Tax Templates

Documents:

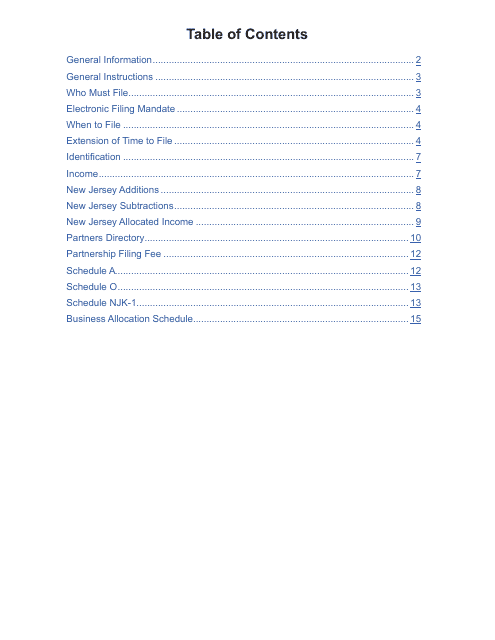

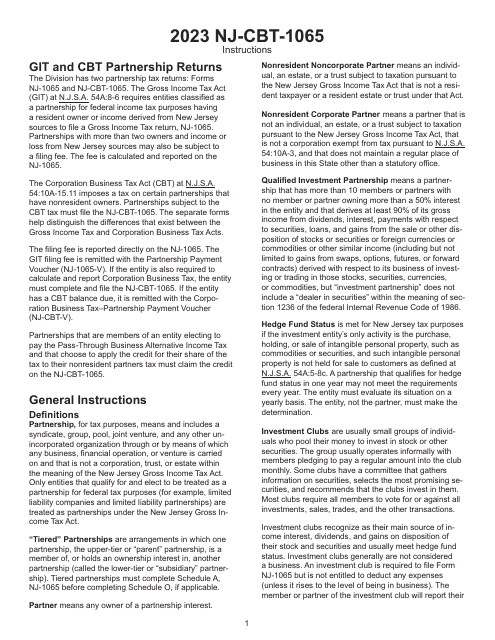

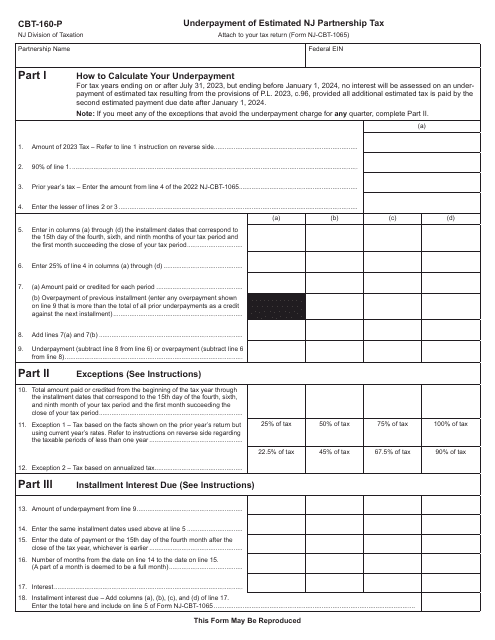

2882

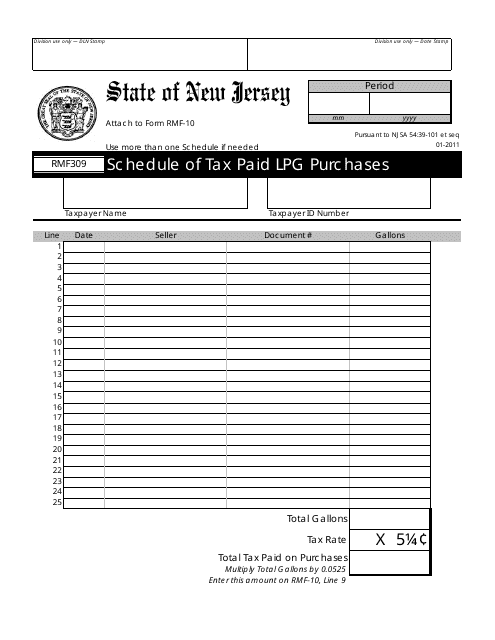

This form is used for reporting and recording the tax paid on purchases of LPG (liquefied petroleum gas) in the state of New Jersey.

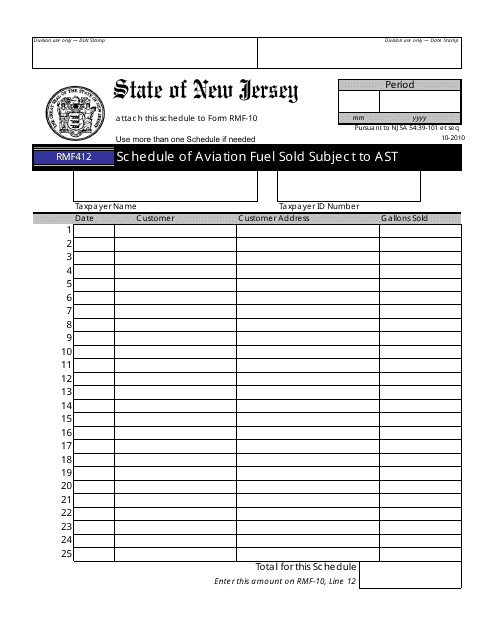

This form is used for reporting the schedule of aviation fuel sold subject to the AST (Aboveground Storage Tank) regulations in New Jersey.

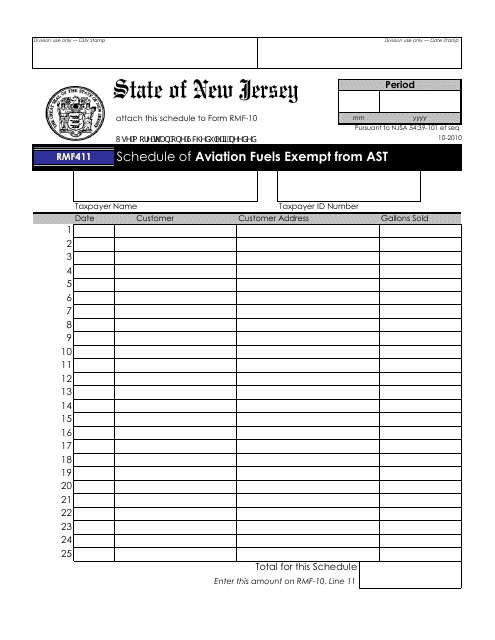

This form is used for listing aviation fuels that are exempt from the petroleum products gross receipts tax in New Jersey.

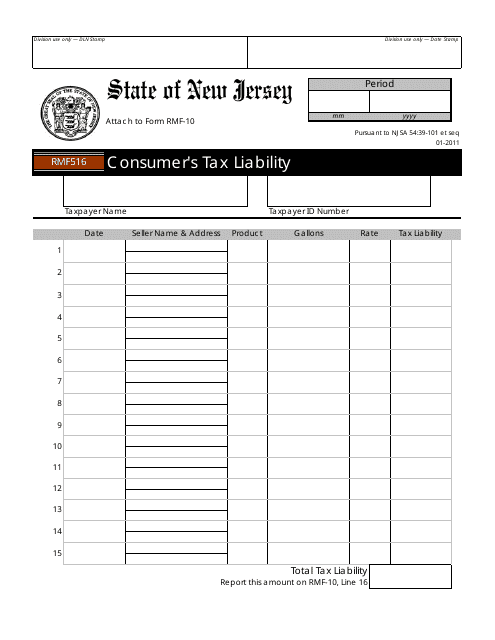

This form is used for reporting a consumer's tax liability in the state of New Jersey.

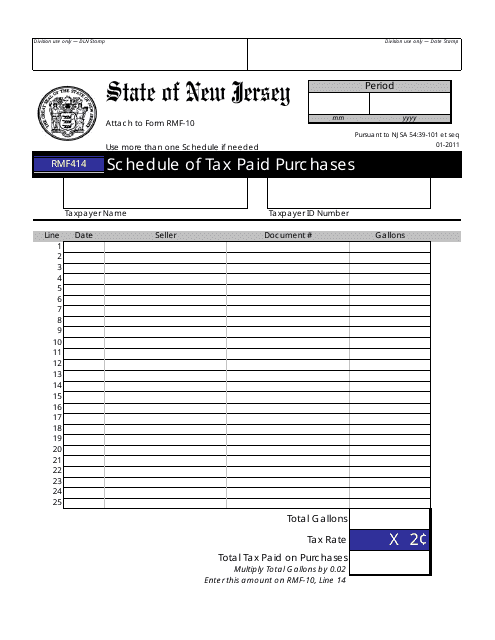

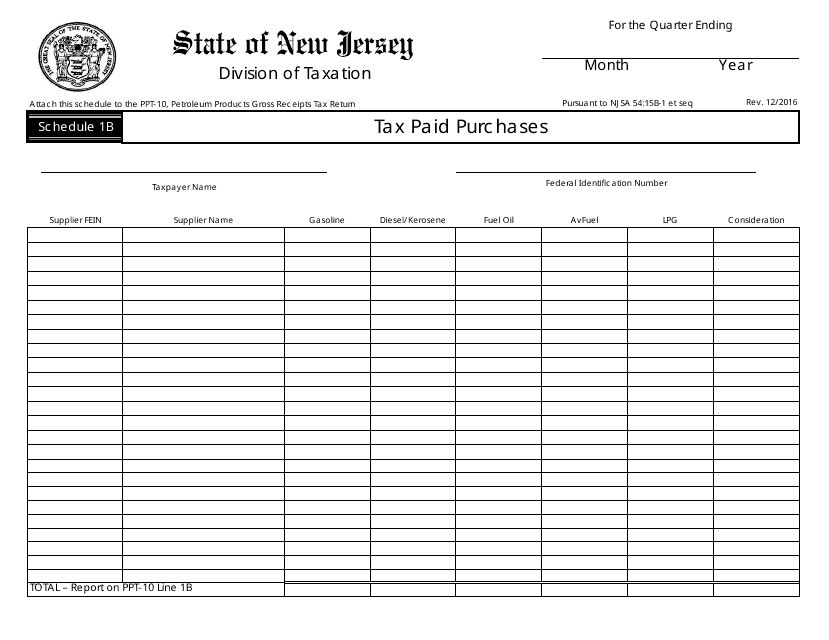

This Form is used for reporting and tracking tax paid purchases in the state of New Jersey. It helps businesses keep a record of their tax payments and is required for tax filing purposes.

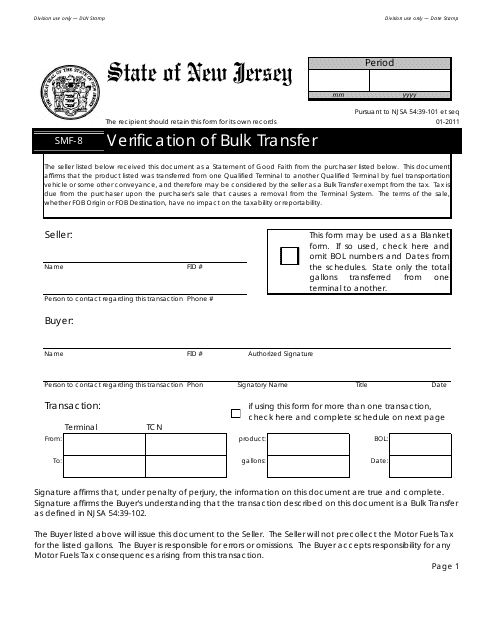

This Form is used for verifying a bulk transfer in the state of New Jersey.

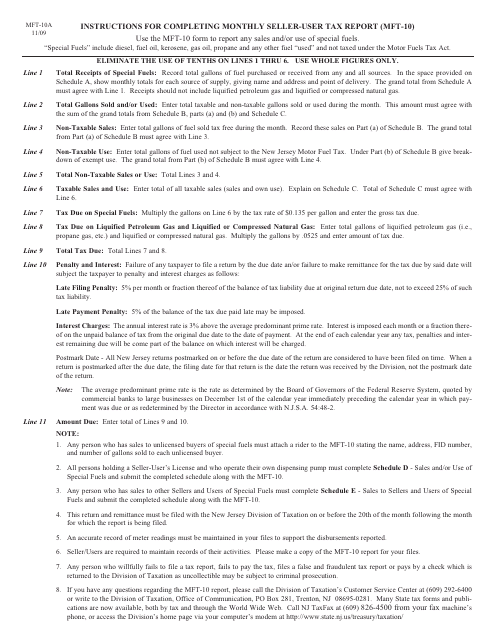

This document is used for filing the Special Fuels Tax Report by sellers and users of special fuels in New Jersey. It provides instructions on how to complete and submit Form MFT-10.

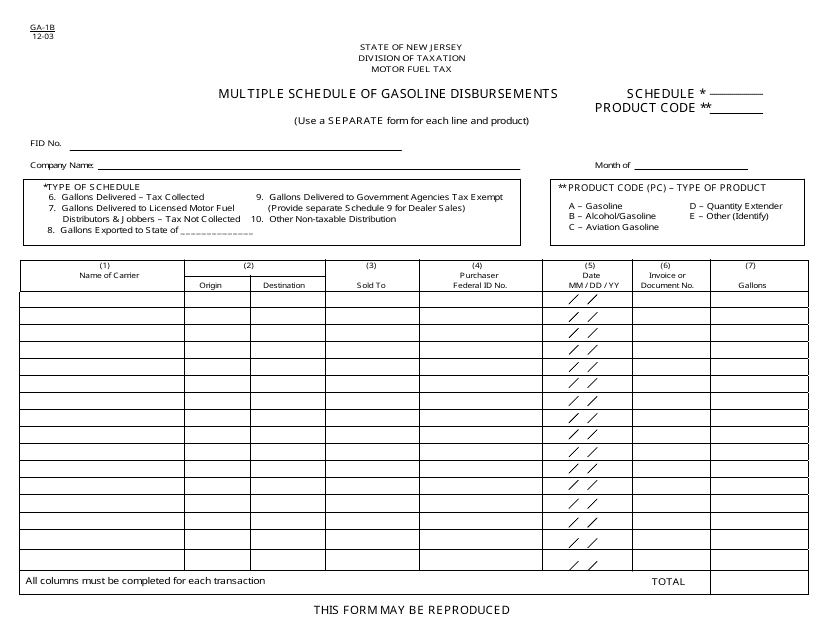

This form is used for reporting multiple schedules of gasoline disbursements in the state of New Jersey.

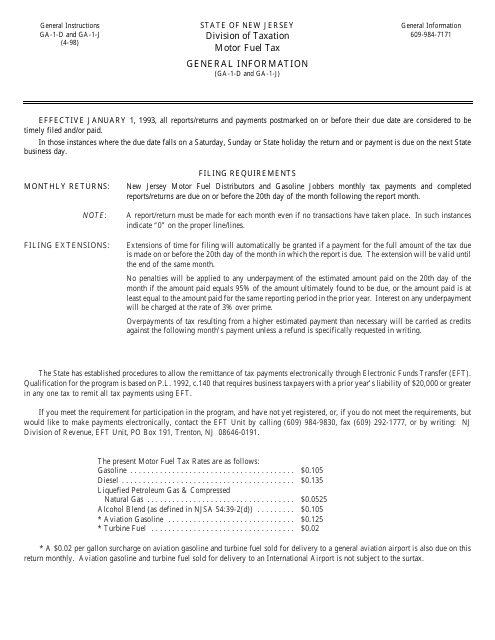

This type of document provides instructions for filling out the Form GA-1-D, GA-1-J Motor Fuel Distributors Report, and Motor Fuel Jobbers Report in New Jersey. It guides motor fuel distributors and jobbers on how to accurately report their information.

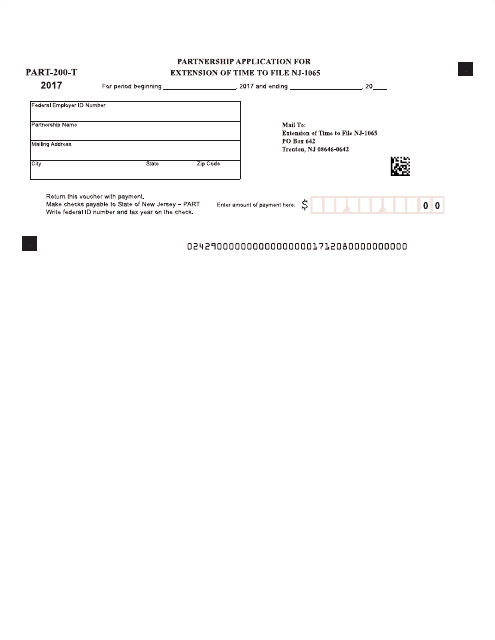

This Form is used to request an extension of time to file the New Jersey Partnership Return (Form NJ-1065).

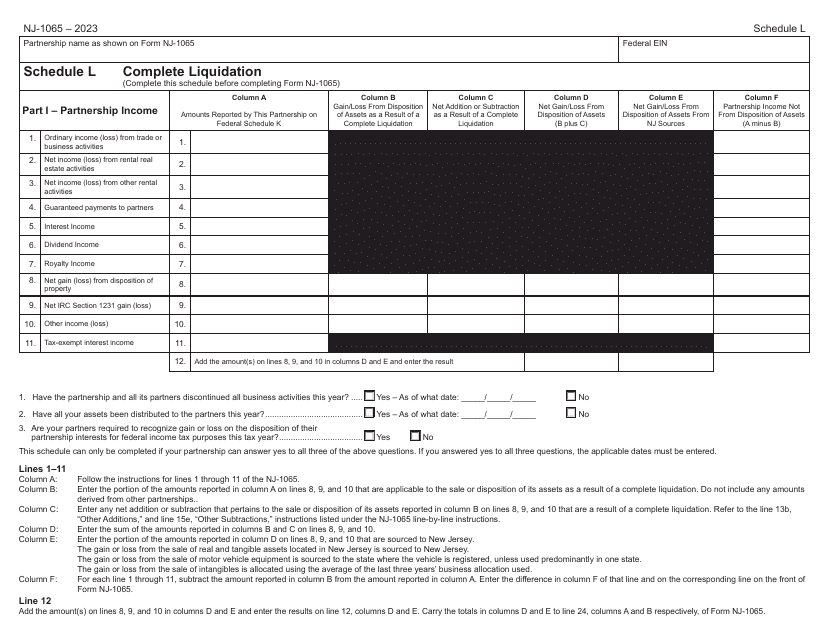

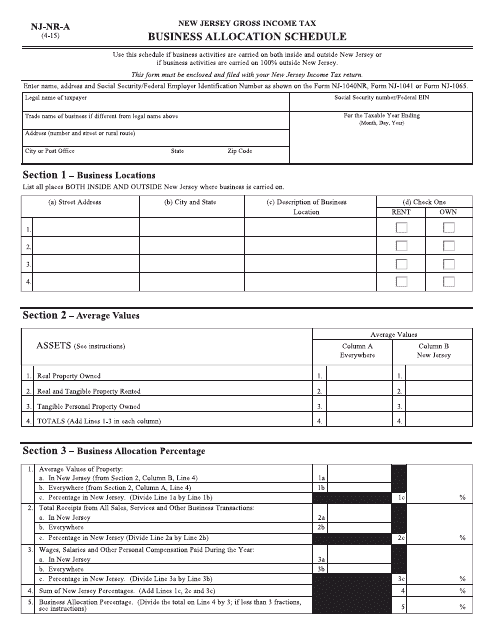

This form is used for business owners to allocate their income and expenses for tax purposes in the state of New Jersey.

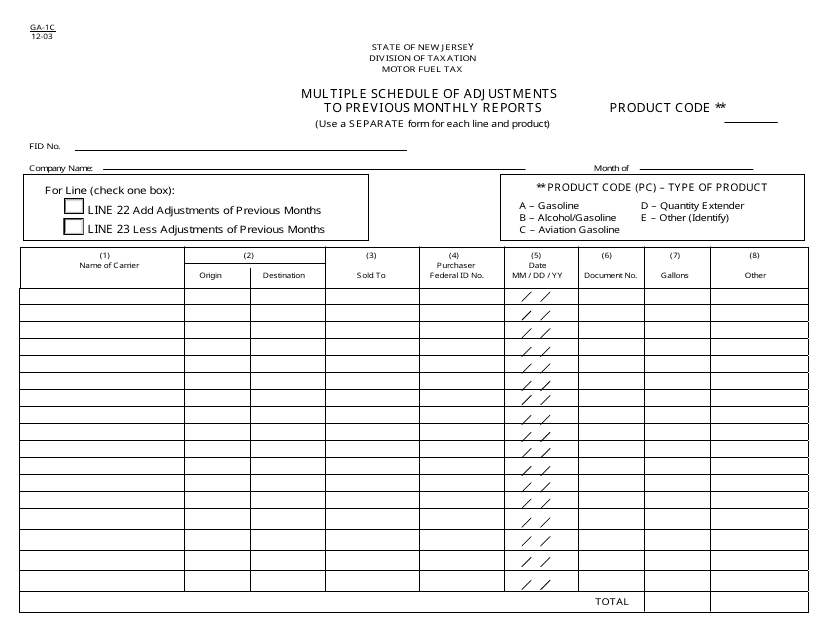

This form is used for making multiple adjustments to previous monthly reports in the state of New Jersey.

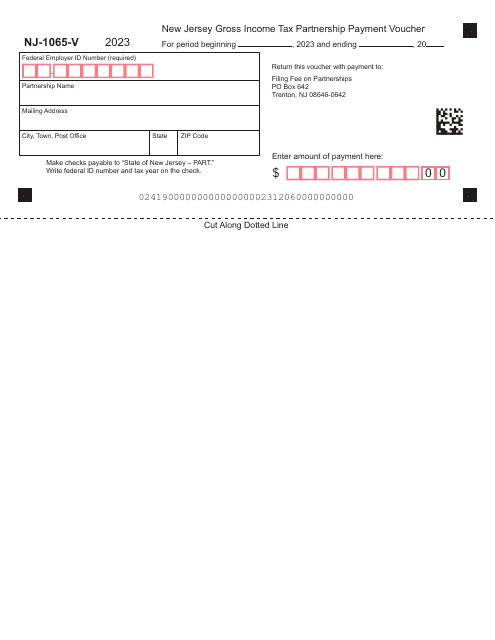

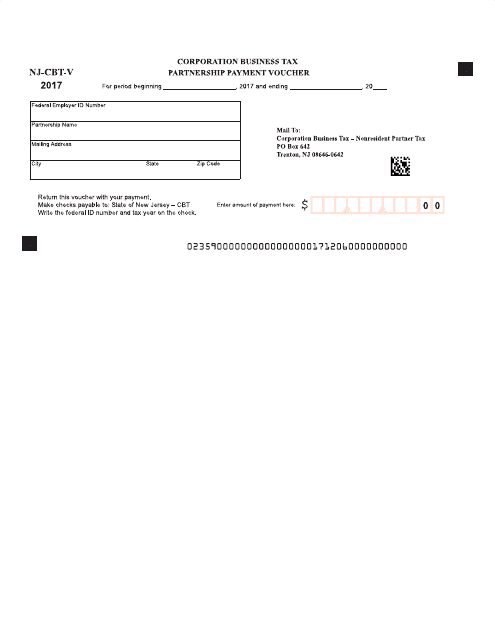

This form is used for making payment vouchers for partnerships in the state of New Jersey

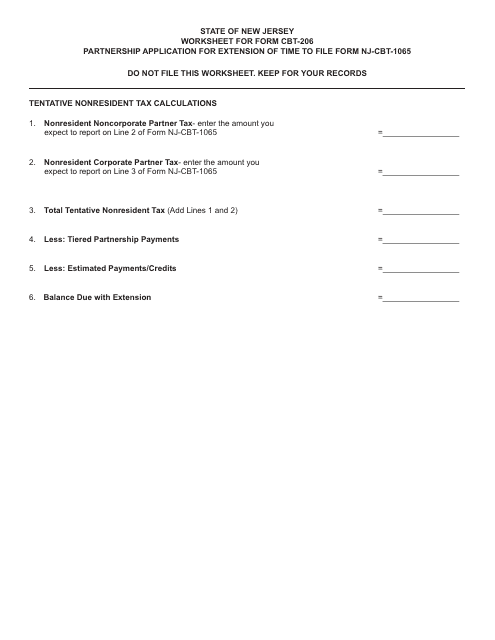

This document is a worksheet for Form CBT-206, which is used for partnership applications for an extension of time to file Form NJ-CBT-1065 in the state of New Jersey.

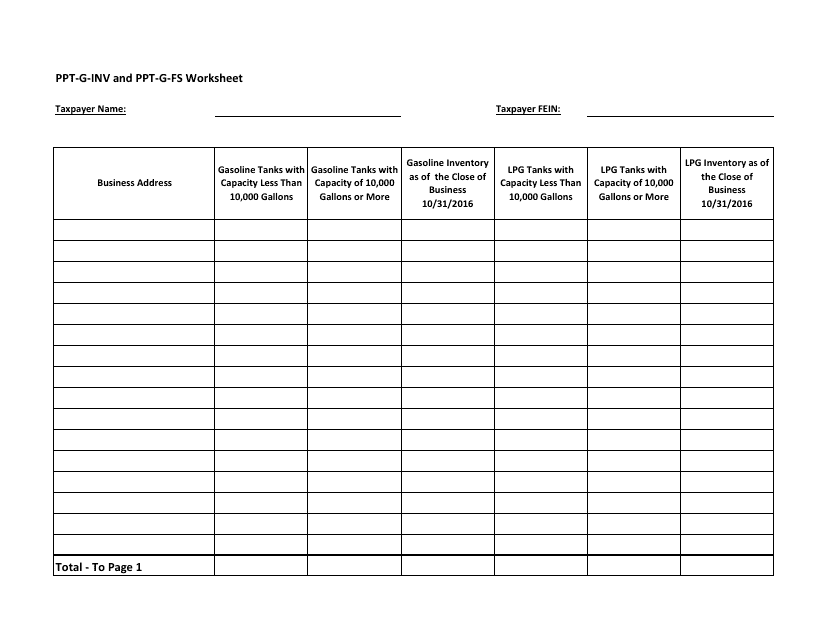

This type of document is a worksheet for the Ppt-G-inv and Ppt-G-fs Forms in New Jersey.

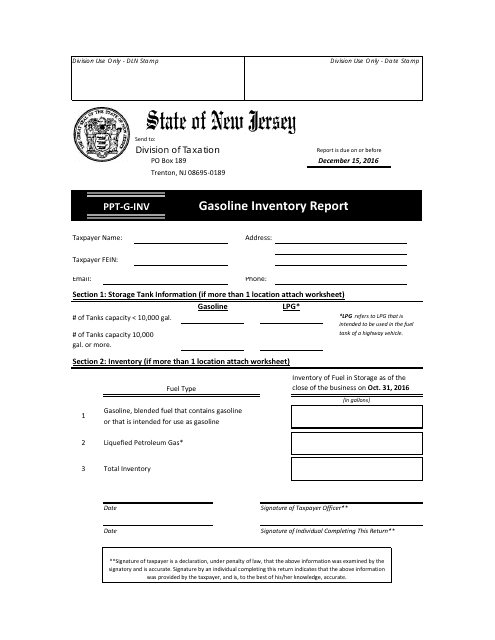

This Form is used for reporting gasoline inventory in New Jersey. It is required by the state's regulations to track and monitor the amount of gasoline stored by businesses.

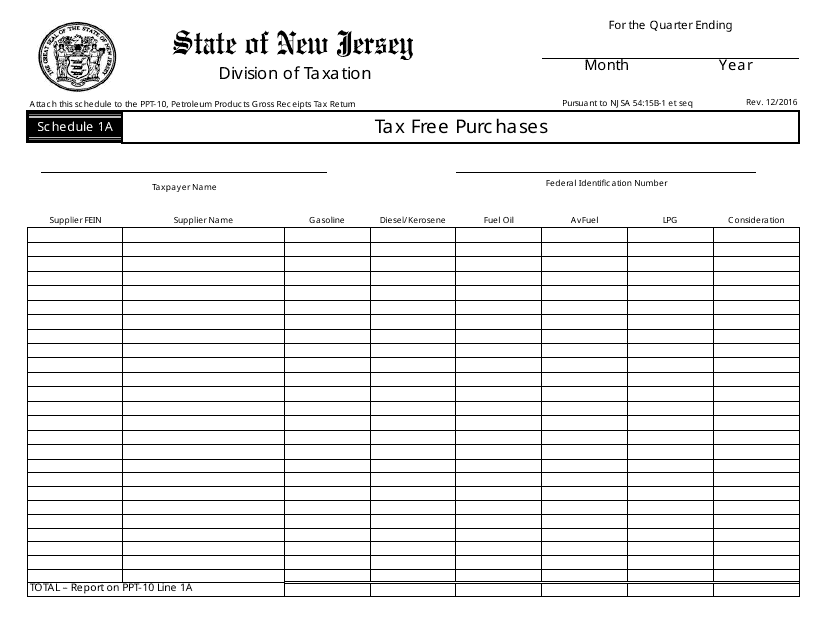

This form is used for reporting tax-free purchases made in the state of New Jersey.

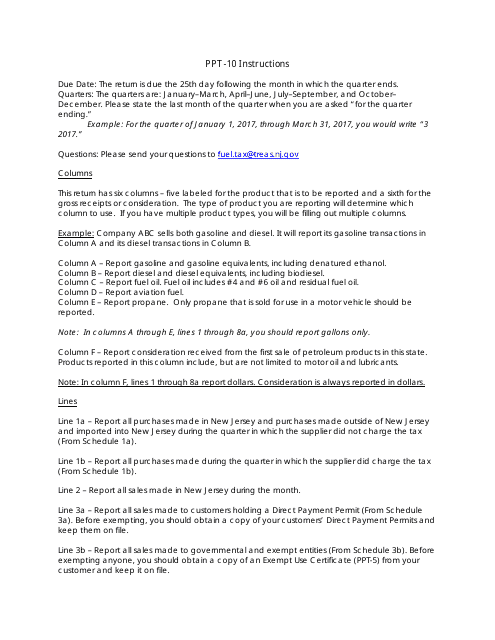

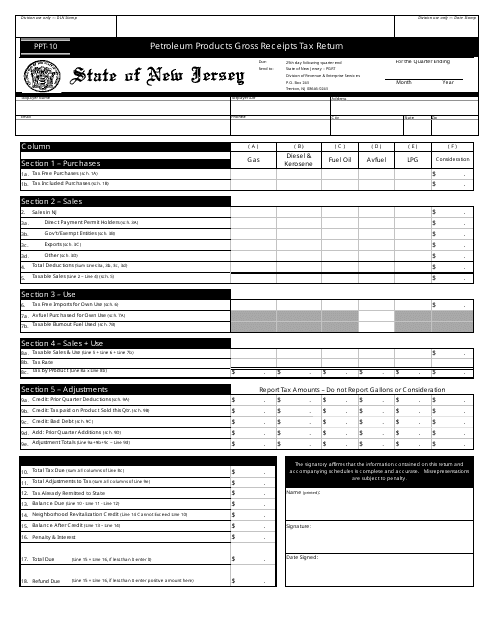

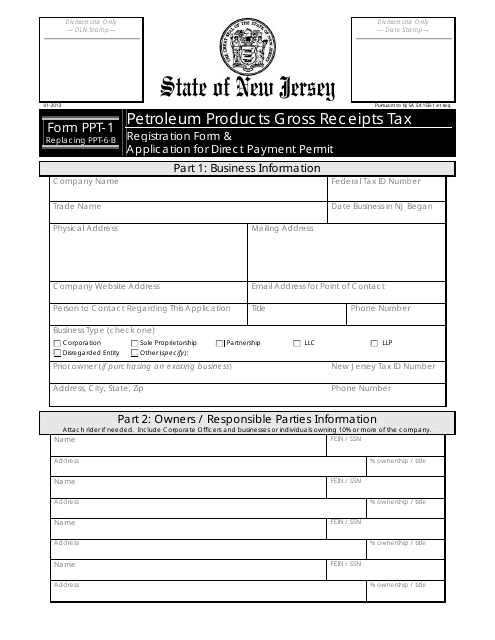

This Form is used for filing the Petroleum Products Gross Receipts Tax Return in the state of New Jersey. It provides instructions on how to accurately report and calculate the tax owed on petroleum products.

This form is used for reporting tax paid purchases in New Jersey.

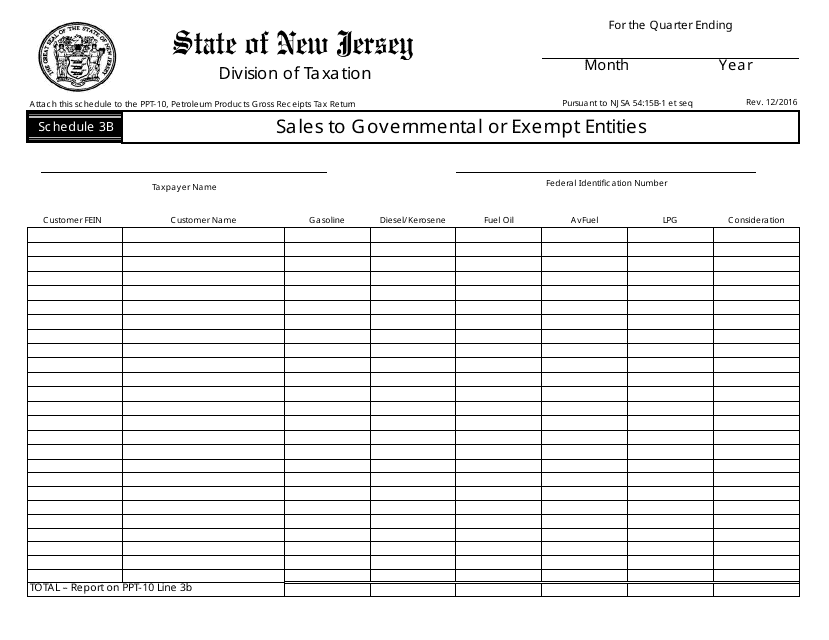

This form is used for reporting sales made to governmental or exempt entities in the state of New Jersey.

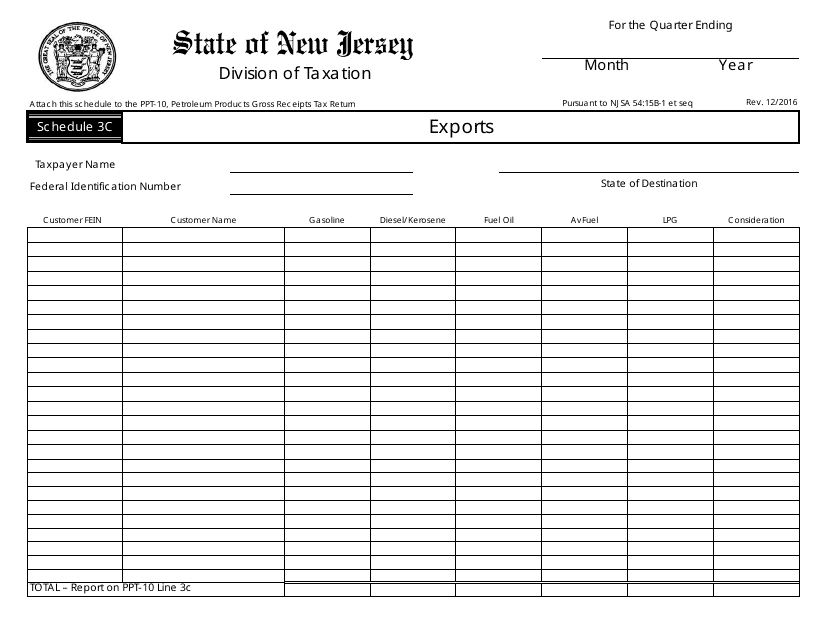

This Form is used for reporting exports from New Jersey.

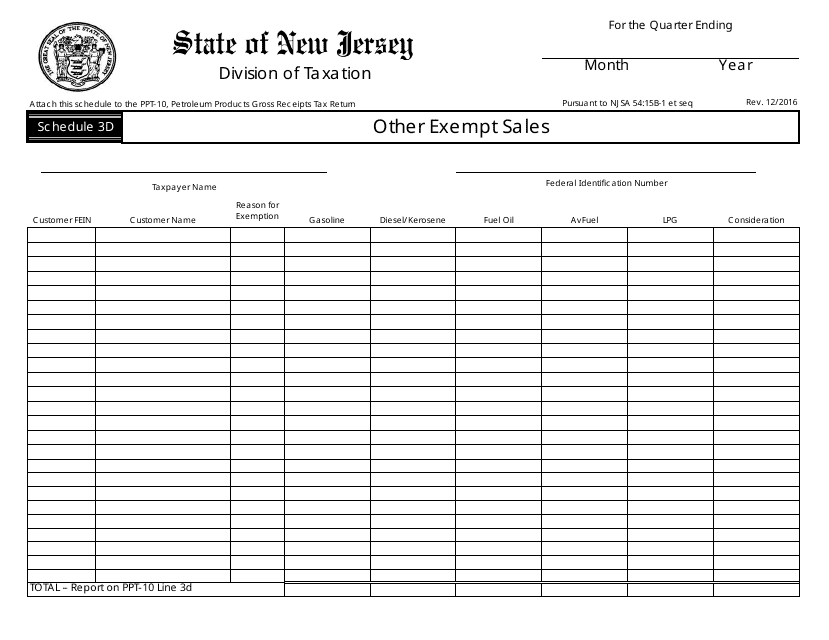

This form is used for reporting other exempt sales in the state of New Jersey.

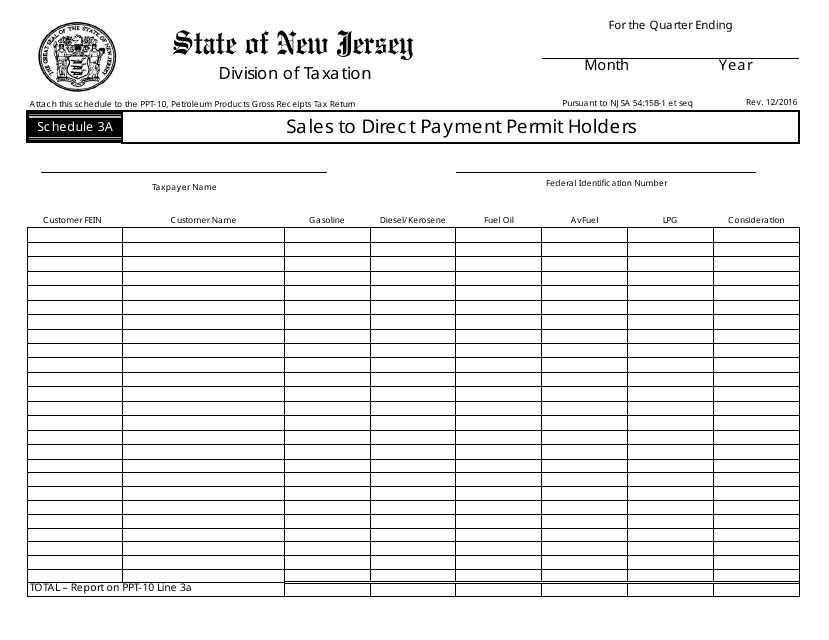

This form is used for reporting sales to direct payment permit holders in New Jersey.

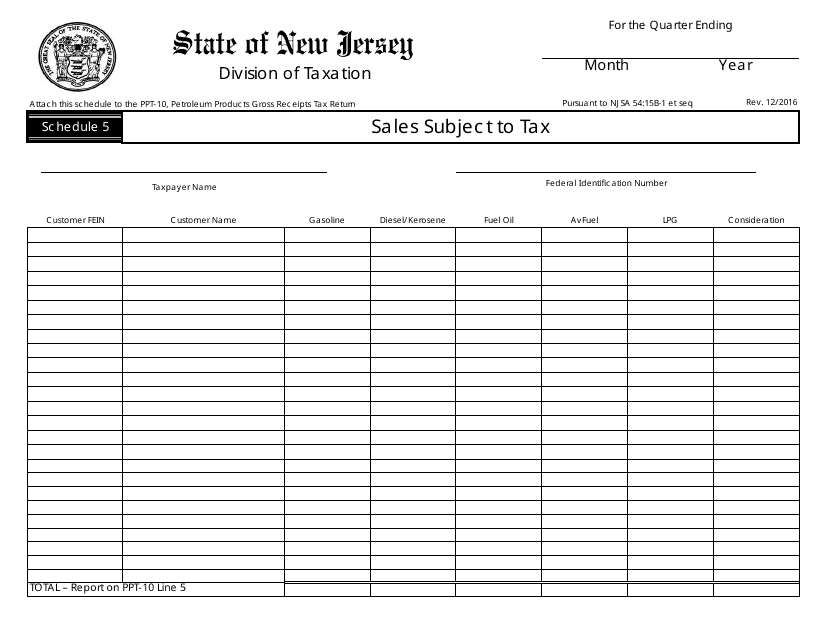

This form is used for reporting sales subject to tax in the state of New Jersey.

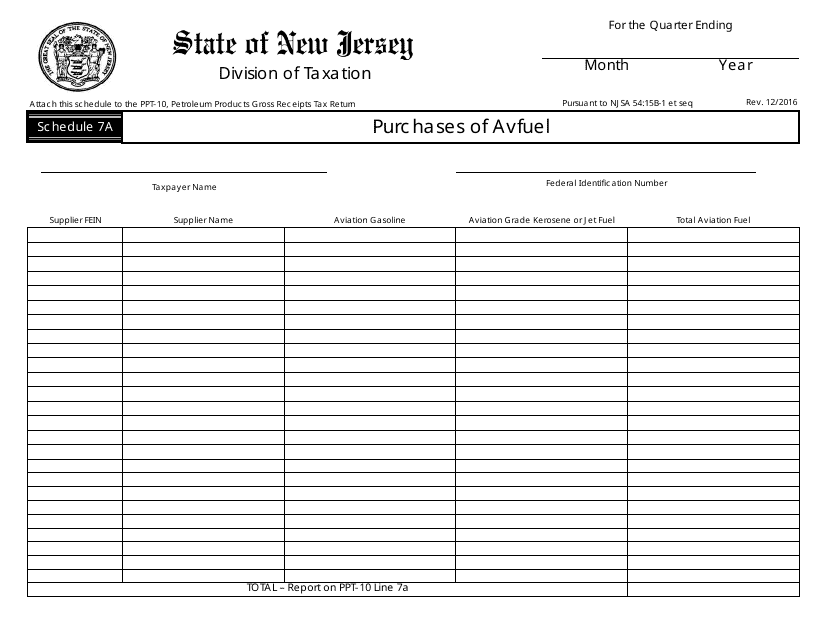

This Form is used for reporting purchases of Avfuel in New Jersey.

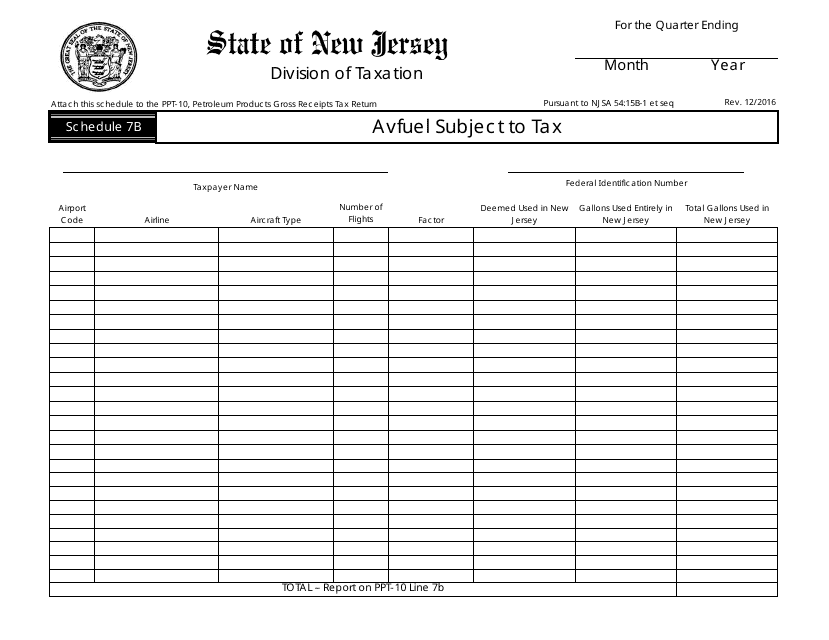

This Form is used for reporting Avfuel subject to tax in New Jersey.

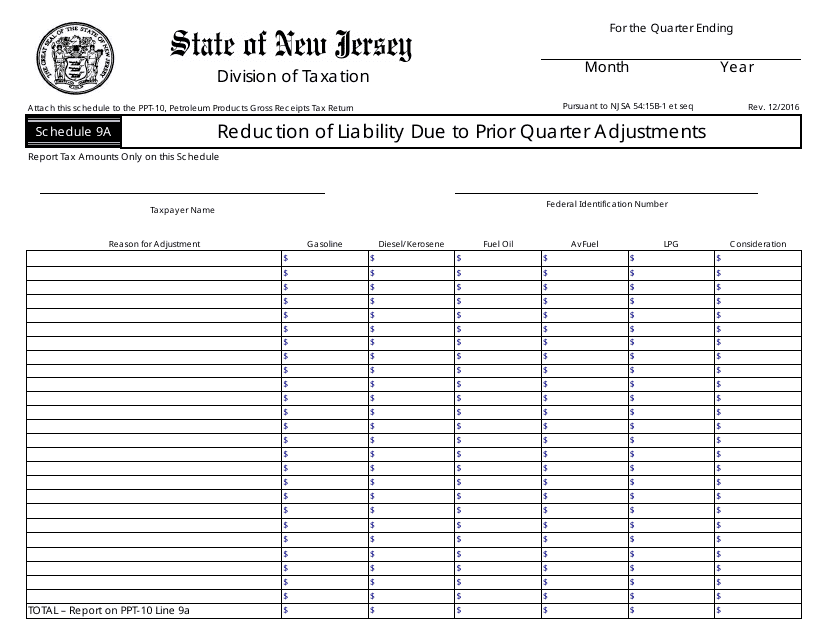

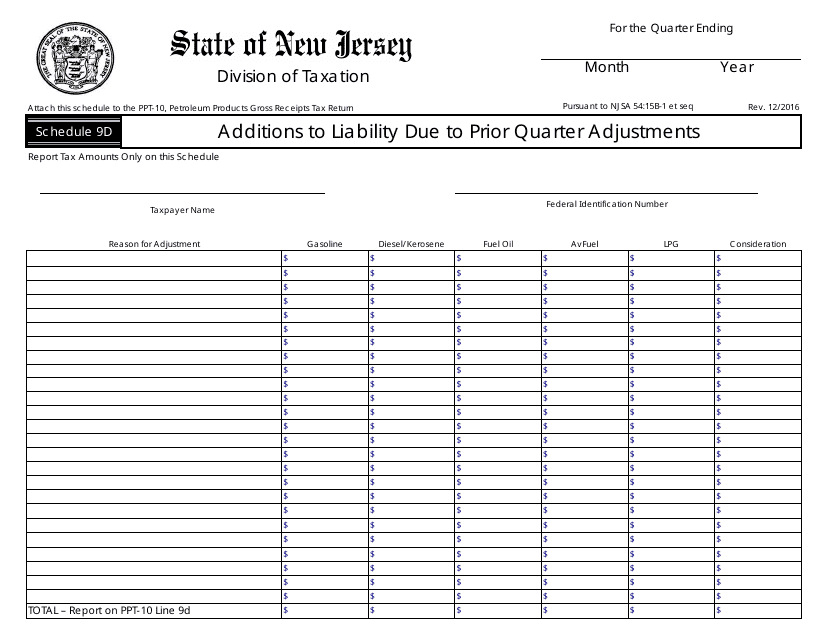

This Form is used for making adjustments to your liability for prior quarters in New Jersey.

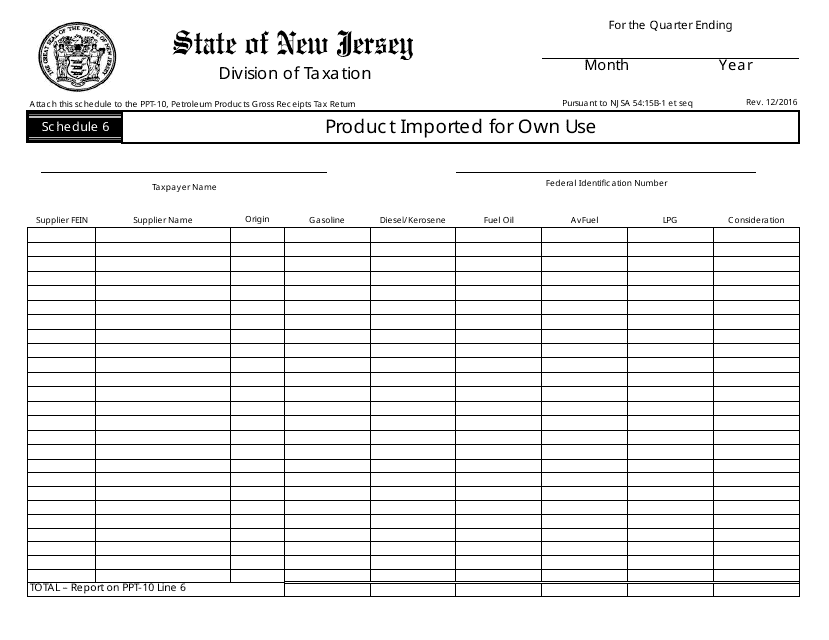

This form is used for reporting products imported for own use in New Jersey.

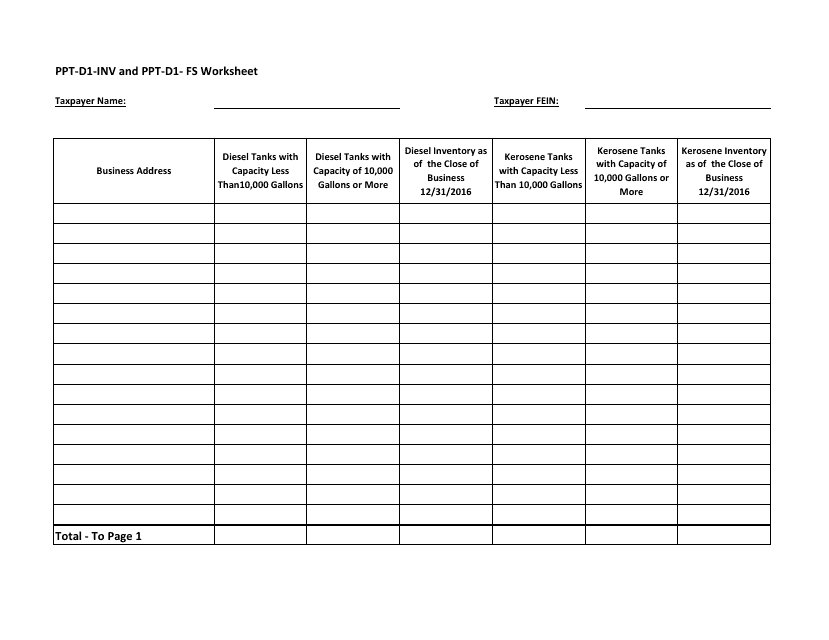

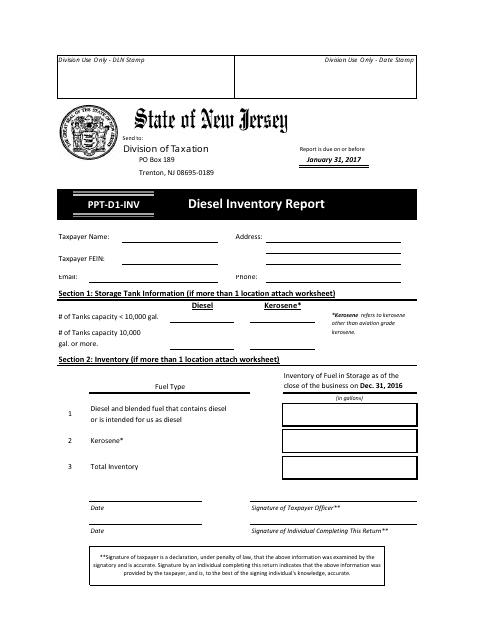

This type of document is used for managing diesel inventory and financial worksheets in the state of New Jersey.

This Form is used for reporting and paying the Petroleum Products Gross Receipts Tax in the state of New Jersey.

This form is used for reporting diesel inventory in New Jersey. It helps track and manage the amount of diesel fuel held in storage at a specific location.

This Form is used for reporting any additional liability that is due to adjustments from previous quarters in the state of New Jersey.

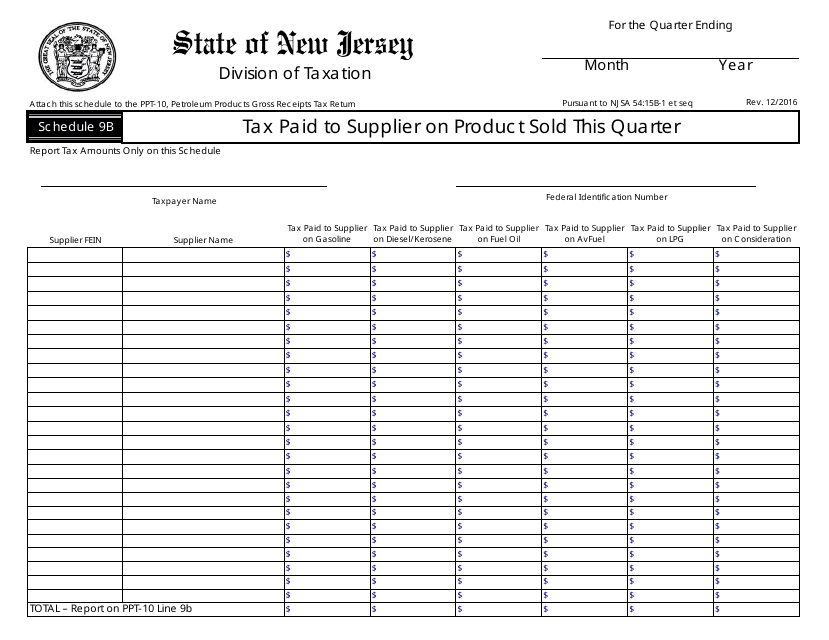

This Form is used for reporting tax paid to suppliers on products sold in the current quarter in the state of New Jersey.