Tax Templates

Documents:

2882

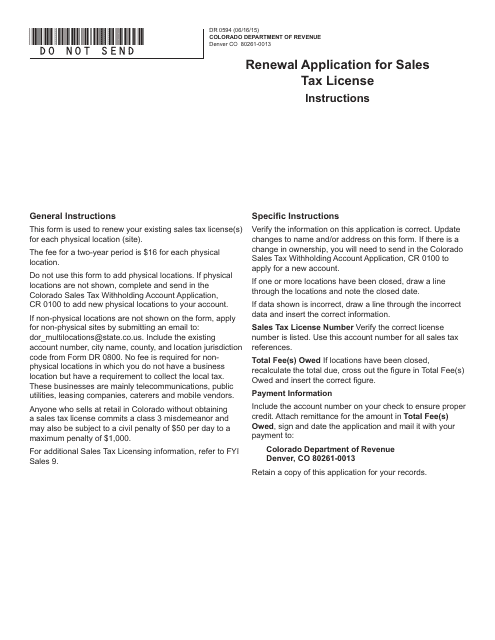

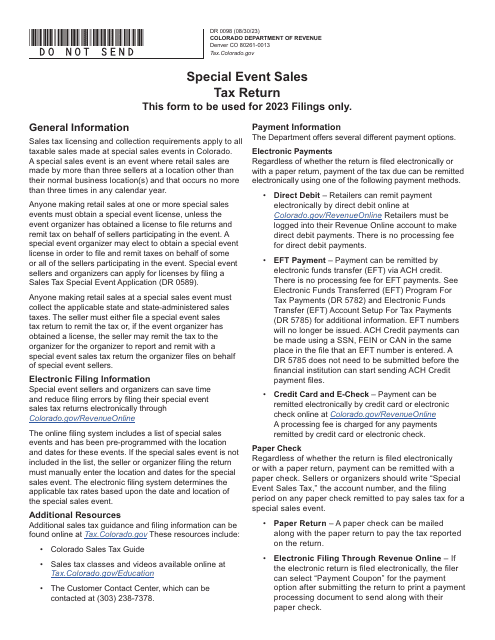

This form is used for renewing a sales tax license in the state of Colorado. It allows businesses to legally collect and remit sales taxes in the state.

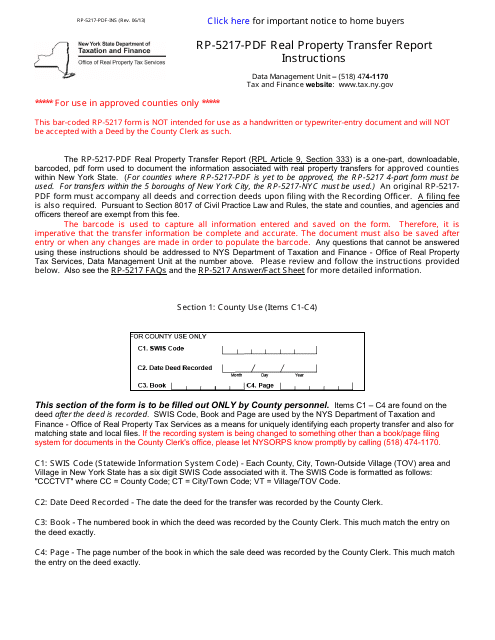

This form is used for reporting the transfer of real property in New York. It provides instructions on how to fill out the RP-5217-PDF form accurately and completely.

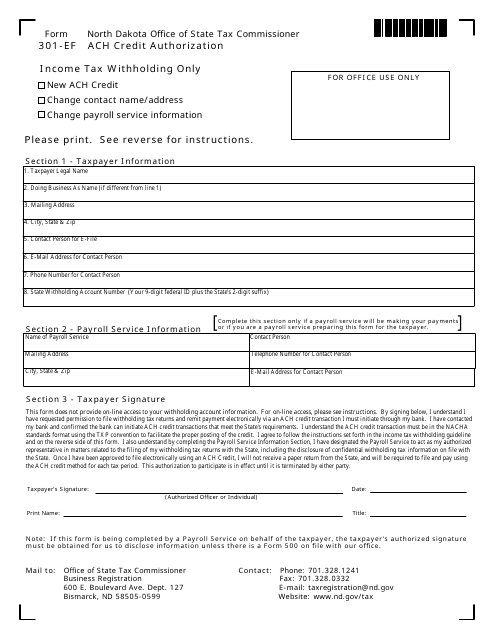

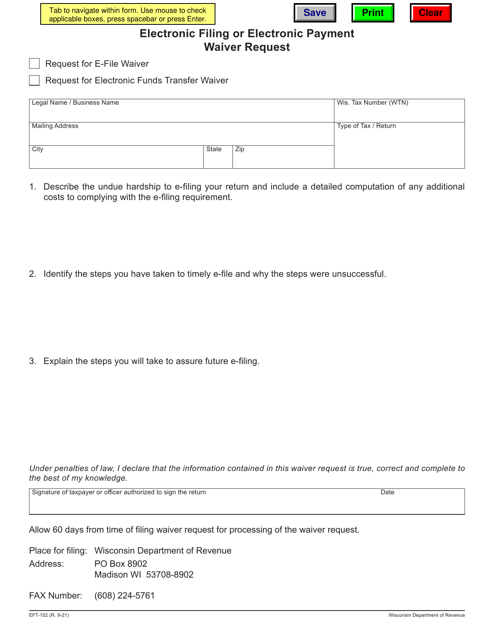

This form is used for applying for withholding and authorizing ACH credits in North Dakota.

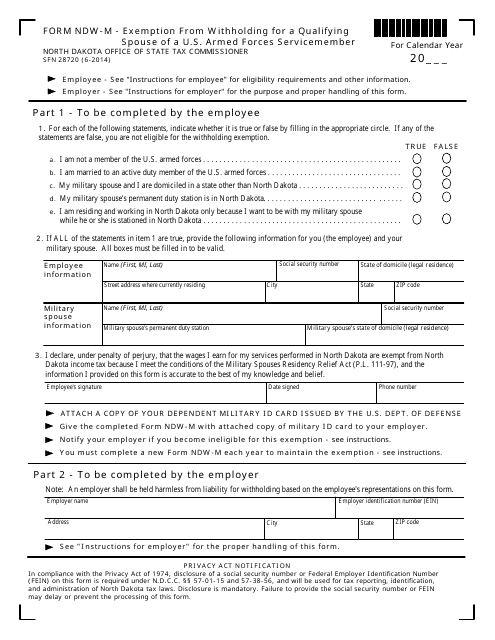

This form is used for claiming exemption from withholding for a qualifying spouse of a U.S. Armed Forces servicemember in North Dakota.

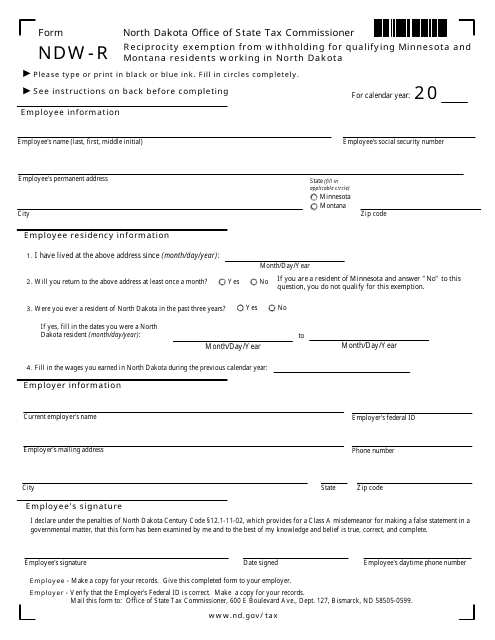

This form is used by qualifying residents of Minnesota and Montana who are working in North Dakota to claim an exemption from withholding taxes.

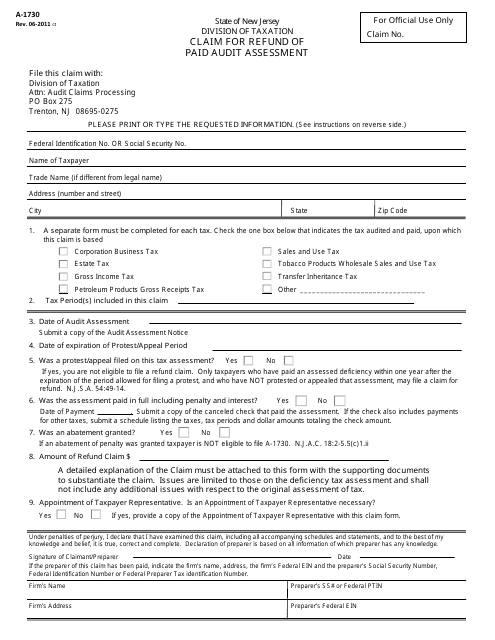

This Form is used for residents of New Jersey to claim a refund for a paid audit assessment.

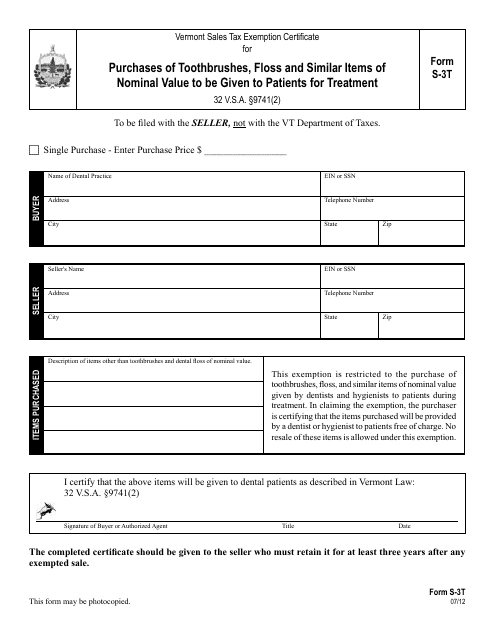

This form is used for claiming sales tax exemption on purchases of toothbrushes, floss, and similar items that are given to patients for treatment in Vermont.

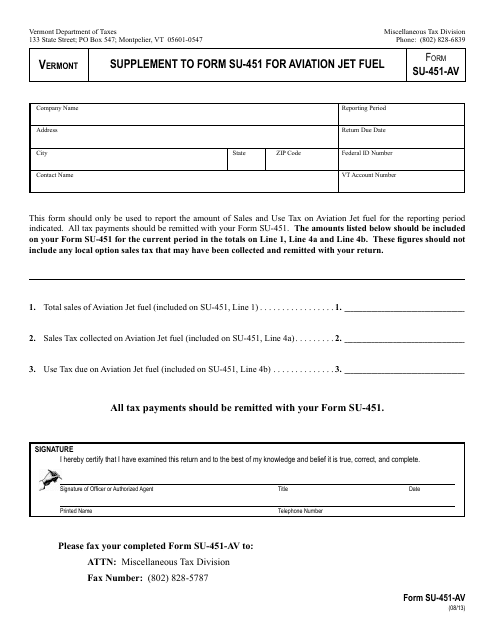

This Form is used for supplementing Form SU-451 for aviation jet fuel in Vermont.

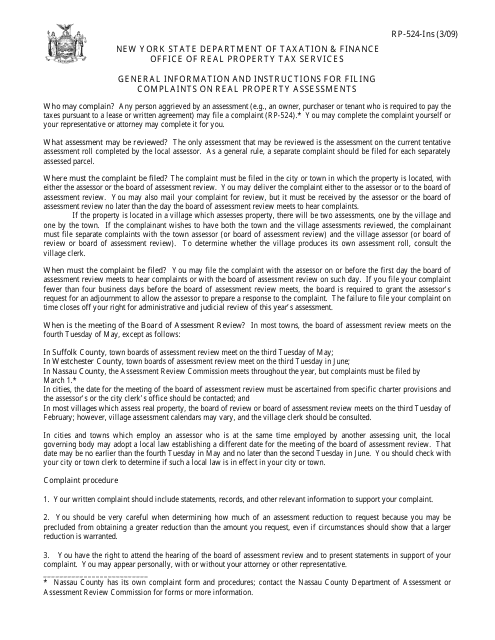

This Form is used for filing complaints regarding real property assessments in the state of New York. It provides instructions on how to submit a complaint and seek resolution for issues related to property assessments.

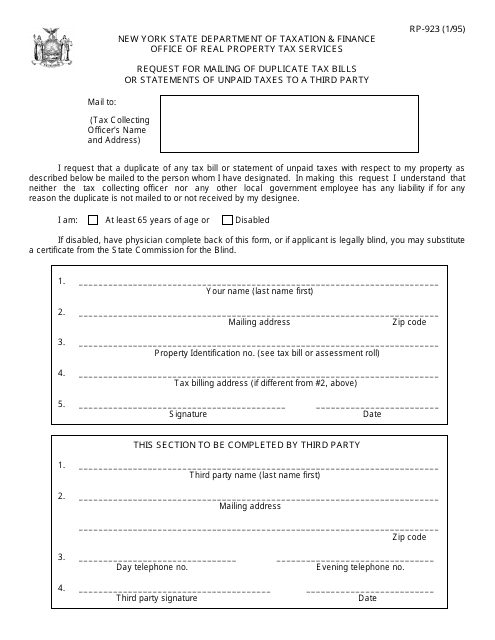

This form is used to request the mailing of duplicate tax bills or statements of unpaid taxes to a third party in New York.

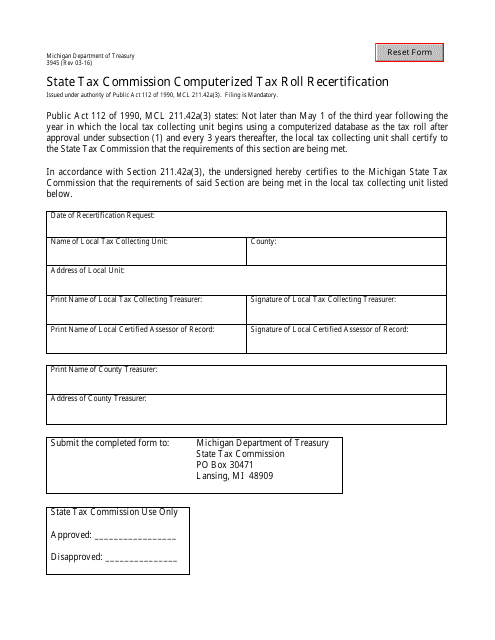

This document is used for recertifying the computerized tax roll with the State Tax Commission in Michigan.

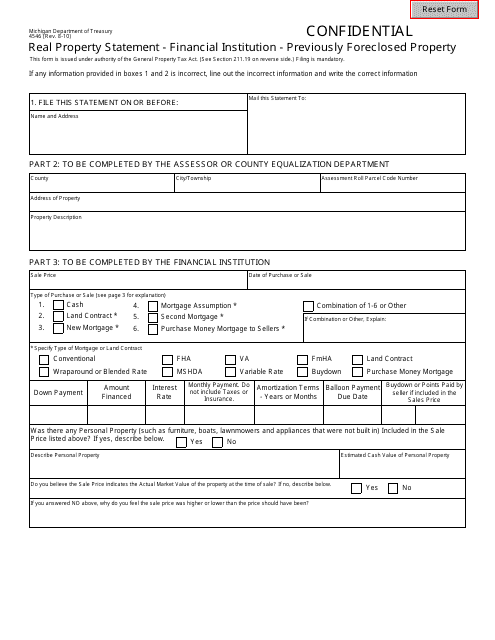

This document is used for reporting real property information to a financial institution in Michigan, specifically for properties that have been previously foreclosed.

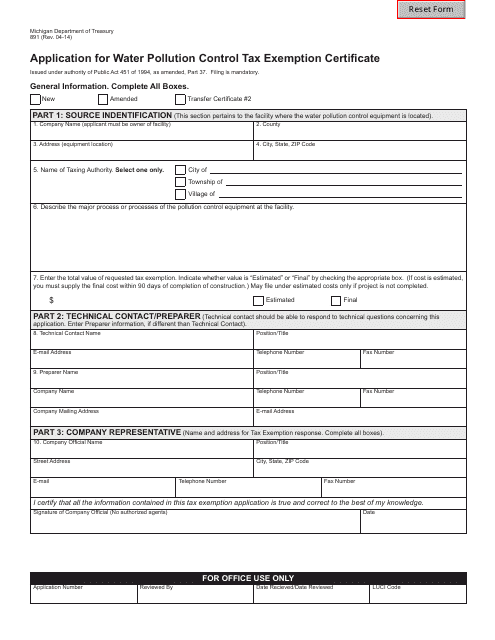

This form is used for applying for a tax exemption certificate for water pollution control in the state of Michigan.

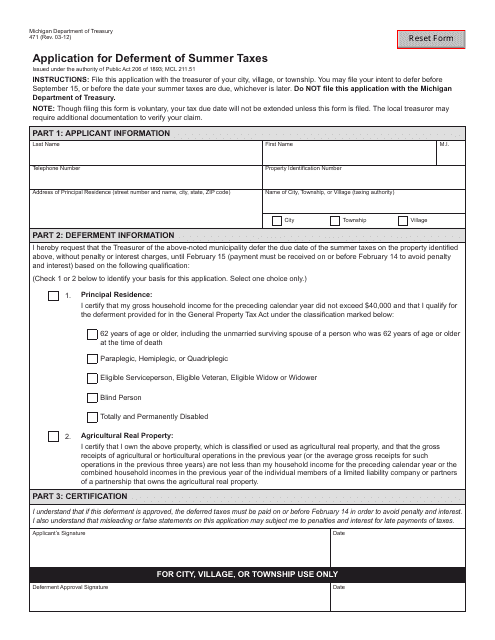

This form is used for applying to defer payment of summer taxes in the state of Michigan.

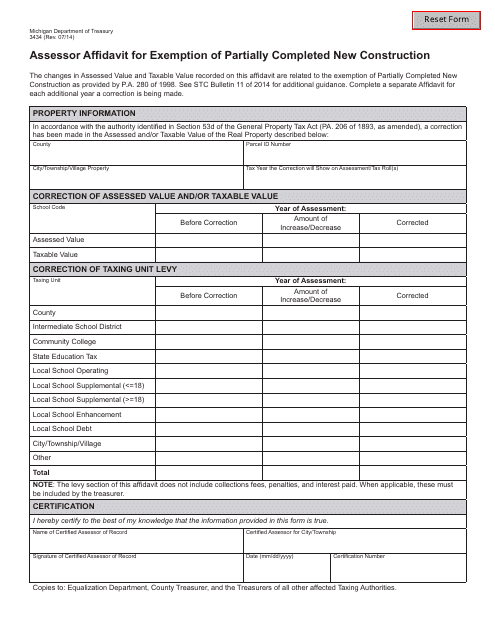

This form is used for filing an Assessor Affidavit for Exemption of Partially Completed New Construction in the state of Michigan. It allows individuals to claim an exemption for property taxes on new construction that is still in progress.

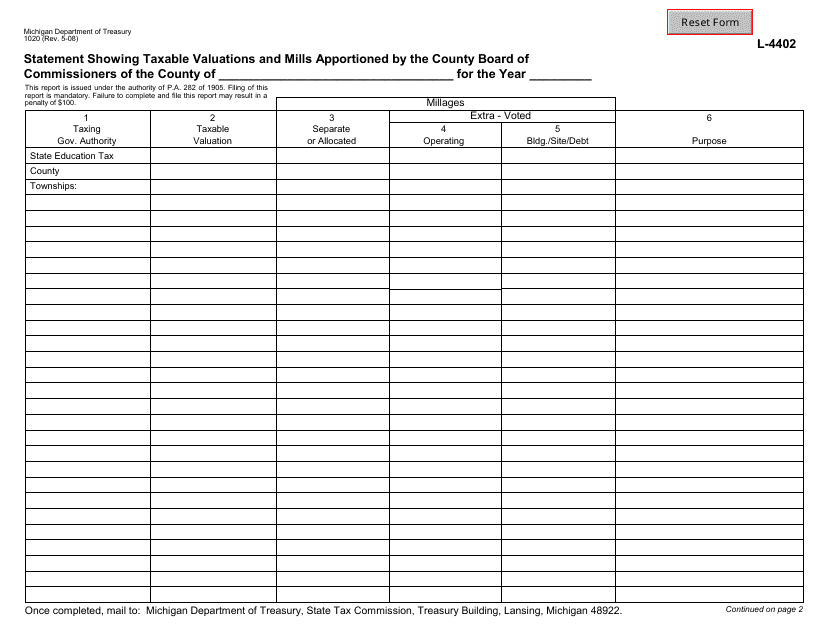

This form is used for showing the taxable valuations and mills apportioned by the County Board of Commissioners in Michigan.

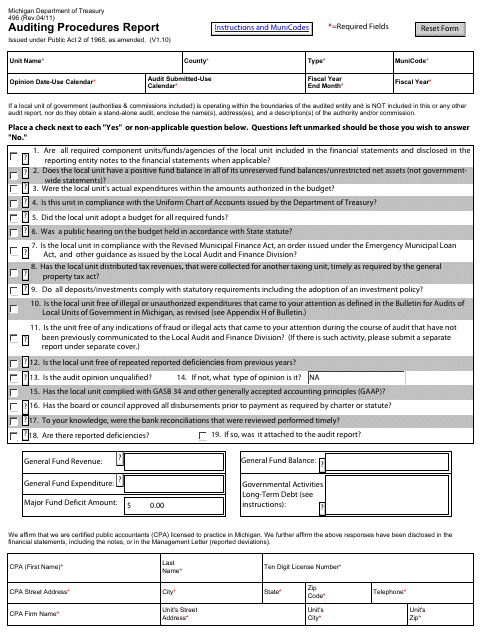

This form is used for submitting an Auditing Procedures Report in the state of Michigan.

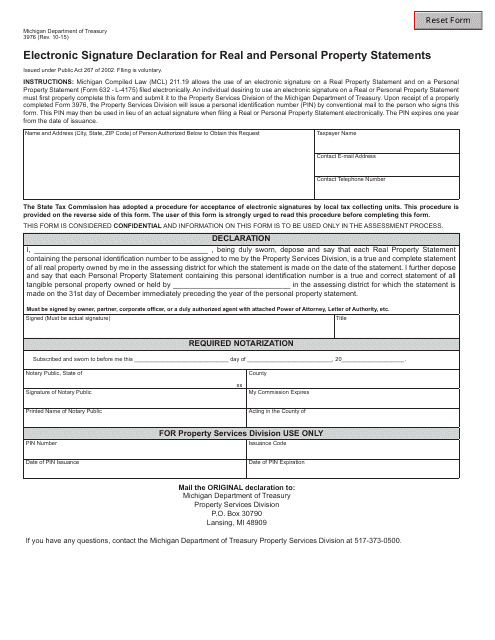

This form is used for declaring electronic signatures on real and personal property statements in the state of Michigan.

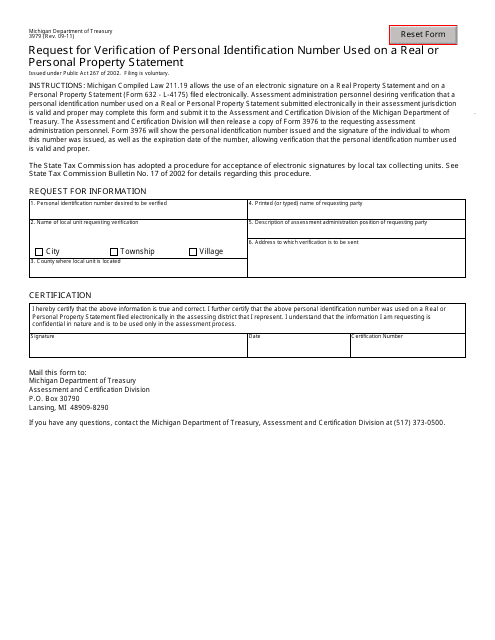

This Form is used for requesting verification of a Personal Identification Number used on a Real or Personal Property Statement in Michigan.

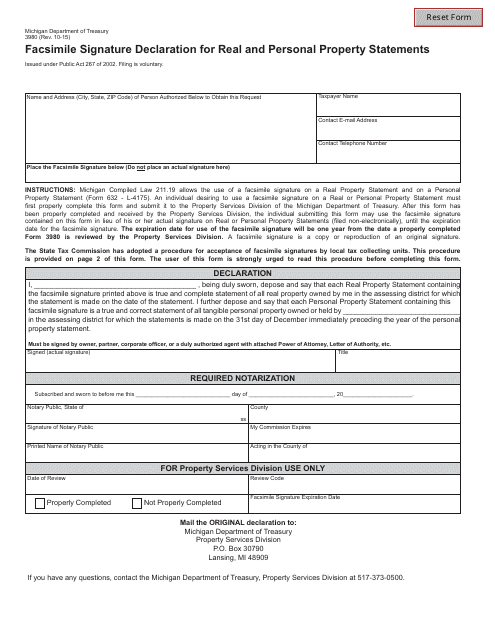

This form is used for declaring facsimile signatures on real and personal property statements in Michigan.

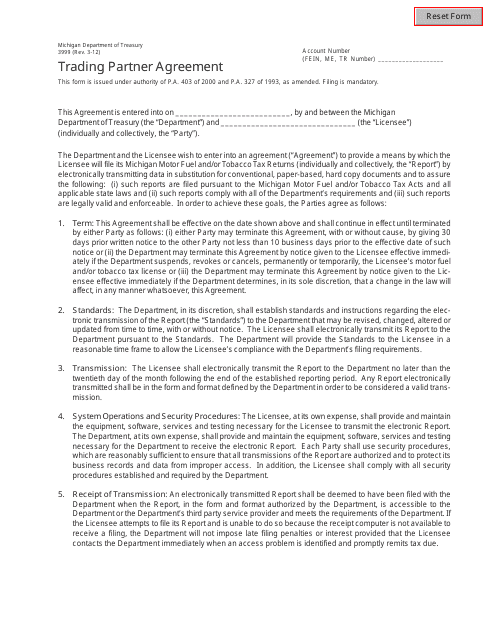

This document is for establishing a trading partner agreement in the state of Michigan.

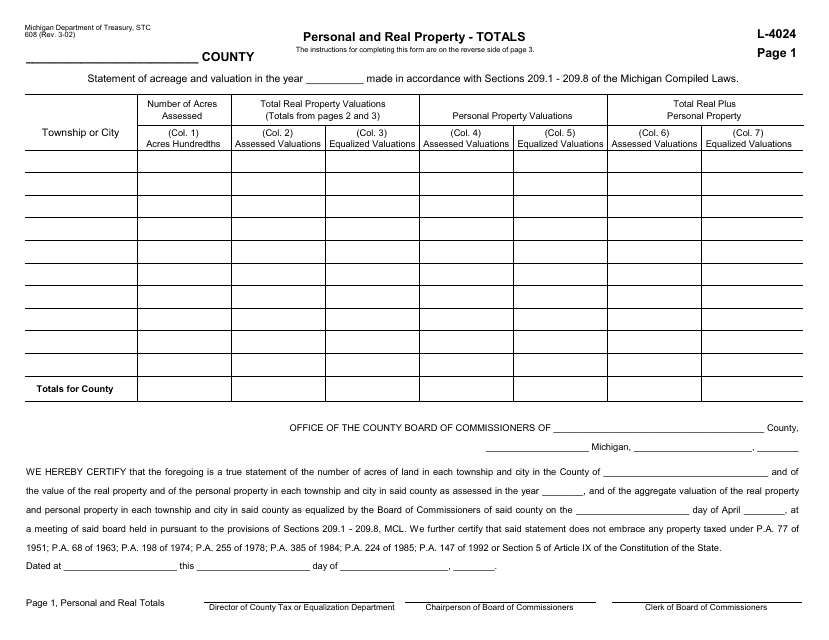

This form is used for reporting equalization in the state of Michigan. It is used to ensure fairness in property tax assessments.

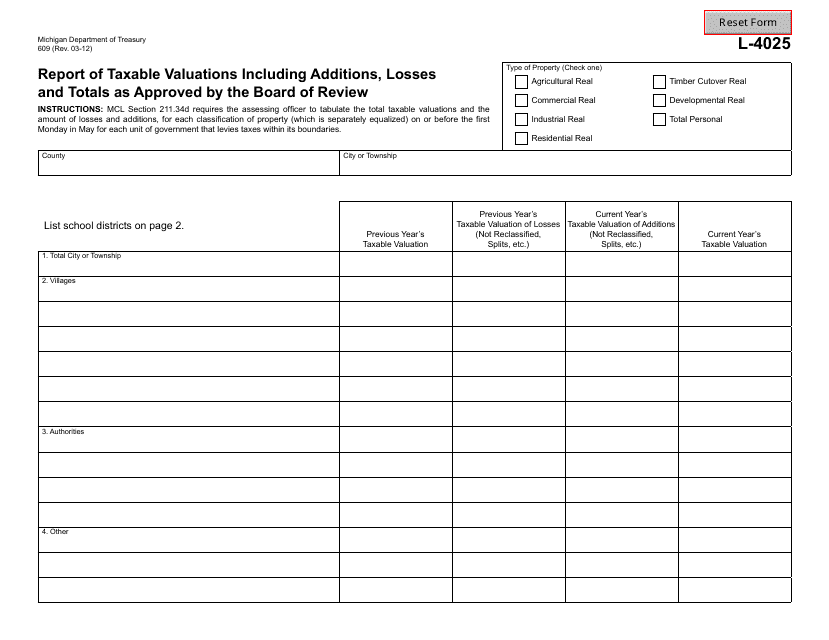

This form is used for reporting taxable valuations including additions, losses, and totals as approved by the Board of Review in Michigan. It helps to calculate the accurate tax amount based on the property values.

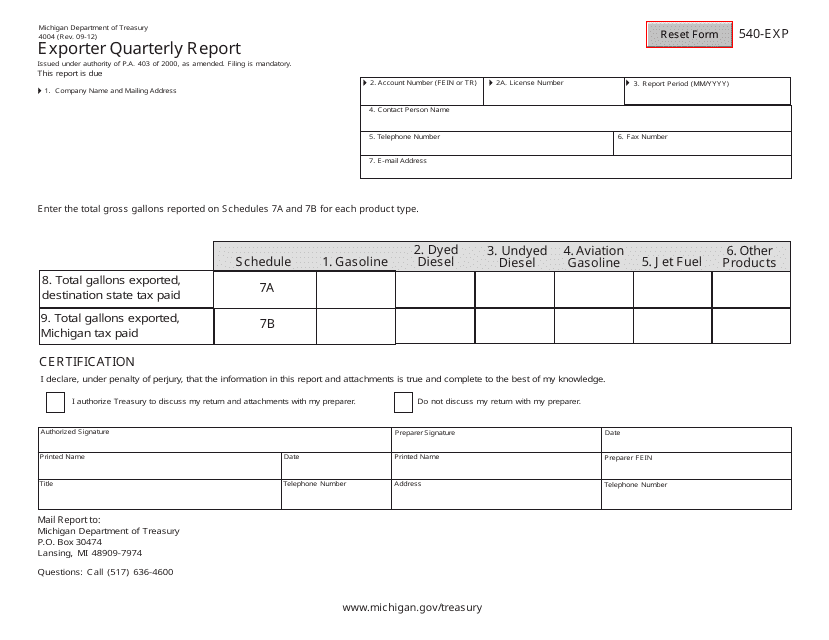

This document is used for submitting quarterly export reports by exporters in Michigan. It is Form 4004 (500-EXP), specifically designed for this purpose.

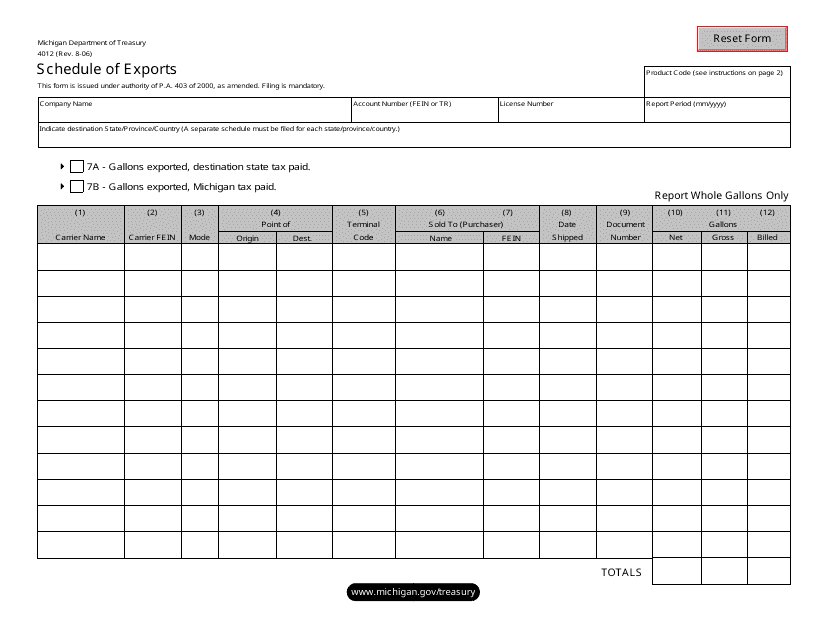

This Form is used for reporting the schedule of exports from Michigan. It provides details about the quantity and value of goods exported from the state.

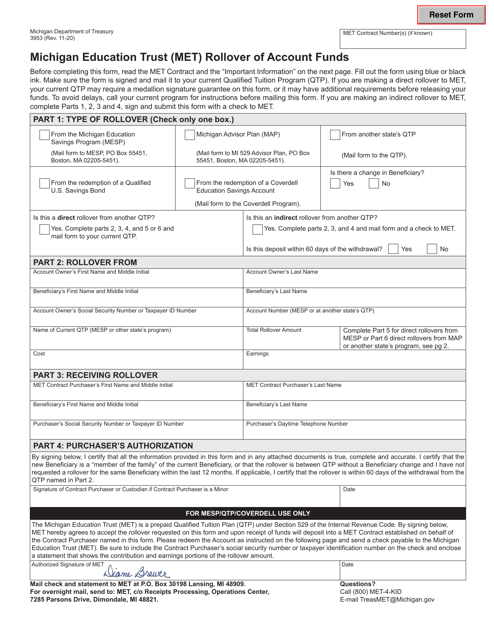

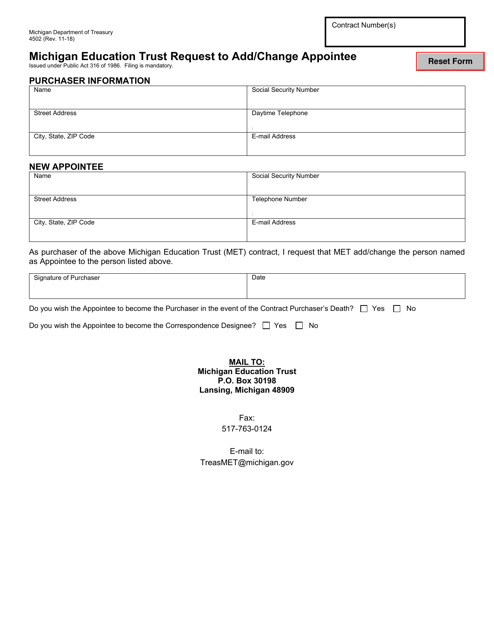

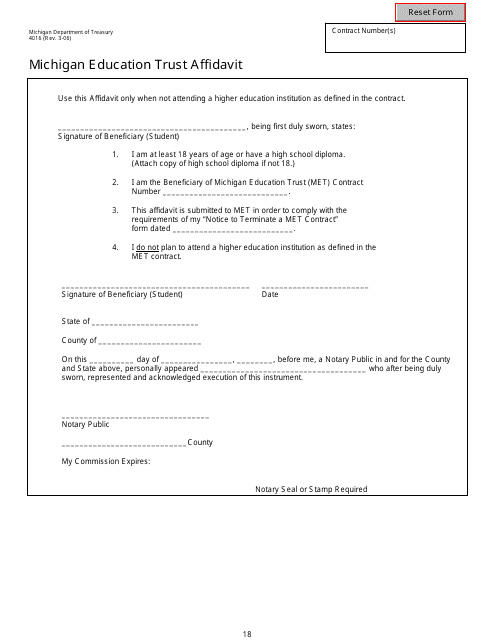

This form is used for the Michigan Education Trust (MET) Affidavit in Michigan. It is a document used to verify information related to the Michigan Education Trust program.

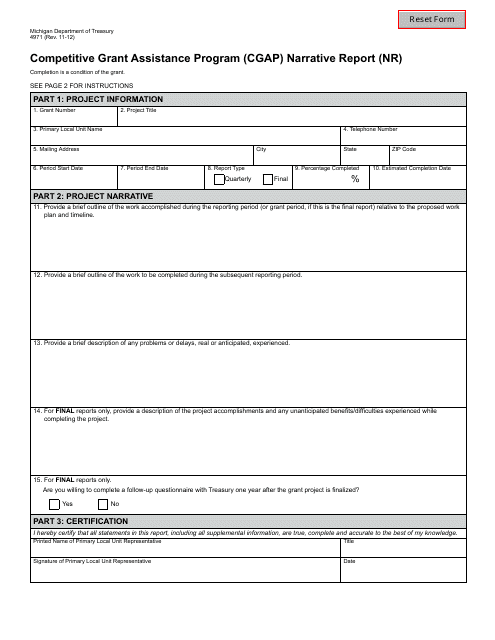

This form is used for submitting a narrative report for the Competitive Grant Assistance Program (CGAP) in Michigan.

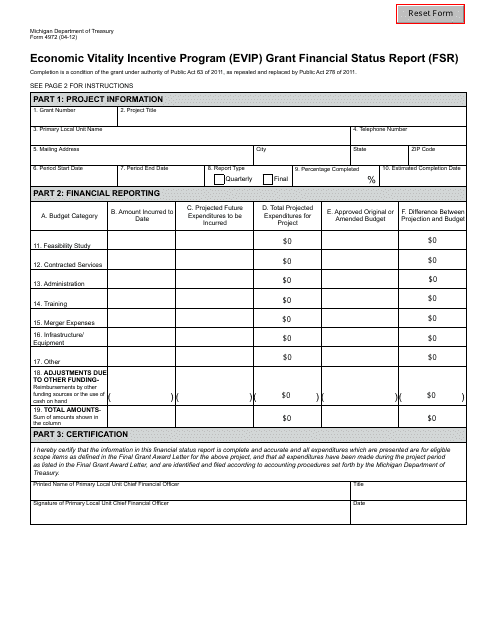

This form is used for reporting the financial status of an Economic Vitality Incentive Program (EVIP) grant in Michigan. It helps organizations track and report their grant funding and how it is being used.

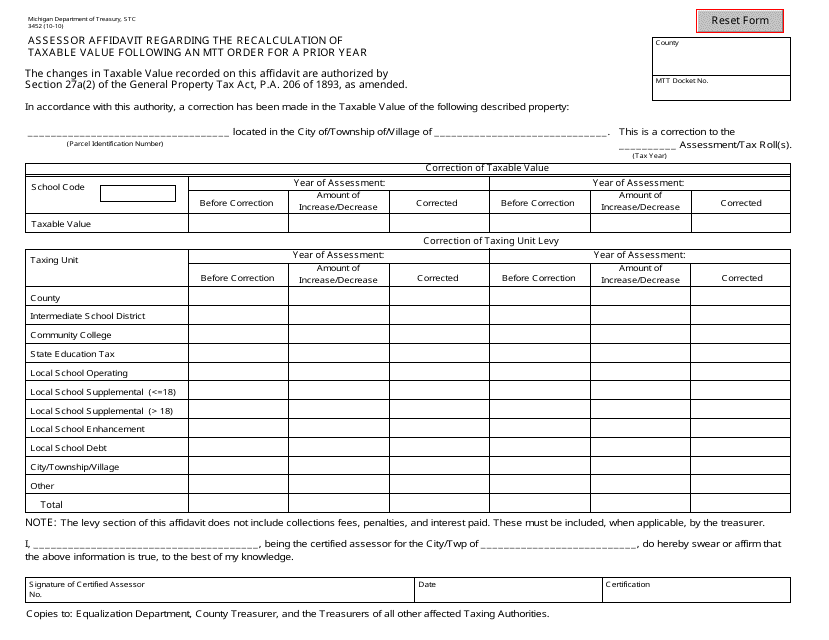

This form is used for submitting an Assessor Affidavit in Michigan for the recalculation of taxable value after an MTT (Michigan Tax Tribunal) order for a previous year.

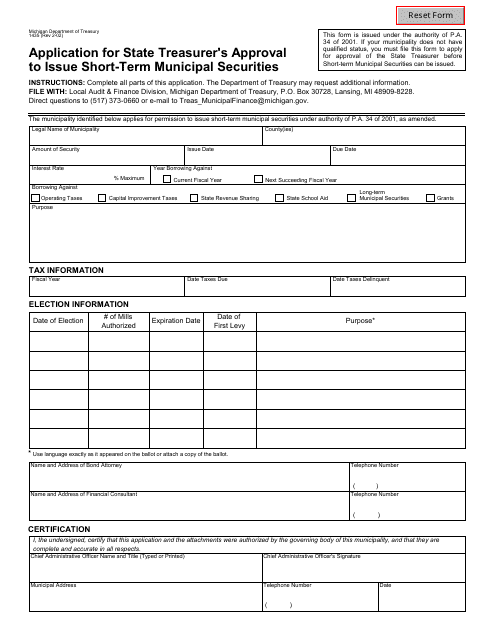

This Form is used for applying to the Michigan State Treasurer for approval to issue short-term municipal securities.