Motor Fuel Templates

Documents:

220

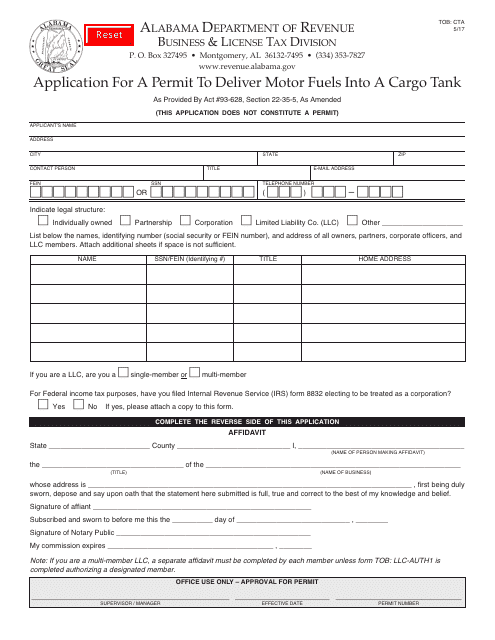

This form is used for applying for a permit to deliver motor fuels into a cargo tank in the state of Alabama.

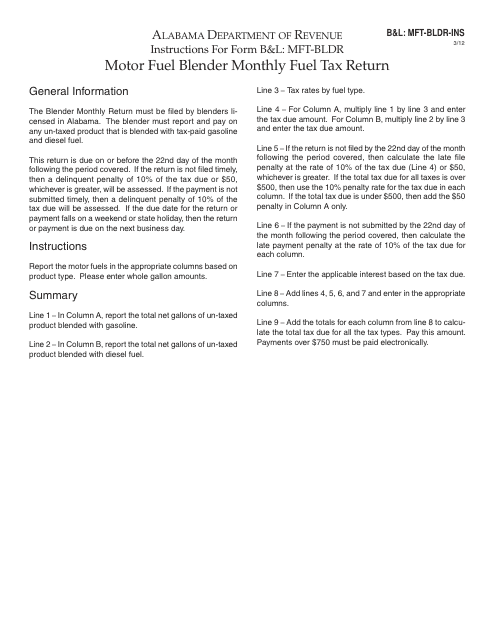

This form is used for submitting the Motor Fuel Blender Monthly Fuel Tax Return in Alabama.

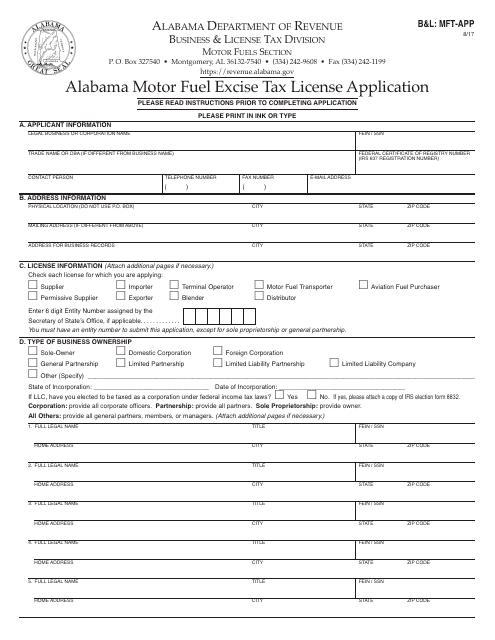

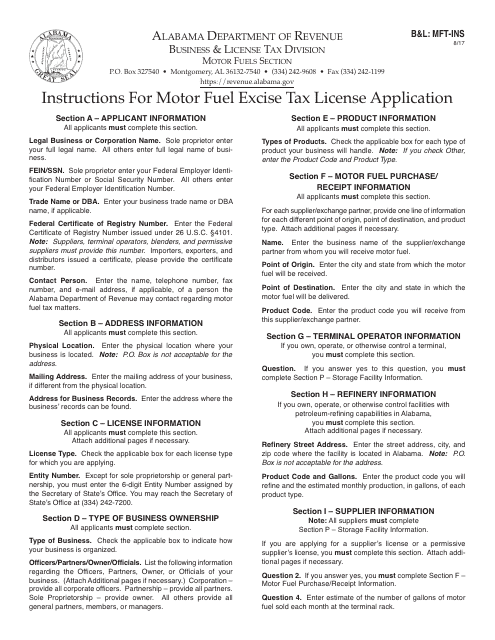

This Form is used for applying for an Alabama Motor Fuel Excise Tax License. It is required for businesses in Alabama that sell or distribute motor fuel.

This Form is used for applying for a Motor Fuel Excise Tax License in Alabama. It is also referred to as Form B&L: MFT-INS or B&L:MFT-APP. Follow the instructions provided to complete the application accurately.

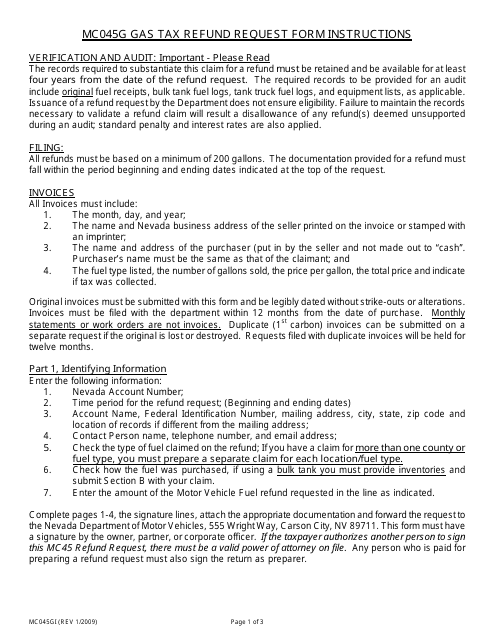

This Form is used for requesting a refund of motor fuel tax in Nevada.

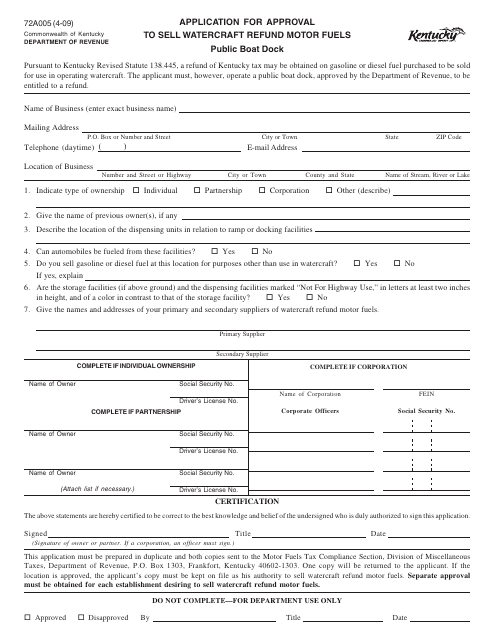

This form is used for applying for approval to sell watercraft refund motor fuels at a public boat dock in Kentucky.

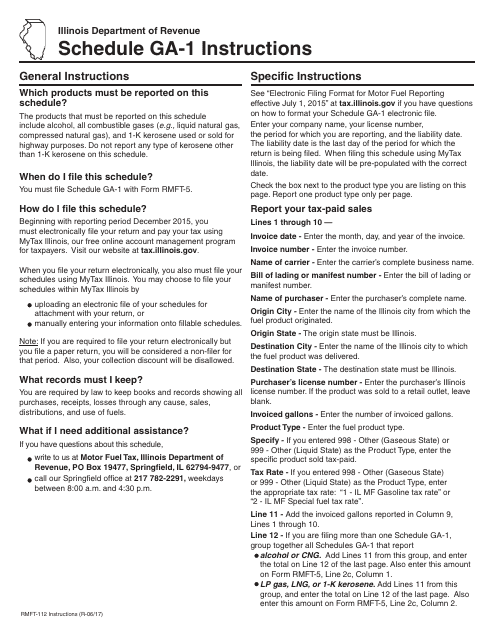

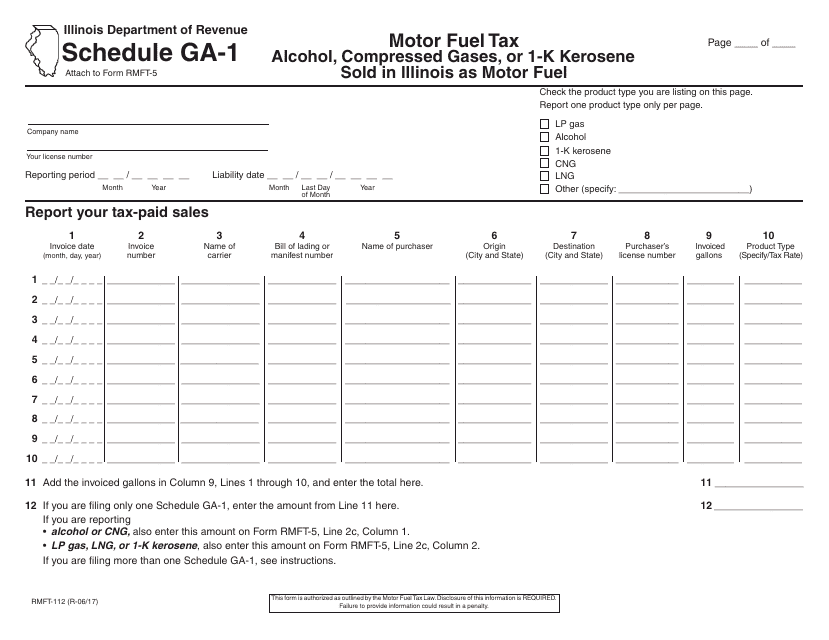

This form is used for reporting the sale of alcohol, compressed gases, or 1-k kerosene as motor fuel in Illinois.

This form is used for reporting the sale of alcohol, compressed gases, or 1-k Kerosene in Illinois as motor fuel.

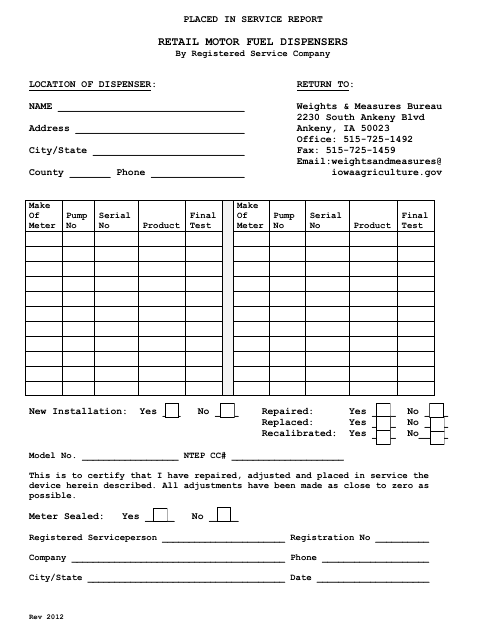

This Form is used for reporting the installation of retail motor fuel dispensers by registered service companies in Iowa.

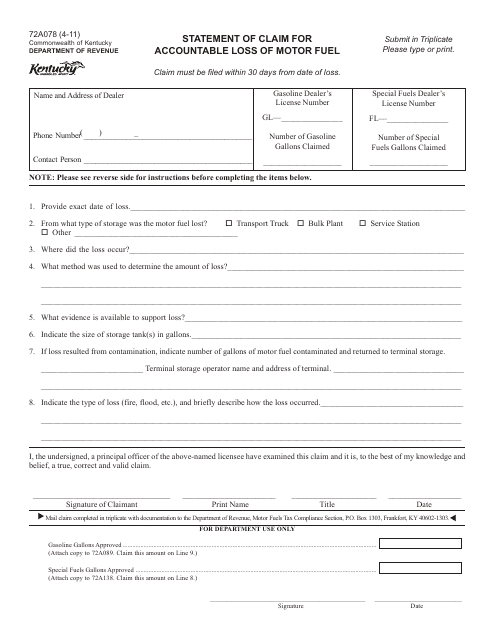

This Form is used for filing a statement of claim for accountable loss of motor fuel in the state of Kentucky.

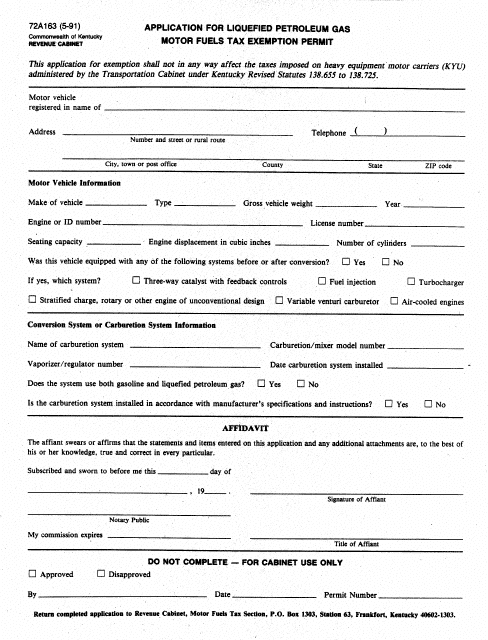

This form is used for applying for an exemption permit for the motor fuels tax on liquefied petroleum gas in the state of Kentucky.

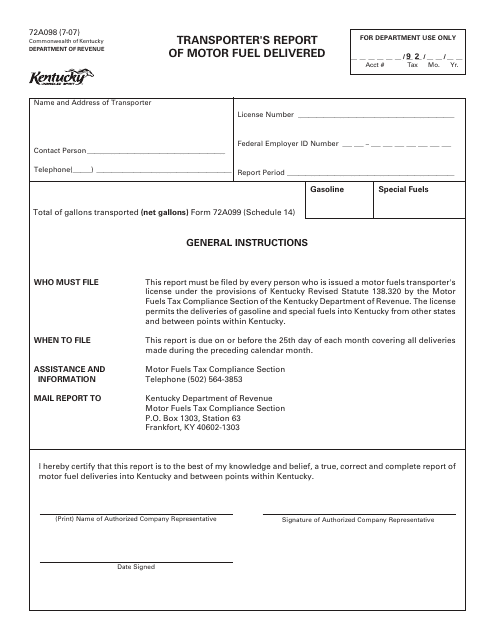

This Form is used for reporting the delivery of motor fuel by transporters in the state of Kentucky.

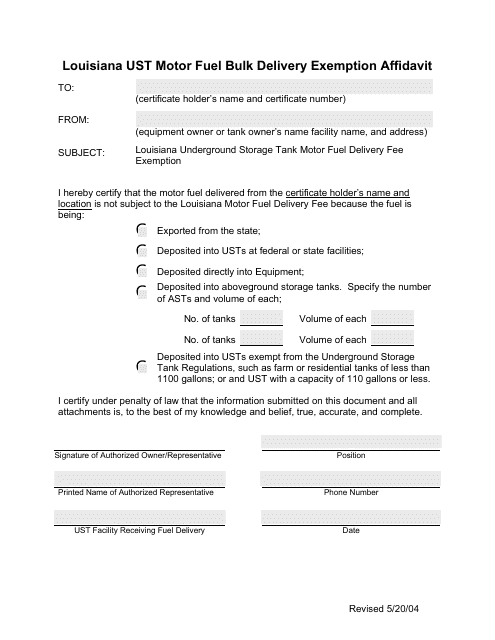

This document is used for claiming an exemption from Louisiana state motor fuel taxes for bulk fuel deliveries.

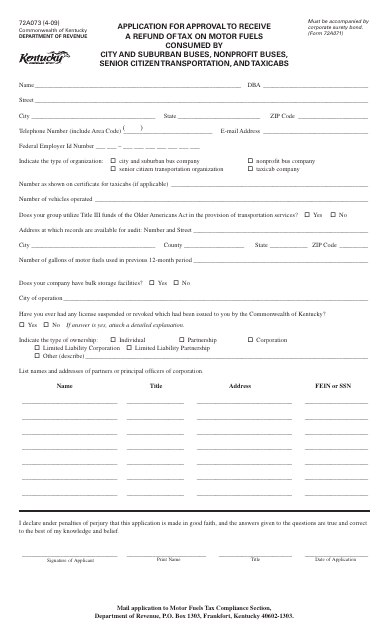

This Form is used for applying to receive a refund of tax on motor fuels consumed by city and suburban buses, nonprofit buses, senior citizen transportation, and taxicabs in Kentucky.

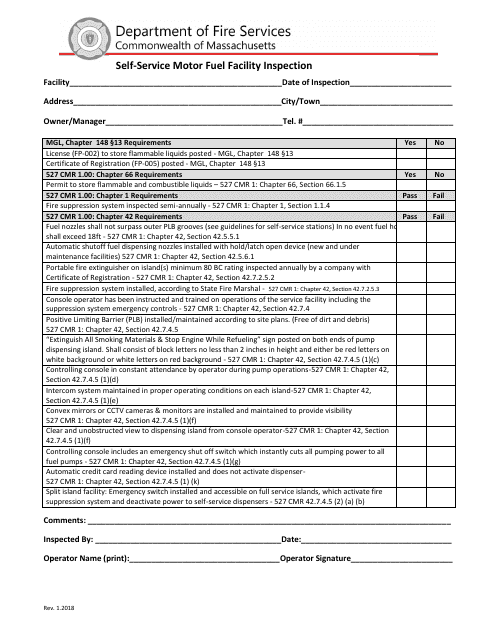

This Form is used for conducting inspections at self-service motor fuel facilities in the state of Massachusetts. It helps ensure compliance with regulations and guidelines related to safety and quality standards.

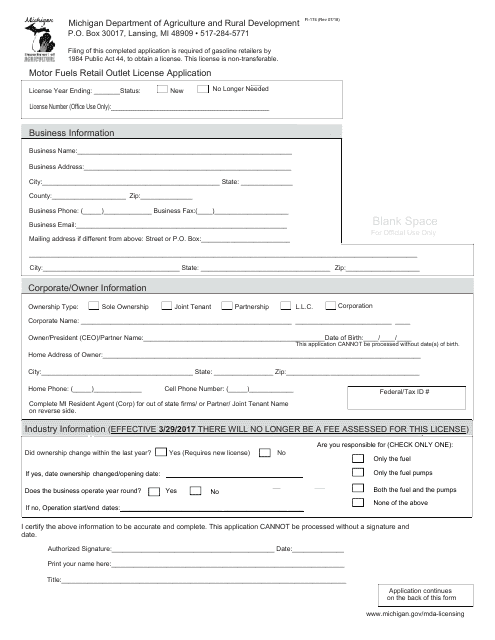

This document is used for applying for a motor fuels retail outlet license in Michigan.

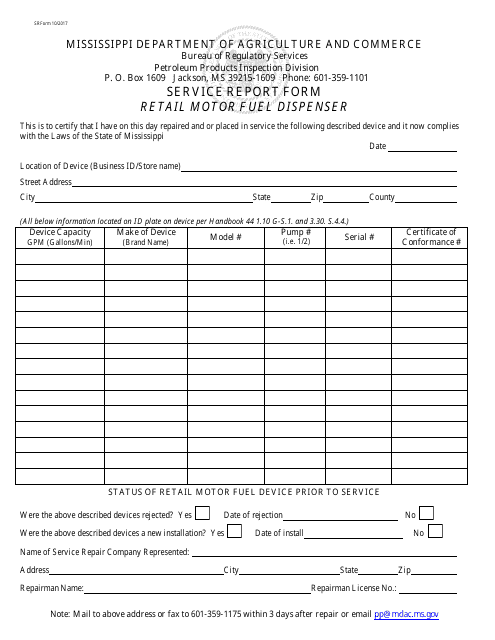

This document is used for reporting service-related issues or maintenance performed on retail motor fuel dispensers in the state of Mississippi.

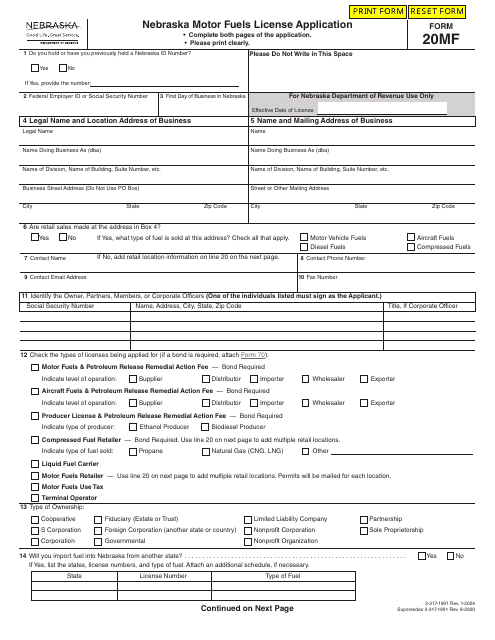

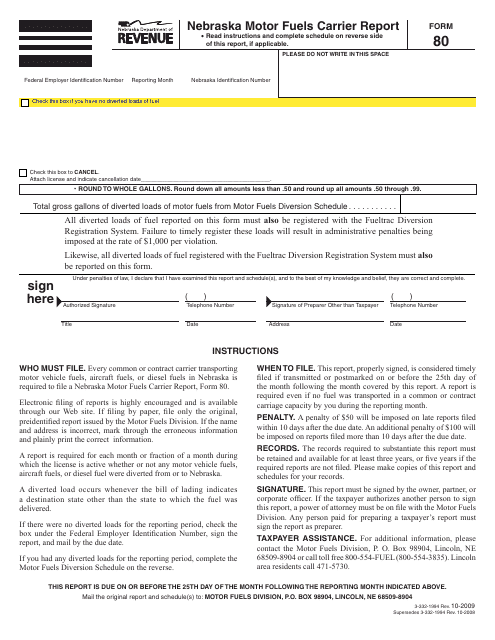

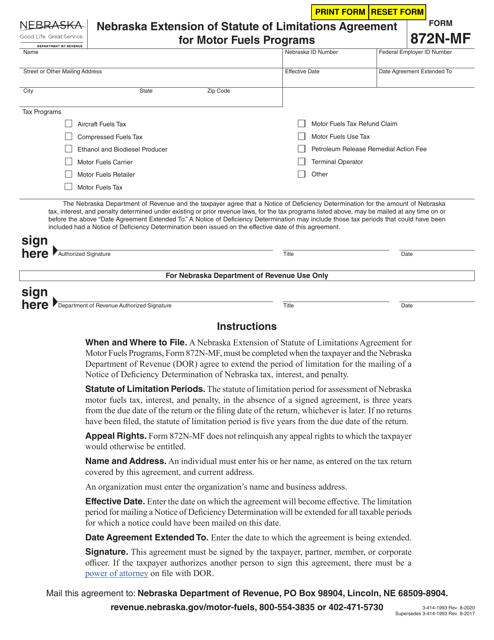

This Form is used for Nebraska motor fuels carriers to report their activities. It is required by the state to track fuel usage and compliance with regulations.

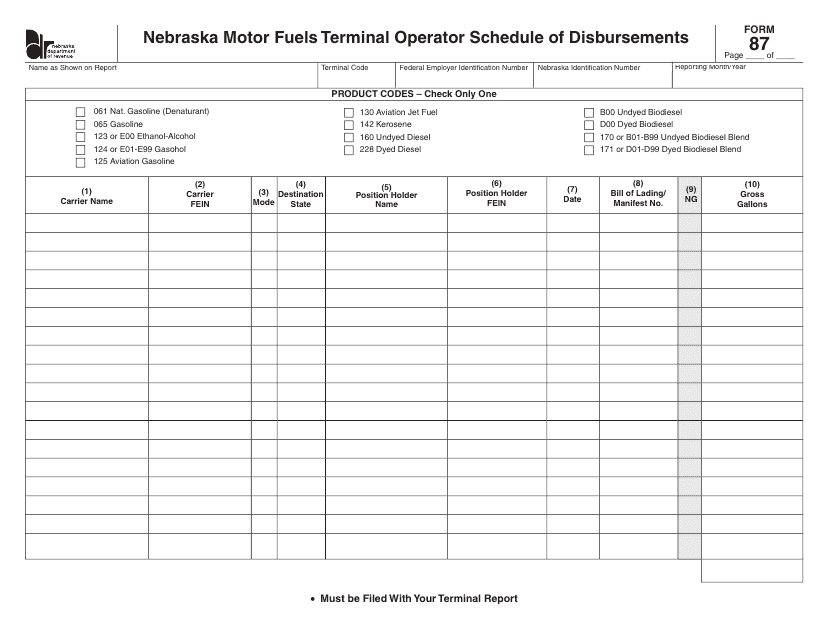

This form is used for reporting the schedule of disbursements by Nebraska motor fuels terminal operators.

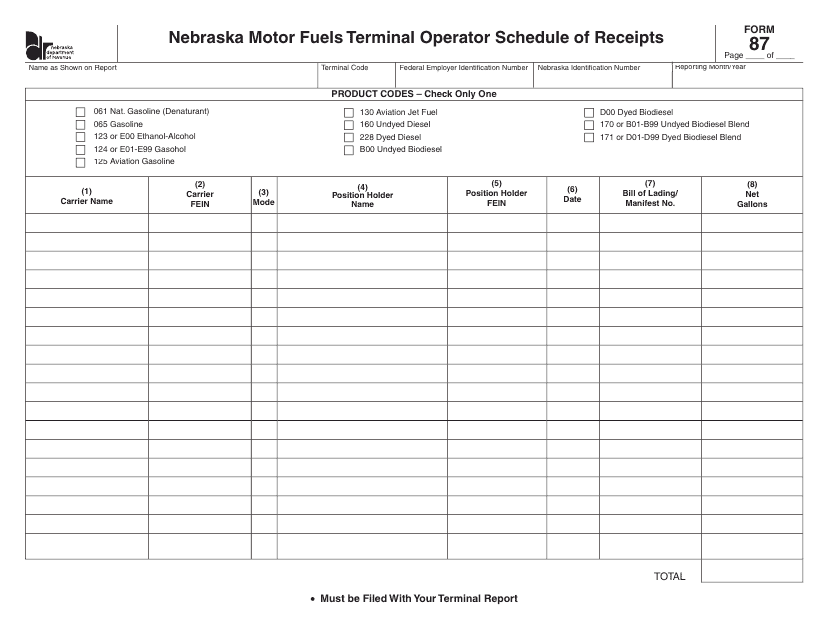

This document is used for reporting the receipts of motor fuels by terminal operators in Nebraska. It is a form that helps track and record the amount of fuel received at terminals.

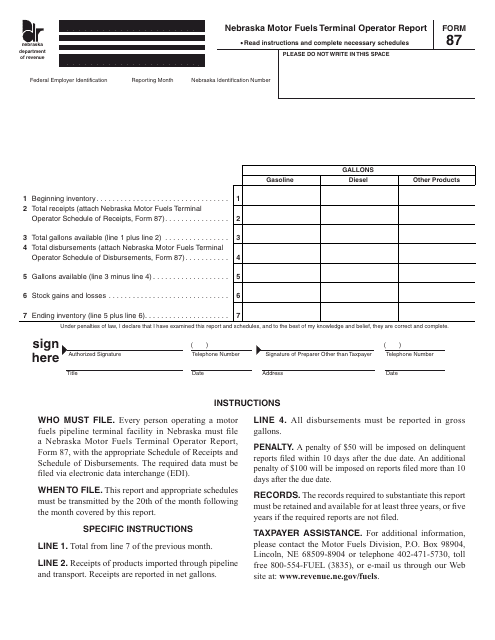

This form is used for reporting motor fuel activities by terminals in Nebraska. It provides important information about fuel inventory, sales, and other data required by the state.

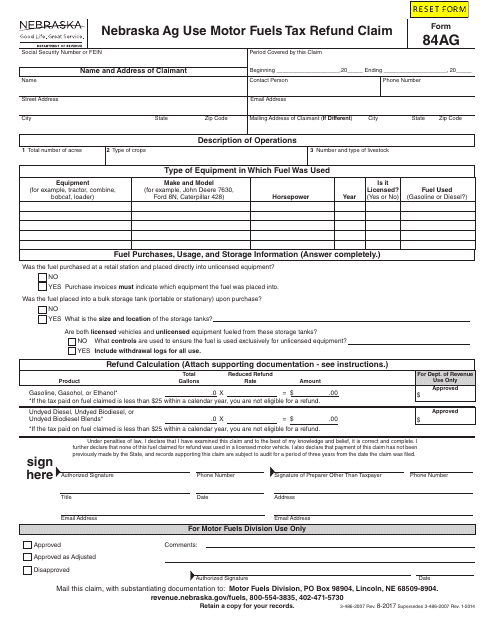

This form is used for claiming a refund of motor fuels tax in Nebraska related to agricultural use.

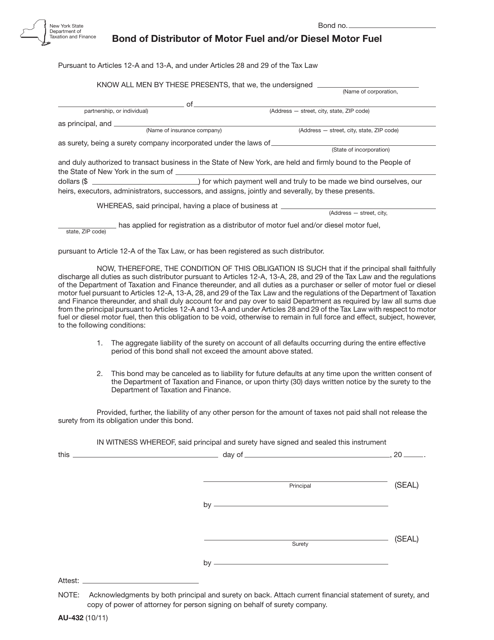

This form is used for distributors of motor fuel and/or diesel motor fuel in New York to submit a bond. It is required by the state to ensure compliance with tax obligations related to fuel distribution.

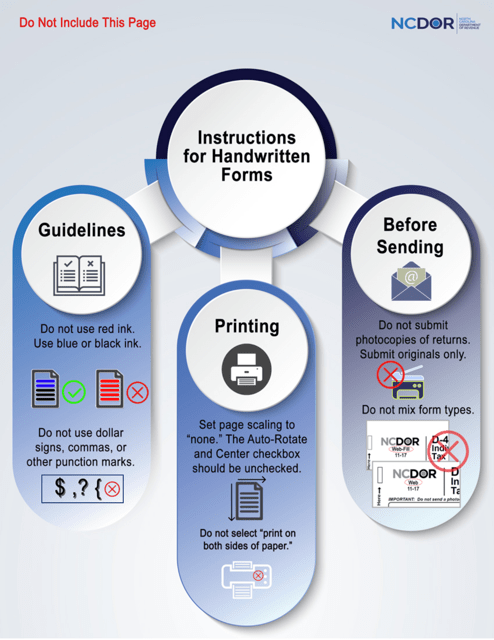

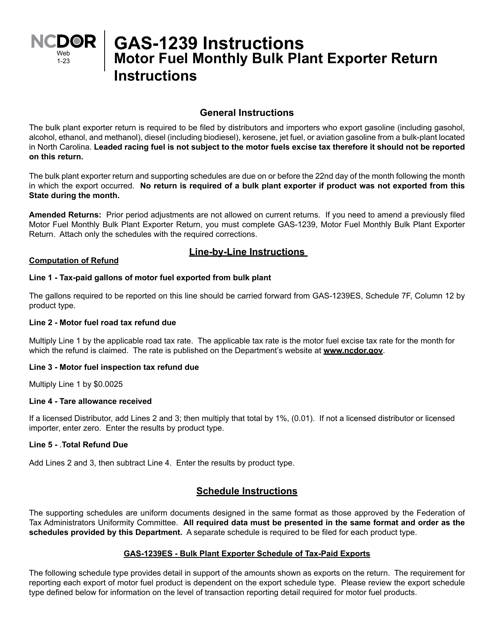

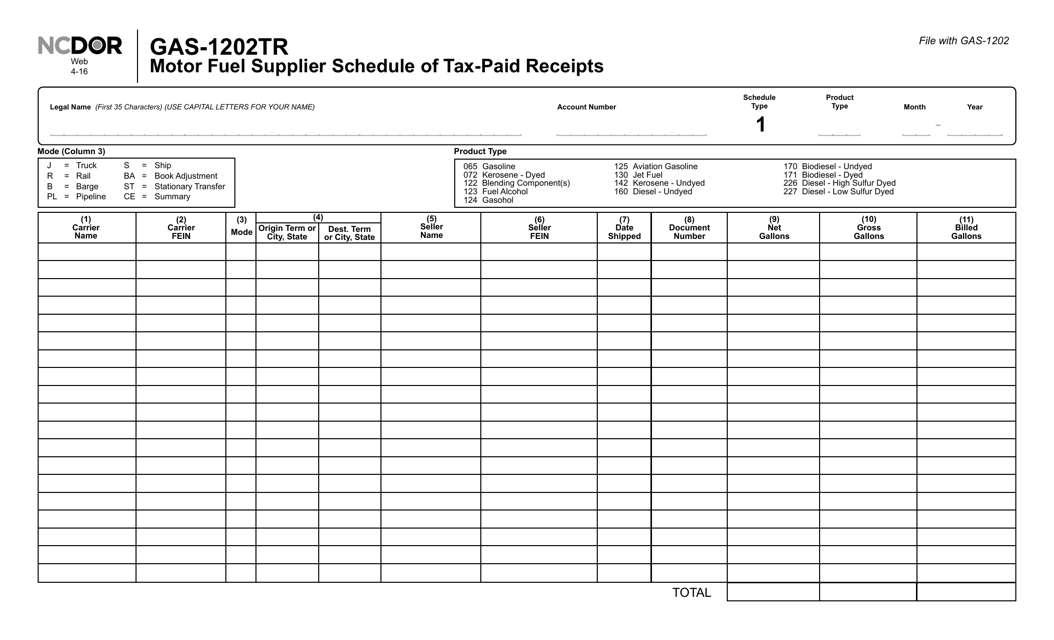

This Form is used for reporting tax-paid receipts for motor fuel suppliers in North Carolina.

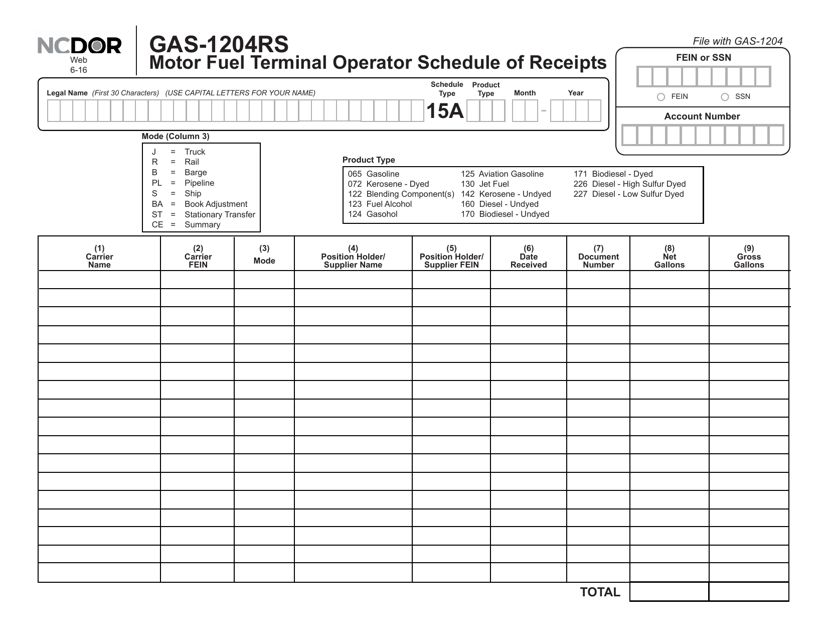

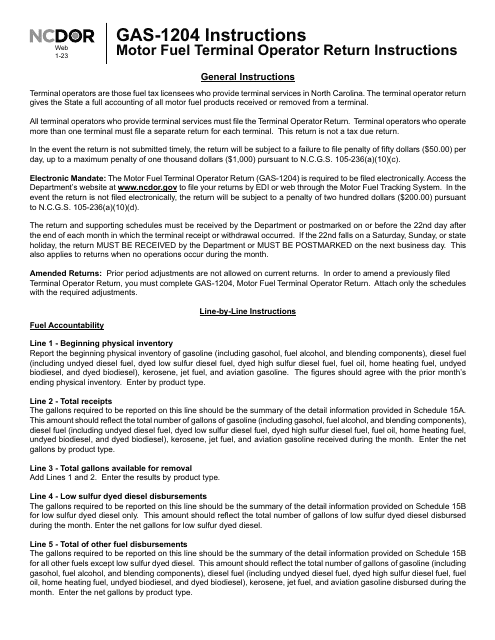

This form is used for reporting the schedule of fuel receipts by motor fuel terminal operators in North Carolina.

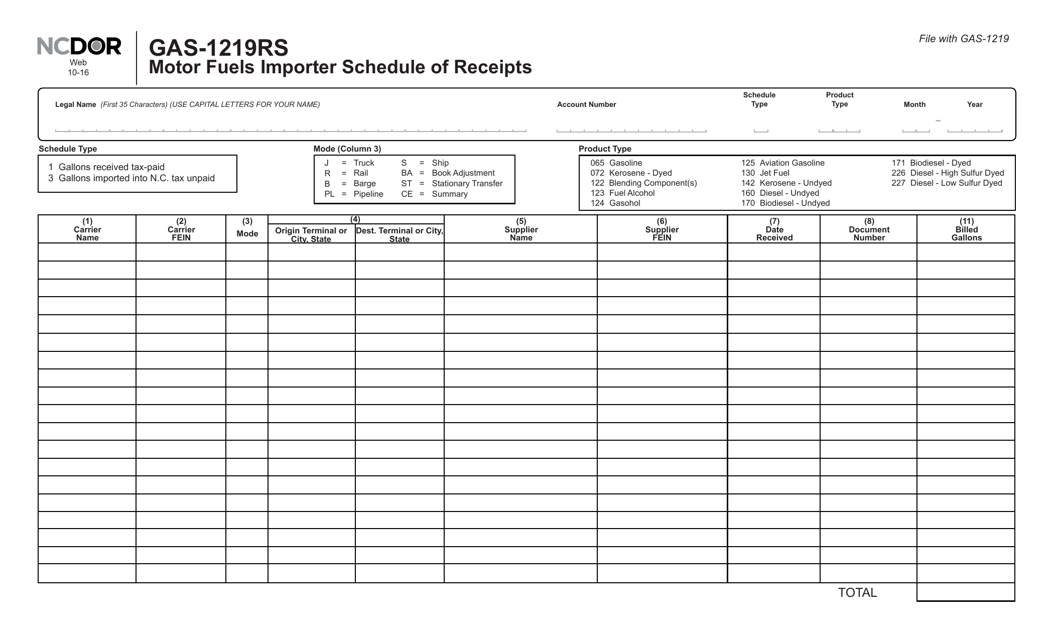

This Form is used for motor fuels importers in North Carolina to report their schedule of receipts. This document helps track and manage the import of motor fuels in the state.

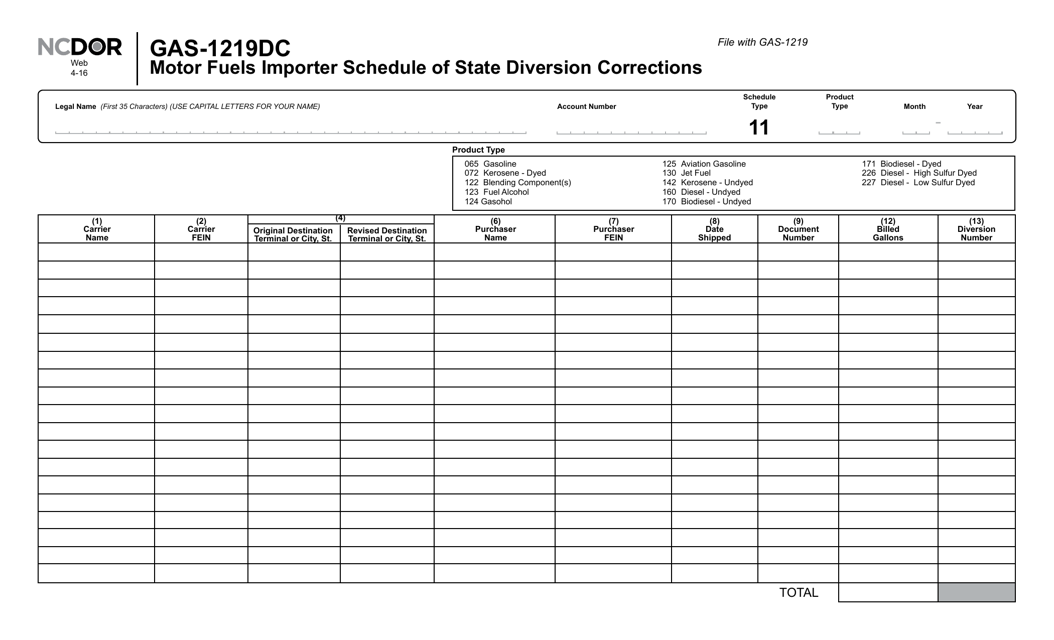

This form is used for North Carolina motor fuels importers to report state diversion corrections.

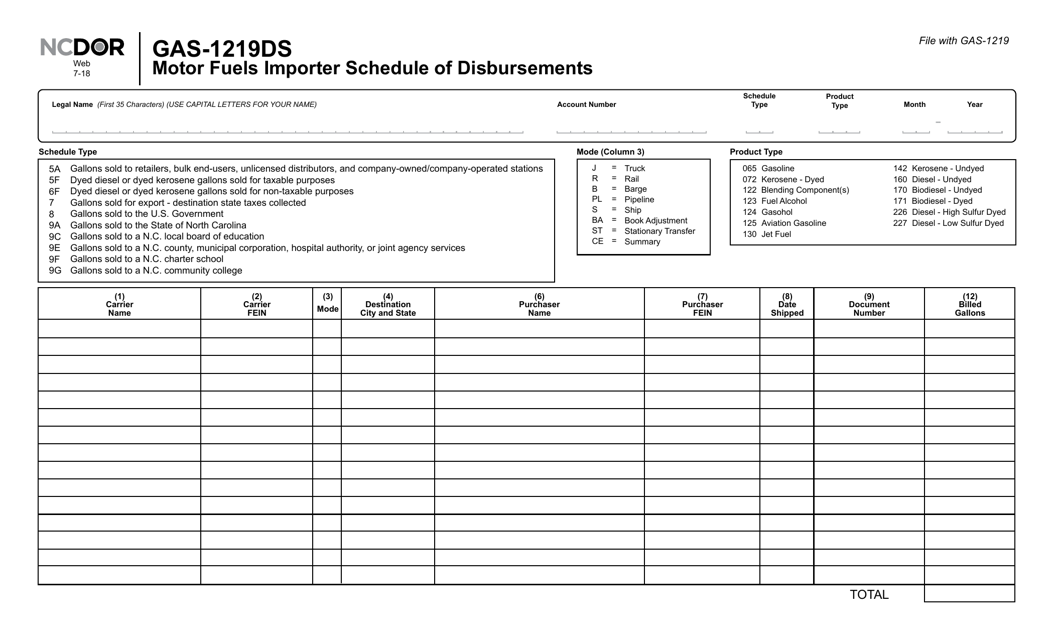

This Form is used for reporting the schedule of disbursements for motor fuels importers in North Carolina.