Tax Templates

Documents:

2882

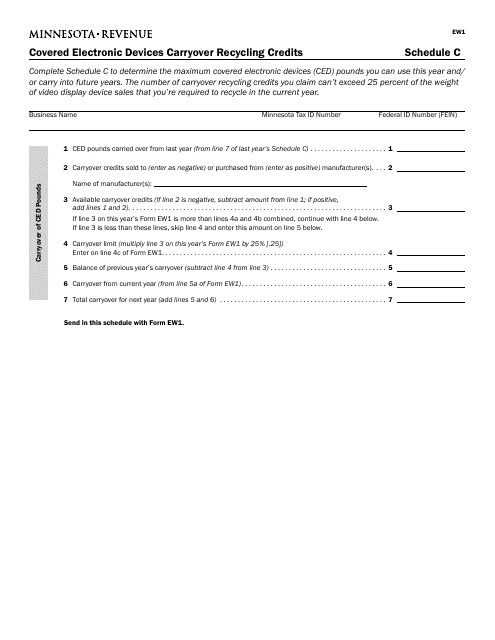

This form is used for reporting and claiming carryover recycling credits for covered electronic devices in Minnesota.

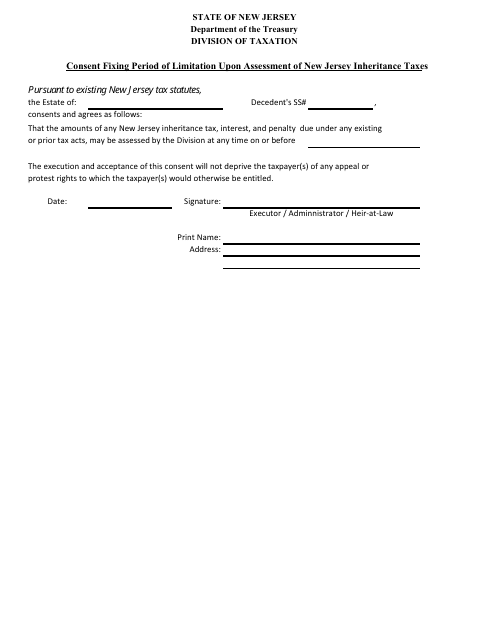

This document is used for fixing the period of limitation for assessing inheritance taxes in the state of New Jersey. It involves obtaining consent for any changes to the assessment of these taxes.

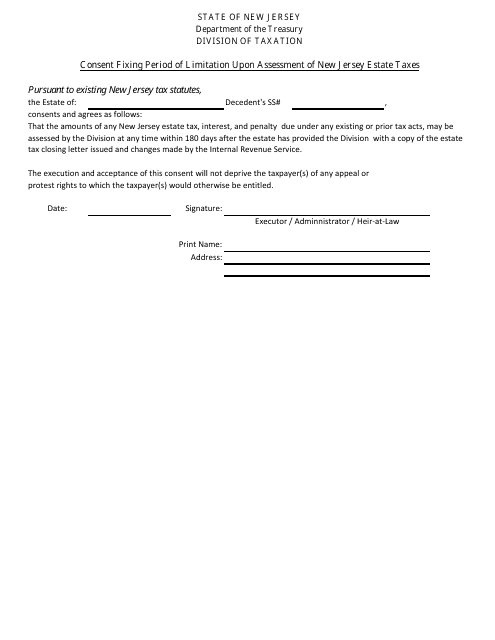

This document establishes the time limit for assessing New Jersey estate taxes.

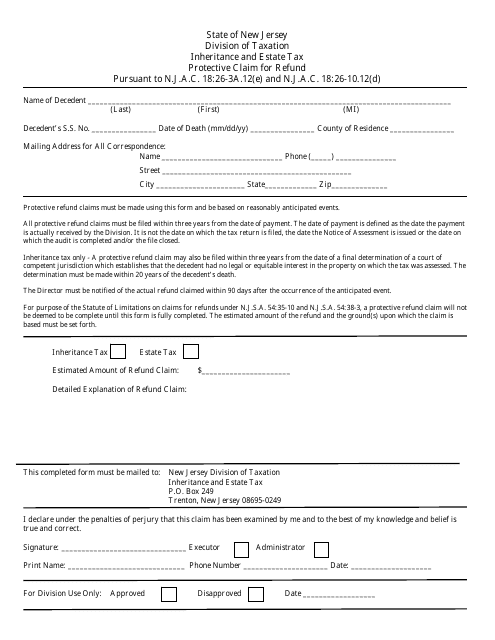

This Form is used for claiming a refund for inheritance and estate taxes paid in New Jersey.

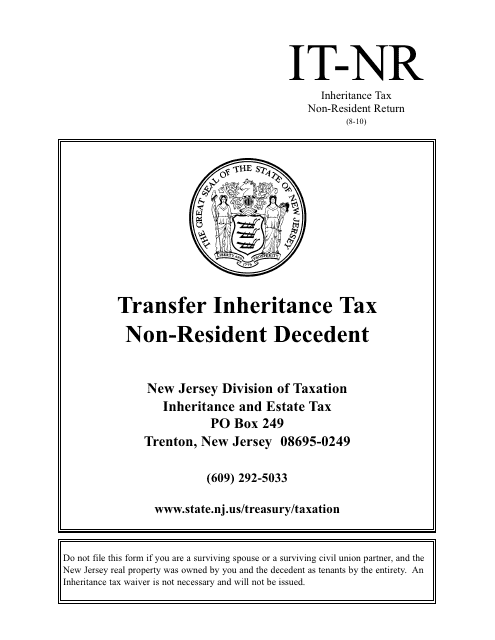

This form is used for transferring inheritance tax for non-resident decedents in New Jersey.

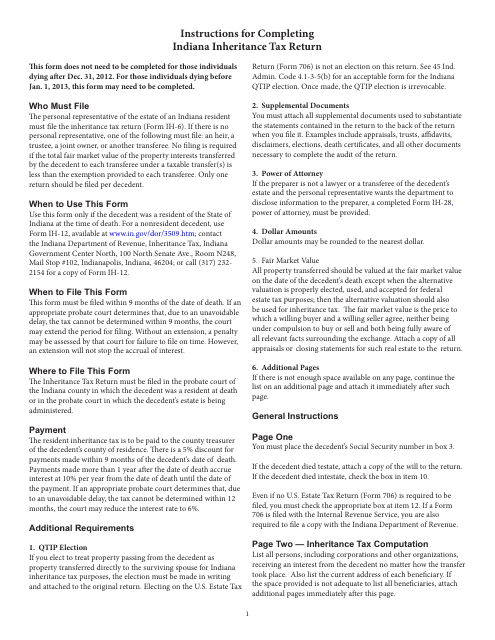

This Form is used for filing an Indiana Inheritance Tax Return in the state of Indiana. It is used to report any inheritance taxes owed on an estate.

This Form is used for requesting a closing agreement in the state of New Jersey.

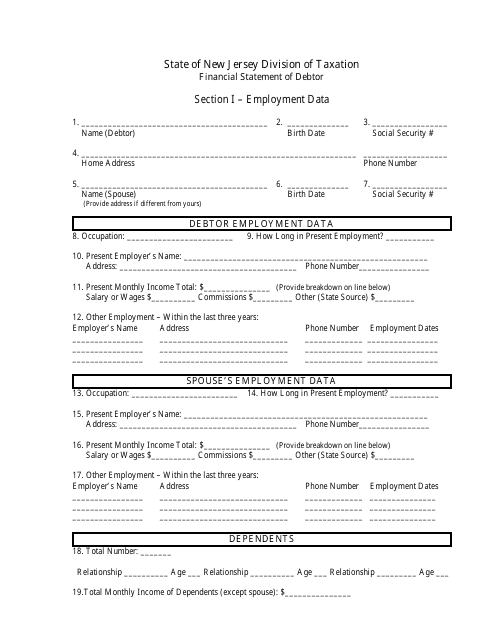

This document provides a detailed overview of the financial status of a debtor residing in New Jersey. It includes information about their income, assets, liabilities, and overall financial health.

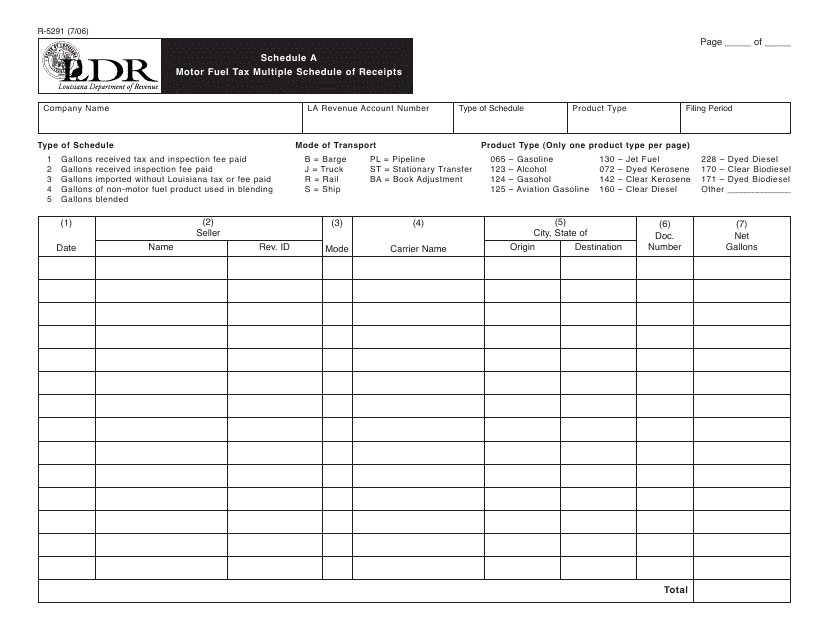

This form is used for reporting multiple motor fuel tax receipts in Louisiana.

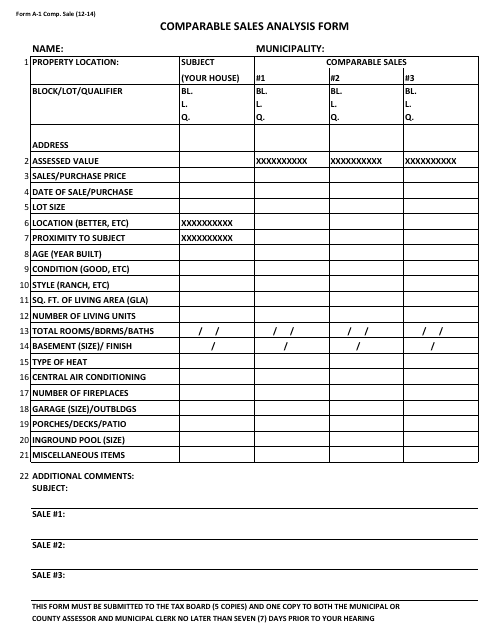

This Form is used for conducting a Comparable Sales Analysis in New Jersey. It helps in evaluating the market value of a property by comparing it to similar properties that have recently sold in the area.

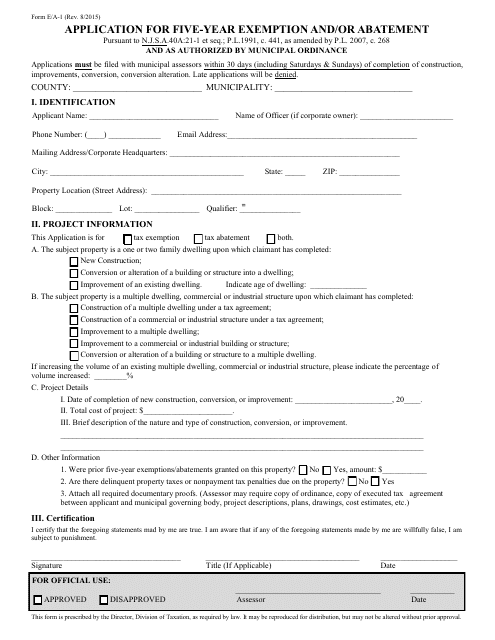

This form is used for applying for a five-year exemption and/or abatement in New Jersey.

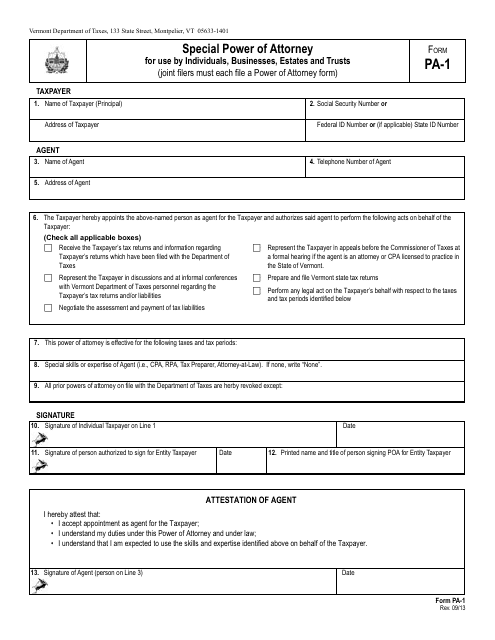

This document is a special power of attorney form that can be used by individuals, businesses, estates, and trusts in the state of Vermont. It grants someone the authority to act on behalf of the person or entity that is granting the power of attorney.

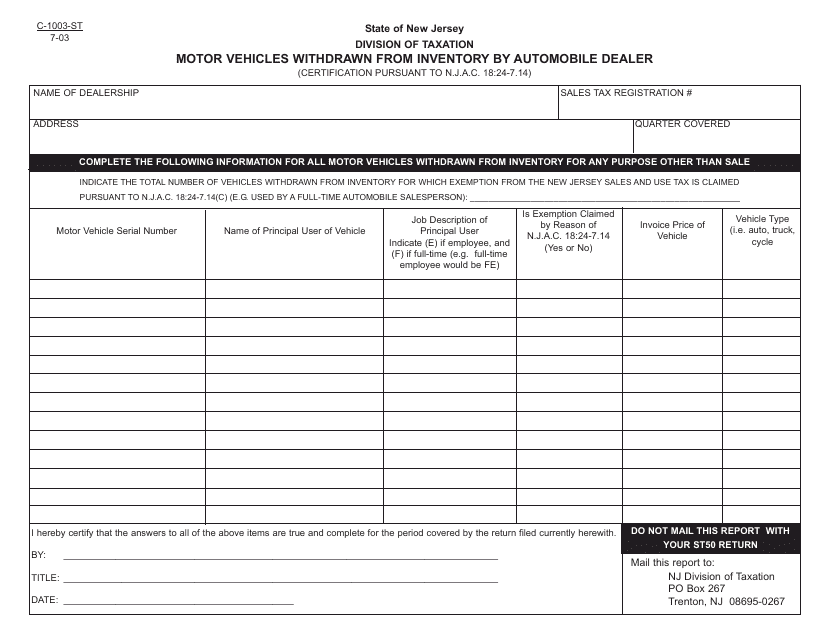

This form is used for automobile dealers in New Jersey to withdraw motor vehicles from their inventory.

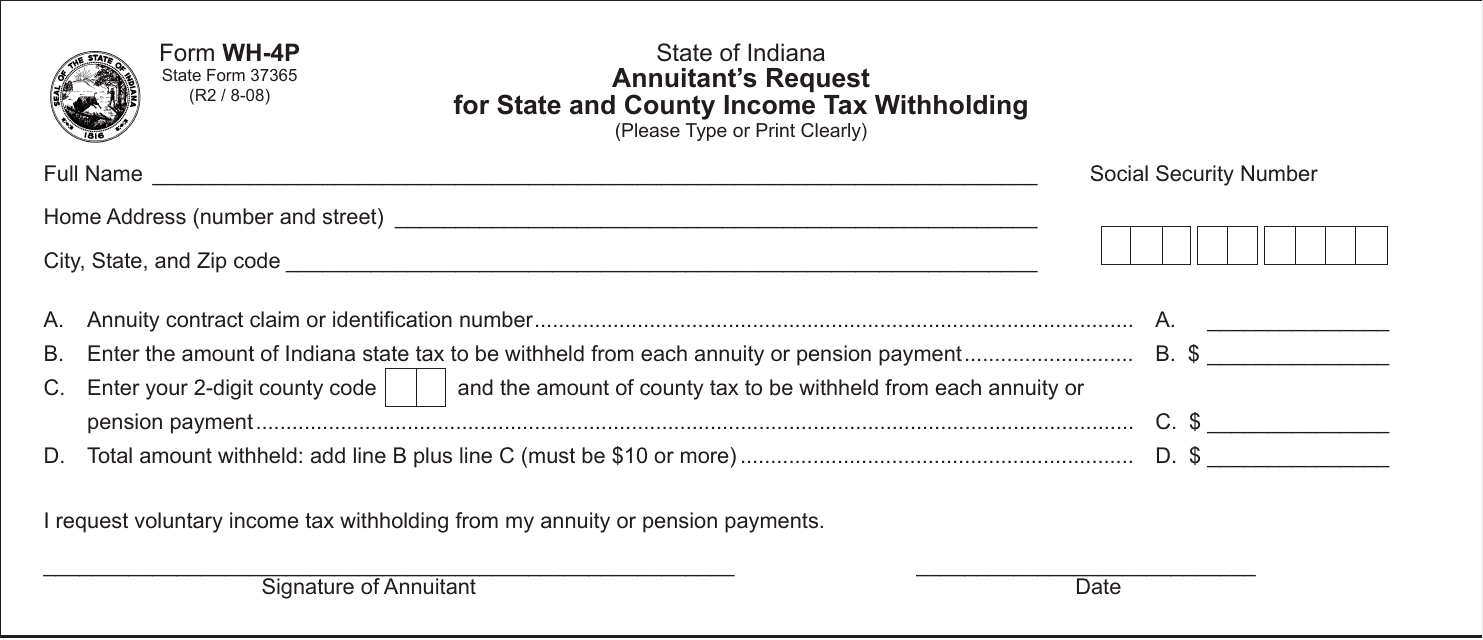

This form is used for annuitants in Indiana to request state and county income tax withholding.

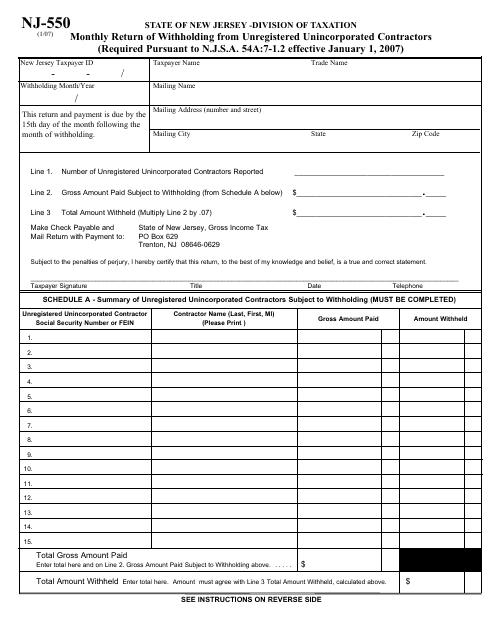

This Form is used for reporting monthly withholding from unregistered unincorporated contractors in the state of New Jersey.

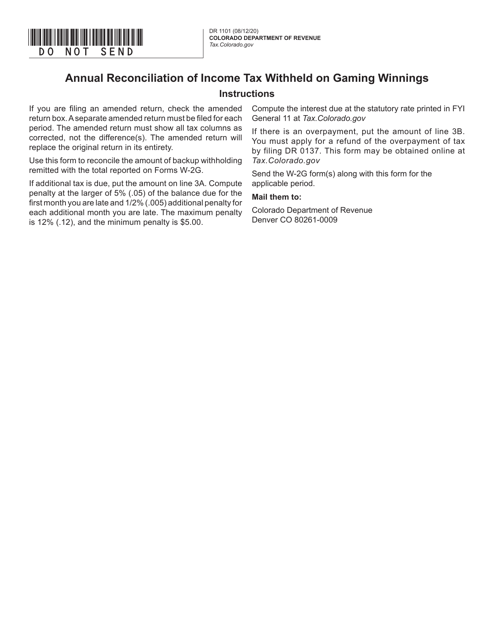

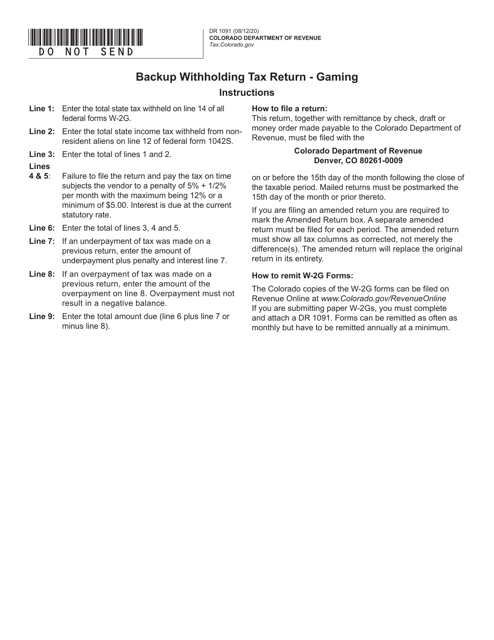

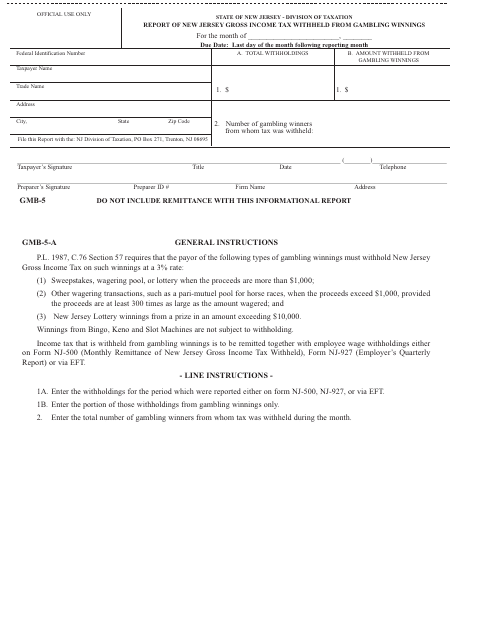

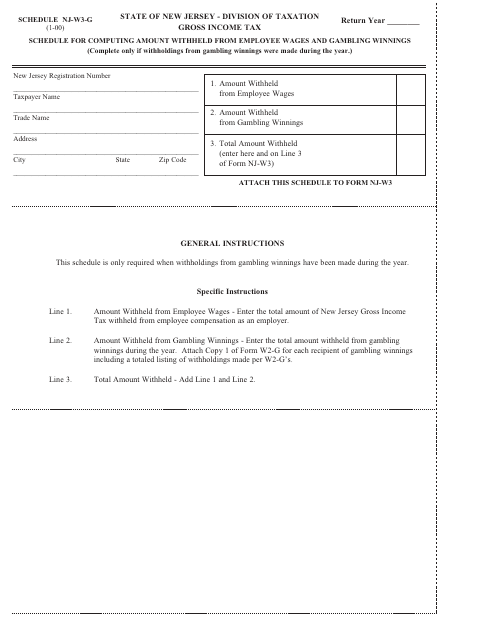

This form is used for reporting the amount of New Jersey Gross Income Tax withheld from gambling winnings in New Jersey.

This document is used for computing the amount withheld from employee wages and gambling winnings in New Jersey.

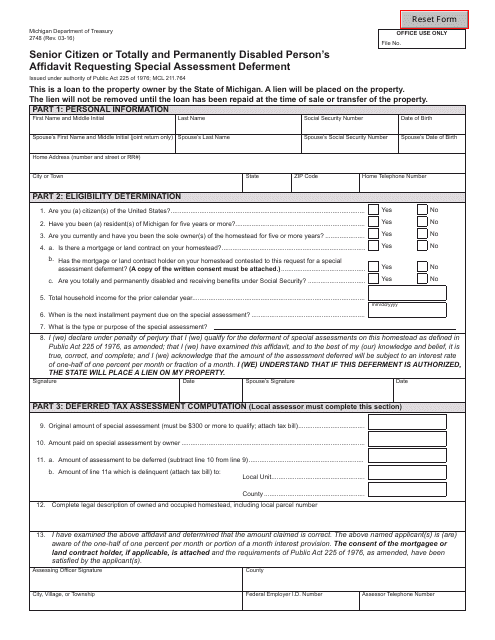

This form is used for senior citizens or individuals who are totally and permanently disabled to request special assessment deferment in the state of Michigan.

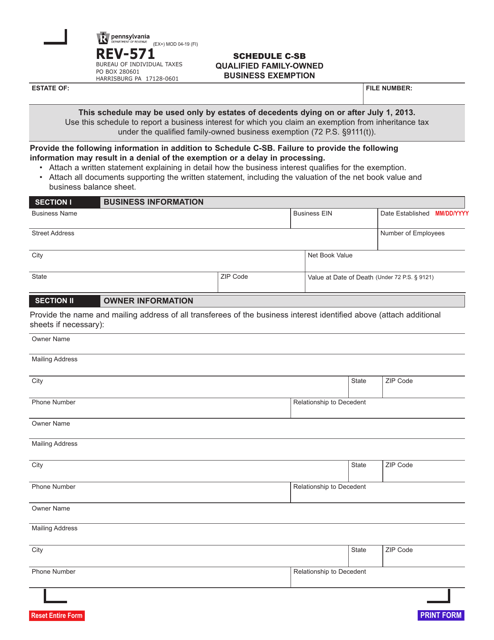

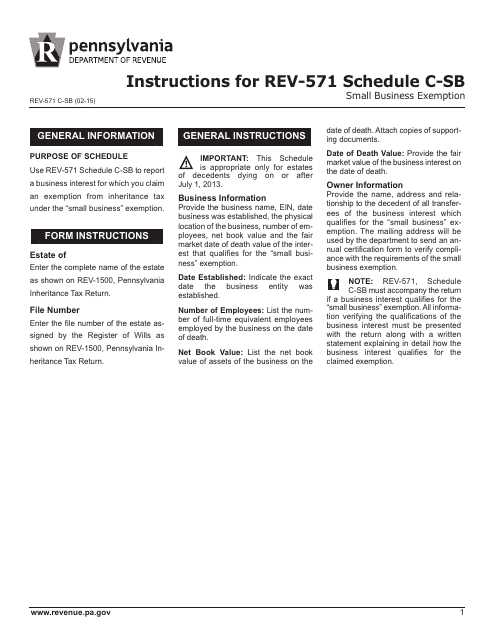

This Form is used for claiming small business exemption in Pennsylvania. It provides instructions on filling out Schedule C-SB.

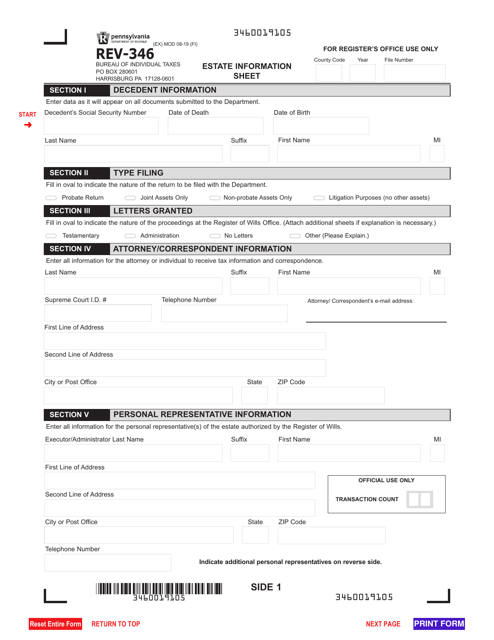

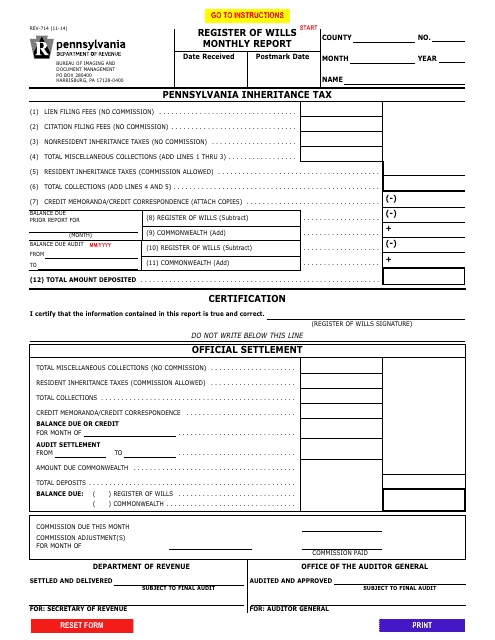

This form is used for submitting a monthly report to the Register of Wills in Pennsylvania. It provides information about the activities and transactions handled by the Register of Wills office.

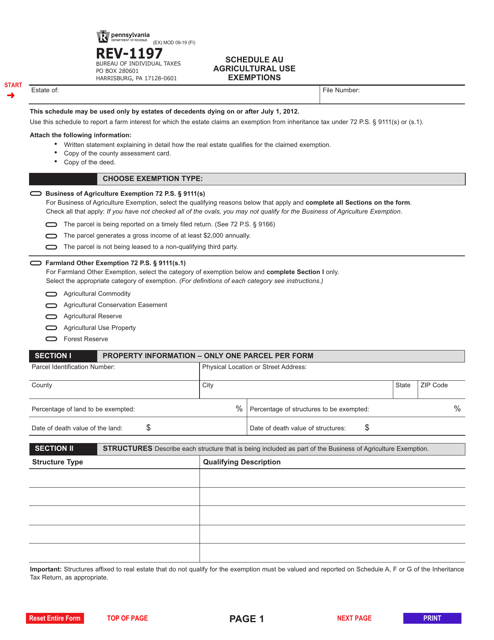

This Form is used for reporting agricultural use exemptions in Pennsylvania. It provides instructions on how to fill out Schedule AU for claiming tax exemptions on agricultural properties.

This form is used for reporting funeral expenses and administrative costs in Pennsylvania. It provides instructions on how to fill out Schedule H of Form REV-1511.

This Form is used for reporting the debts of a deceased person, including mortgage liabilities and liens, in the state of Pennsylvania. It provides instructions on how to accurately fill out the Schedule I section of Form REV-1512.