Tax Templates

Documents:

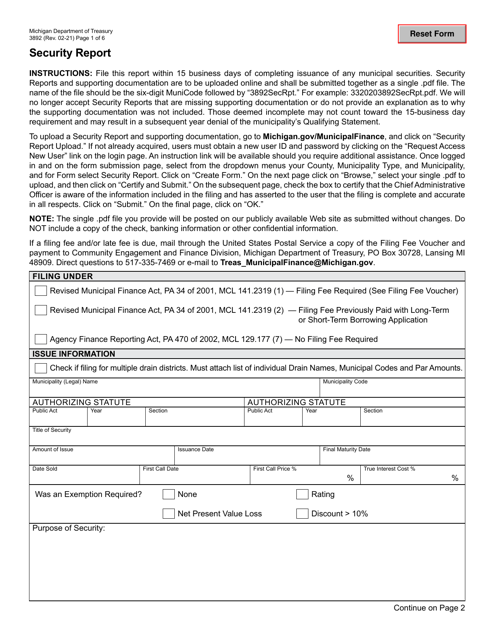

2882

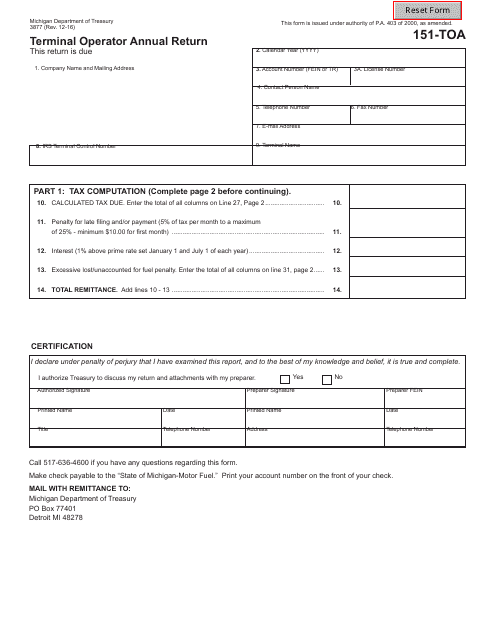

This form is used for terminal operators in Michigan to submit their annual return.

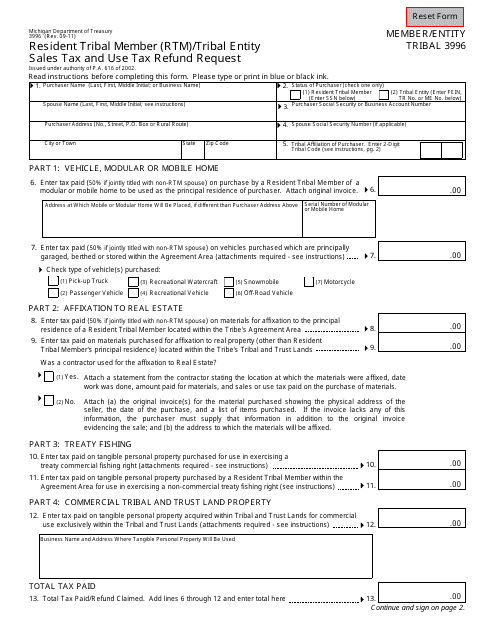

Form 3996 Resident Tribal Member (Rtm)/Tribal Entity Sales Tax and Use Tax Refund Request - Michigan

This Form is used for requesting a sales tax and use tax refund for residents who are tribal members or tribal entities in Michigan.

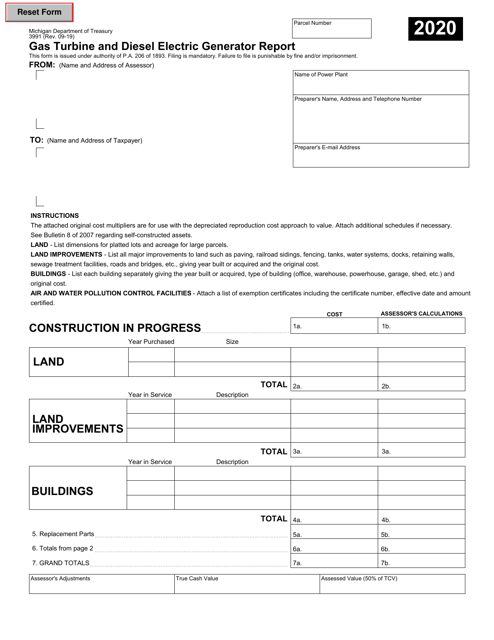

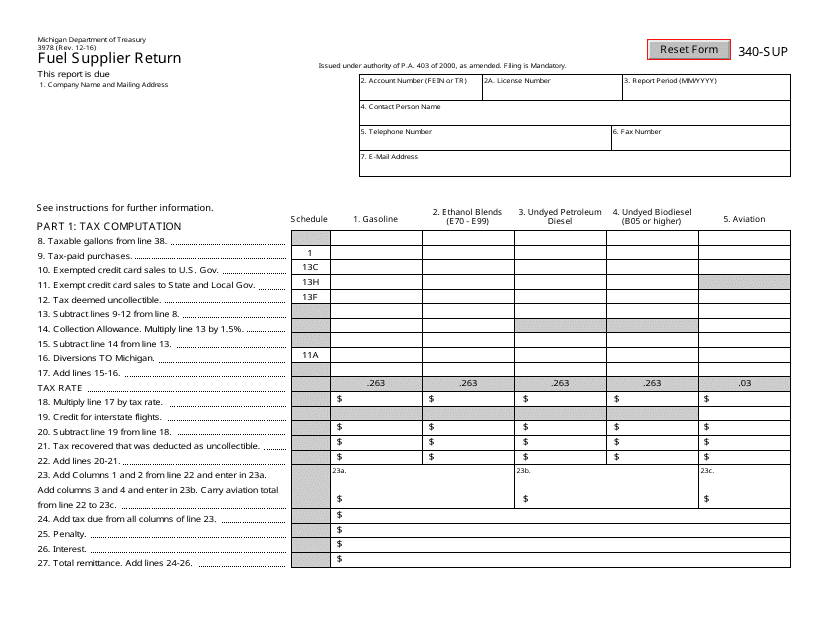

This form is used for fuel suppliers in the state of Michigan to report their activities and comply with tax regulations.

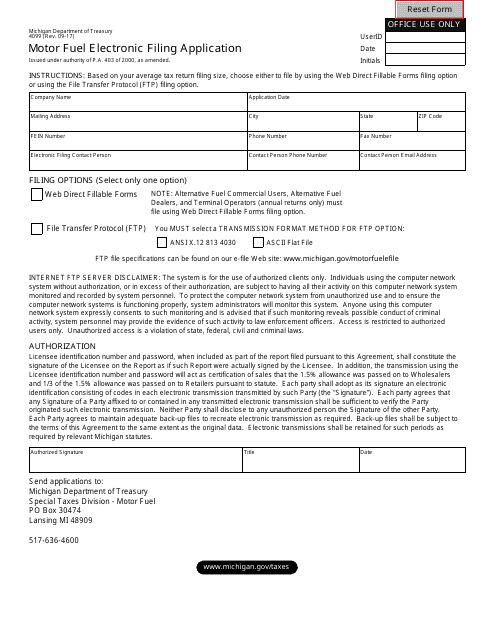

This form is used for electronically filing motor fuel applications in the state of Michigan.

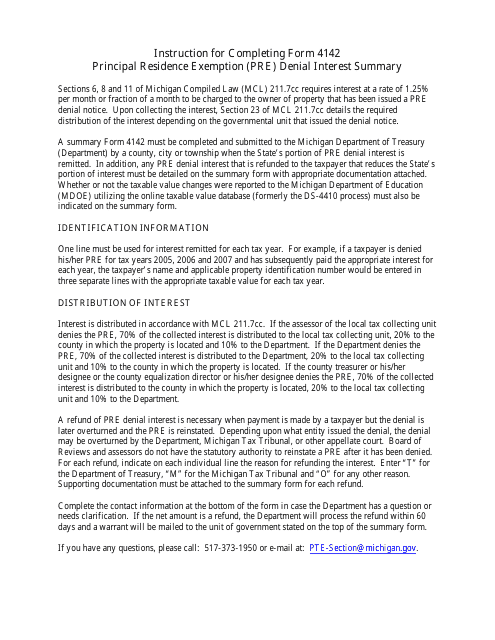

This document is used to provide instructions for completing Form 4142 Principal Residence Exemption (PRE) Denial Interest Summary in the state of Michigan.

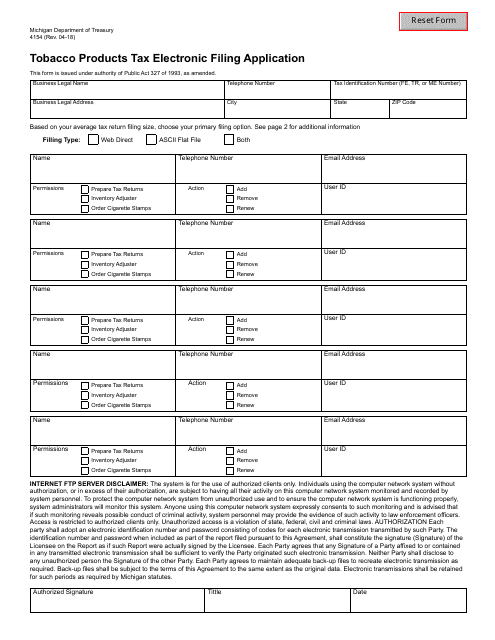

This form is used for electronic filing of tobacco products tax in the state of Michigan.

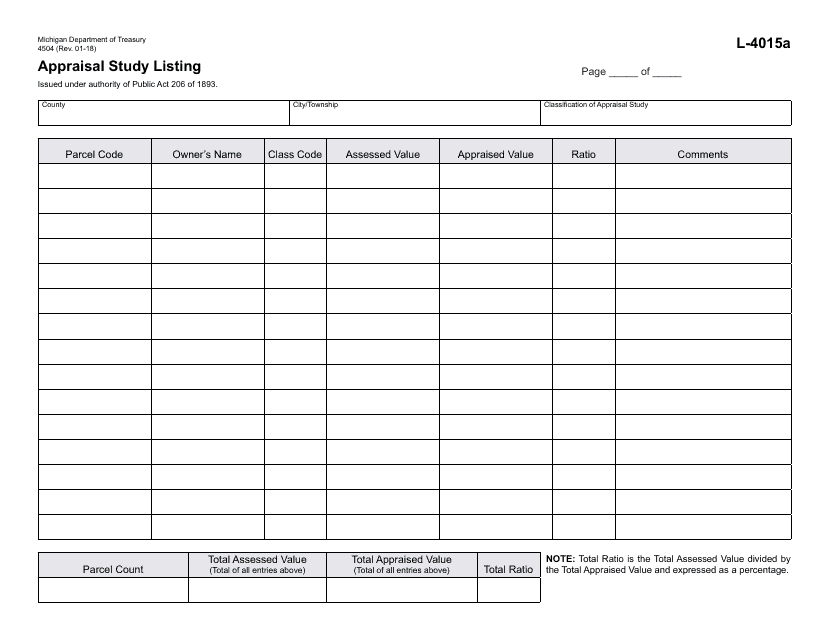

This form is used for listing appraisal studies in the state of Michigan. It provides a comprehensive record of different appraisals conducted within the state.

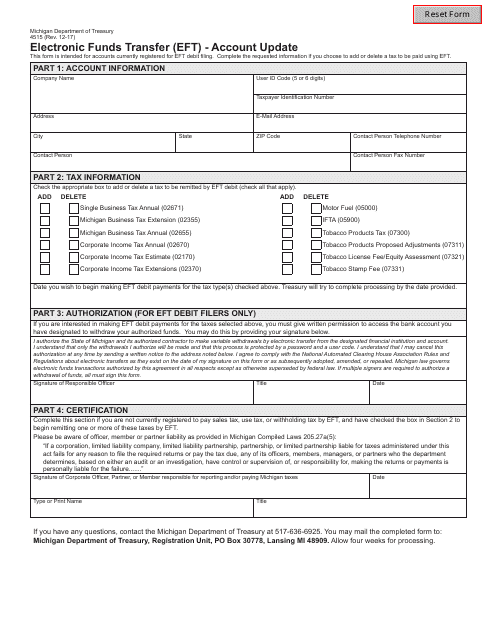

This form is used for updating account information for electronic funds transfers in Michigan.

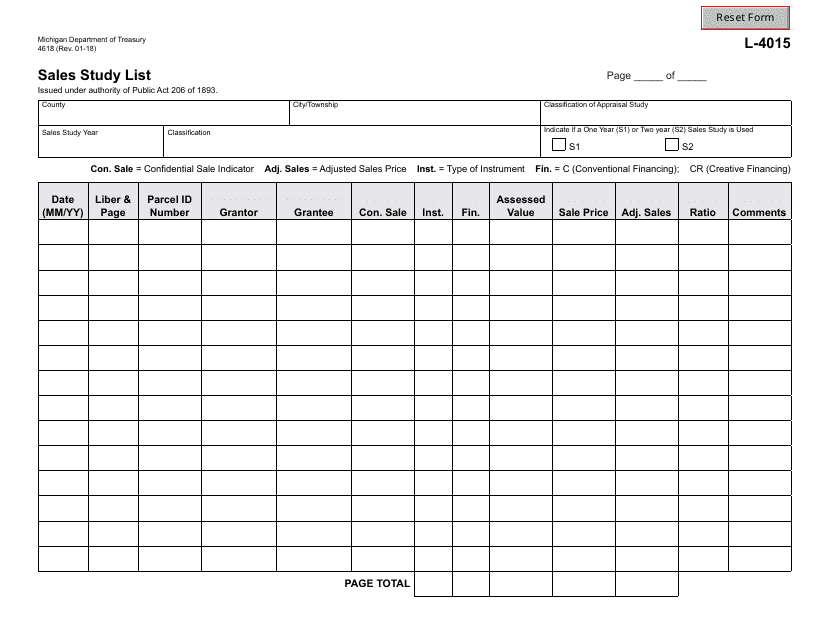

This form is used for submitting a sales study list in the state of Michigan.

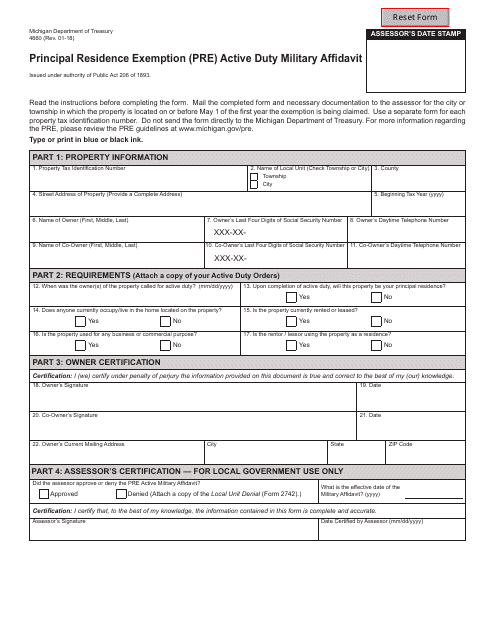

This form is used for applying for a Principal Residence Exemption (PRE) for active duty military members in Michigan. It is an affidavit that helps military personnel receive property tax exemptions for their primary residence while they are serving.

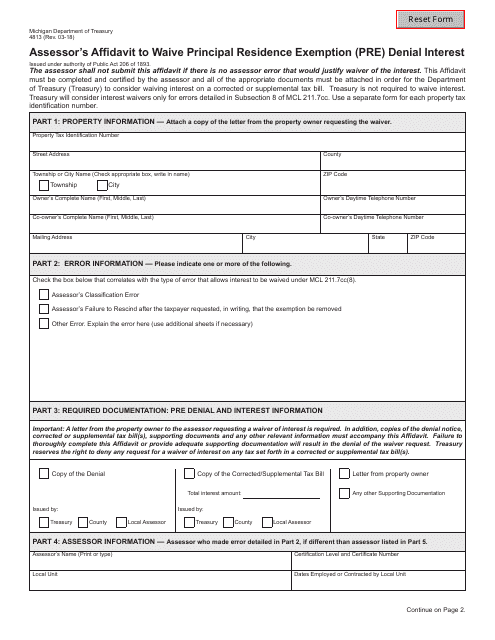

This form is used for Assessor's Affidavit to waive Principal Residence Exemption (PRE) Denial Interest in Michigan.

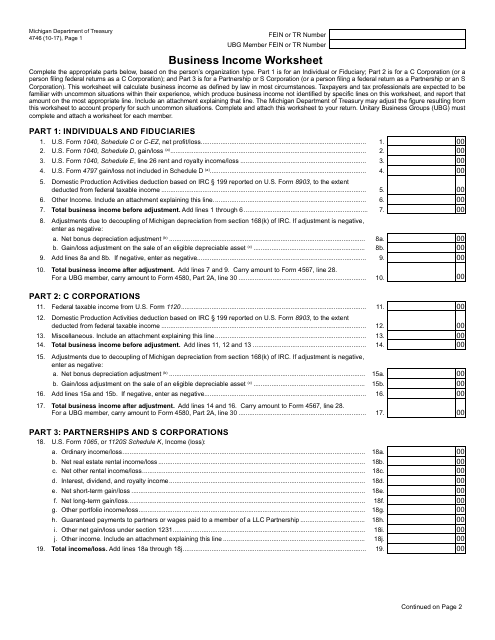

This document is used for calculating business income in the state of Michigan. It helps business owners organize their financial information and determine their taxable income.

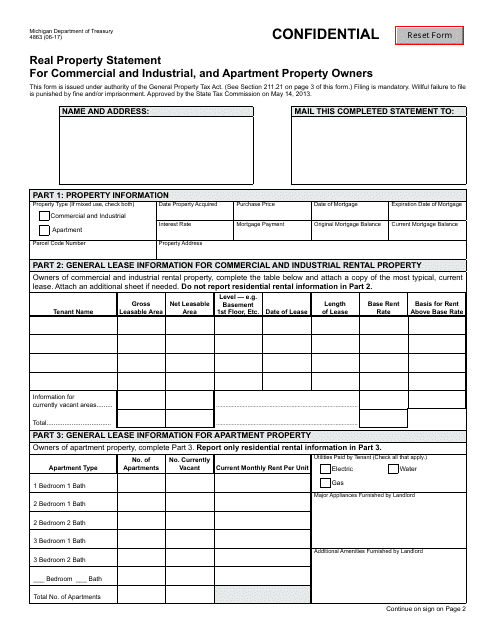

This form is used for commercial and industrial, and apartment property owners in Michigan to provide a statement about their real property.

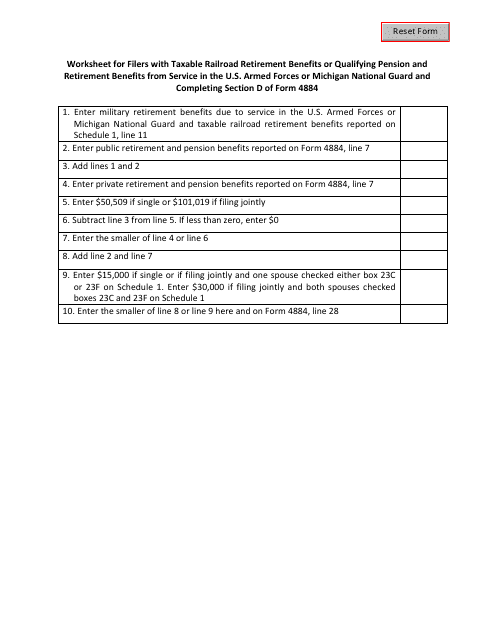

This document is a worksheet for individuals who have taxable railroad retirement benefits or qualifying pension and retirement benefits from service in the U.S. Armed Forces or Michigan National Guard. It is used for completing Section D of Form 4884 in the state of Michigan.

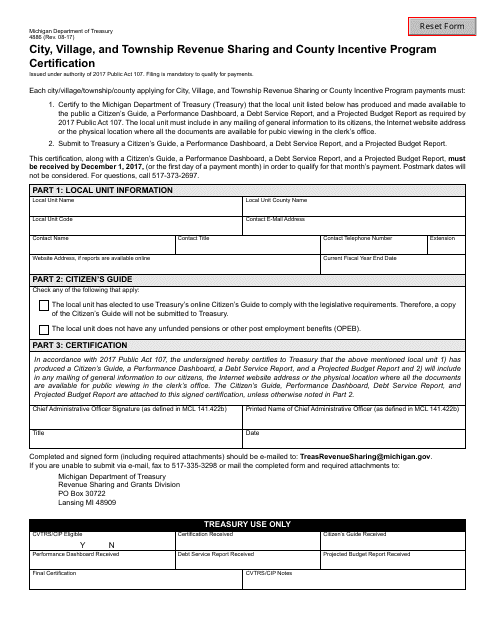

This form is used for certifying revenue sharing and county incentive programs for cities, villages, townships in Michigan.

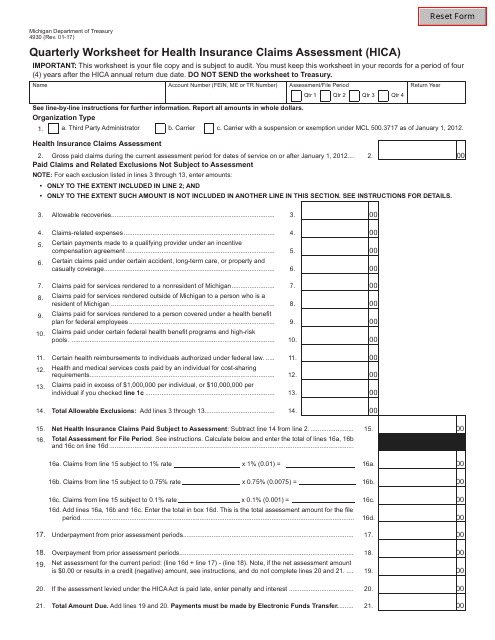

This form is used for the quarterly assessment of health insurance claims in Michigan. It is used to calculate the amount owed for the Health Insurance Claims Assessment (HICA).

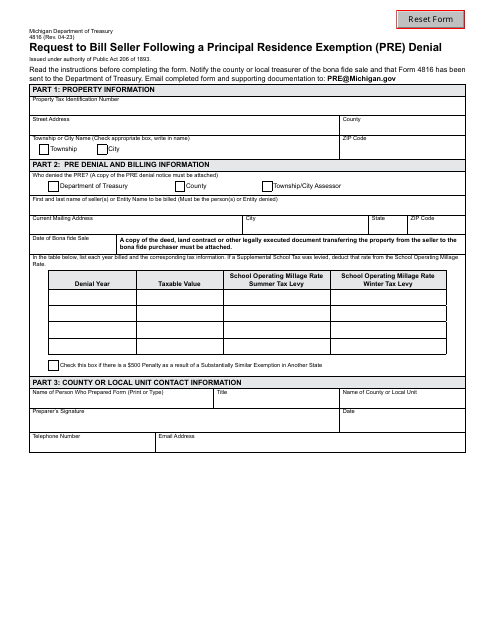

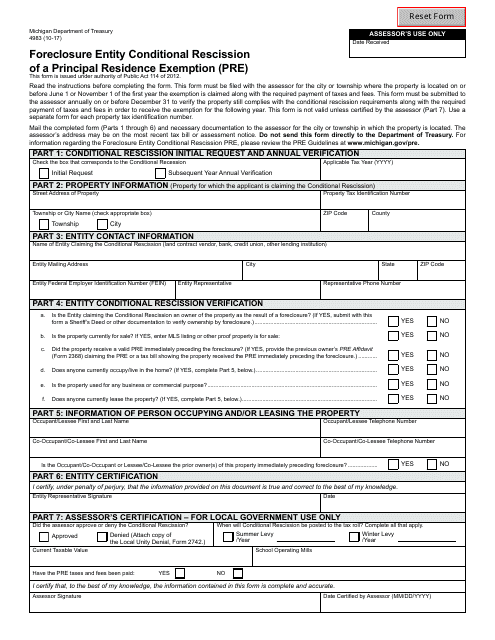

This Form is used for requesting the conditional rescission of a principal residence exemption for foreclosure entities in the state of Michigan.

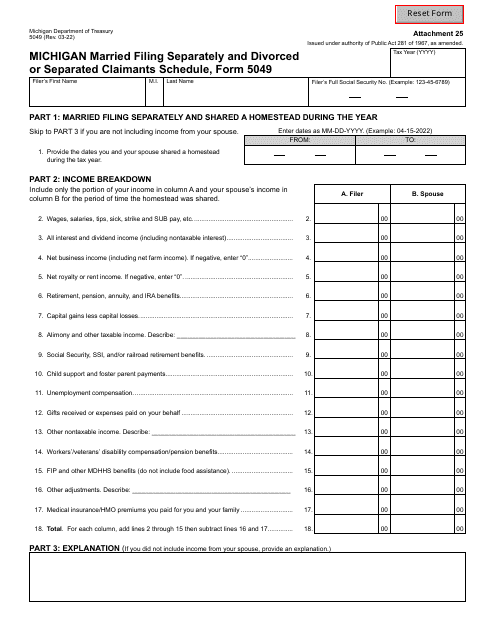

Form 5049 Michigan Married Filing Separately and Divorced or Separated Claimants Schedule - Michigan

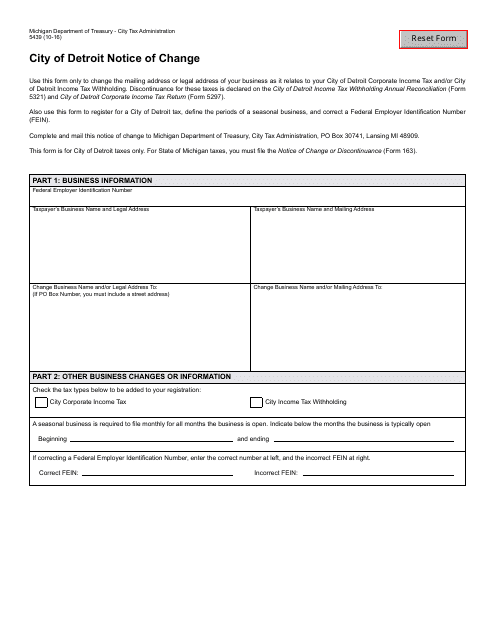

This document is used for notifying the City of Detroit about a change in a person's information in the state of Michigan.

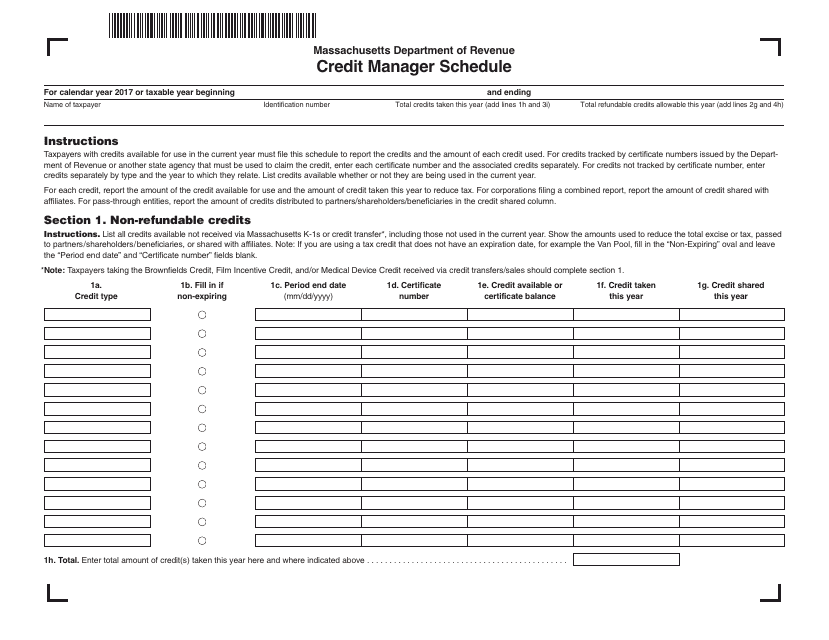

This document is a schedule for the Credit Manager in the state of Massachusetts. It outlines the specific tasks and responsibilities of the Credit Manager in managing credit operations.

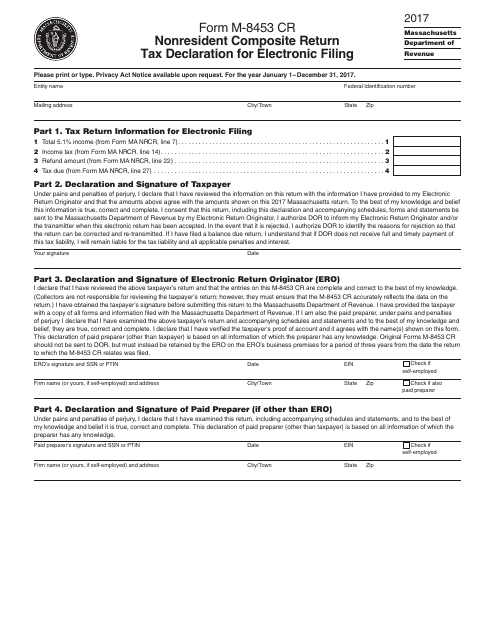

This Form is used for nonresident individuals in Massachusetts to declare their tax information for electronic filing.

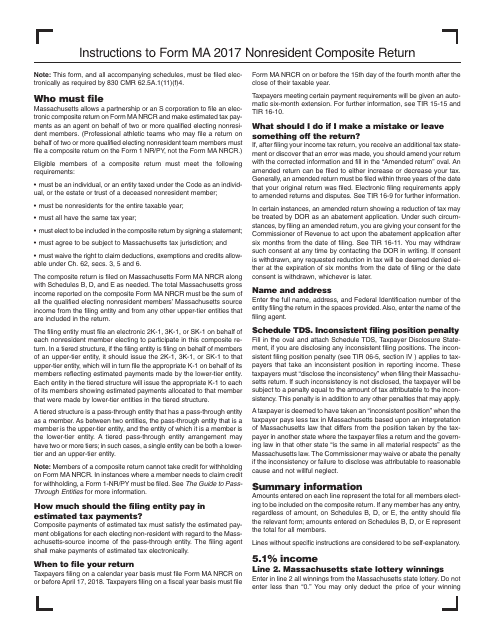

This form is used for filing a nonresident composite return in Massachusetts. It provides instructions for completing and submitting the Form MA Nonresident Composite Return.