Motor Fuel Templates

Are you in the motor fuel industry and in need of official forms and documents related to motor fuel? Look no further! Our website offers a comprehensive collection of motor fuel forms that are essential for your business operations. Whether you are a transporter, a terminal operator, or need to submit reports on motor fuel delivered, we have the forms you need.

Our motor fuel forms are easy to fill out and free to access. You can conveniently download and print the forms you require directly from our website. We understand the importance of accuracy and compliance when it comes to motor fuel reporting, which is why our forms are designed to guide you through the process and ensure that you meet all regulatory requirements.

In addition to providing a wide range of motor fuel forms, we also offer instructions for completing the forms specific to each state. These instructions will help you navigate the reporting process and ensure that you provide all the necessary information. Whether you need instructions for the Report of Motor Fuel Delivered in Illinois or the Tax on Motor Fuels in New York, we have you covered.

Our motor fuel forms and instructions are trusted by businesses across the country. With our easy-to-use interface, you can quickly find the forms you need and complete them with ease. Save time and avoid the hassle of searching for official motor fuel forms elsewhere. Visit our website today and access our collection of motor fuel forms and instructions.

Don't miss out on our valuable resource for the motor fuel industry. Get the motor fuel forms you need in a few simple clicks. Explore our website now and take advantage of our comprehensive collection of motor fuel forms and instructions.

Documents:

220

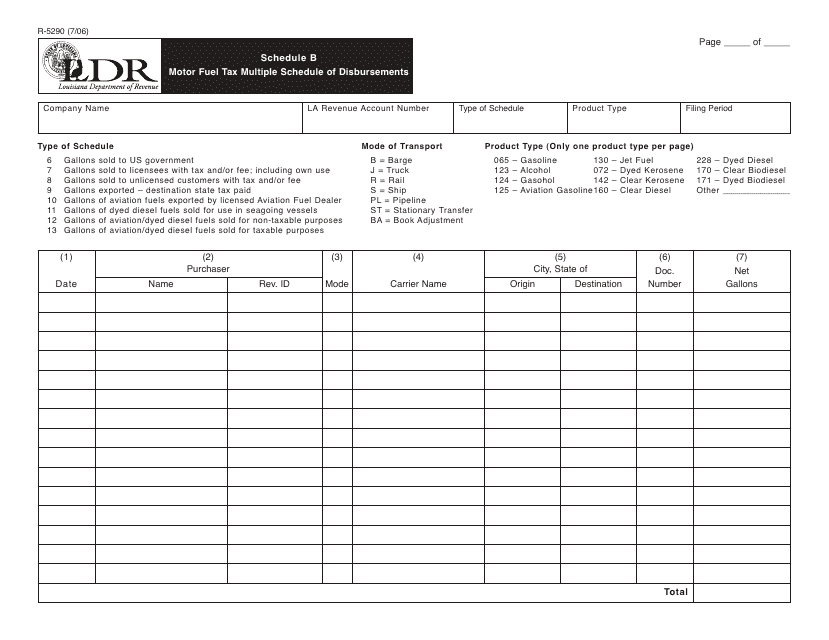

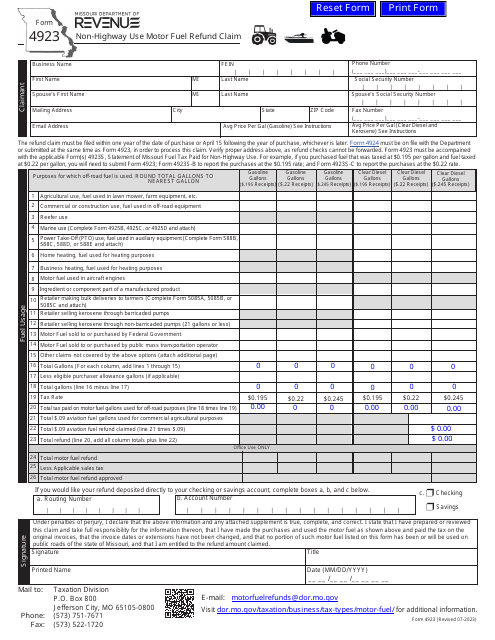

This form is used for reporting multiple schedules of disbursements for motor fuel tax in the state of Louisiana.

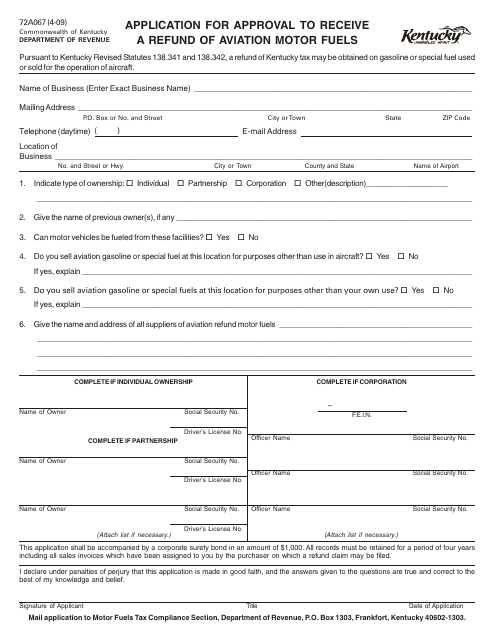

This form is used for applying to receive a refund of aviation motor fuels in the state of Kentucky.

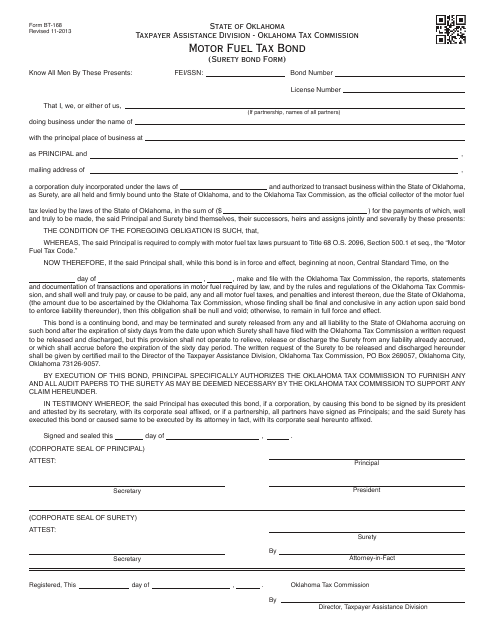

This Form is used for obtaining a Motor Fuel Tax Bond (Surety Bond) in Oklahoma for businesses that sell motor fuel over-the-counter. This bond ensures that the business complies with state laws and regulations regarding motor fuel taxes.

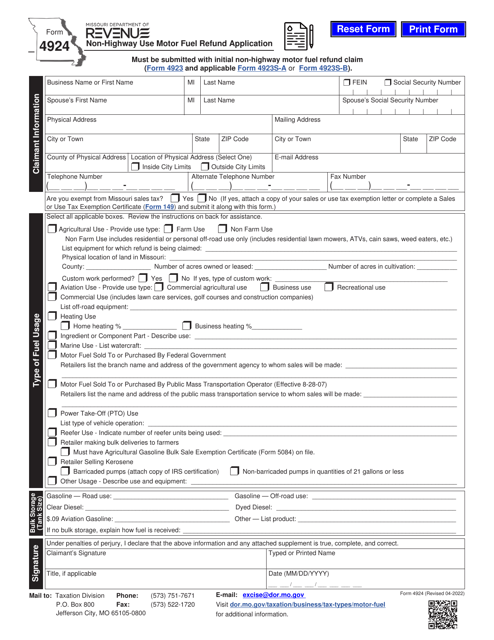

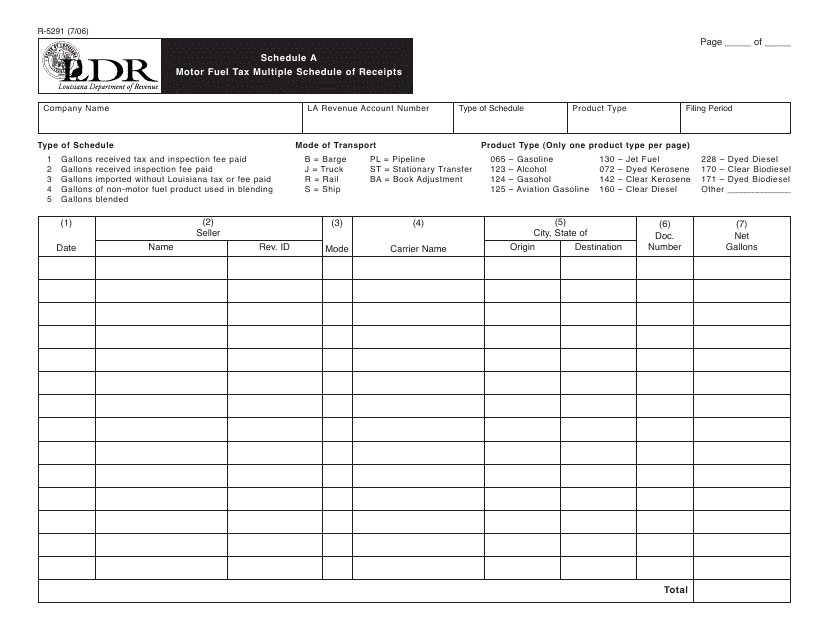

This form is used for reporting multiple motor fuel tax receipts in Louisiana.

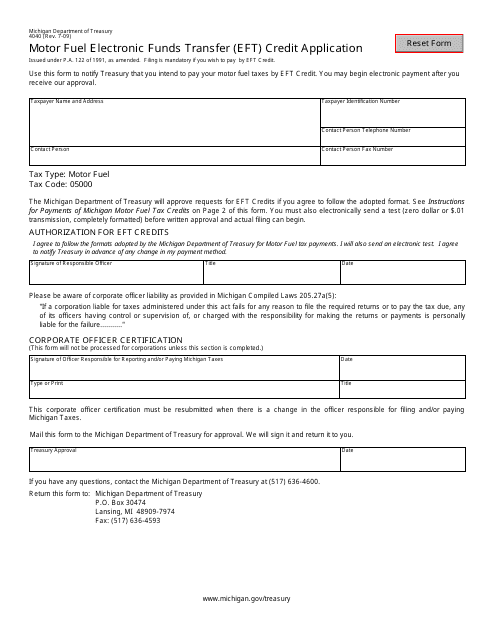

This Form is used for applying for electronic funds transfer (EFT) credit for motor fuel in the state of Michigan.

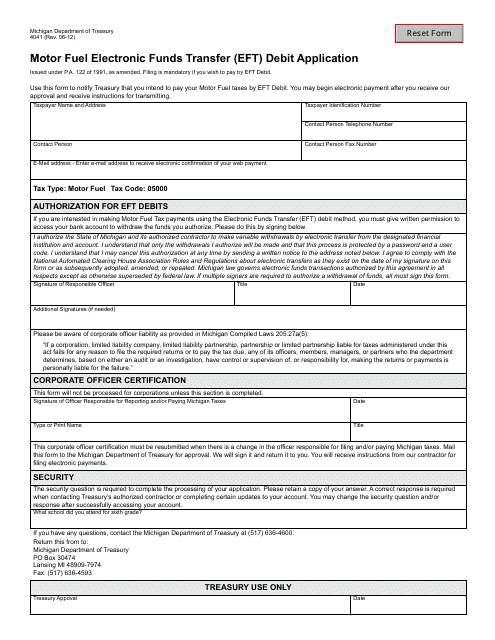

This form is used for applying for electronic funds transfer (EFT) debit for motor fuel payments in the state of Michigan.

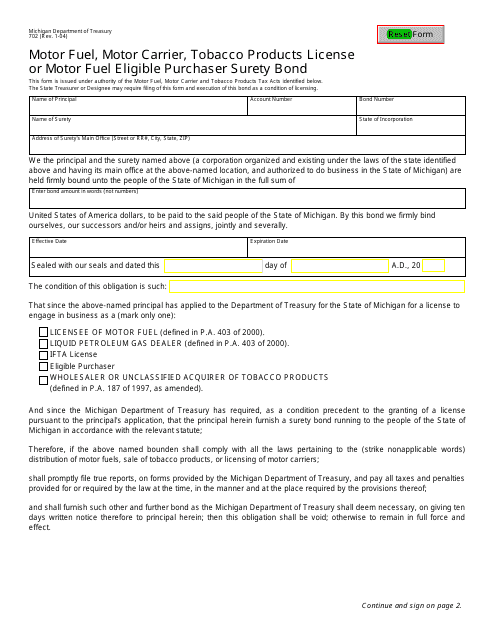

This Form is used for applying for a Motor Fuel, Motor Carrier, Tobacco Products License or Motor Fuel Eligible Purchaser Surety Bond in the state of Michigan.

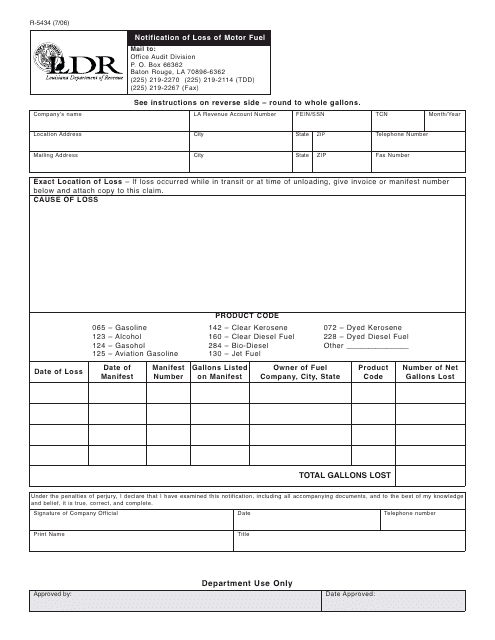

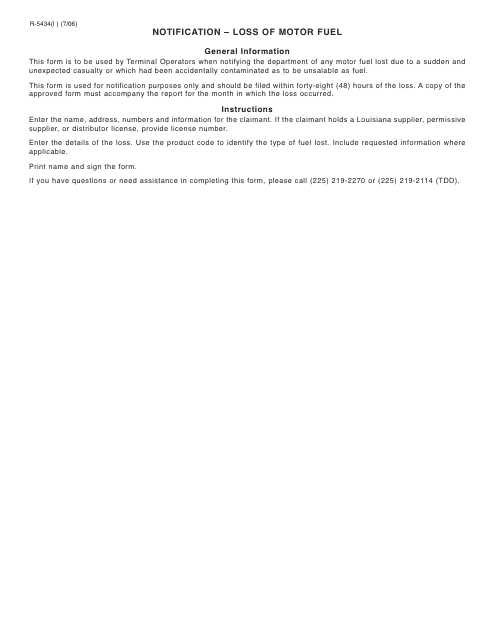

This Form is used for notifying the state of Louisiana about the loss of motor fuel.

This Form is used for notifying the state of Louisiana about the loss of motor fuel.

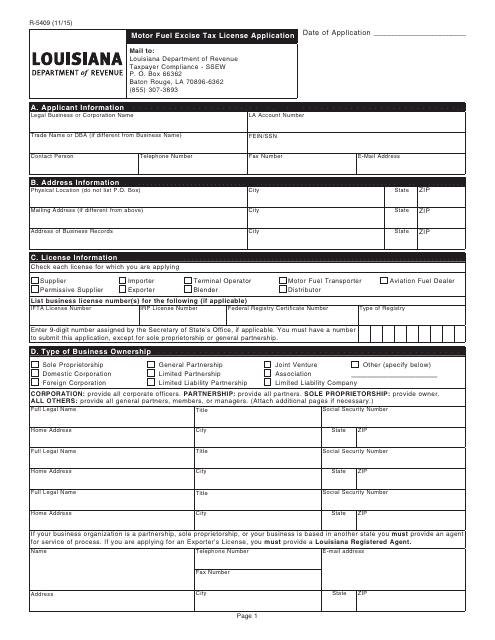

This Form is used for applying for a motor fuel excise tax license in the state of Louisiana.

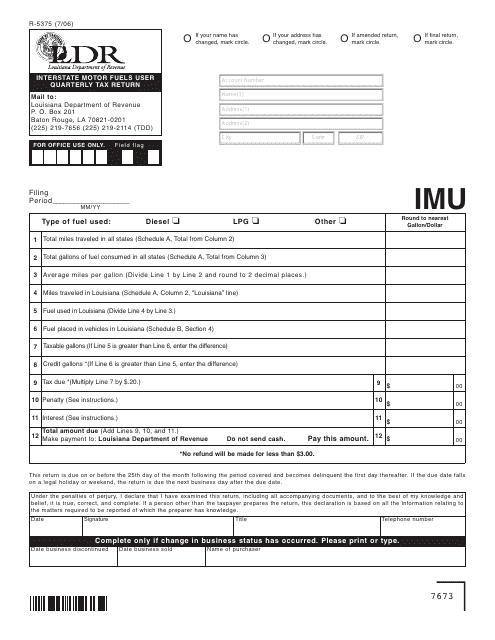

This document is used for filing the quarterly tax return for users of interstate motor fuels in Louisiana.

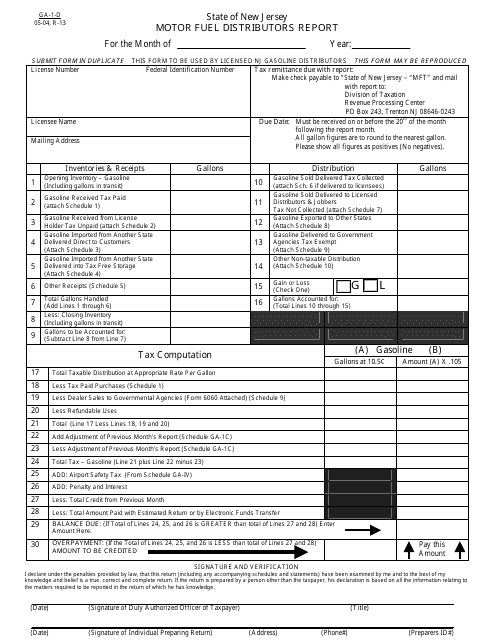

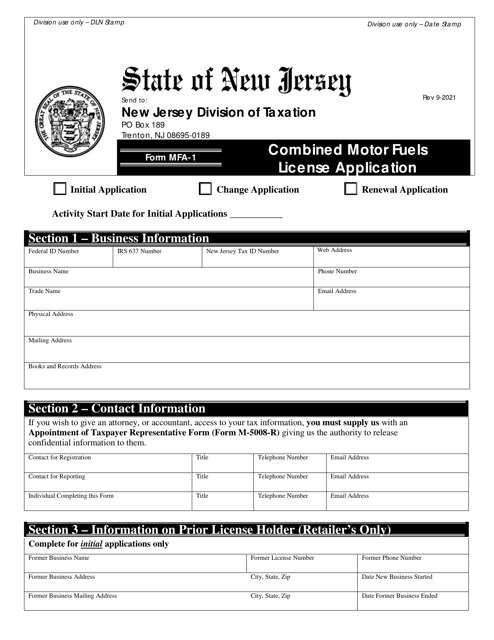

This Form is used for motor fuel distributors in New Jersey to report their activities.

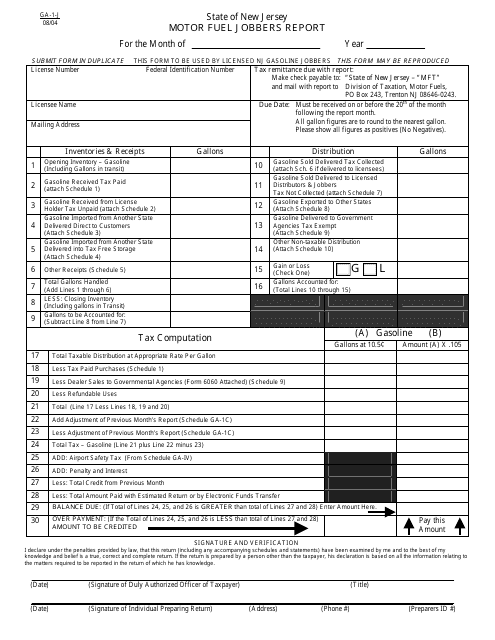

This form is used for motor fuel jobbers in New Jersey to report their activity related to fuel sales and distribution.

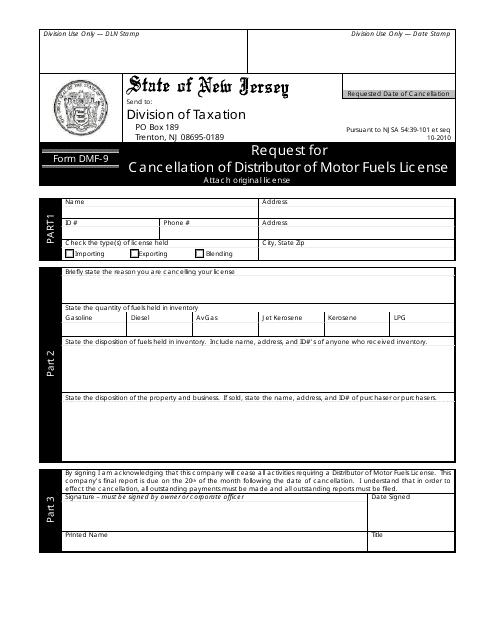

This form is used for requesting the cancellation of a distributor of motor fuels license in New Jersey.

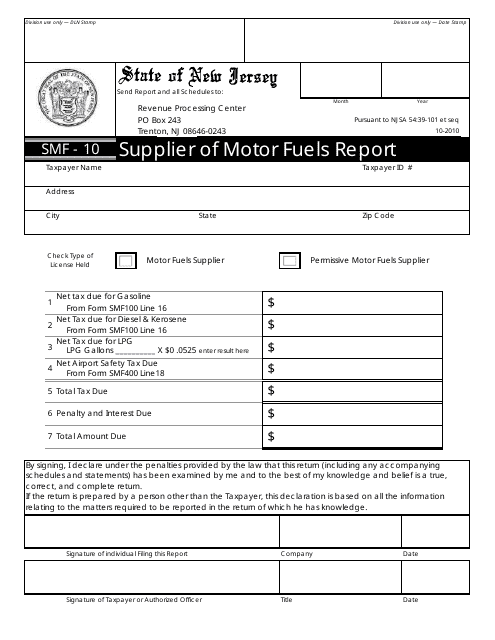

This form is used for suppliers of motor fuels in New Jersey to report their sales and related information.

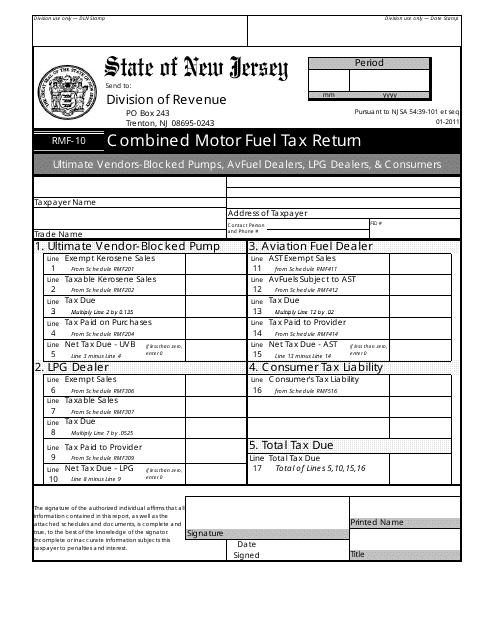

This form is used for filing motor fuel tax returns in the state of New Jersey.

This packet contains the necessary forms and instructions for registering motor fuel in the state of Oklahoma. It is used by individuals or businesses who produce, distribute, or sell motor fuel in Oklahoma.

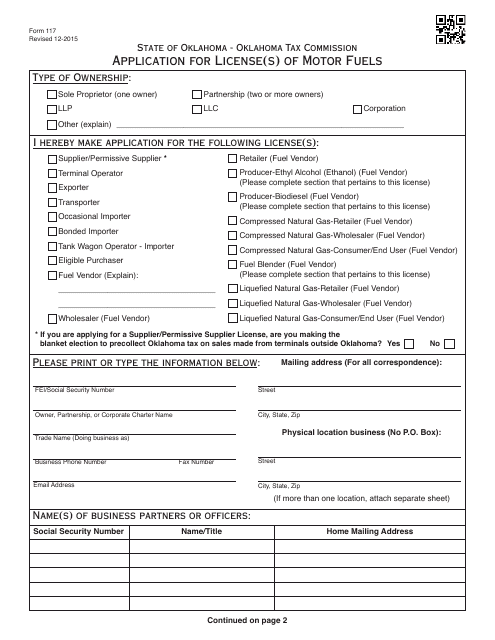

This Form is used for applying for a license(s) to sell motor fuels in Oklahoma.

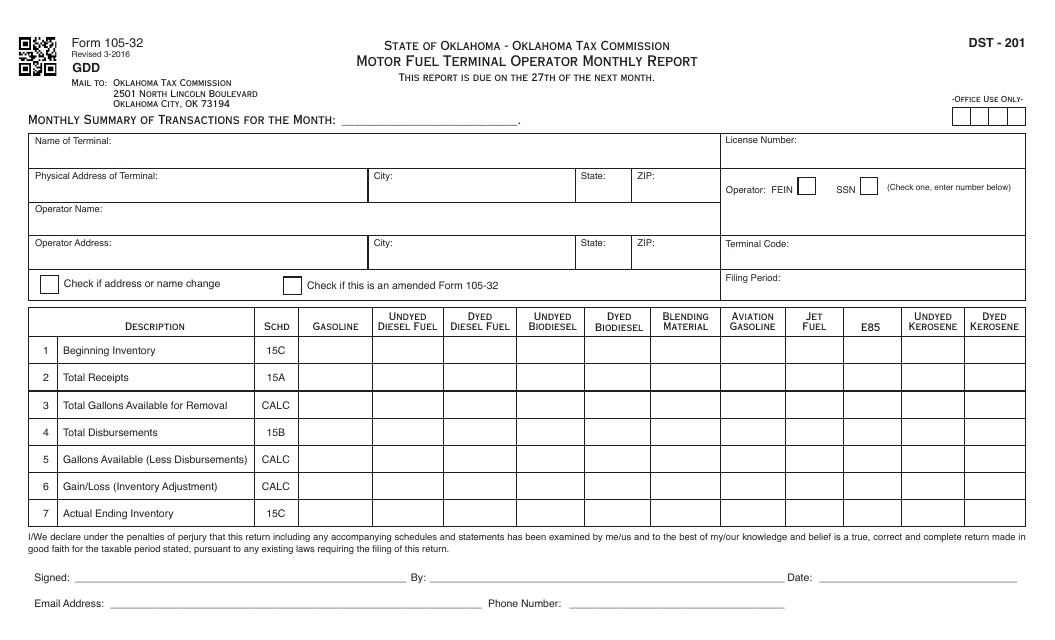

This form is used for motor fuel terminal operators in Oklahoma to report their monthly activities.

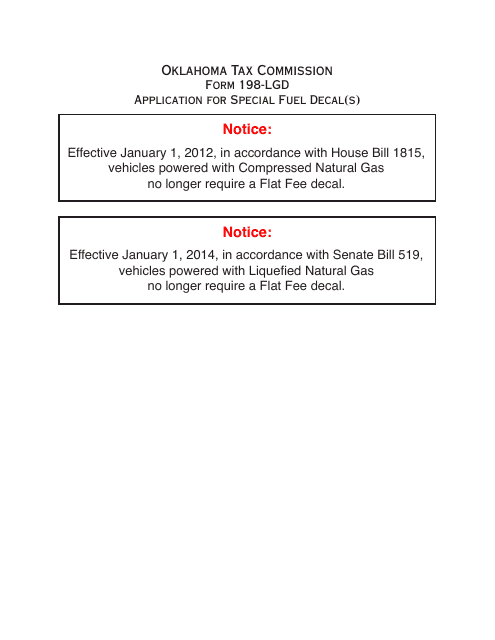

This document is used for applying for special fuel decals in Oklahoma.

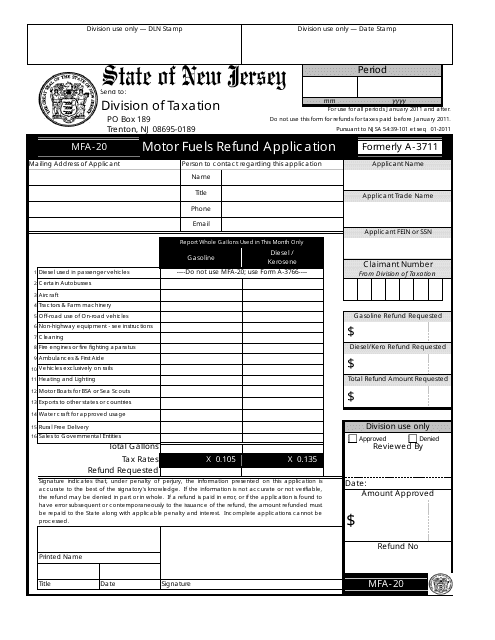

This form is used for applying for a motor fuels refund in the state of New Jersey.

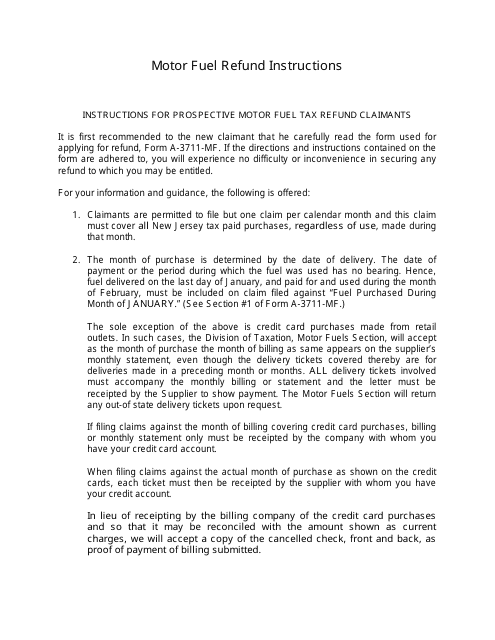

This document provides instructions for obtaining a refund on motor fuel taxes paid in the state of New Jersey. It outlines the process and requirements for eligible individuals or businesses to apply for a refund.

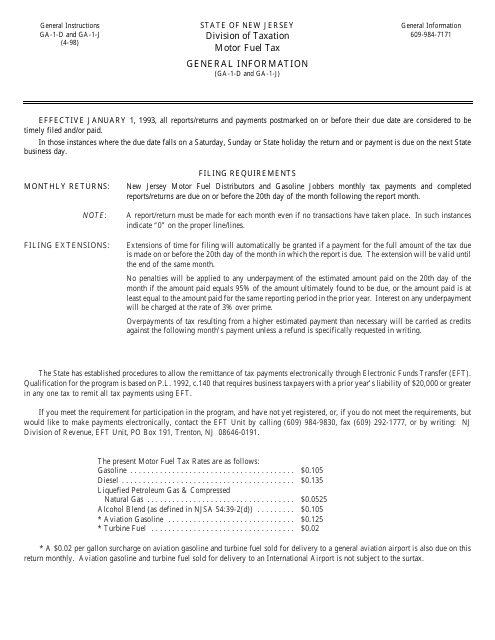

This type of document provides instructions for filling out the Form GA-1-D, GA-1-J Motor Fuel Distributors Report, and Motor Fuel Jobbers Report in New Jersey. It guides motor fuel distributors and jobbers on how to accurately report their information.

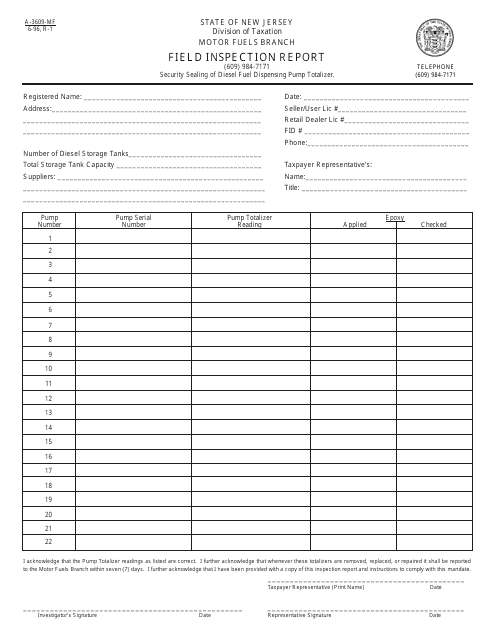

This form is used for conducting field inspections of motor fuel in New Jersey. It helps to ensure compliance with fuel regulations and maintain quality standards.

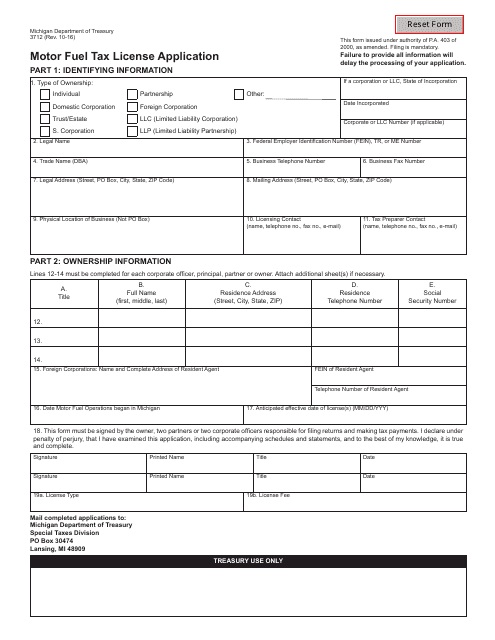

This form is used for applying for a Motor Fuel Tax License in the state of Michigan.

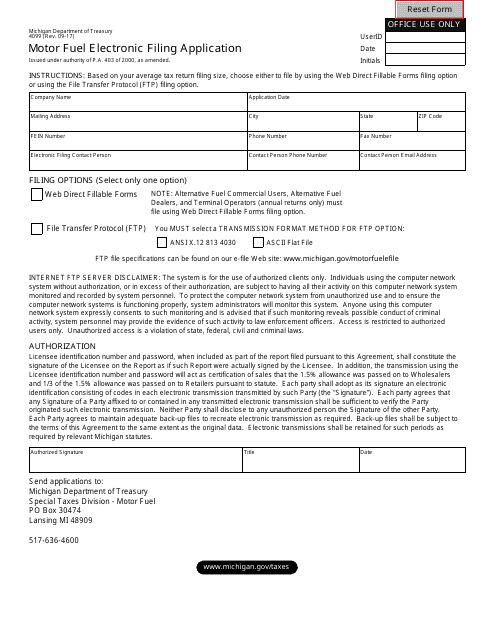

This form is used for electronically filing motor fuel applications in the state of Michigan.

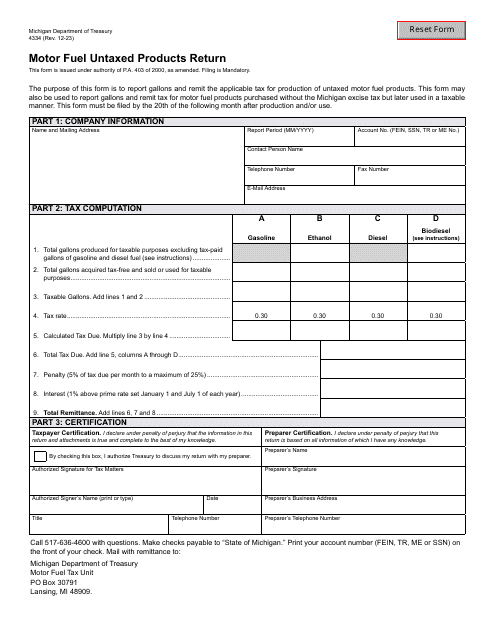

This form is used for monthly tax calculation by occasional importers of motor fuel in Oklahoma.

This document is used for monthly tax calculation for motor fuel tankwagon importers in Oklahoma

This document is used for monthly tax calculation for motor fuel bonded importers in Oklahoma.

This Form is used for monthly tax calculation for motor fuel suppliers and permissive suppliers in Oklahoma.

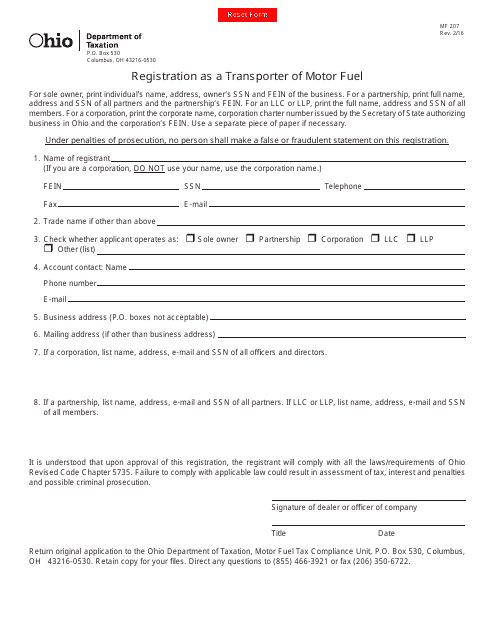

This form is used for registering as a transporter of motor fuel in Ohio.

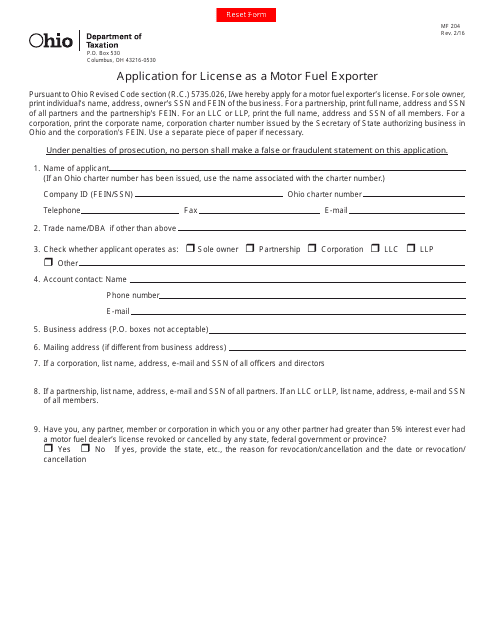

This form is used for applying for a license as a Motor Fuel Exporter in the state of Ohio.

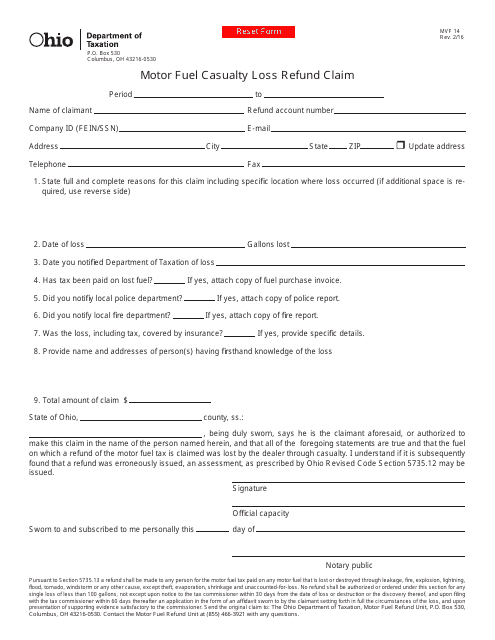

This form is used for claiming a refund for motor fuel lost due to accidents or spills in Ohio.

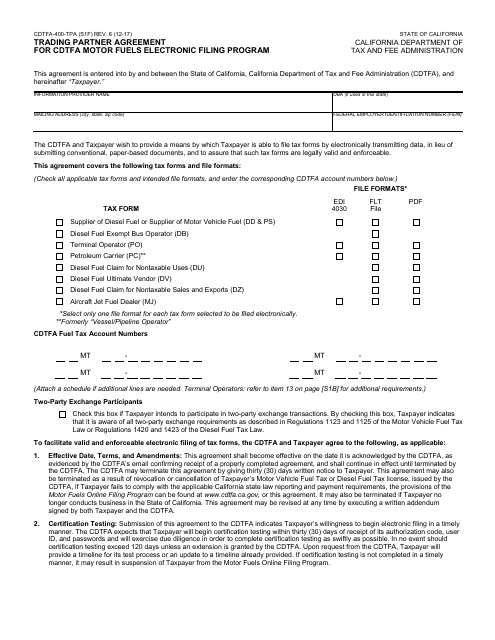

This form is used for creating a Trading Partner Agreement for the CDTFA Motor Fuels Electronic Filing Program in California.