Tax Templates

Documents:

2882

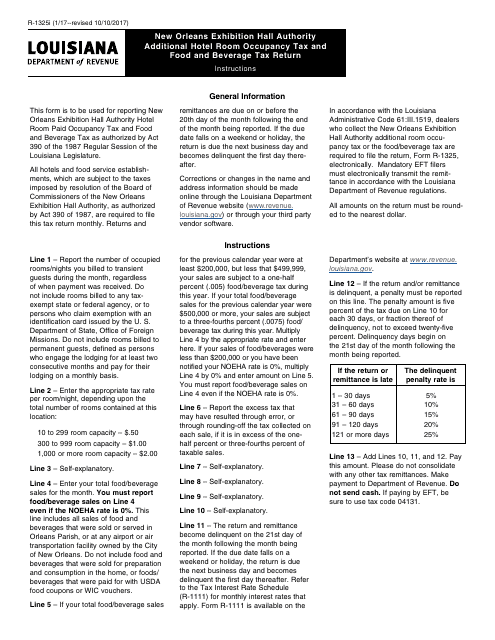

This Form is used for filing additional hotel room occupancy tax and food and beverage tax returns in Louisiana.

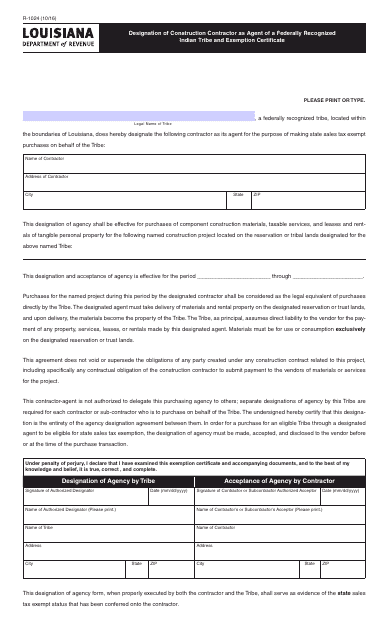

This type of document is used for designating a construction contractor as an agent of a federally recognized Indian tribe in Louisiana and for obtaining an exemption certificate.

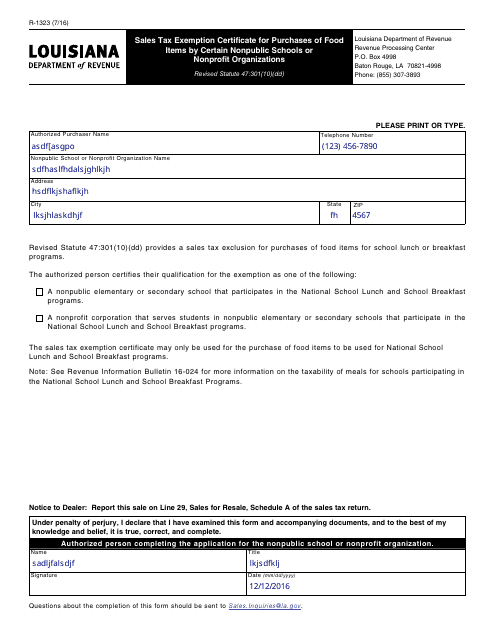

This form is used for obtaining a sales tax exemption certificate in Louisiana for the purchase of food items by certain nonpublic schools or nonprofit organizations.

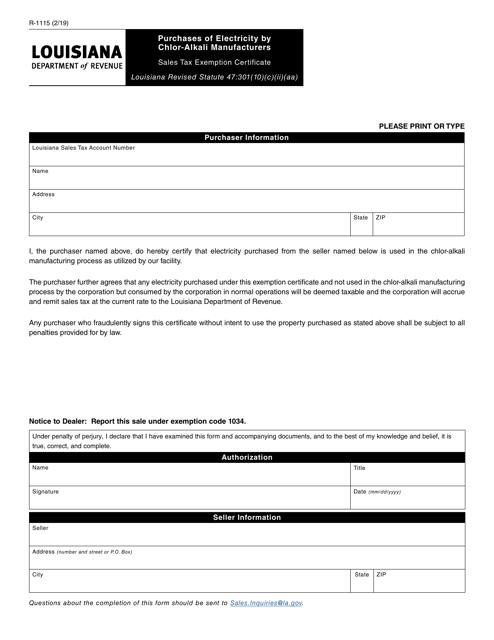

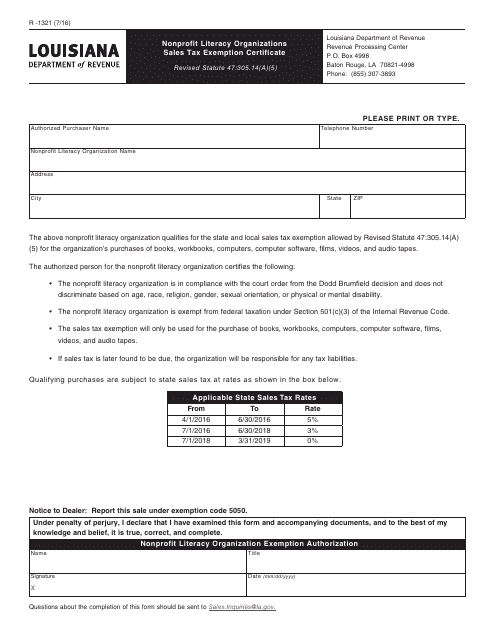

This form is used for nonprofit literacy organizations in Louisiana to request a sales tax exemption certificate.

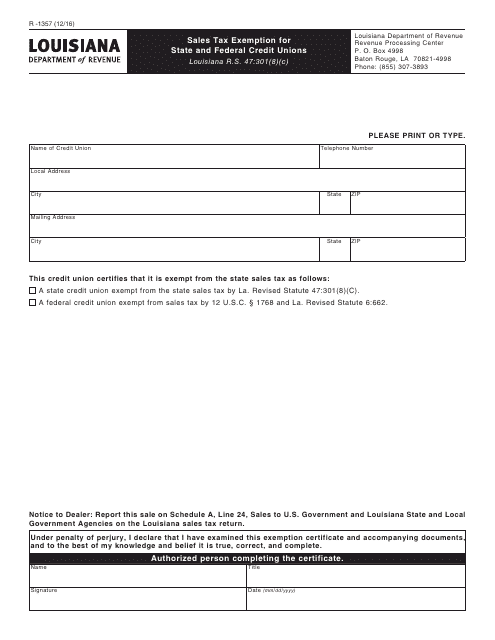

This form is used for state and federal credit unions in Louisiana to claim an exemption from sales tax.

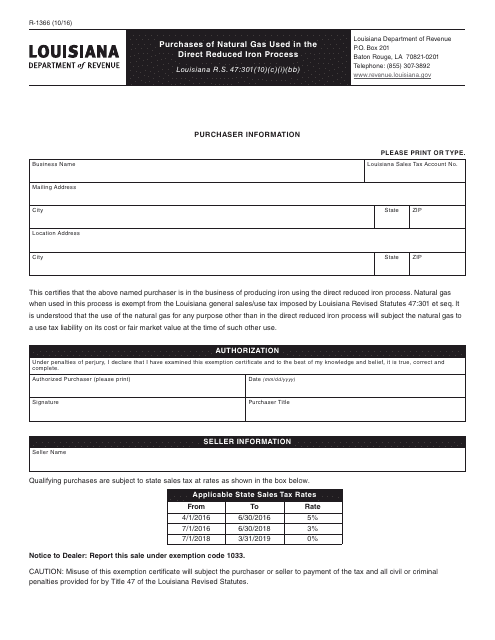

This form is used for reporting the purchases of natural gas that is used in the direct reduced iron process in the state of Louisiana.

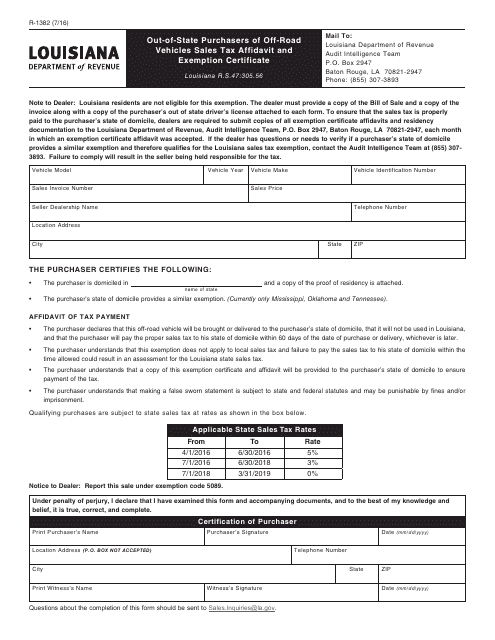

This form is used for out-of-state purchasers of off-road vehicles in Louisiana to declare their sales tax exemption and provide necessary information.

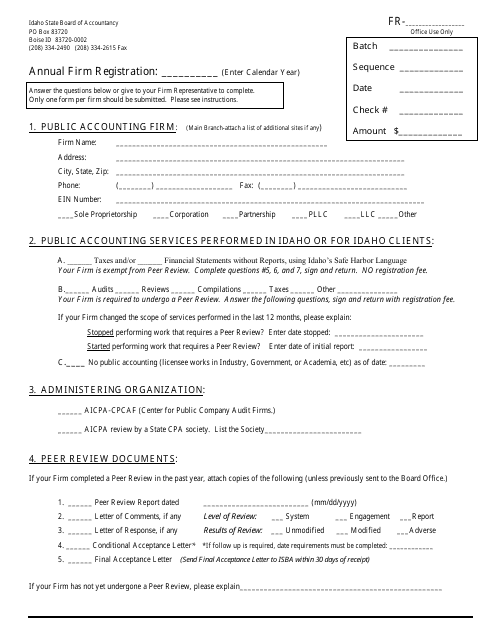

This Form is used for registering a firm on an annual basis in the state of Idaho.

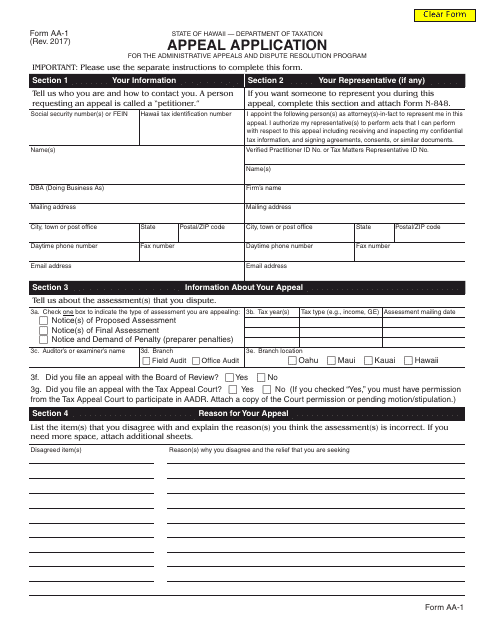

This form is used for filing an appeal application in the state of Hawaii.

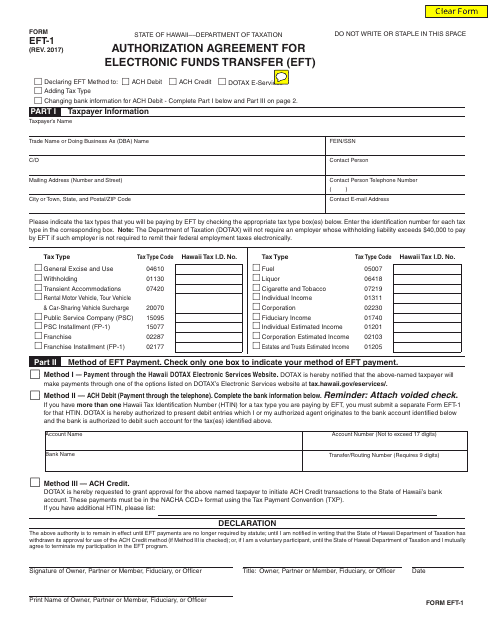

This Form is used for authorizing electronic funds transfer in Hawaii.

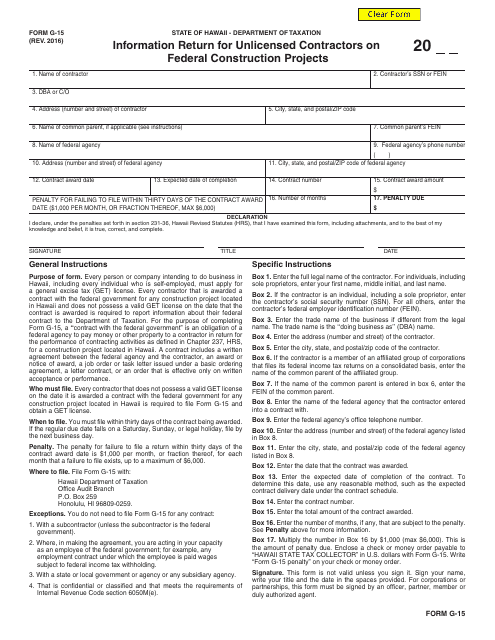

This Form is used for reporting information about unlicensed contractors working on federal construction projects in Hawaii. It helps ensure compliance with regulations and promotes fair competition in the construction industry.

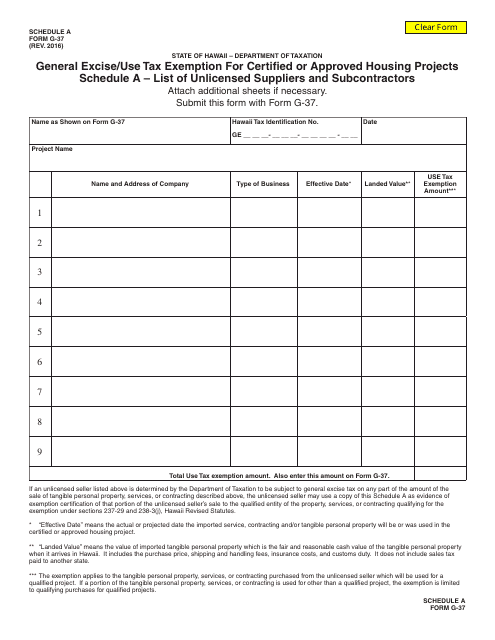

This form is used for listing unlicensed suppliers and subcontractors for claiming a general excise/use tax exemption for certified or approved housing projects in Hawaii.

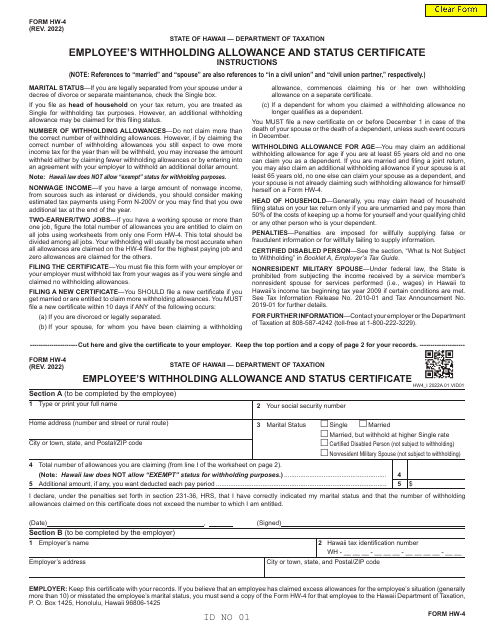

This is a state of Hawaii legal document completed by an employee for their employer's records to provide information about withholding allowances.

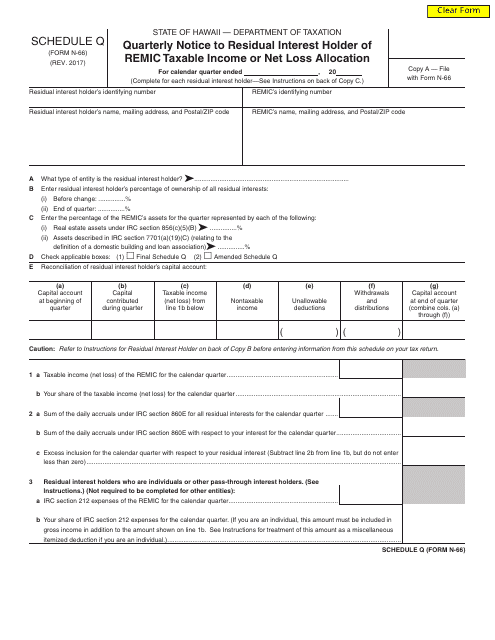

This form is used for providing quarterly notice to residual interest holders of REMIC taxable income or net loss allocation in Hawaii.

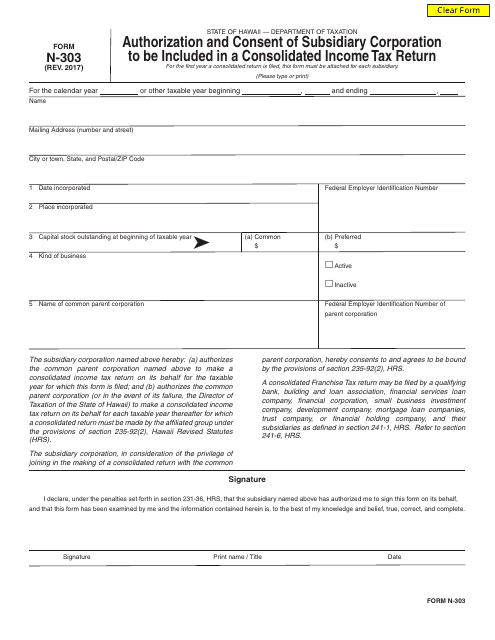

This form is used for a subsidiary corporation in Hawaii to authorize and consent to be included in a consolidated income tax return.

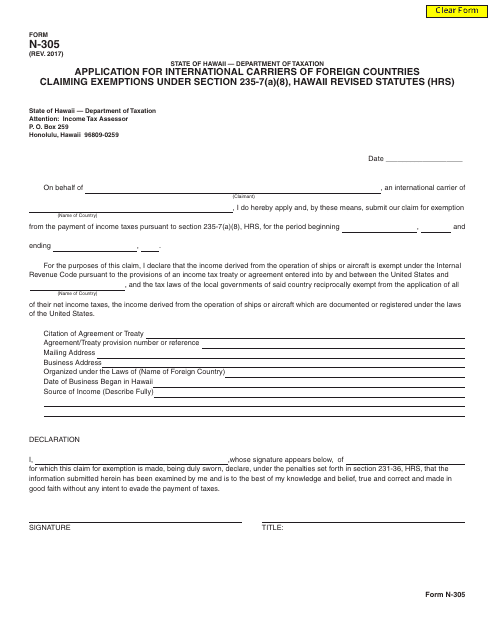

This document is used by international carriers of foreign countries to apply for exemptions under Section 235-7(A)(8) of the Hawaii Revised Statutes.