Motor Fuel Templates

Documents:

220

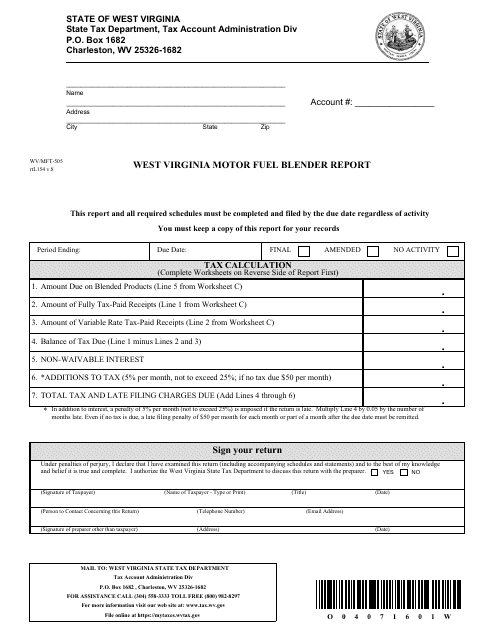

This form is used for reporting motor fuel blending activities in West Virginia. It is required for businesses that blend motor fuels in the state.

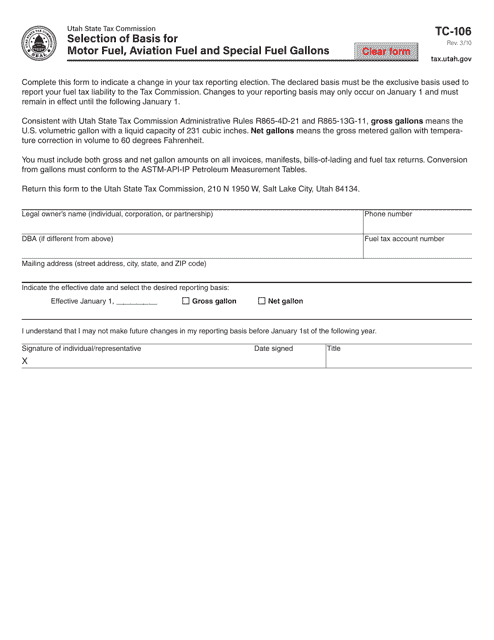

This form is used for selecting the reporting basis for motor fuel, aviation fuel, and special fuel gallons in Utah.

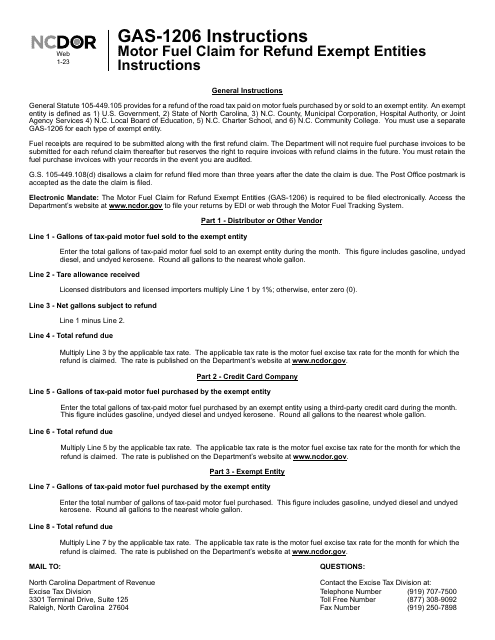

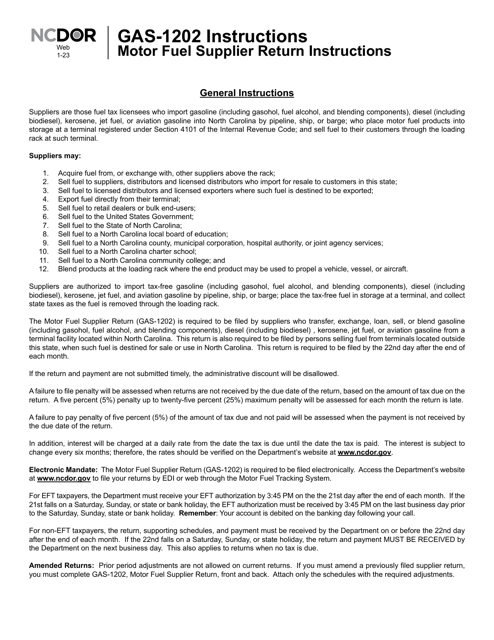

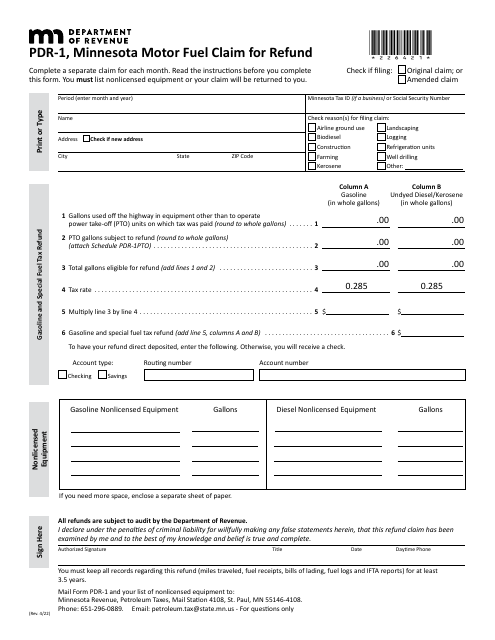

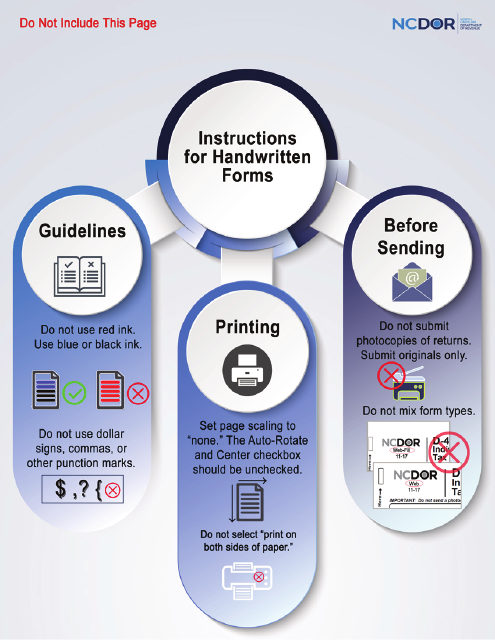

This form is used for claiming a refund for motor fuel taxes paid in North Carolina when the fuel is used off-highway.