Tax Preparer Templates

Documents:

1288

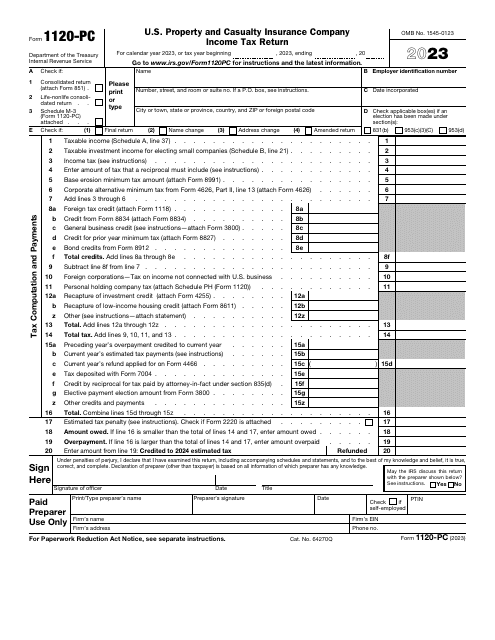

This form is filed by non-life insurance companies wishing to inform the Internal Revenue Service (IRS) of their income, deductions, and credits, as well as to figure their income tax liability.

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

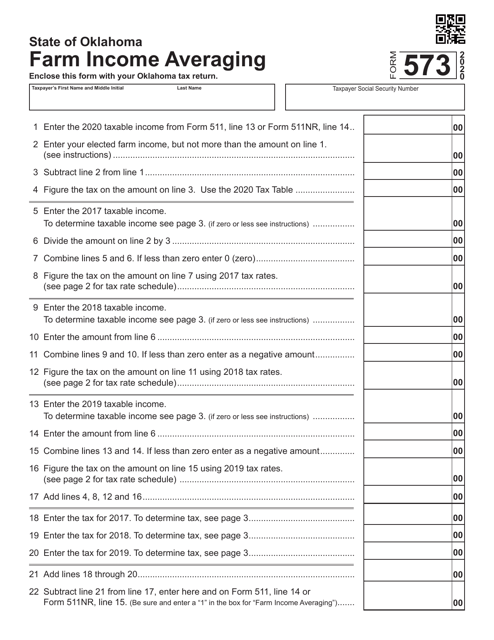

This form is used for farm income averaging in Oklahoma. It helps farmers in calculating their average income over a period of time to reduce tax liability.

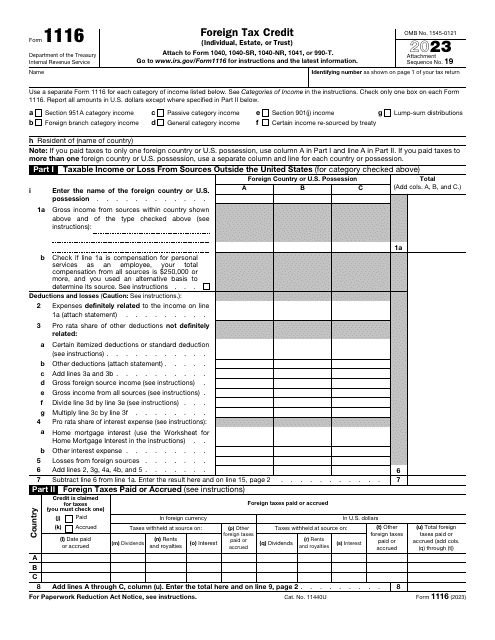

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.

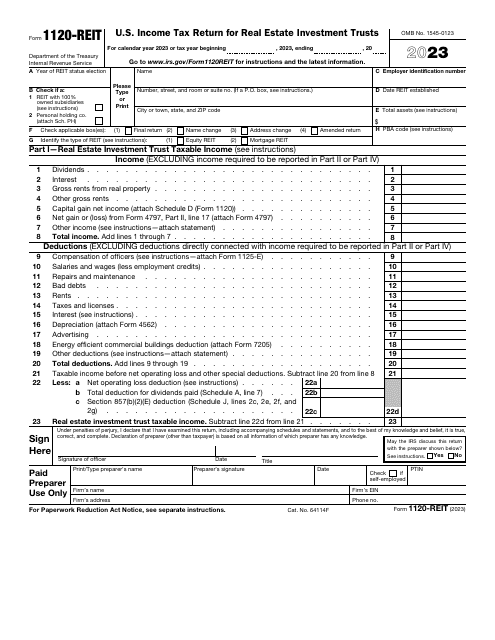

File this form if you are a corporation, trust, or an association electing to be treated as Real Estate Investment Trusts (REITs) in order to report your income, deductions, credits, penalties, as well as your income tax liability.

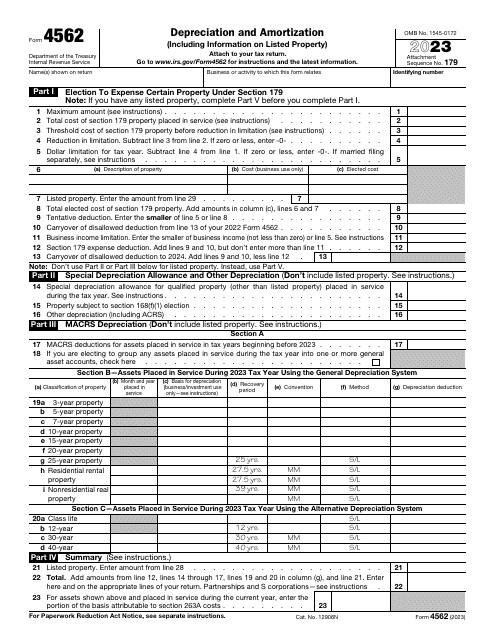

This is a formal document prepared by business owners whose intention is to ask for tax deductions due to depreciation of assets they used to carry out business operations and amortization of this property.

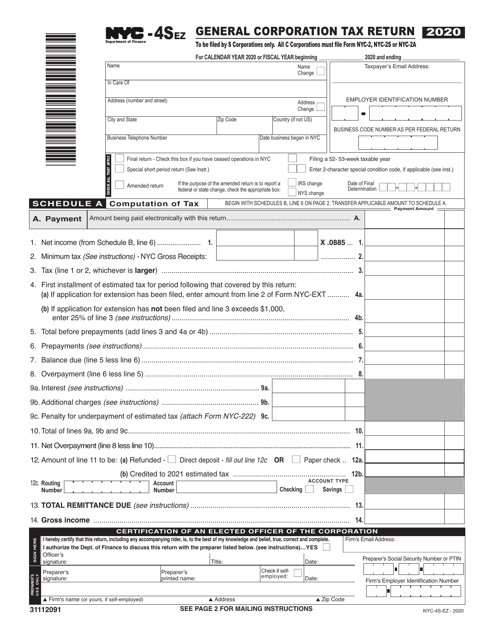

This form is used for filing the General Corporation Tax Return for businesses located in New York City.

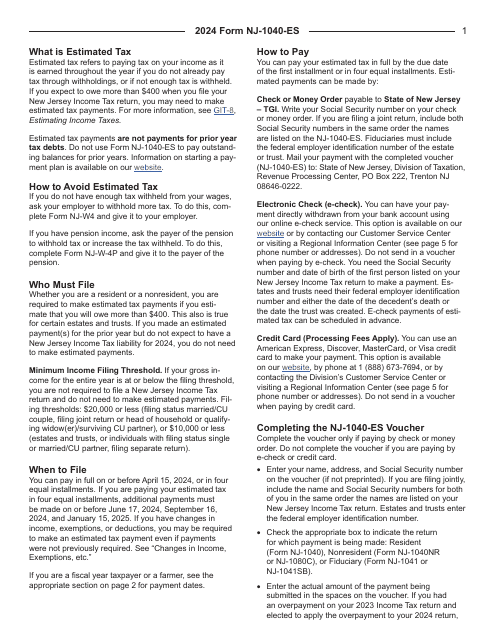

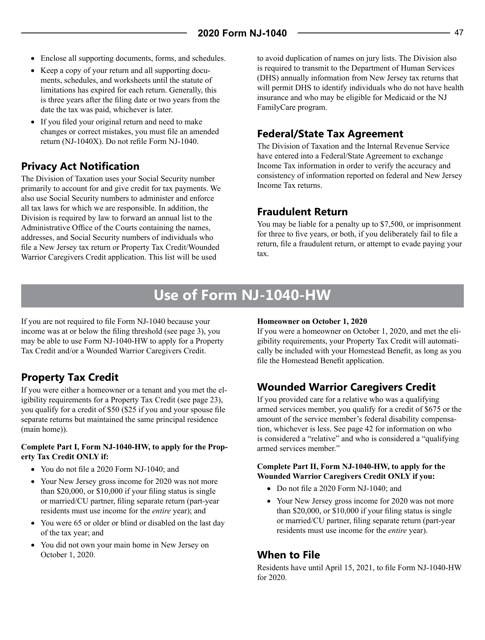

This Form is used for filing New Jersey Resident Income Tax Return for residents of New Jersey. It provides instructions for completing the form and includes information on tax filing requirements and deductions specific to New Jersey.