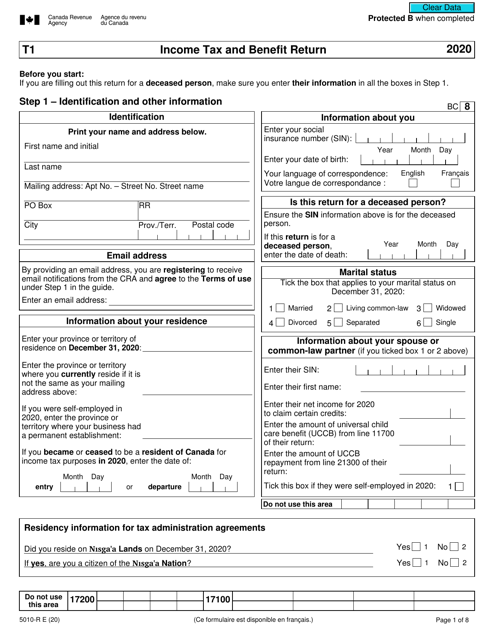

This form is used to report income, deductions, and tax credits for individuals in Canada filing their income tax and benefit return.

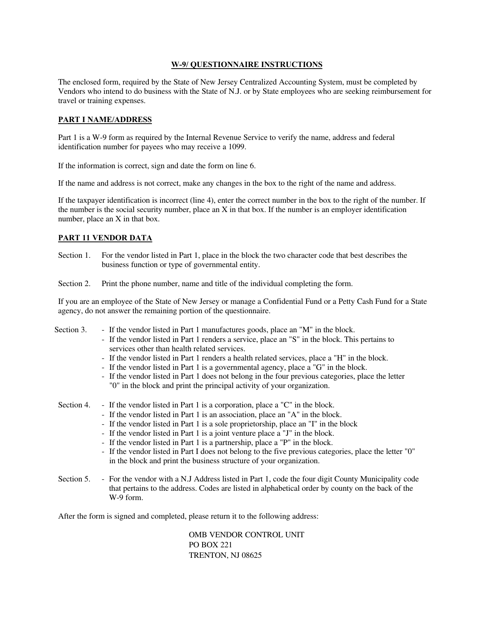

This document is a W-9 questionnaire specific to the state of New Jersey. It is used to collect taxpayer identification information for reporting purposes.

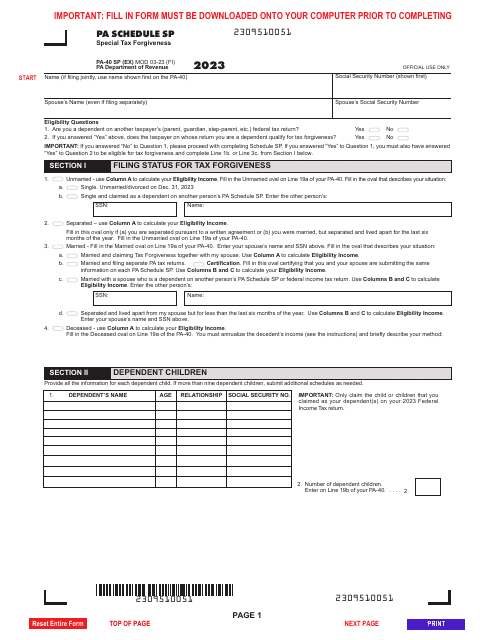

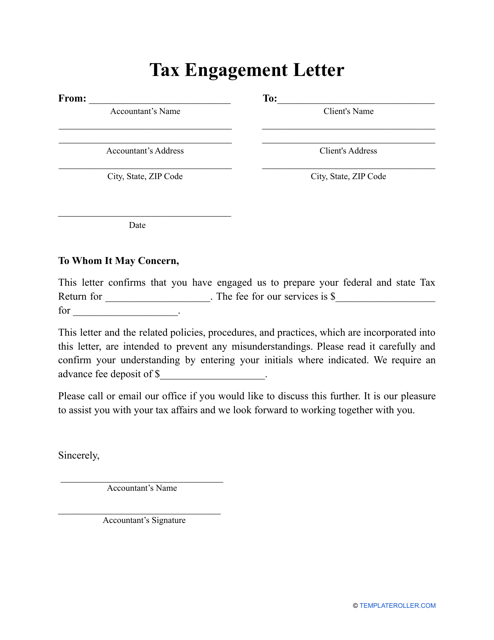

Complete this template to describe the work to be performed, the terms and conditions of performing that work, any limitations, and payment terms to the client.

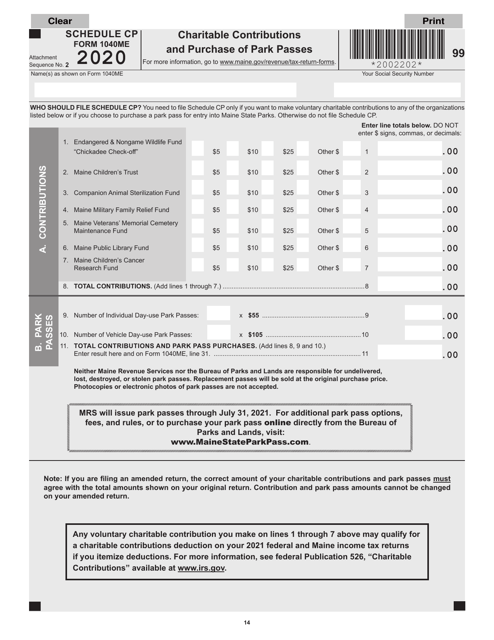

This form is used for reporting charitable contributions and the purchase of park passes in the state of Maine on the Maine tax return.

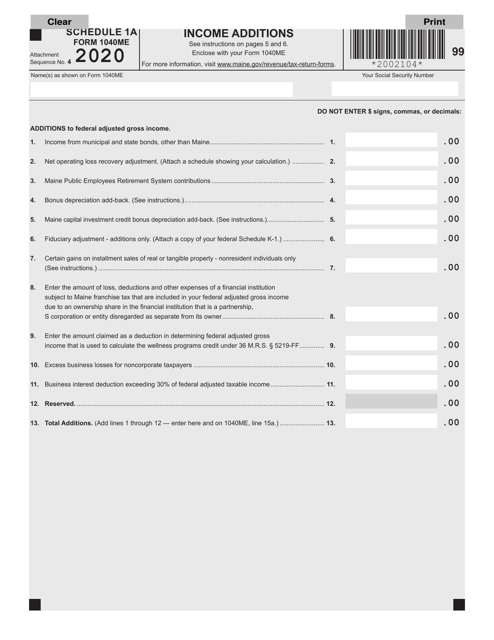

This form is used for reporting additional income additions for Maine residents filing the Form 1040ME. It helps taxpayers accurately include any income sources that need to be added to their overall income calculations.

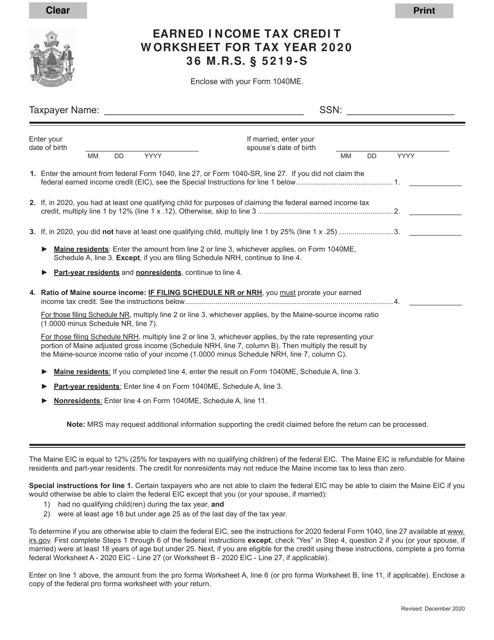

This document is used for calculating the Earned Income Tax Credit in the state of Maine. It provides a worksheet to help residents determine their eligibility and calculate the amount of credit they may qualify for.