Tax Templates

Documents:

2882

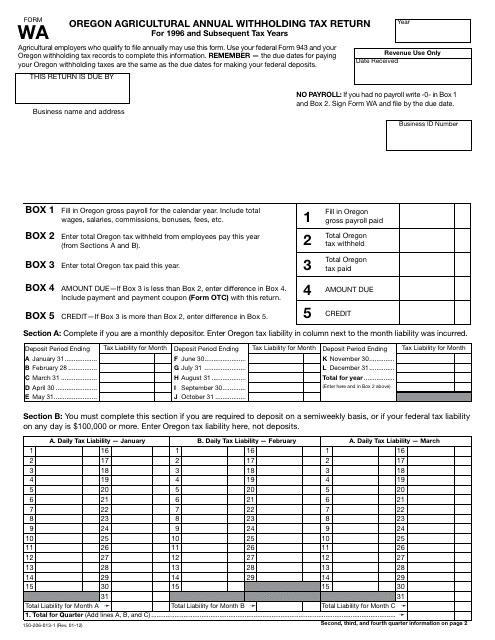

This document is used for reporting and paying the annual withholding tax for agricultural businesses in the state of Oregon.

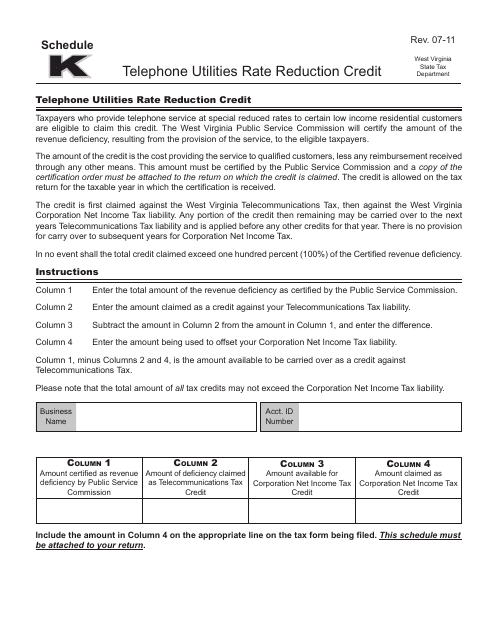

This Form is used for claiming the Telephone Utilities Rate Reduction Credit in West Virginia. This credit may help reduce the amount of tax you owe on your telephone bill.

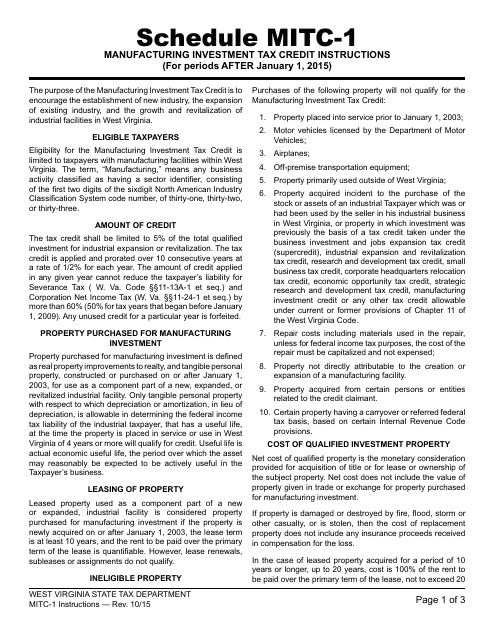

This Form is used to claim a tax credit for manufacturing investment in West Virginia for periods after January 1, 2015. It provides instructions on how to fill out the form and what documentation is required.

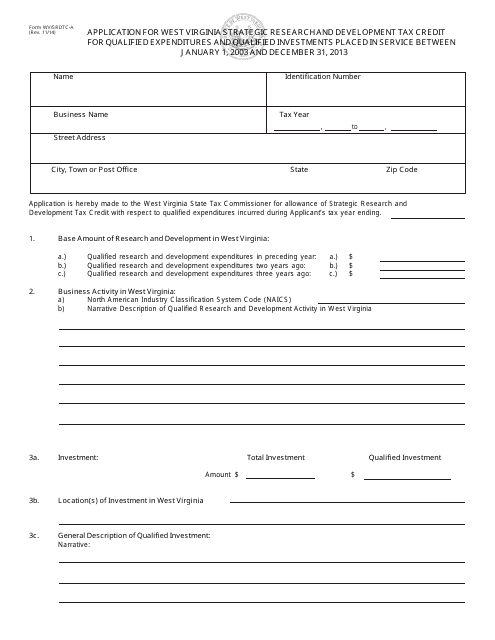

This Form is used for applying for the West Virginia Strategic Research and Development Tax Credit. It applies to qualified expenditures and qualified investments placed in service on or after January 1, 2003.

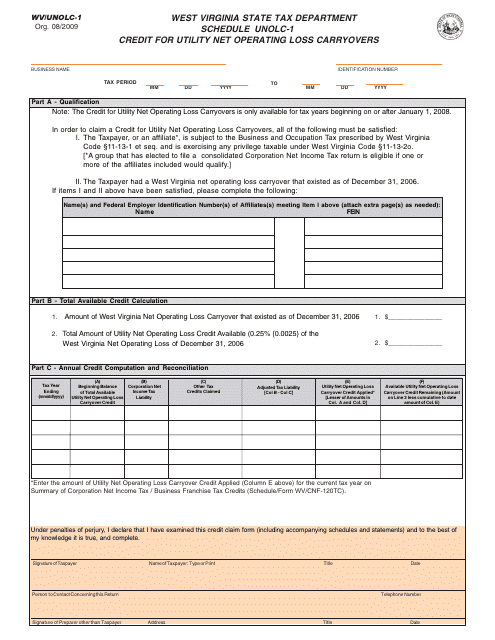

This form is used for claiming credits for utility net operating loss carryovers in West Virginia.

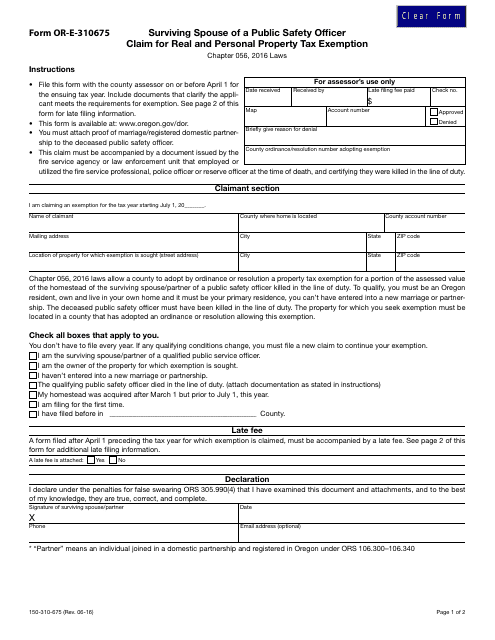

This form is used for a surviving spouse of a public safety officer to claim a real and personal property tax exemption in the state of Oregon.

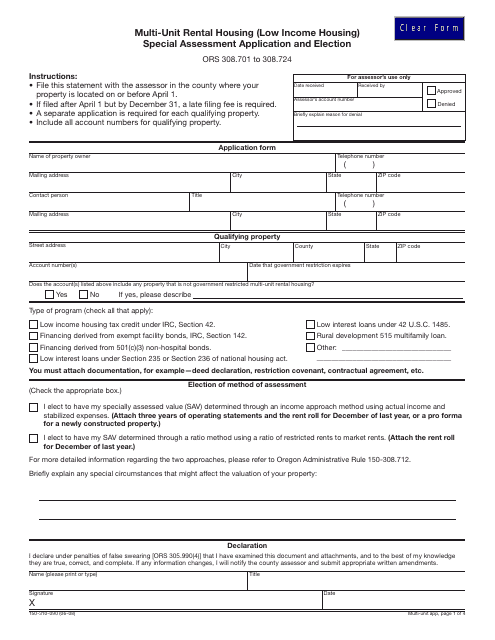

Form 150-310-090 Multi-Unit Rental Housing Special Assessment Application and Election Form - Oregon

This Form is used for applying for special assessment and conducting elections for multi-unit rental housing in Oregon.

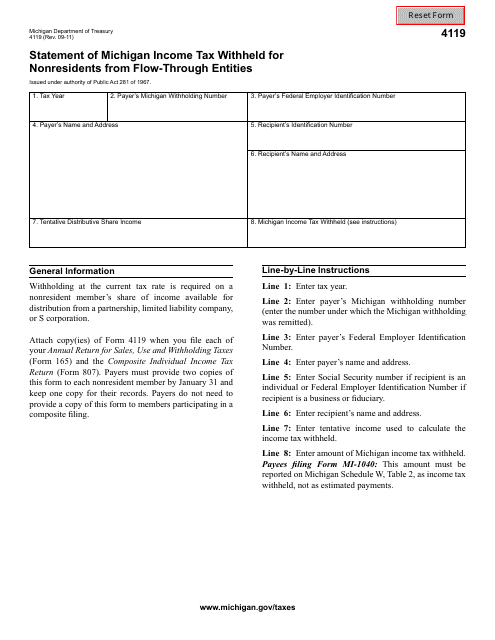

This Form is used for reporting income tax withheld from nonresidents in Michigan by flow-through entities.

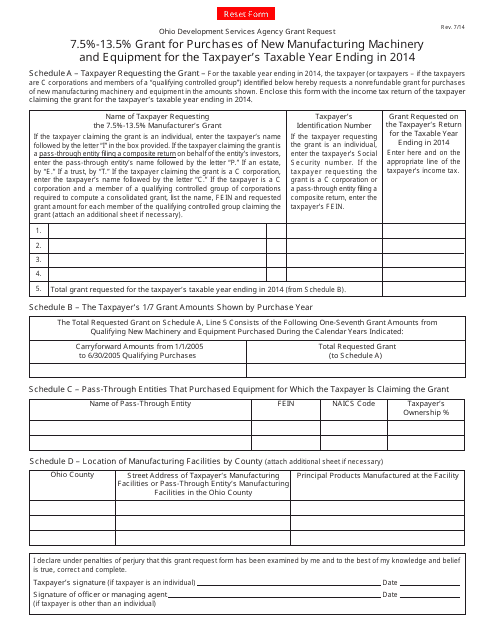

This form is used to apply for a grant of 7.5%-13.5% for the purchase of new manufacturing machinery and equipment in Ohio for the taxpayer's taxable year ending in 2014.

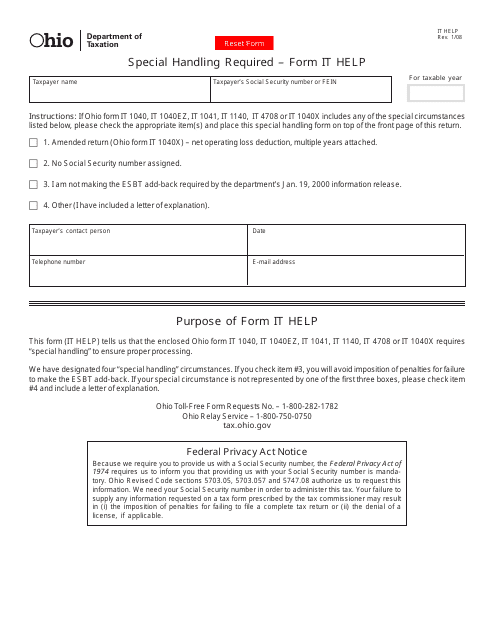

This Form is used for IT support requests from Ohio residents that require special handling.

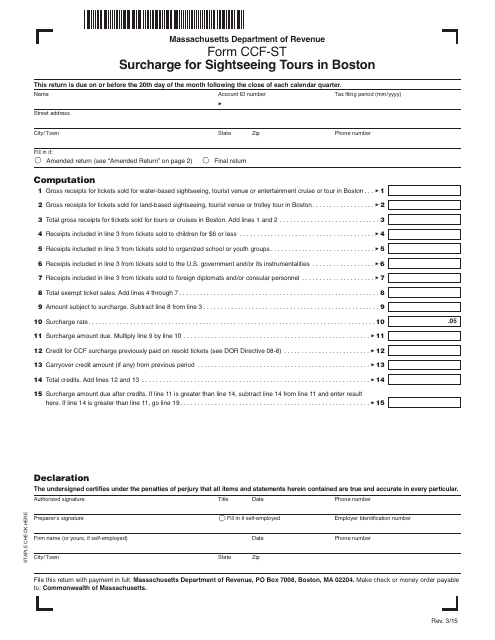

This Form is used for paying surcharges for sightseeing tours in Boston, Massachusetts.

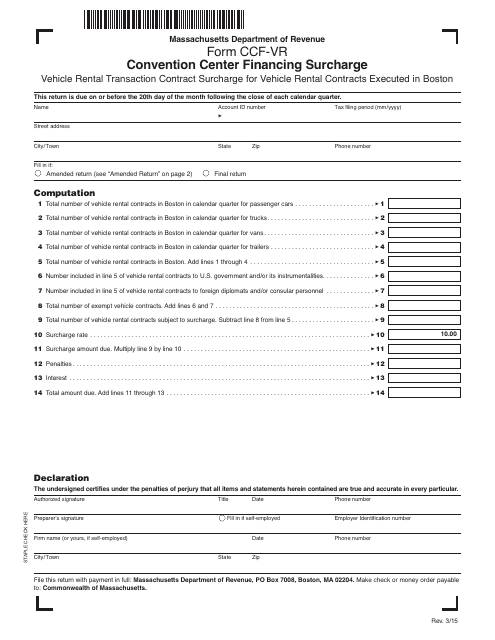

This form is used for the Convention Center Financing Surcharge in Massachusetts.

This form is used for individuals in Massachusetts to provide their financial information and other relevant details.

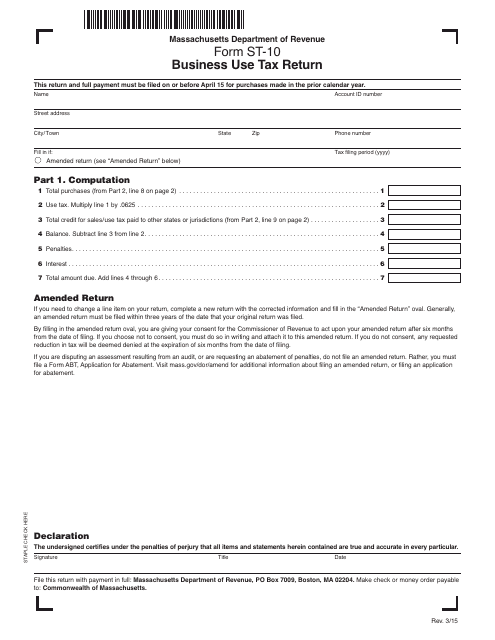

This form is used for reporting and paying business use tax in the state of Massachusetts.

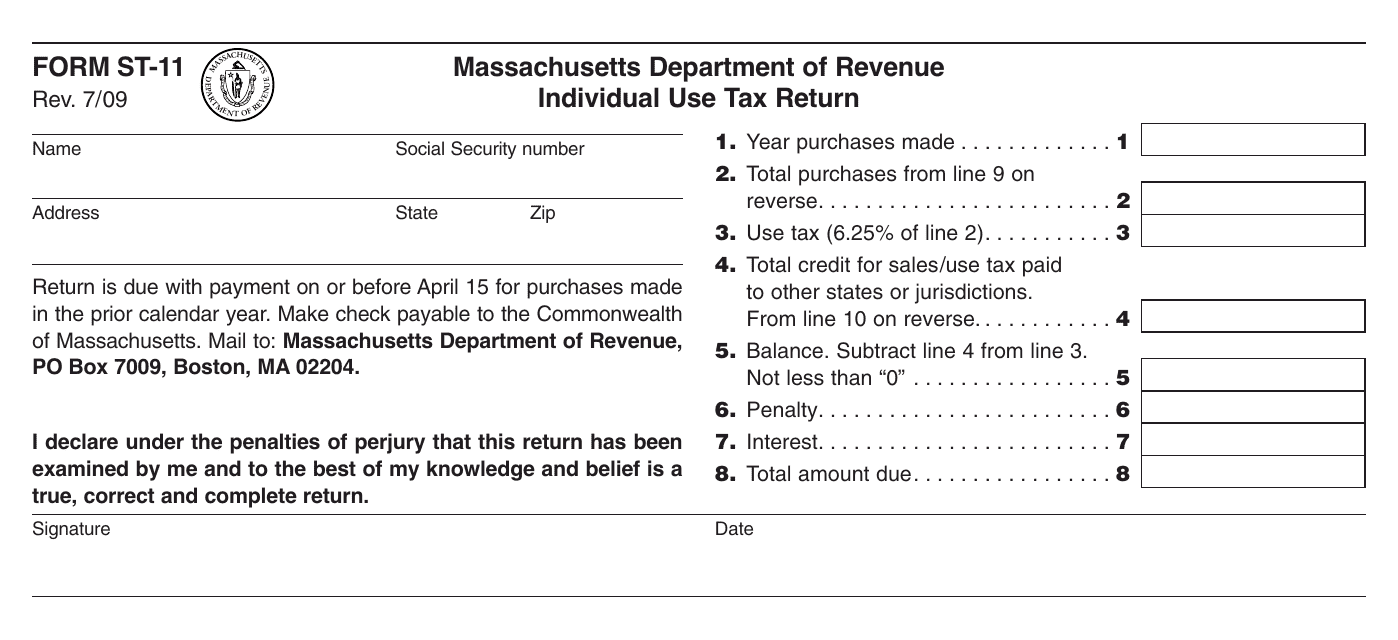

This form is used for reporting and paying use tax by individuals in Massachusetts. Use tax is a tax on goods purchased outside the state of Massachusetts for use within the state.

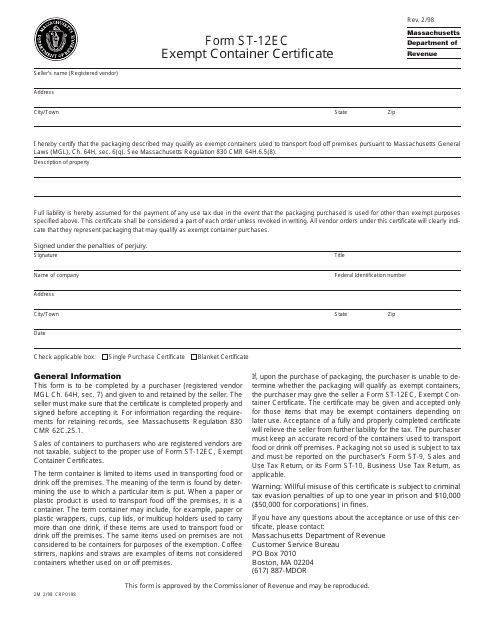

This form is used for obtaining an exempt container certificate in Massachusetts.

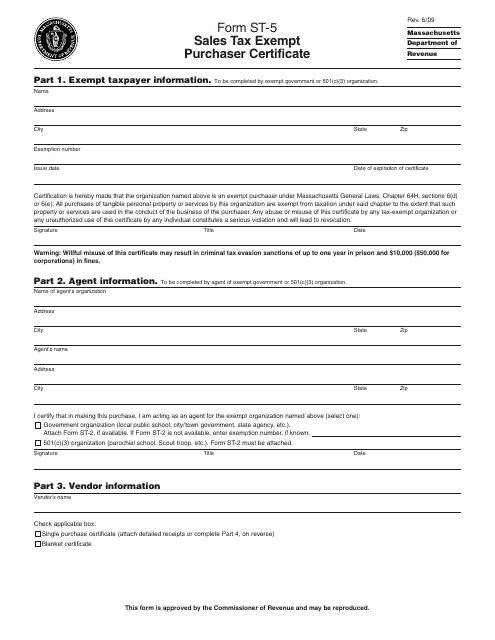

This form is used for Massachusetts purchasers to claim exemption from sales tax.

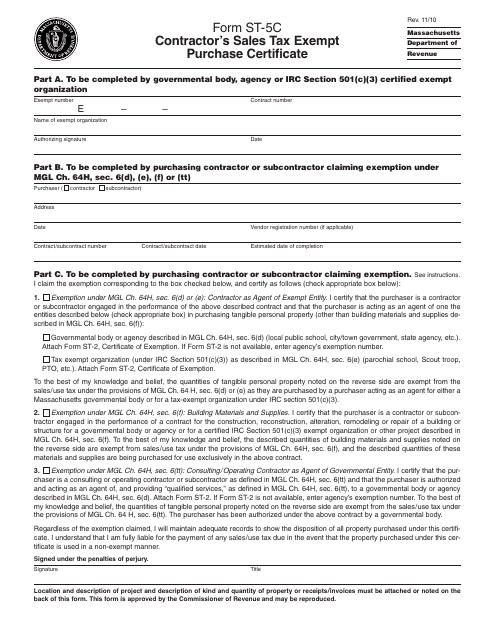

This form is used for contractors in Massachusetts to claim sales tax exemption on their purchases.

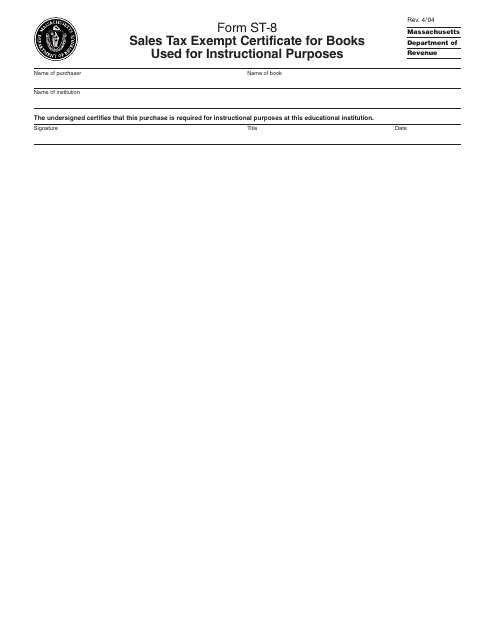

This form is used for claiming sales tax exemption on books used for educational purposes in Massachusetts.

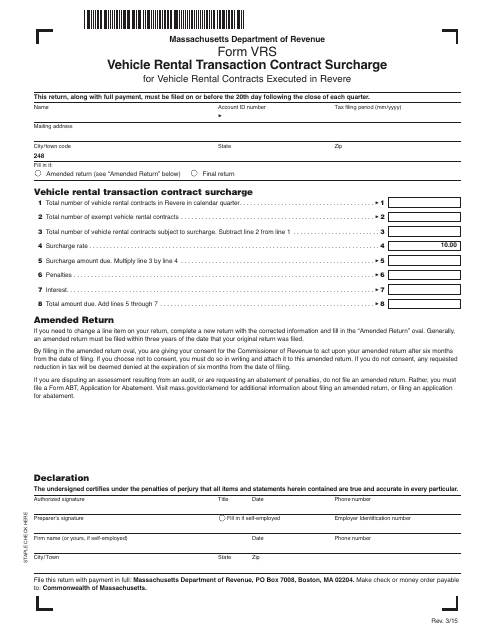

This form is used for adding a surcharge to a vehicle rental transaction contract in Massachusetts.

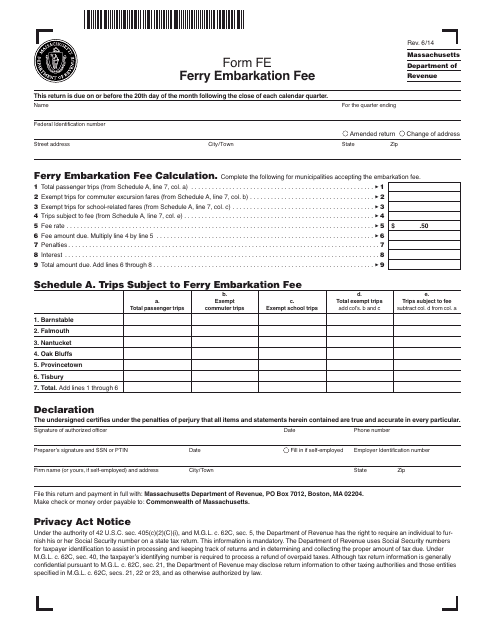

This form is used for paying the ferry embarkation fee in Massachusetts. It is required for anyone boarding a ferry in the state.

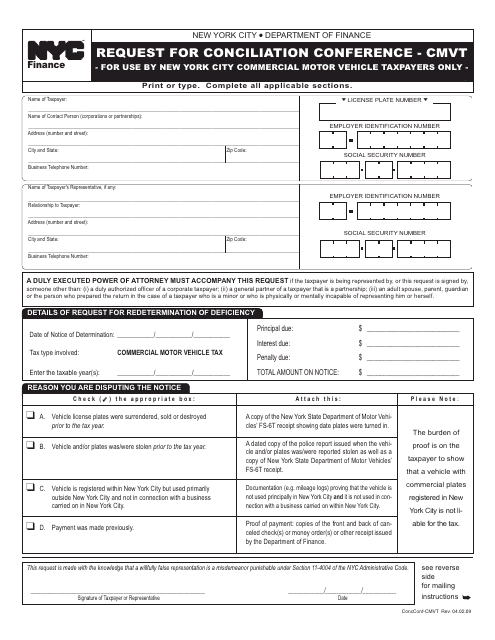

This document is a request for a conciliation conference in New York City. It is used to initiate a meeting between parties involved in a dispute in order to find a resolution through mediation.

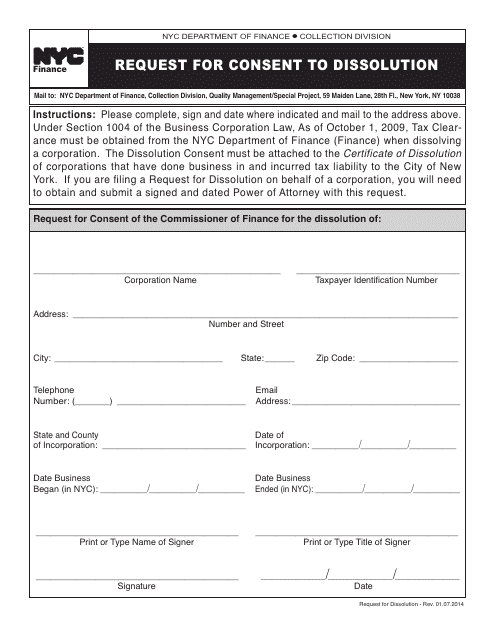

This document is used to request consent for the dissolution of a company in New York City.

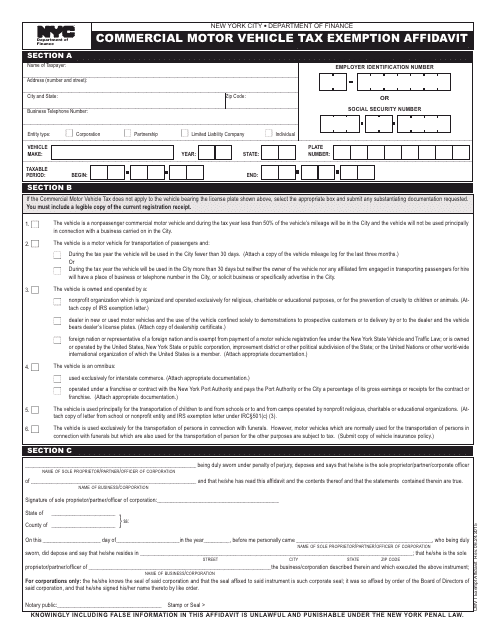

This form is used for applying for a tax exemption for commercial motor vehicles in New York City.

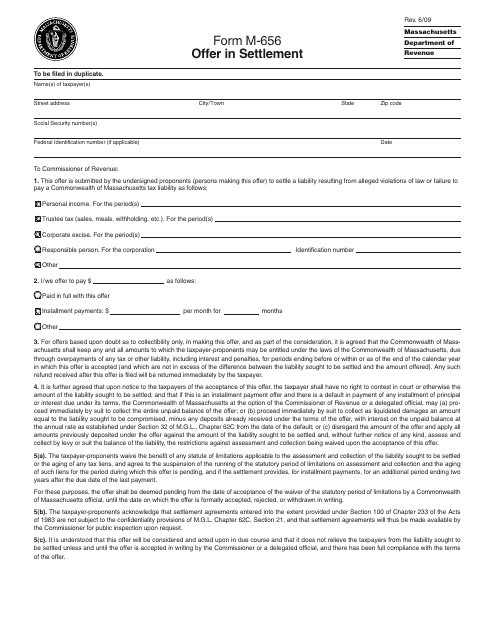

This form is used for making an offer in settlement in the state of Massachusetts.

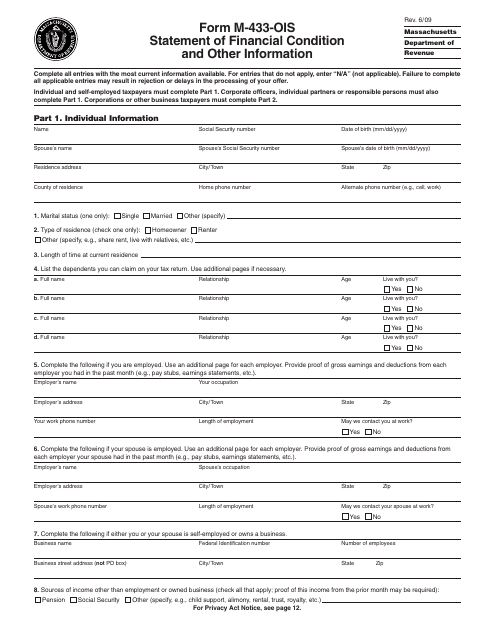

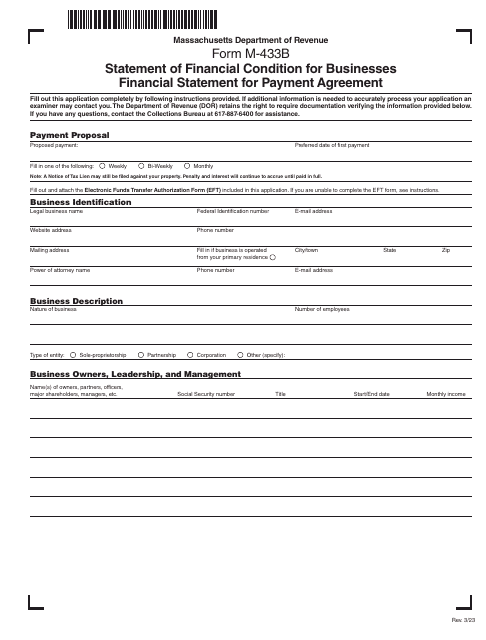

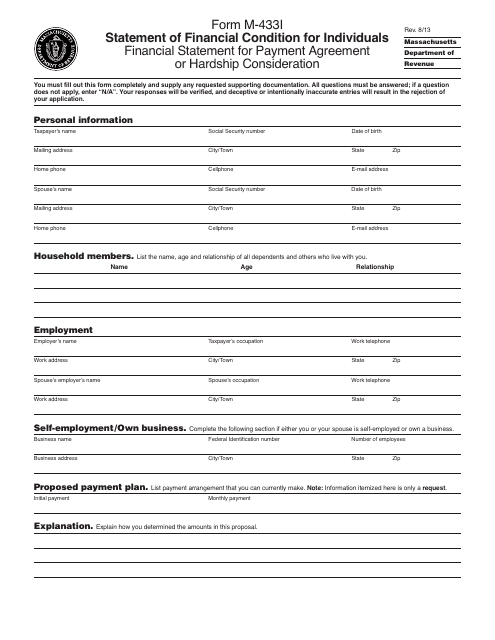

This form is used for individuals in Massachusetts to provide a statement of their financial condition. It includes information about income, expenses, assets, and liabilities. This document is important for assessing an individual's financial situation, especially in cases involving bankruptcy or debt repayment.

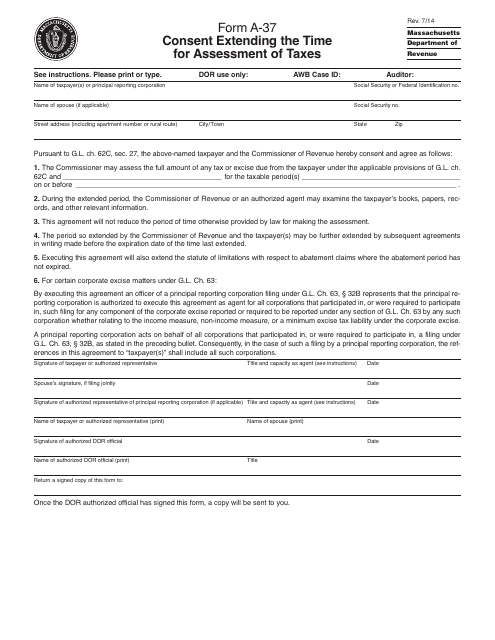

This form is used for requesting an extension of the time for assessment of taxes in Massachusetts.

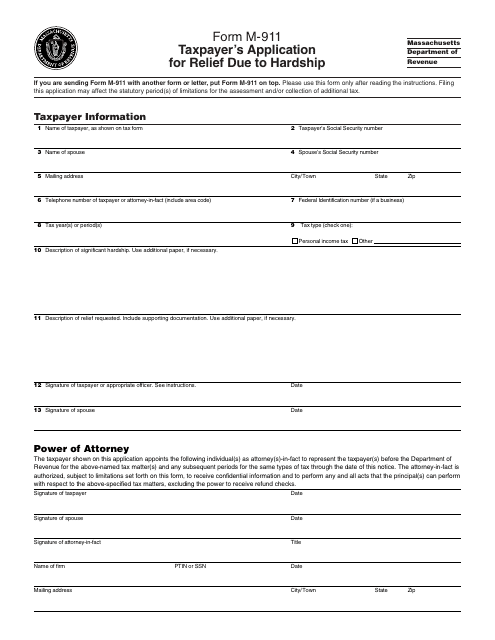

This form is used for Massachusetts taxpayers to apply for relief due to financial hardship.