Tax Templates

Documents:

2882

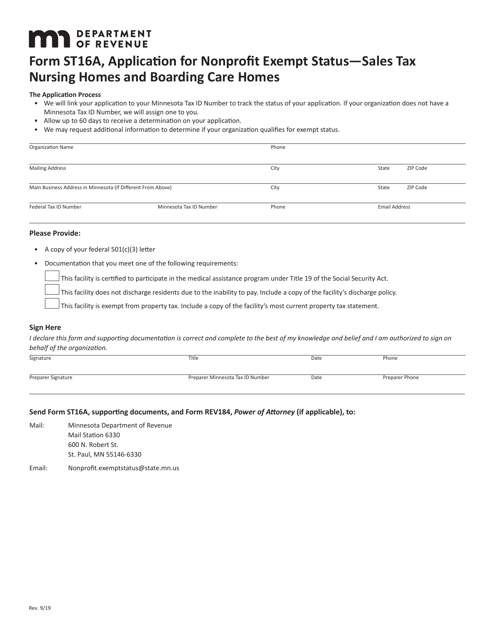

This form is used for applying for certification or recertification to the Motor Vehicle Leasing List in Massachusetts.

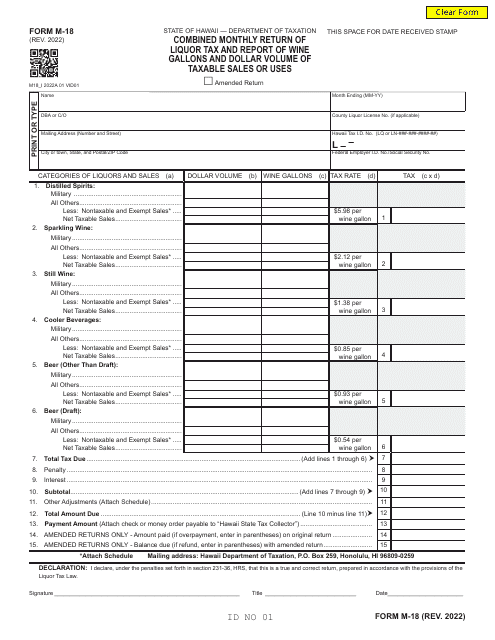

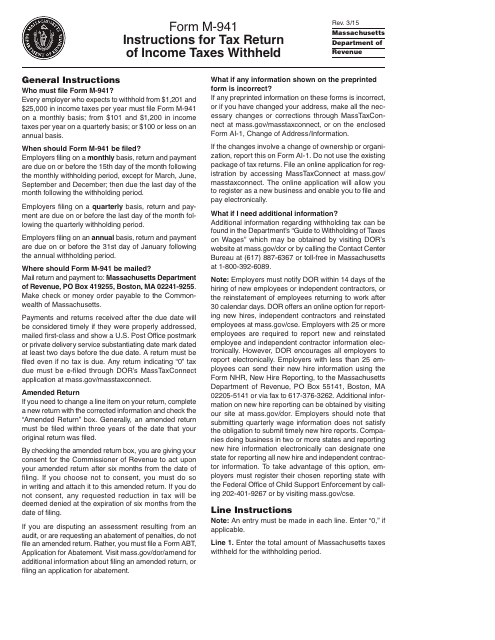

This form is used for submitting the Alcoholic Beverages Excise Return in Massachusetts.

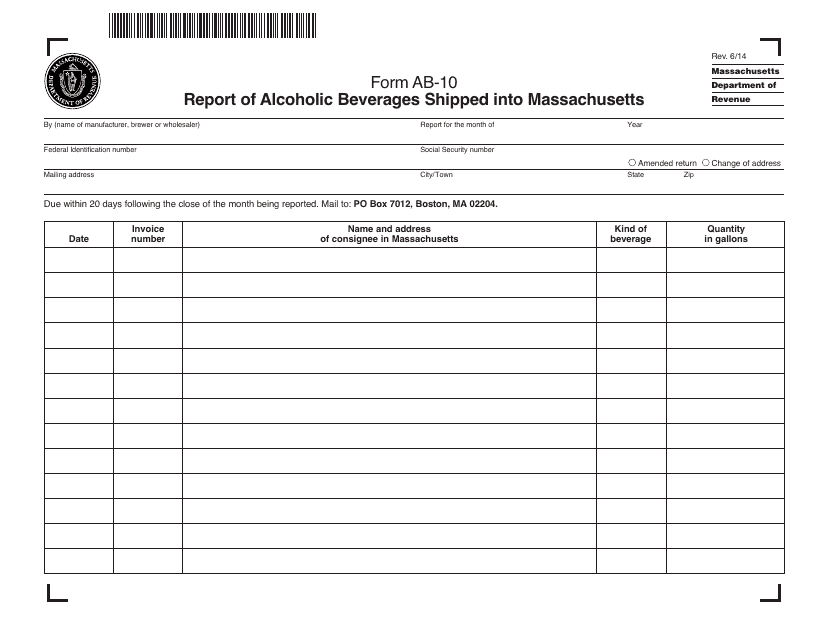

This document is used for reporting the shipment of alcoholic beverages into Massachusetts. It is required for businesses who transport alcohol into the state.

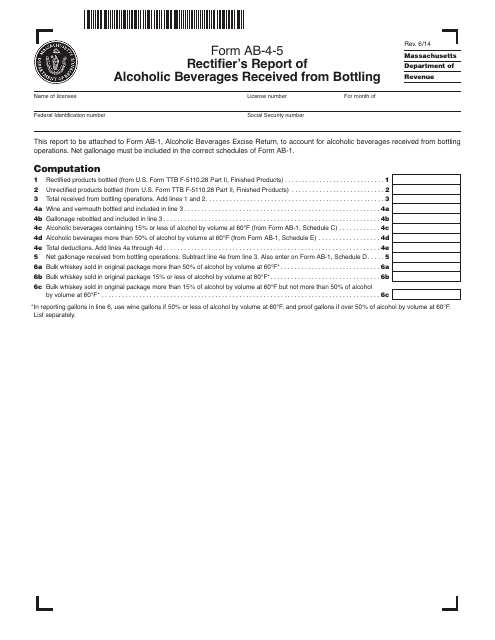

This Form is used for rectifiers in Massachusetts to report the receipt of alcoholic beverages from bottling companies.

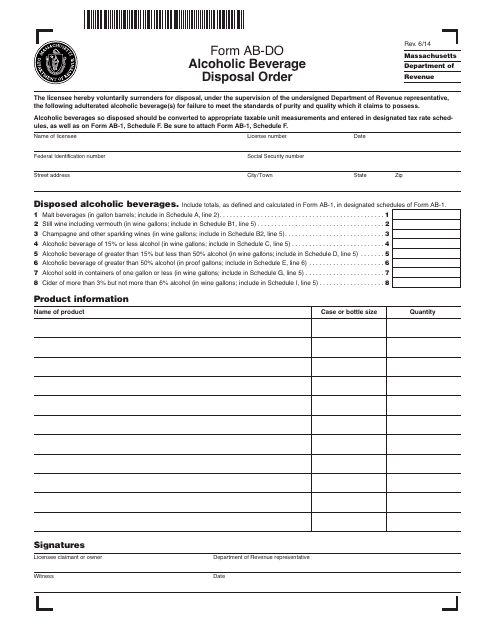

This form is used for requesting an alcoholic beverage disposal order in Massachusetts. It allows individuals or businesses to dispose of alcoholic beverages that are no longer usable or needed.

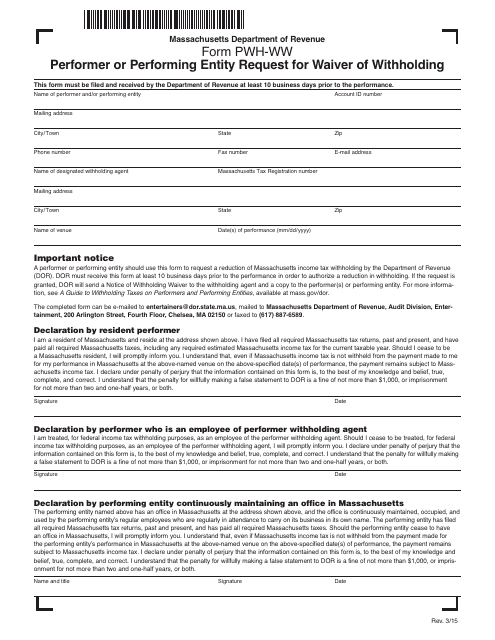

This Form is used for requesting a waiver of withholding in Massachusetts for performers or performing entities.

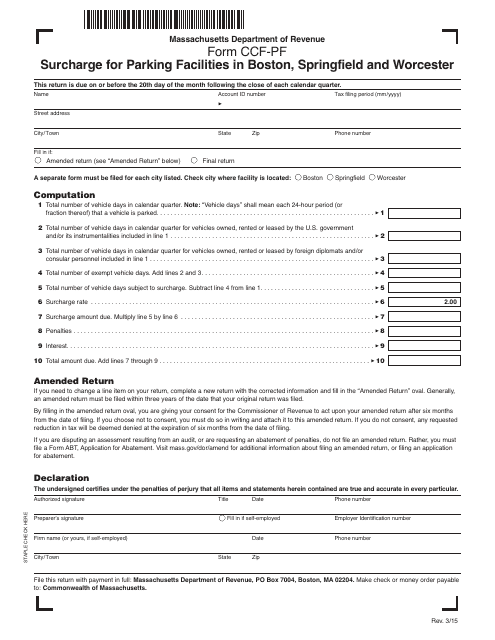

This form is used for paying surcharges for parking facilities in Boston, Springfield, and Worcester, Massachusetts.

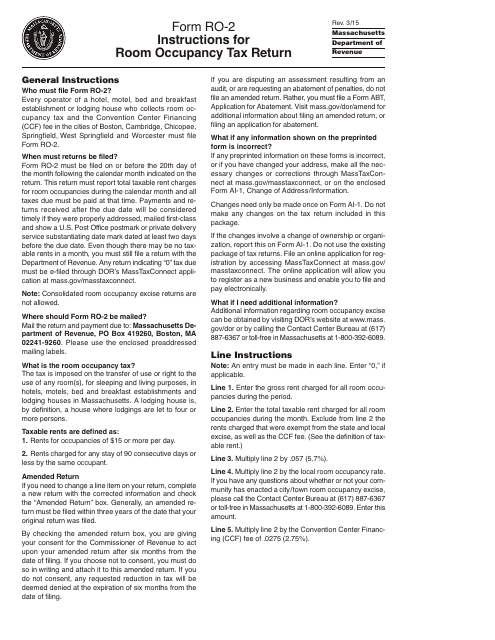

This Form is used for filing the Room Occupancy Tax Return in Massachusetts. It provides instructions on how to accurately complete and submit the form for reporting and paying the room occupancy tax.

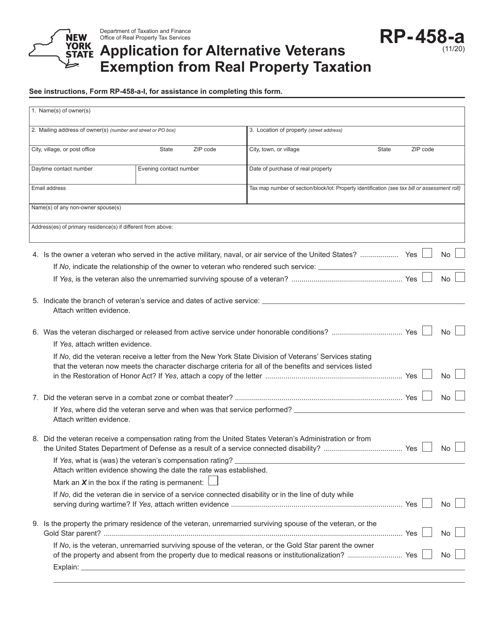

This Form is used for applying for the Volunteer Firefighters / Volunteer Ambulance Workers Exemption in Putnam County, New York.

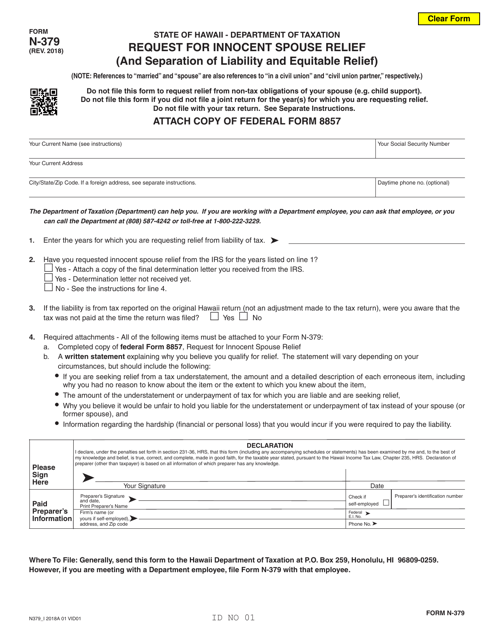

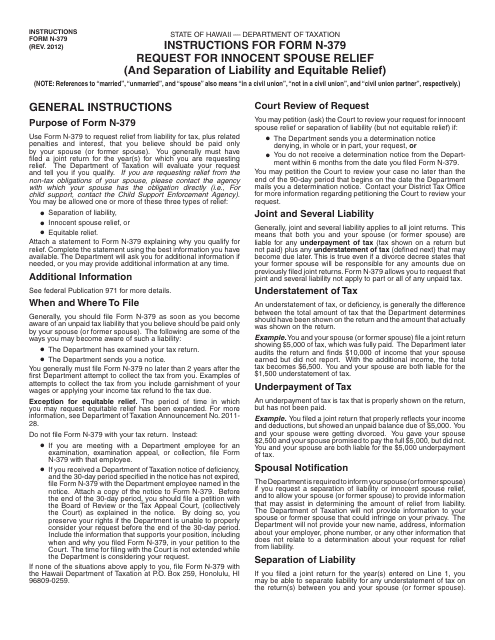

This Form is used for requesting innocent spouse relief in the state of Hawaii. It provides instructions on how to apply for relief from joint tax liability when a spouse or former spouse believes they should not be held responsible for the other spouse's tax obligations.

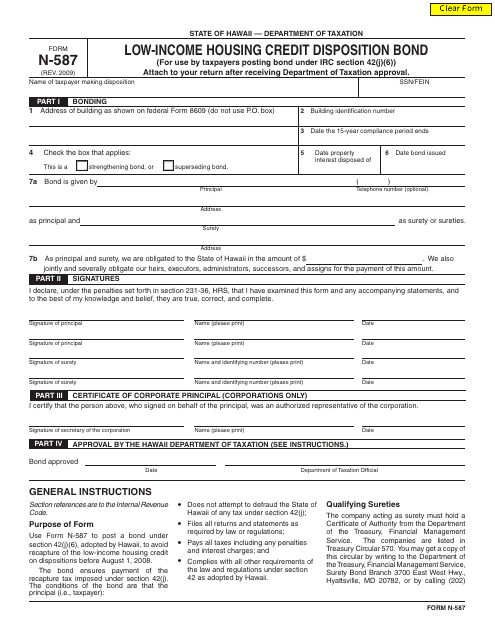

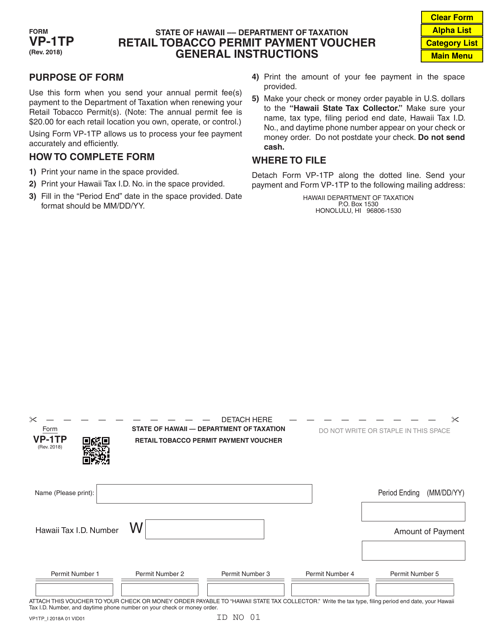

This Form is used for low-income housing credit disposition bond in Hawaii. It helps individuals and organizations in Hawaii to claim tax credits for Low-Income Housing projects.

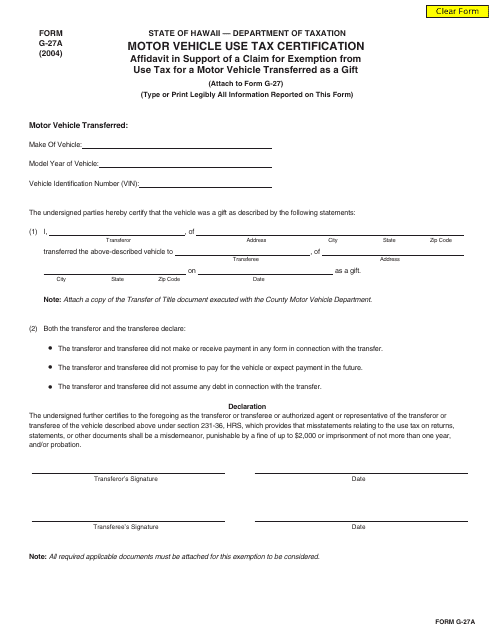

This document is used for claiming an exemption from motor vehicle use tax in Hawaii when transferring a vehicle as a gift.

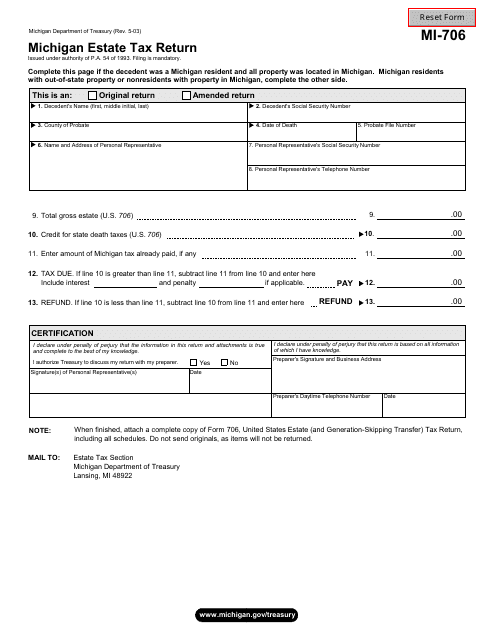

This form is used for filing the Michigan Estate Tax Return in the state of Michigan.

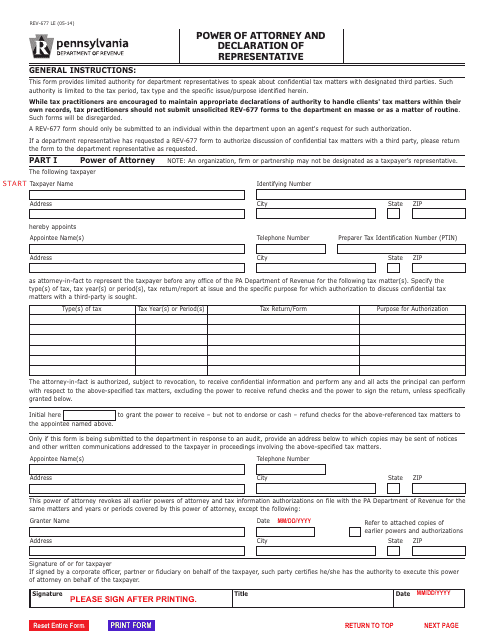

This form is used for creating a power of attorney and declaring a representative in the state of Pennsylvania.

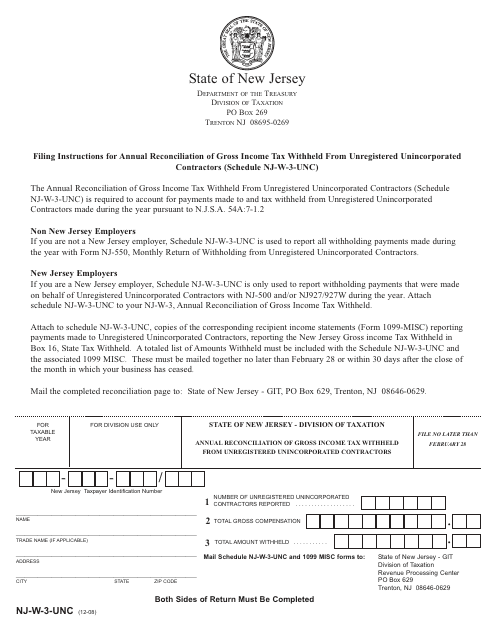

This form is used for the annual reconciliation of gross income tax withheld from unregistered unincorporated contractors in New Jersey.

![Form RP-466-C [PUTNAM] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Putnam County Only) - New York](https://data.templateroller.com/pdf_docs_html/1731/17310/1731027/form-rp-466-c-putnam-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-putnam-county-only-new-york_big.png)