Tax Templates

Documents:

2882

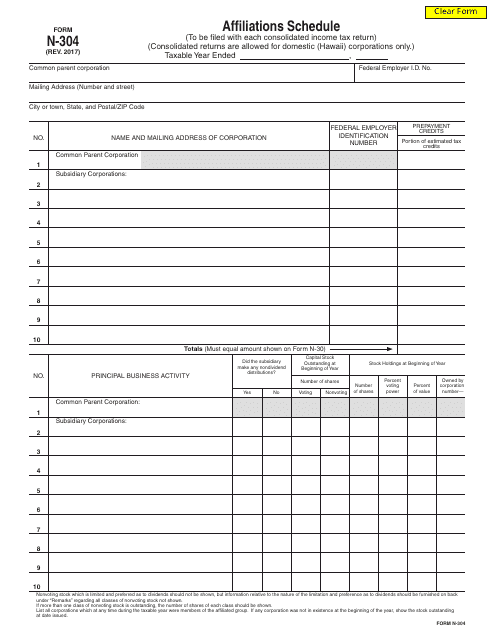

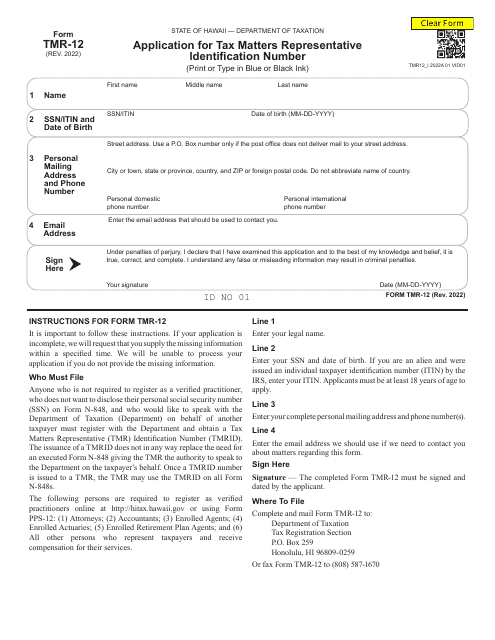

This Form is used for reporting any affiliations or connections that a taxpayer has with entities in Hawaii. It is used as part of the Hawaii state income tax return.

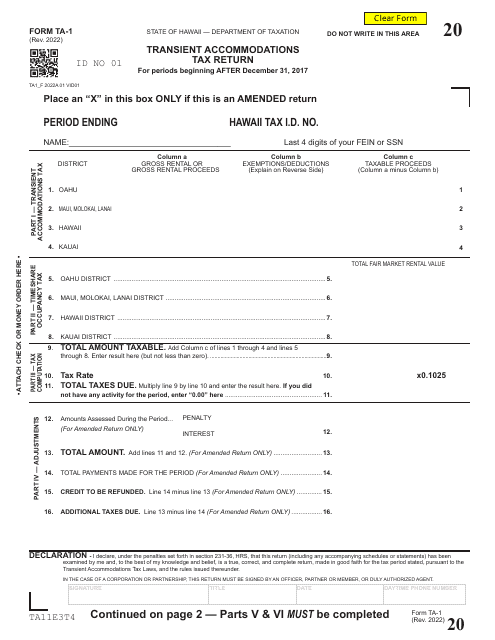

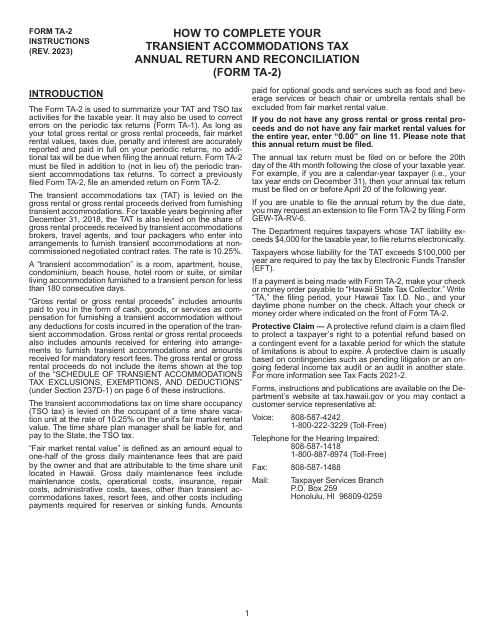

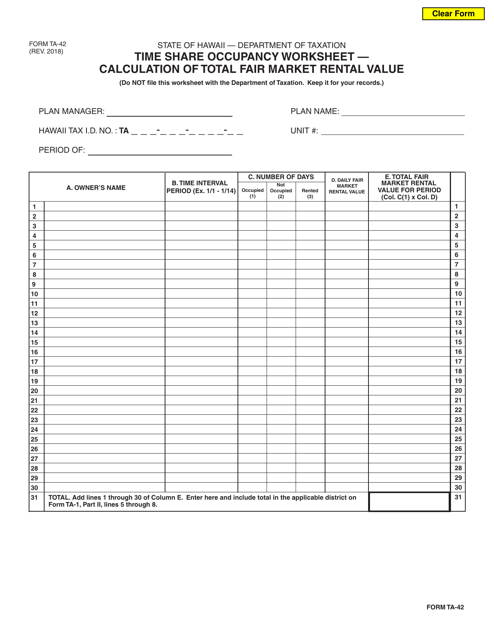

Form TA-1 Transient Accommodations Tax Return for Periods Beginning After December 31, 2017 - Hawaii

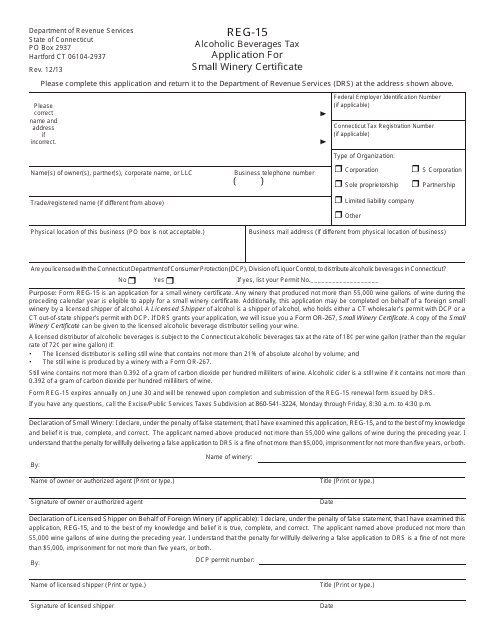

This form is used for small wineries in Connecticut to apply for a certificate related to the alcoholic beverages tax.

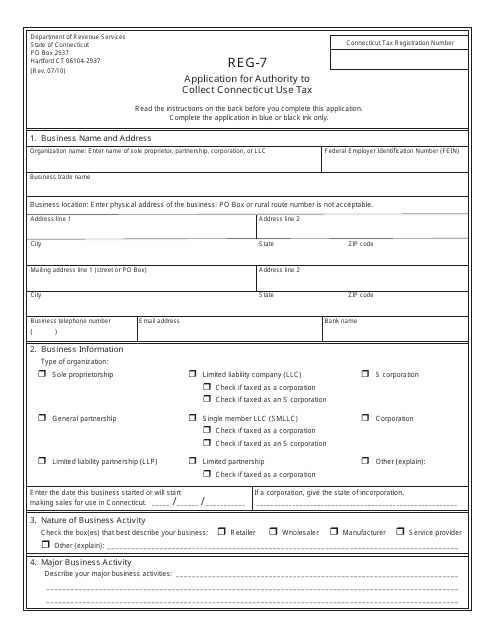

This form is used for individuals or businesses to apply for the authority to collect Connecticut Use Tax in the state of Connecticut.

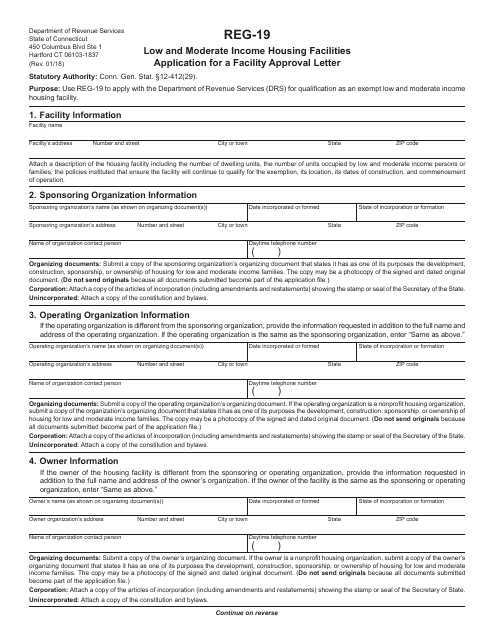

This Form is used for low and moderate income housing facilities in Connecticut to apply for a Facility Approval Letter. The form helps in ensuring that housing facilities meet the necessary requirements for providing affordable housing options.

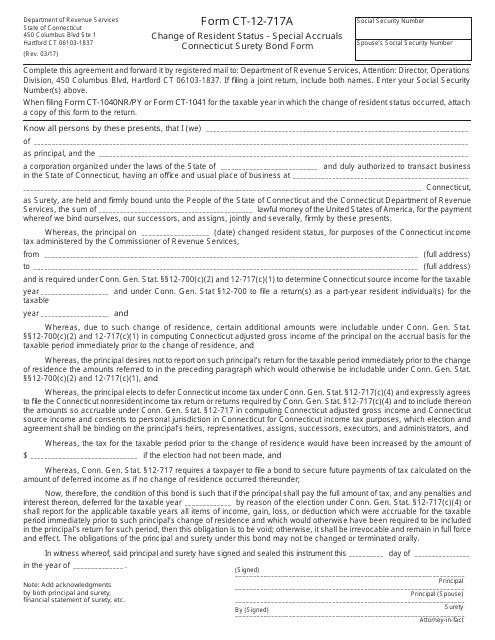

This Form is used for changing resident status and special accruals in Connecticut. It also includes the Connecticut Surety Bond Form.

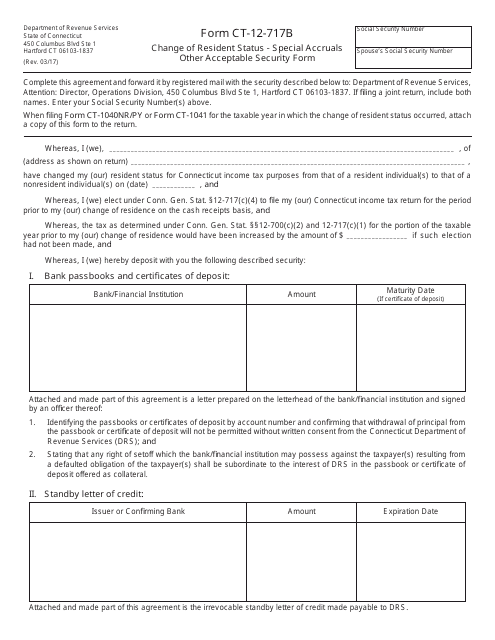

This form is used for changing resident status and reporting other acceptable securities in Connecticut.

This Form is used for making changes in resident status and reporting special accruals in the state of Connecticut.

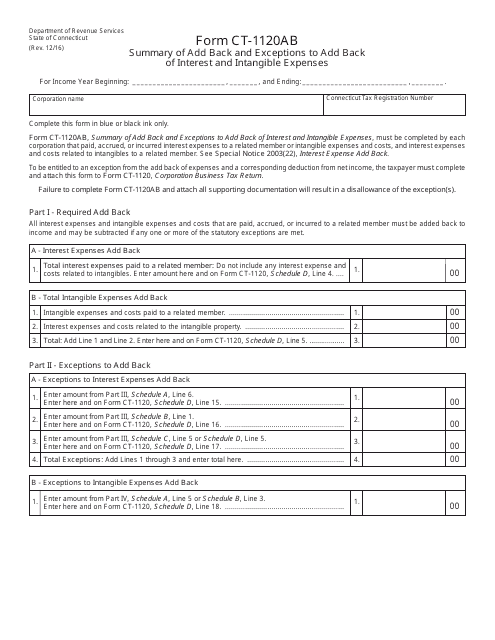

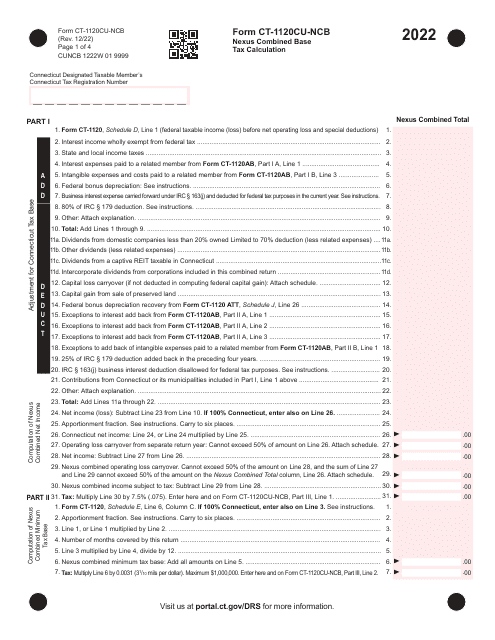

This form is used for summarizing the add back and exceptions to add back of interest and intangible expenses in Connecticut.

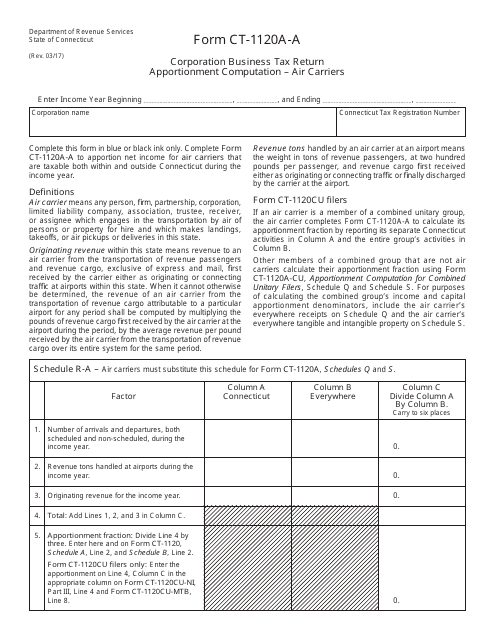

This form is used by air carriers in Connecticut to calculate the apportionment of their corporation business tax return.

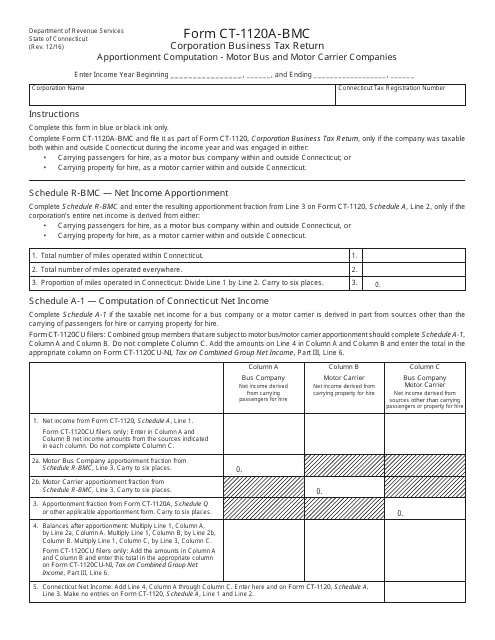

This form is used for BMC Corporation business tax return in Connecticut. It specifically focuses on apportionment computation for motor bus and motor carrier companies.

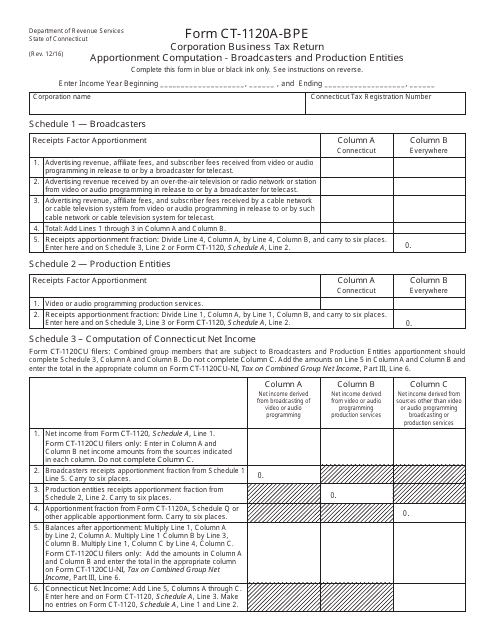

This document is used for Corporation Business Tax Return for broadcasters and production entities in Connecticut. It is specifically for apportionment computation.

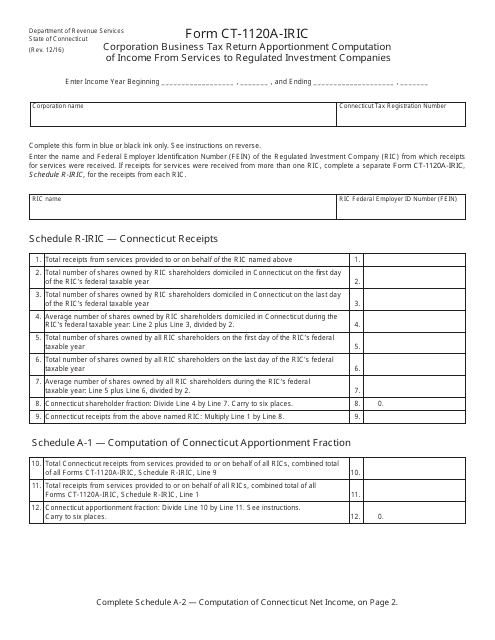

This form is used by corporations in Connecticut to calculate the apportionment of income from services to regulated investment companies for the purpose of filing their business tax return.

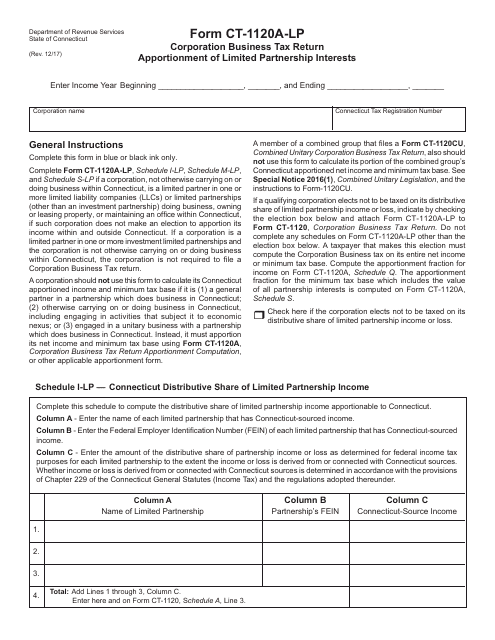

This Form is used for filing the Corporation Business Tax Return and apportioning limited partnership interests in Connecticut.

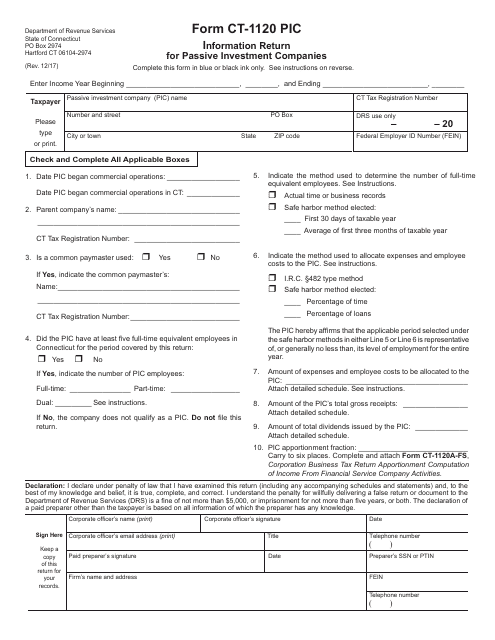

This form is used for filing the CT-1120 PIC Information Return for Passive Investment Companies in Connecticut.

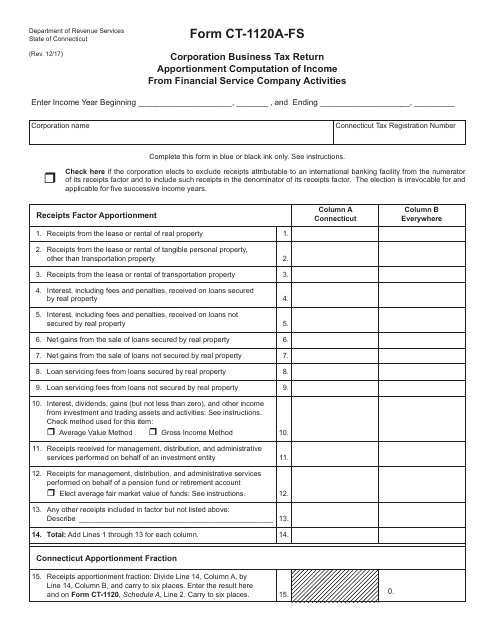

This Form is used for corporations to calculate and report the apportionment of income from financial service company activities in the state of Connecticut for business tax purposes.

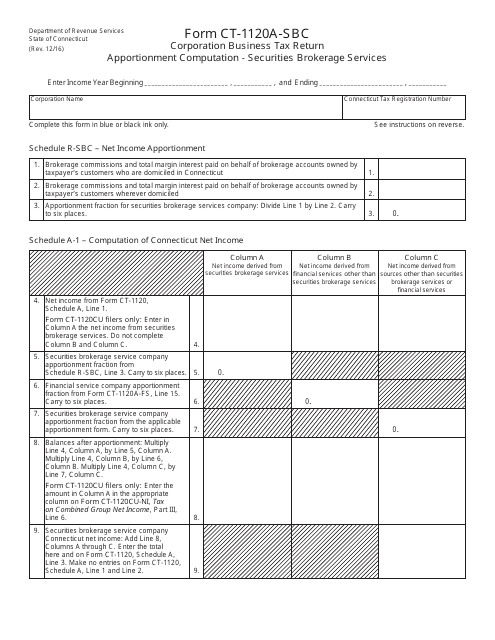

This Form is used for calculating the apportionment of business tax for corporations in Connecticut that provide securities brokerage services. It helps determine the portion of income that can be attributed to the state for tax purposes.

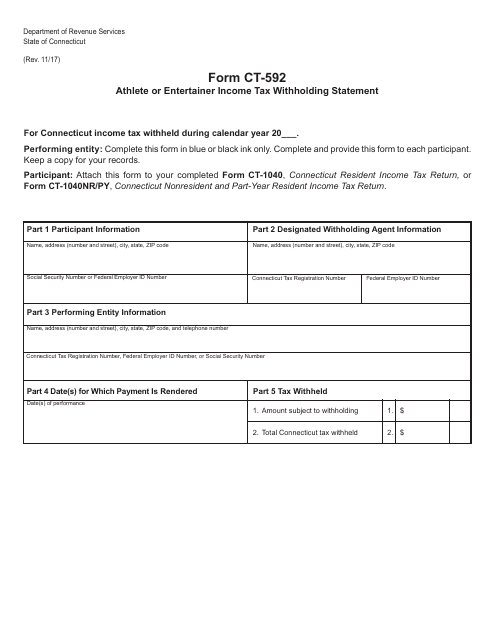

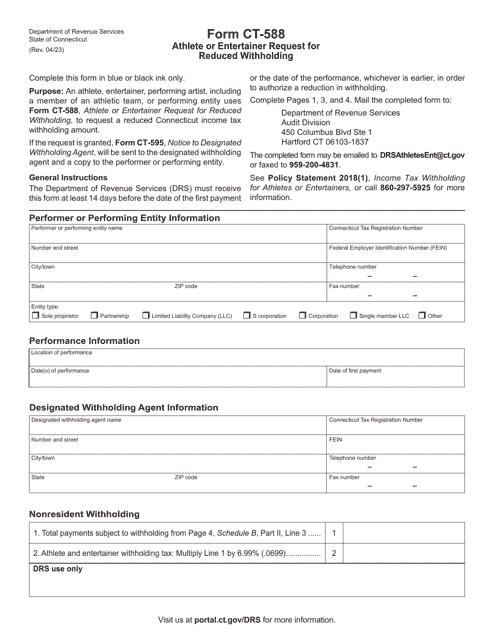

This form is used for reporting income tax withholding for athletes or entertainers in Connecticut.

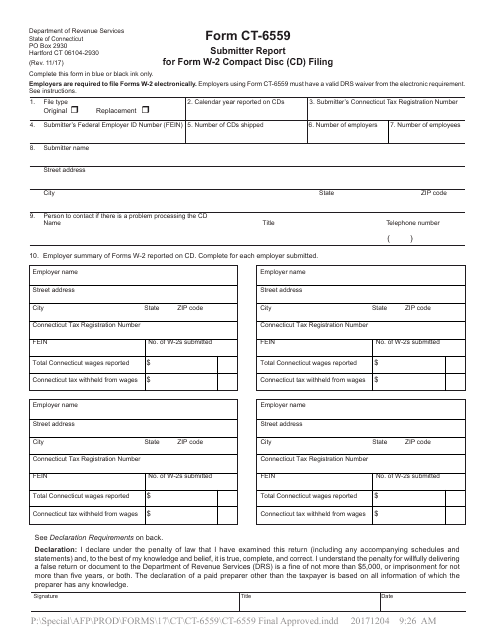

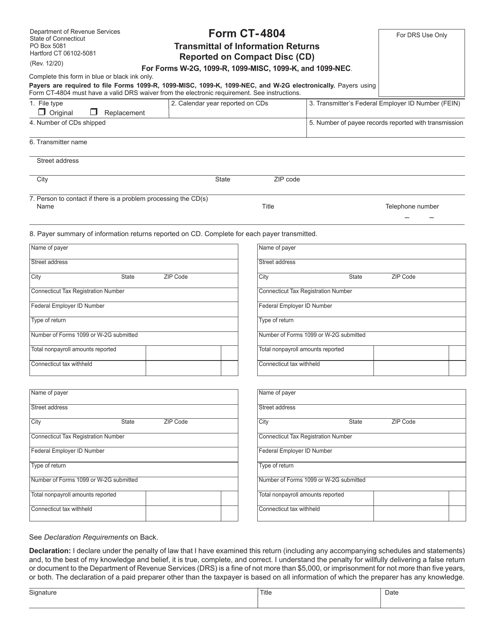

This form is used for submitting the Submitter Report for Form W-2 Compact Disc (CD) Filing in Connecticut.

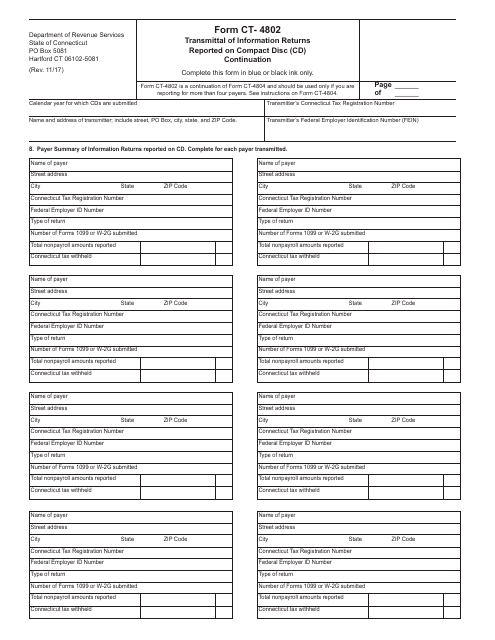

This form is used for transmitting information returns that are reported on a compact disc (CD) continuation in the state of Connecticut.

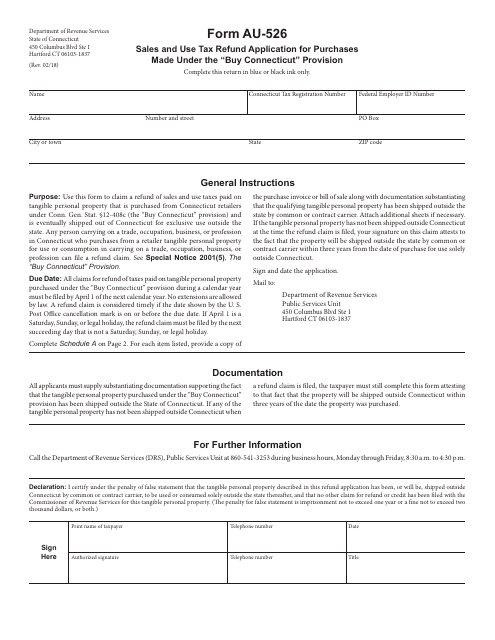

This Form is used for requesting a refund of sales and use tax on purchases made under the "buy Connecticut" provision in Connecticut.

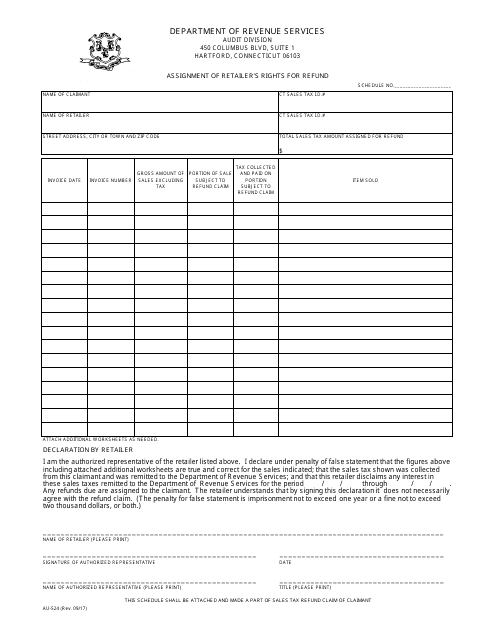

This form is used for assigning a retailer's rights for refund in Connecticut. It allows retailers to transfer their right to claim a refund to another party.

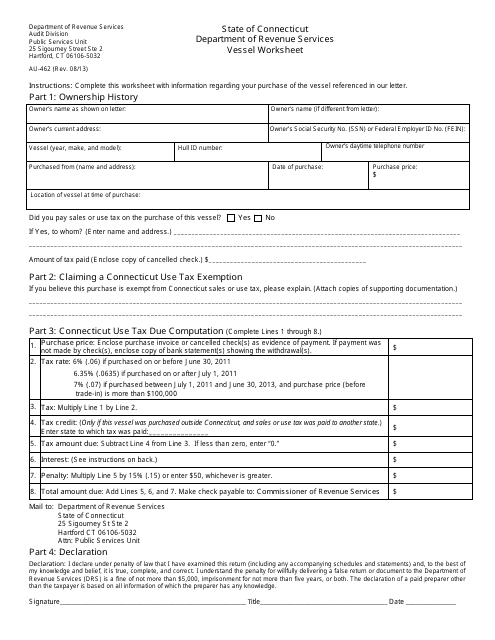

This form is used for completing a vessel worksheet in the state of Connecticut. The worksheet provides information about the vessel, such as the make, model, and registration details.

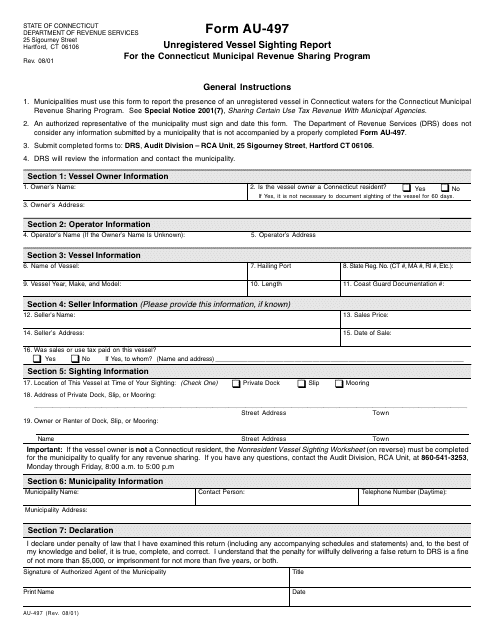

This Form is used for reporting unregistered vessel sightings in Connecticut for the Municipal Revenue Sharing Program.

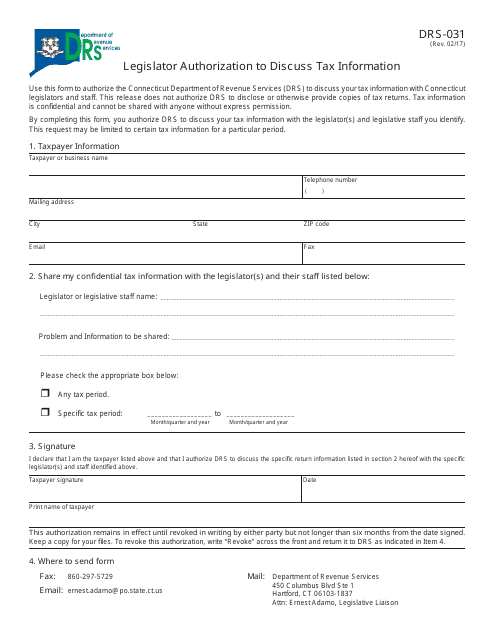

This form is used for Connecticut legislators to authorize discussion of tax information.