Tax Templates

Documents:

2882

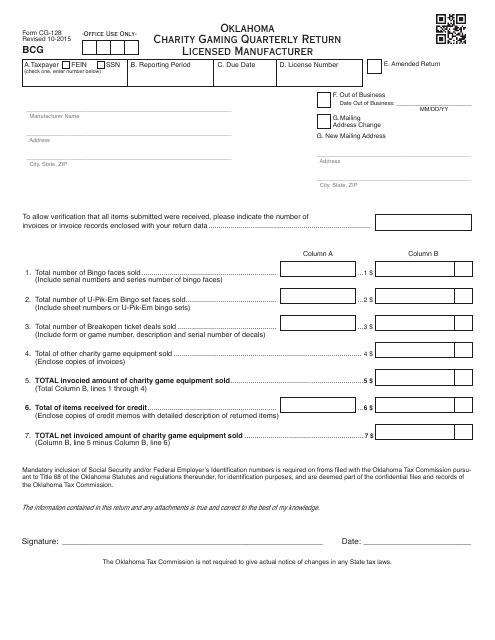

This form is used for Oklahoma licensed manufacturers to report their quarterly gaming activity for charitable purposes. It is required by the Oklahoma Charity Gaming Division.

This Form is used for reporting and paying the New Jersey Motor Vehicle Tire Fee, which is required for anyone selling new tires in the state of New Jersey.

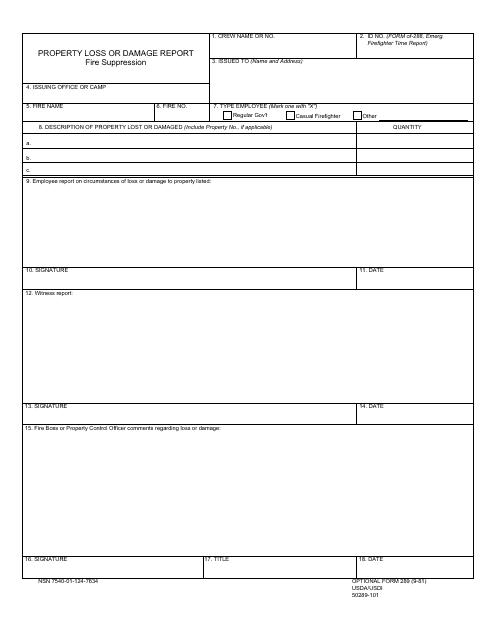

This Form is used for reporting property loss or damage caused by fire suppression.

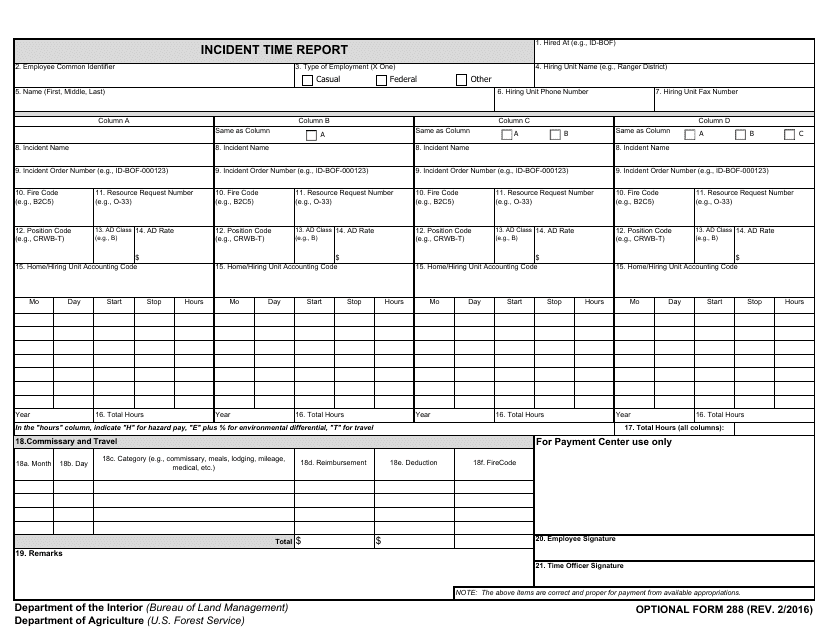

This Form is used for reporting the time of an incident. It contains information about when the incident occurred and is used for record keeping and analysis purposes.

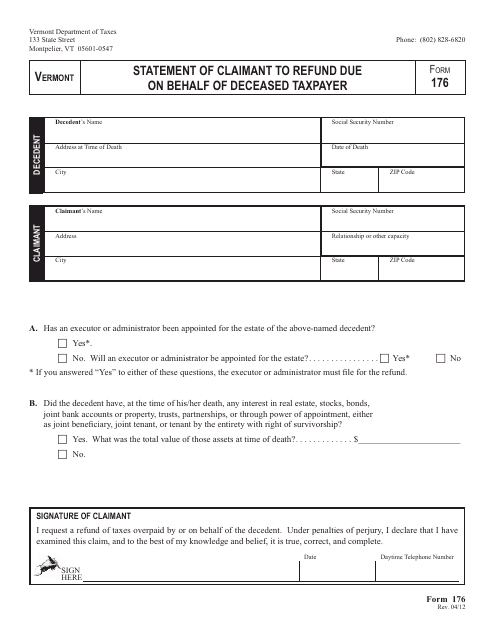

This document is used for making a claim for a refund on behalf of a deceased taxpayer in the state of Vermont.

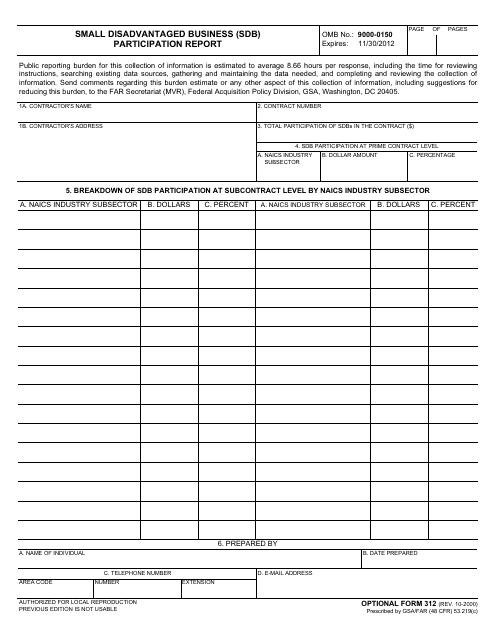

This Form is used for reporting the participation of Small Disadvantaged Businesses (SDBs) in government contracts.

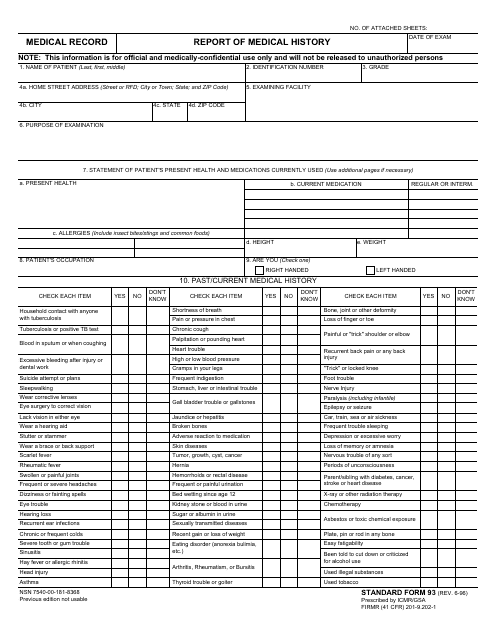

This form is used for gathering information about a person's medical history. It is commonly used by medical professionals to assess an individual's health condition.

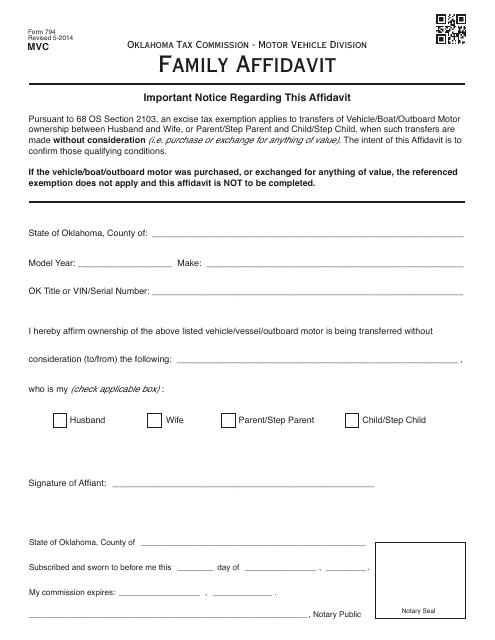

This Form is used for submitting a Family Affidavit in Oklahoma for over-the-counter (OTC) transactions.

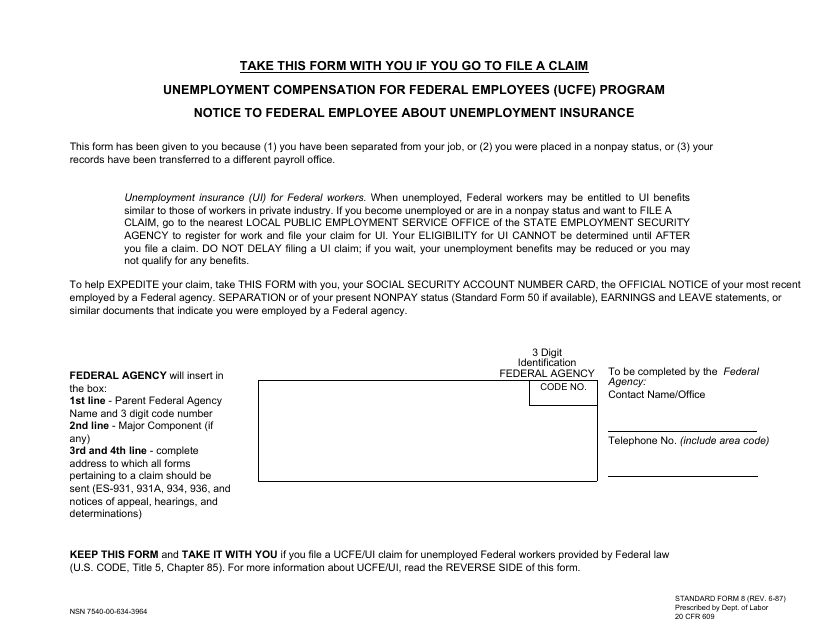

This form is used for notifying federal employees about their eligibility for unemployment insurance under the Unemployment Compensation for Federal Employees program.

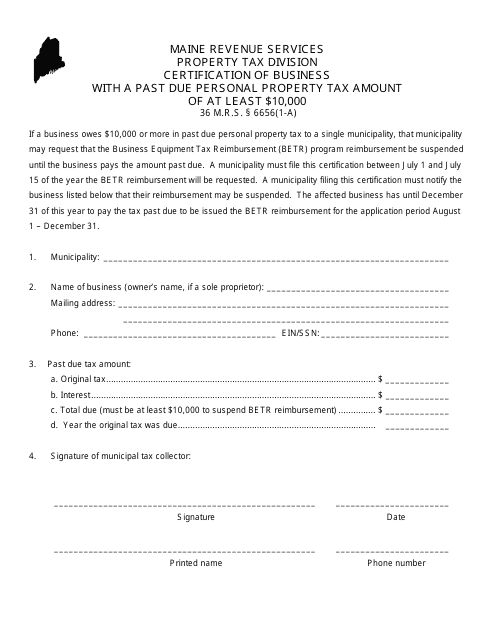

This document certifies a business with a past due personal property tax amount of at least $10,000 in the state of Maine.

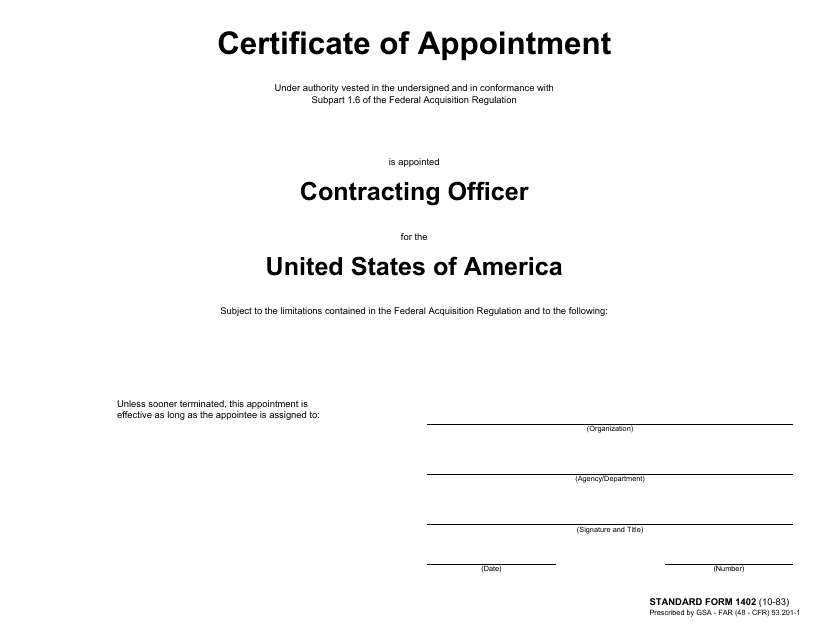

This form is used for certifying an individual's appointment to a federal position.

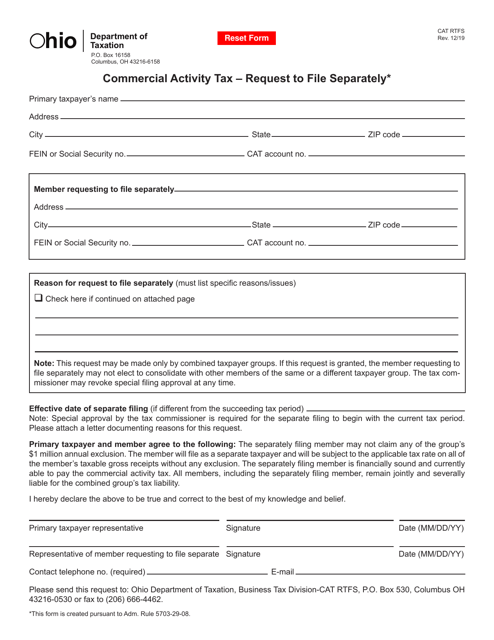

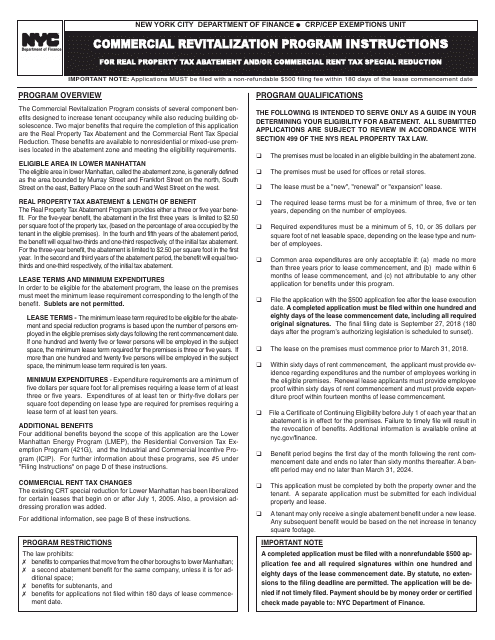

This document provides instructions for the Commercial Revitalization Program in New York City. It explains how to participate in the program and outlines the steps and requirements.

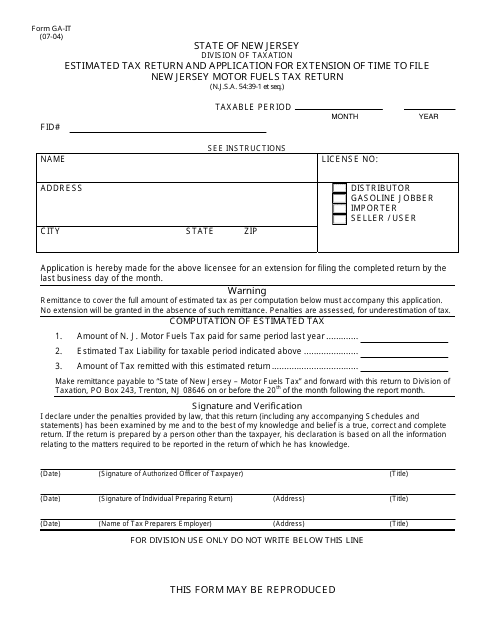

This Form is used for filing a Georgia state estimated tax return and applying for an extension of time to file a New Jersey Motor Fuels Tax Return.

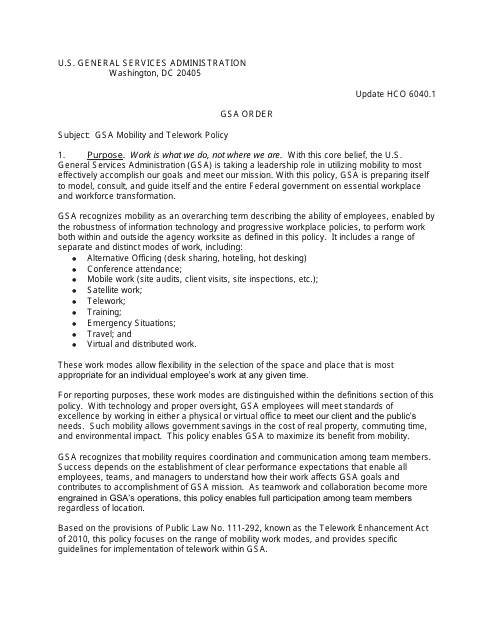

This document is a contract between an employee and the General Services Administration (GSA) regarding remote work arrangements. It outlines the terms and conditions for teleworking, including work hours, responsibilities, and equipment. Use this form to establish an agreement between the employee and the GSA for telecommuting.

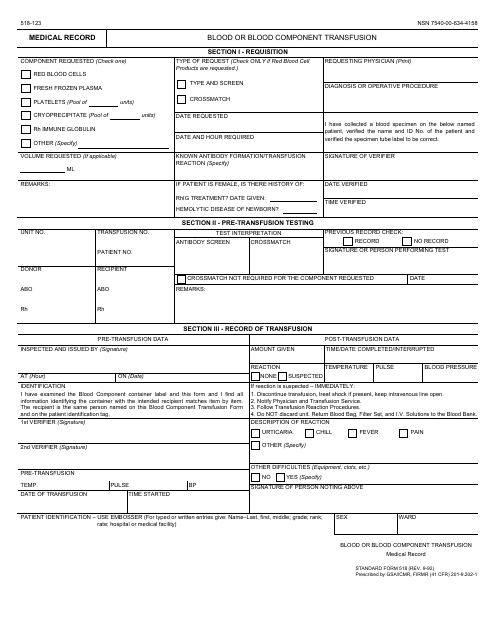

This Form is used for documenting and tracking blood or blood component transfusions.

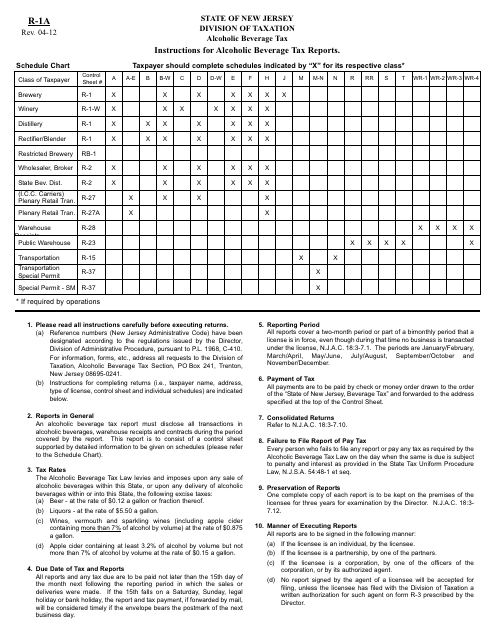

This document provides instructions for completing and filing the Alcoholic Beverage Tax Reports (Form R-1A) in the state of New Jersey. It is a necessary form for businesses involved in the sale of alcoholic beverages in order to report and pay the required taxes.

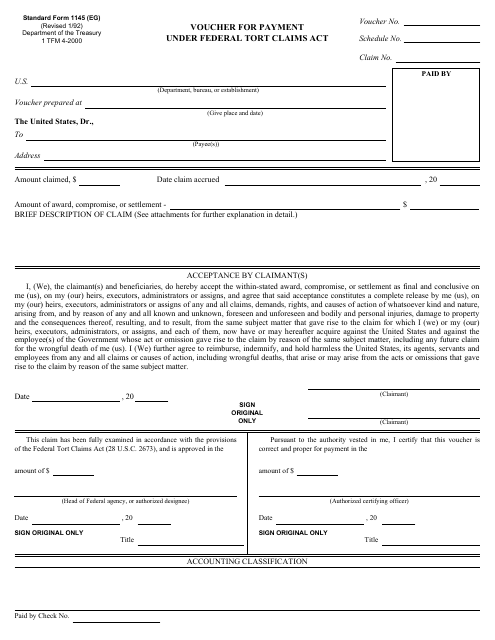

This form is used for submitting a voucher for payment under the Federal Tort Claims Act in the United States. It is specifically designed for claims related to personal injury, property damage, or wrongful death caused by federal government employees or agencies. The form helps to streamline the process of seeking compensation for these claims.

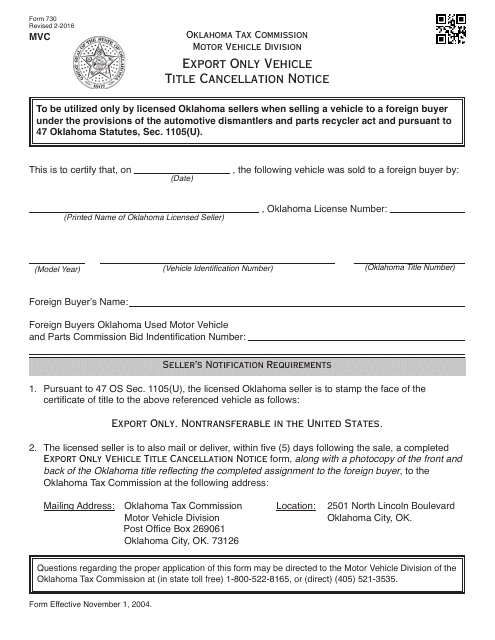

This type of document is used for canceling the title of an export-only vehicle in Oklahoma.

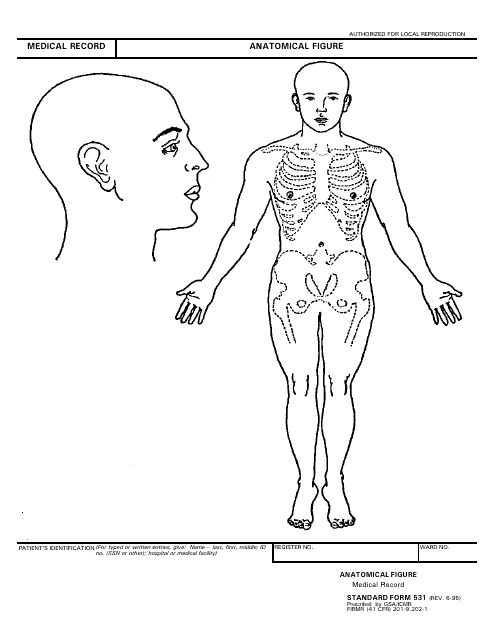

This form is used for recording and documenting medical information and includes an anatomical figure for visual reference.

This form is used for filing Indiana inheritance tax return in the state of Indiana.

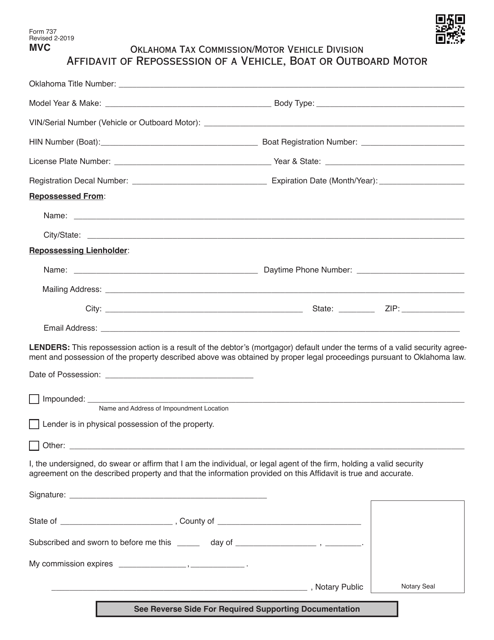

This form is used for releasing a lien on a property in Oklahoma. It is an affidavit letter that confirms the lien is no longer active.

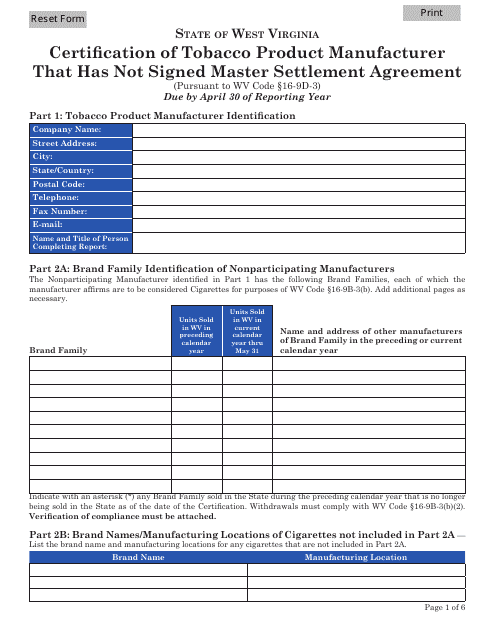

This document certifies a tobacco product manufacturer in West Virginia who has not signed the Master Settlement Agreement.

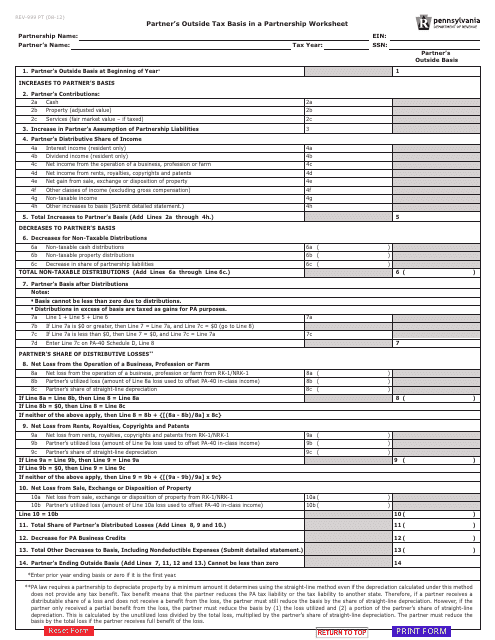

This form is used for calculating the partner's outside tax basis in a partnership in Pennsylvania.

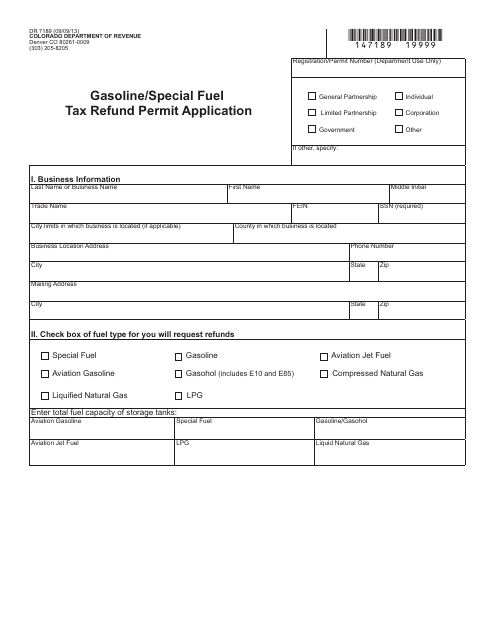

This form is used for applying for a gasoline/special fuel tax refund permit in Colorado.

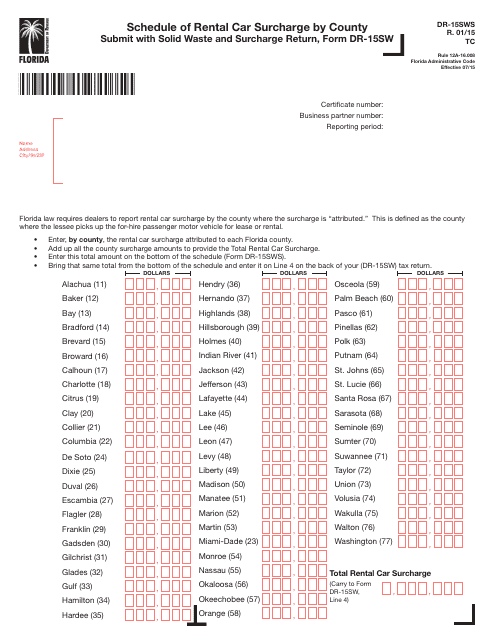

This form is used for reporting the rental car surcharge by county in the state of Florida. It helps in tracking and documenting the surcharges on rental cars in different counties.

This is a legal document needed to gain tax exemption for the purpose of product resale in the state of Georgia.

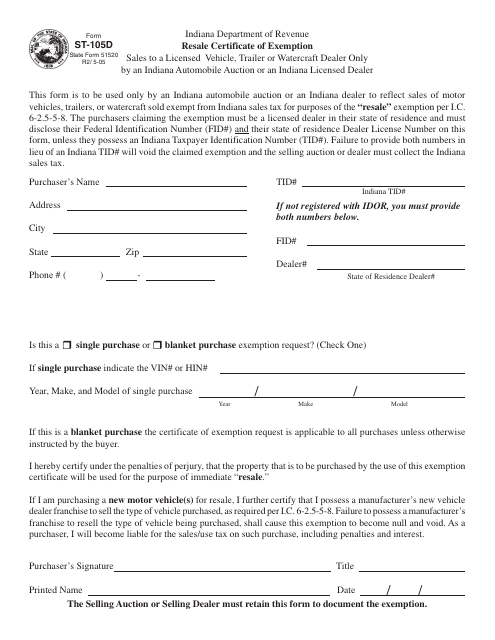

This form is used for claiming a resale exemption in the state of Indiana. It allows businesses to purchase items for resale without paying sales tax.

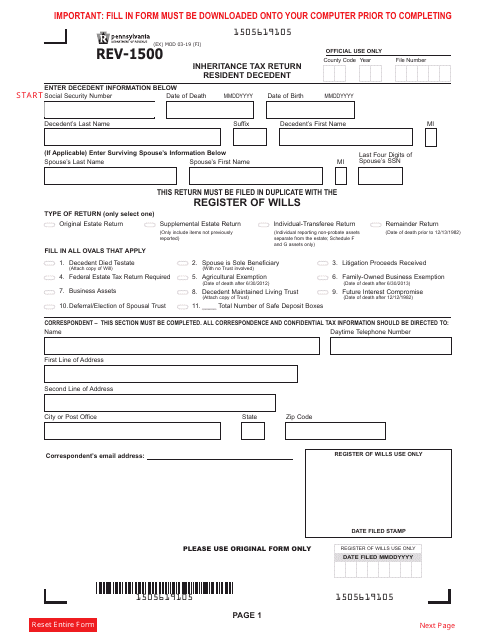

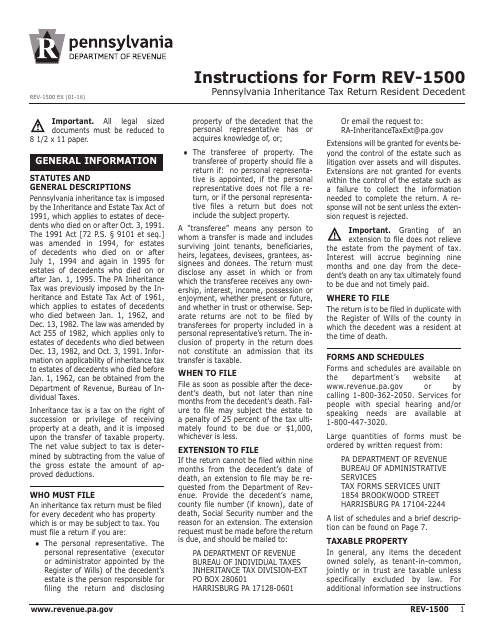

This Form is used for filing the Pennsylvania Inheritance Tax Return for a deceased resident of Pennsylvania. It provides instructions on how to complete the form accurately and report any applicable inheritance tax owed.

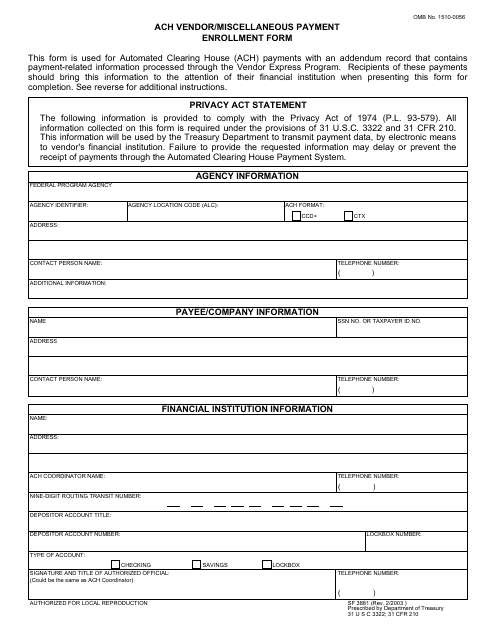

This form is used for enrolling vendors or receiving miscellaneous payments through the Automated Clearing House (ACH) system.

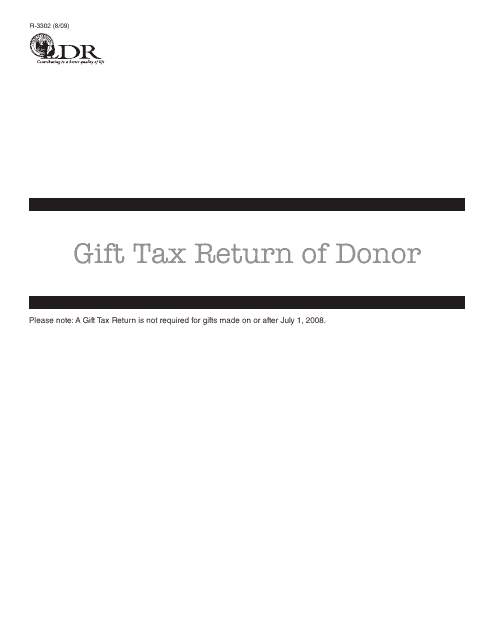

This form is used for reporting gifts made by a donor for tax purposes in the state of Louisiana.

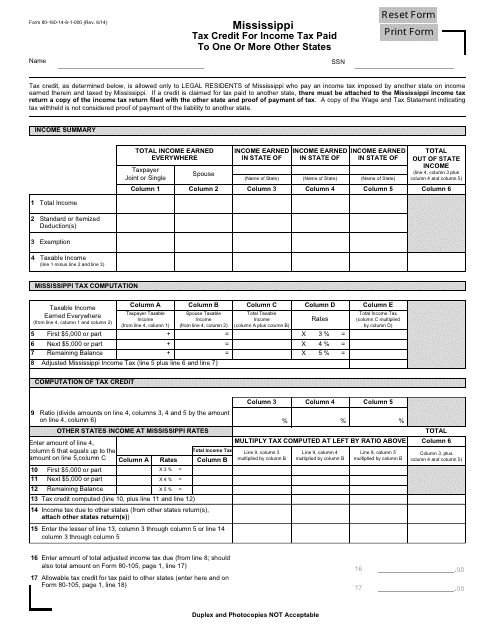

This Form is used for claiming a tax credit in Mississippi for income tax paid to other states.

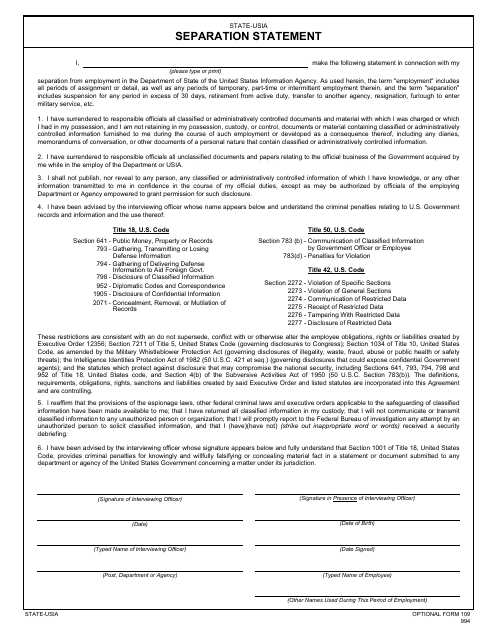

This Form is used for employees who are separating from their job to provide information regarding their employment status and benefits.

This form is used for reporting and paying inheritance tax for residents of New Jersey.