Tax Templates

Documents:

2882

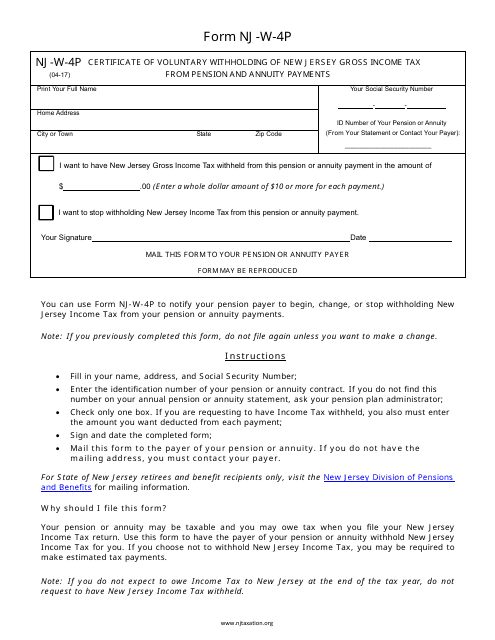

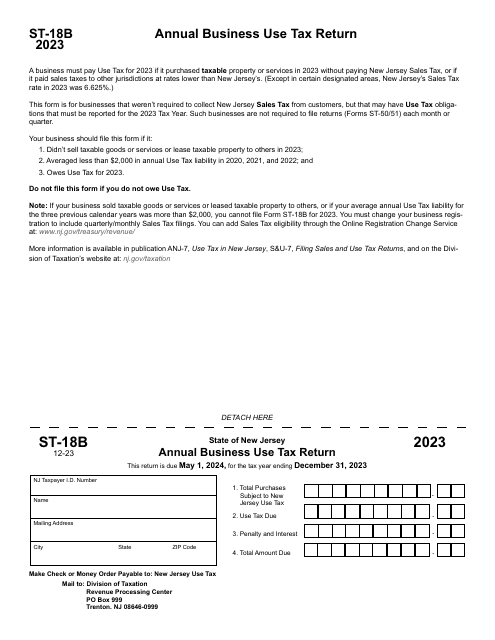

This Form is used for voluntary withholding of New Jersey Gross Income Tax from pension and annuity payments in the state of New Jersey. It allows individuals to request the withholding of a certain amount from their pension or annuity payments to cover their state income tax liability.

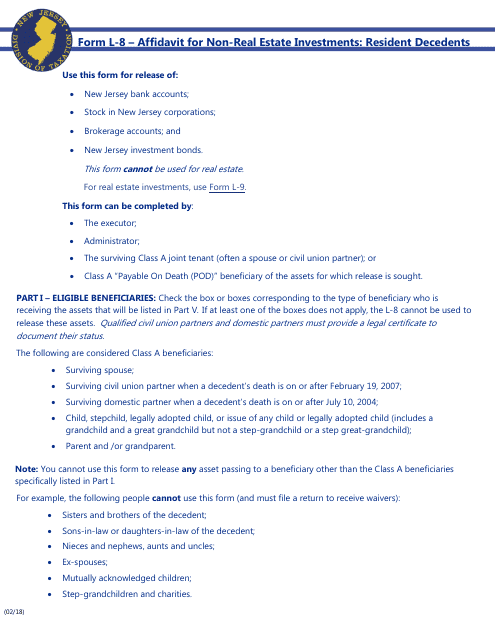

This form is used for New Jersey residents to declare their non-real estate investments in the event of a resident's death.

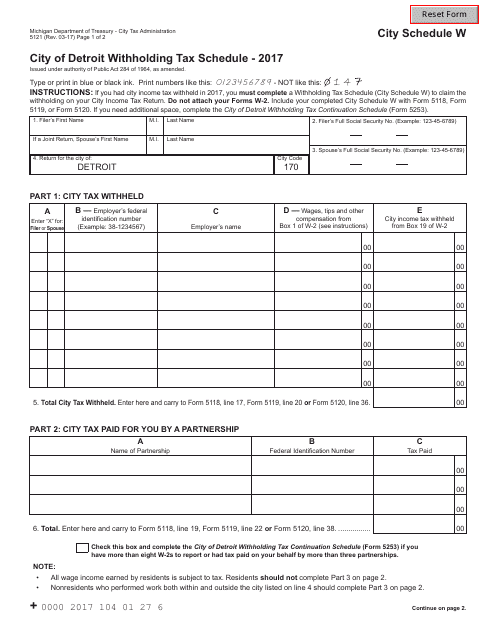

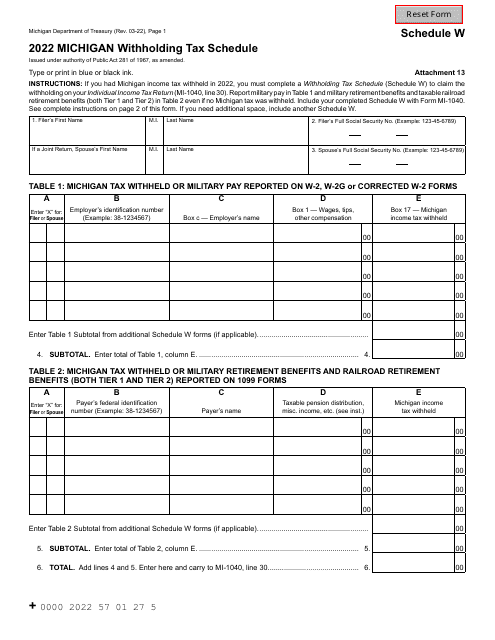

This form is used for reporting and calculating the withholding tax for City of Detroit residents in Michigan.

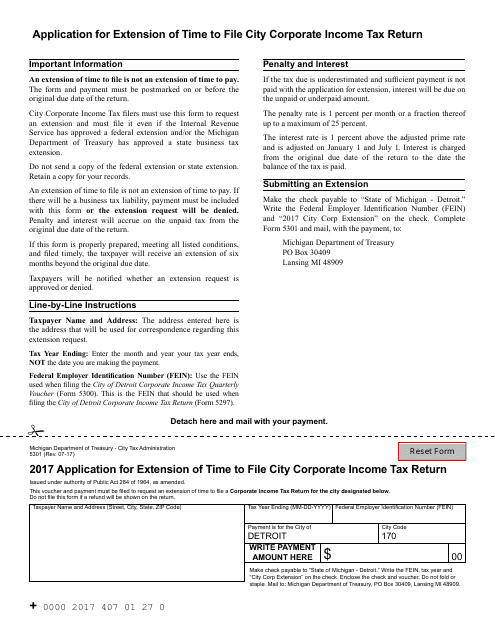

This document is for businesses in the City of Detroit, Michigan who need more time to file their city corporate income tax return.

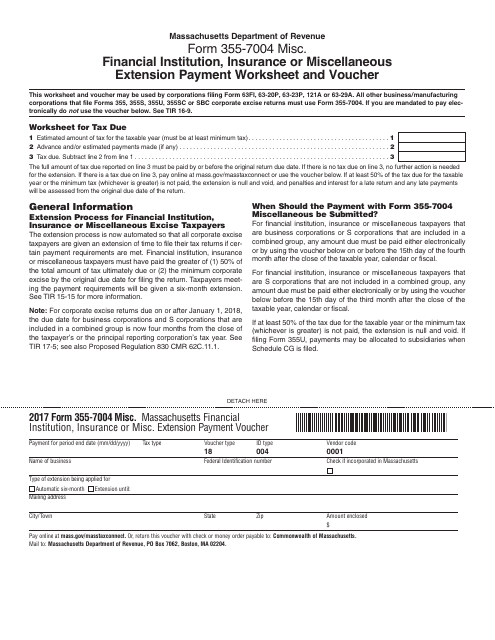

This form is used for making extension payments for financial institutions, insurance companies, or other miscellaneous entities in Massachusetts. It serves as a worksheet and voucher for making the payment.

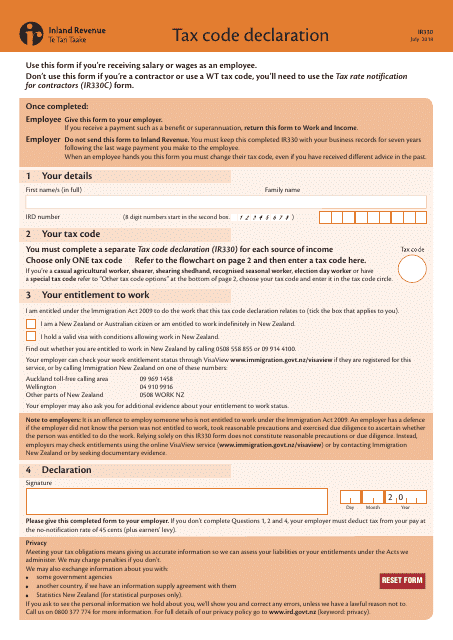

This Form is used for declaring your tax code in New Zealand.

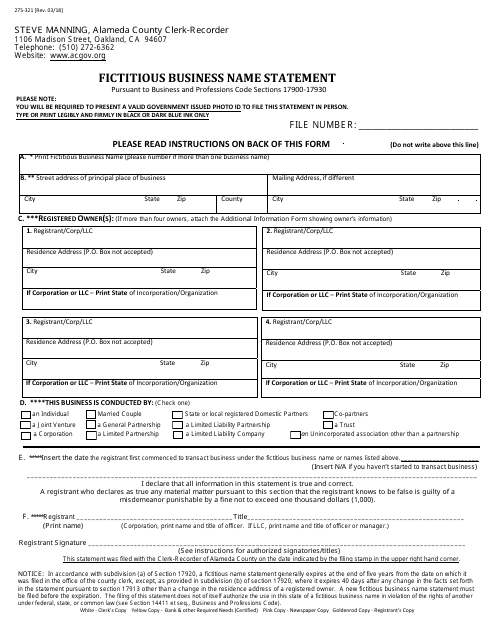

This Form is used for filing a Fictitious Business Name Statement in Alameda County, California.

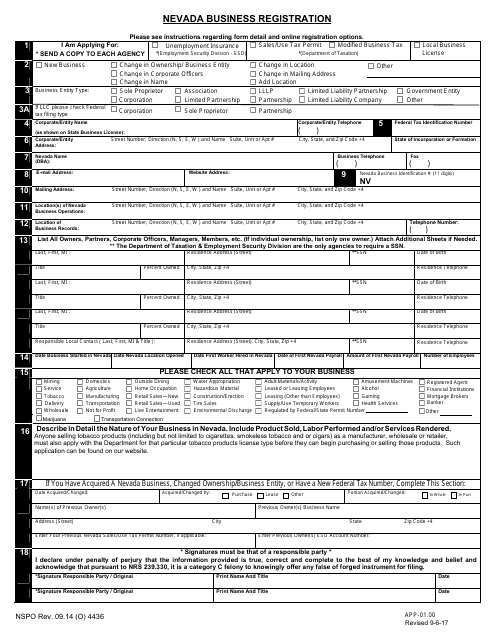

This Form is used for registering a business in Nevada.

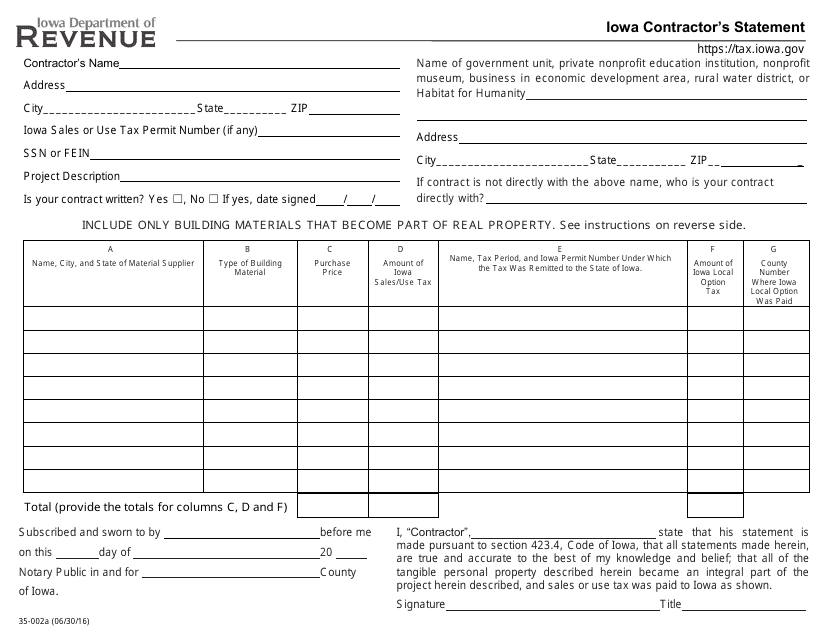

This form is used for Iowa contractors to provide a statement regarding their work.

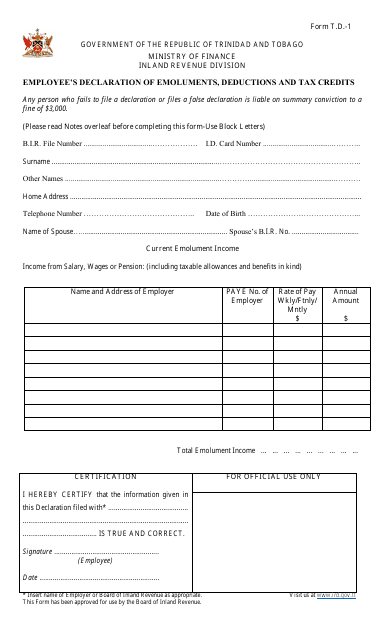

This Form is used for employees in Trinidad and Tobago to declare their income, deductions, and tax credits to the tax authorities.

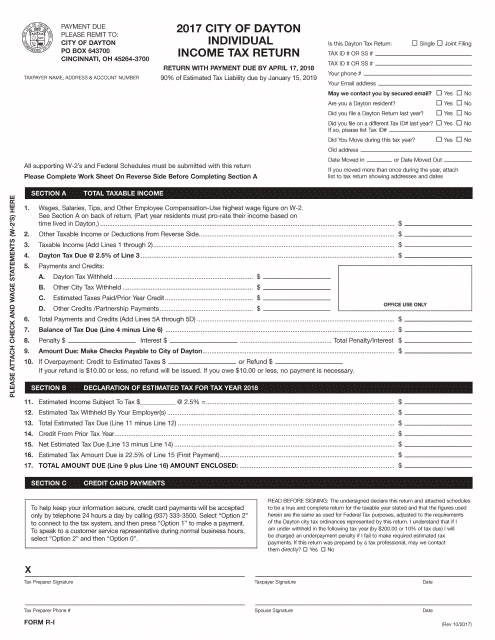

This form is used to report individual income tax return for residents of the City of Dayton, Ohio.

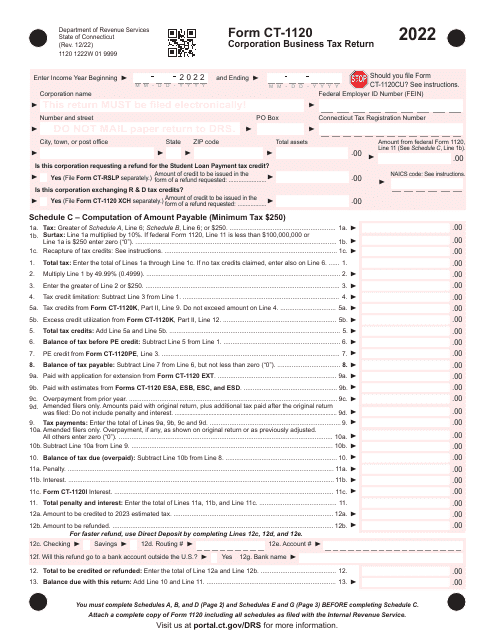

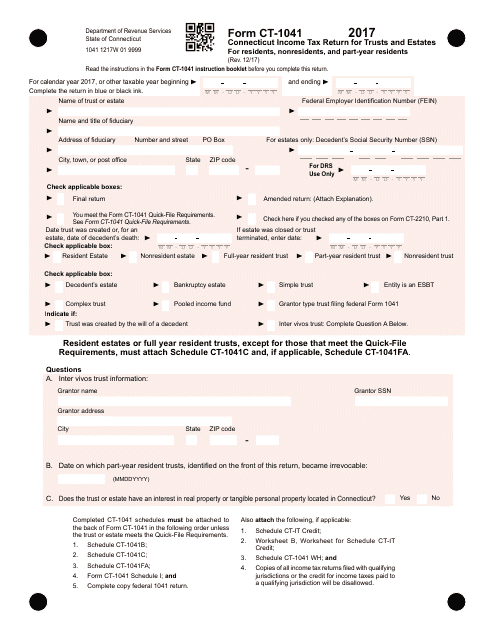

This Form is used for filing Connecticut state income tax return for trusts and estates. It is applicable for residents, nonresidents, and part-year residents in Connecticut.

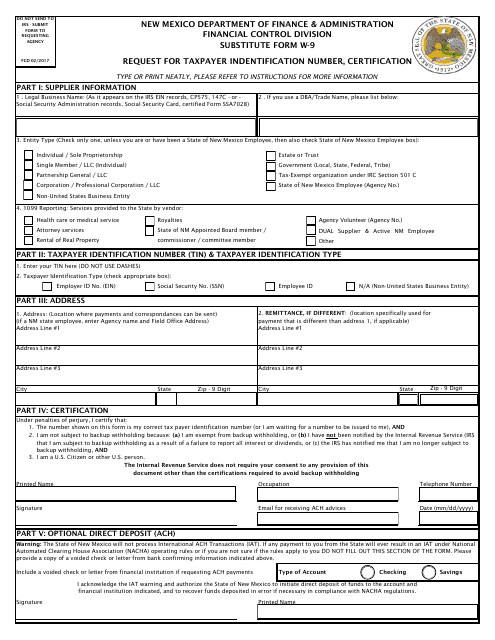

This form is used for requesting taxpayer identification number and certification for individuals or businesses in New Mexico.

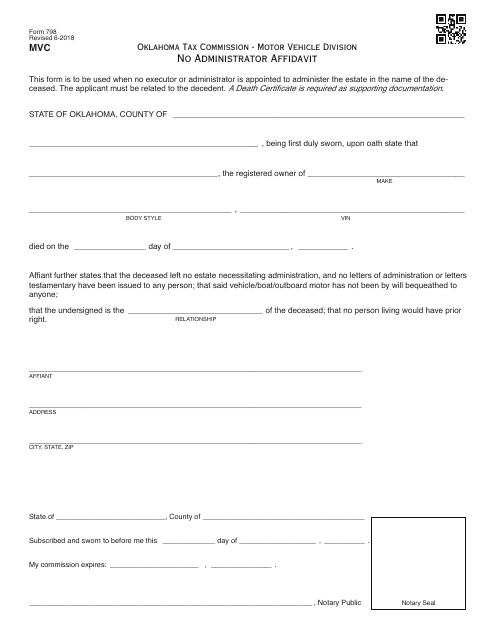

This document is used for filing an affidavit in Oklahoma when there is no administrator for a certain matter.

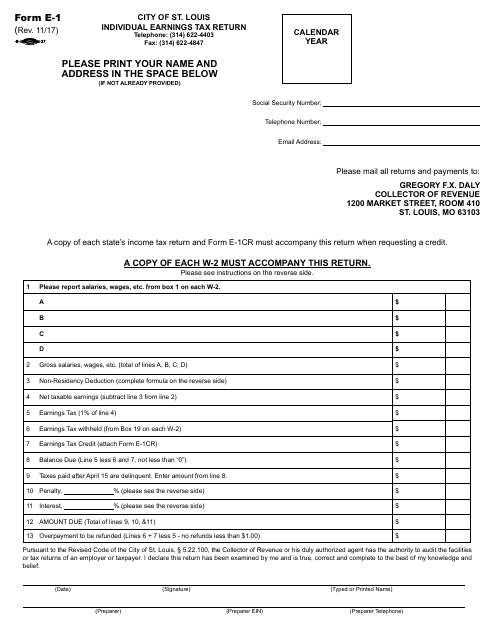

This document is for individuals in the City of St. Louis, Missouri, to file their earnings tax return.

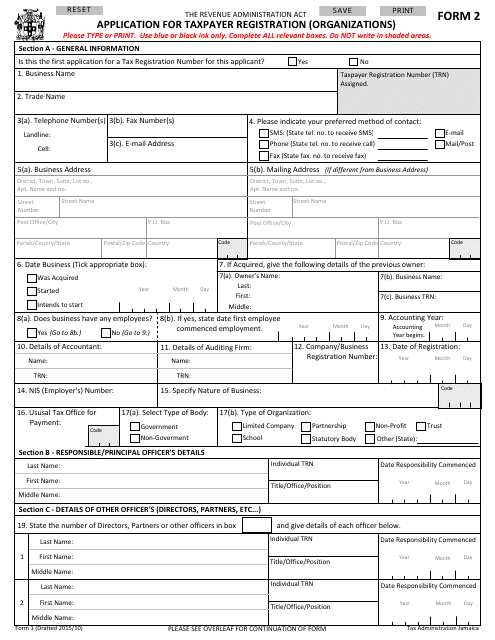

This document is used for organizations in Jamaica to apply for taxpayer registration.

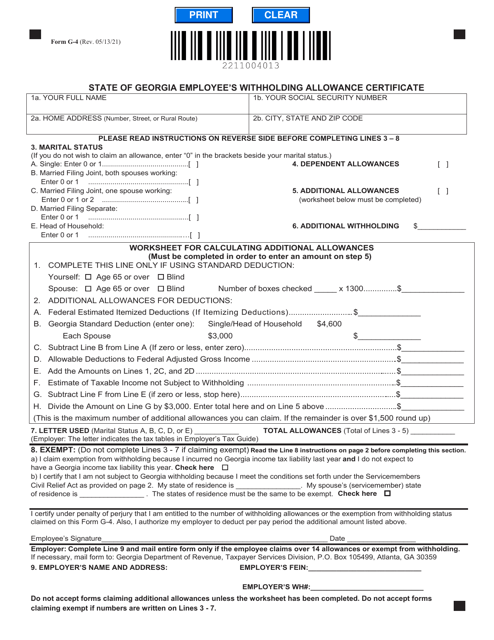

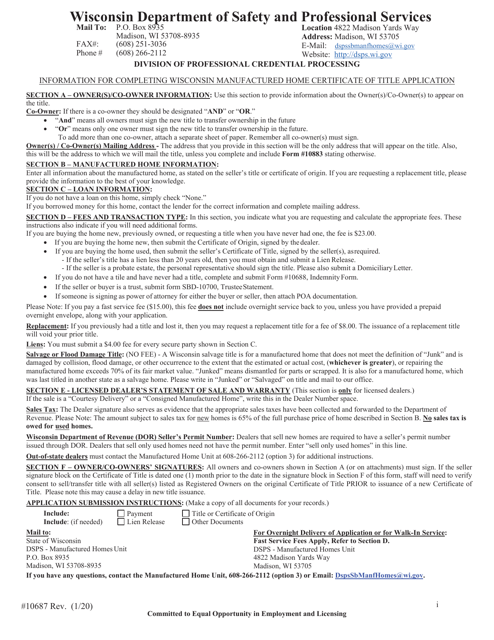

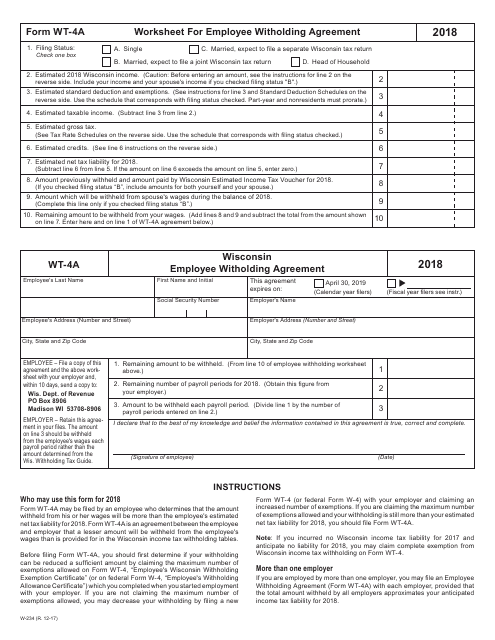

This Form is used for calculating employee withholding agreement in Wisconsin.