Motor Fuel Templates

Documents:

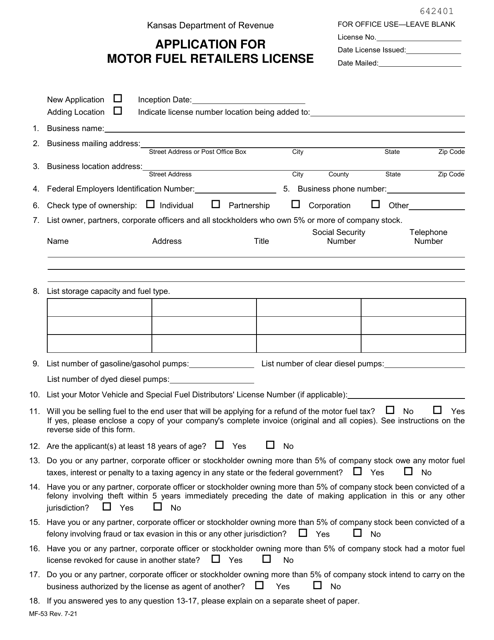

220

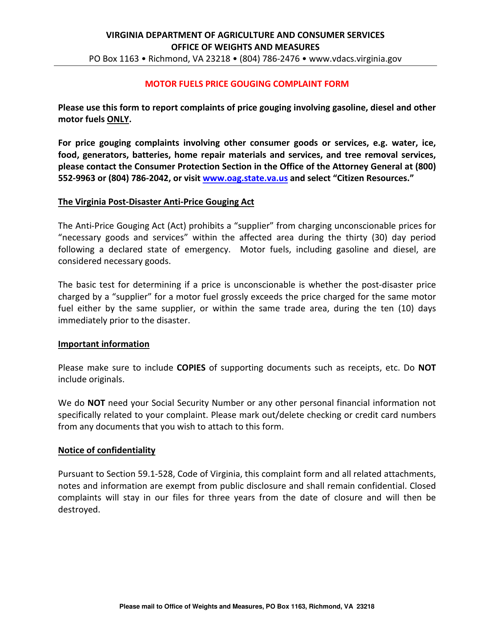

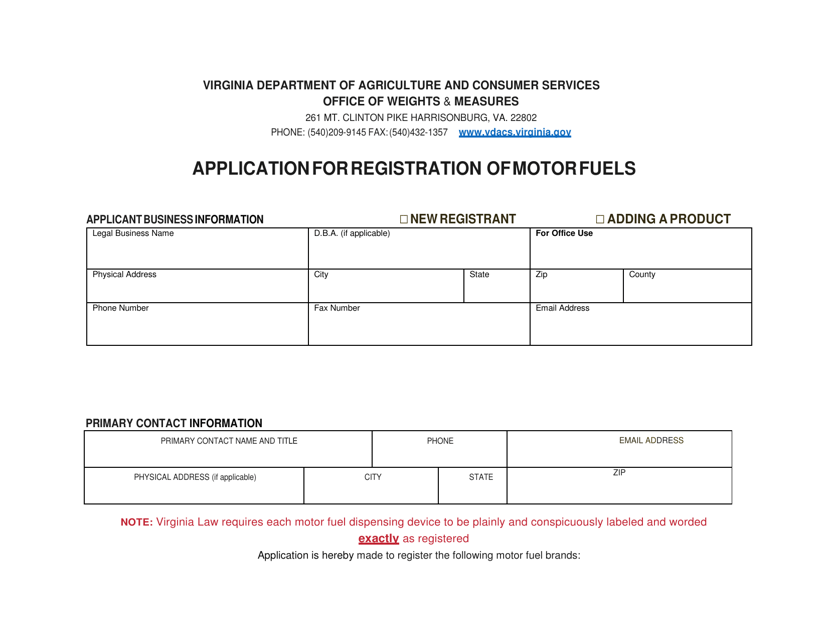

This Form is used for reporting complaints of motor fuels price gouging in Virginia. It allows consumers to report businesses that are charging excessive prices for gasoline or diesel fuel.

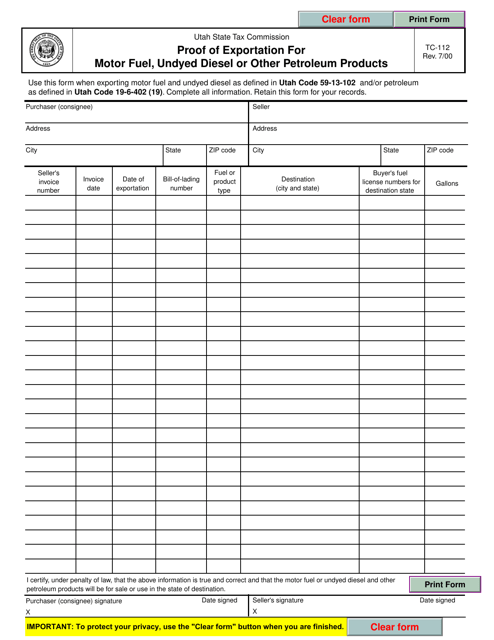

This form is used for providing proof of exportation for motor fuel, undyed diesel, or other petroleum products in the state of Utah. It is required to demonstrate that these products have been exported out of the state.

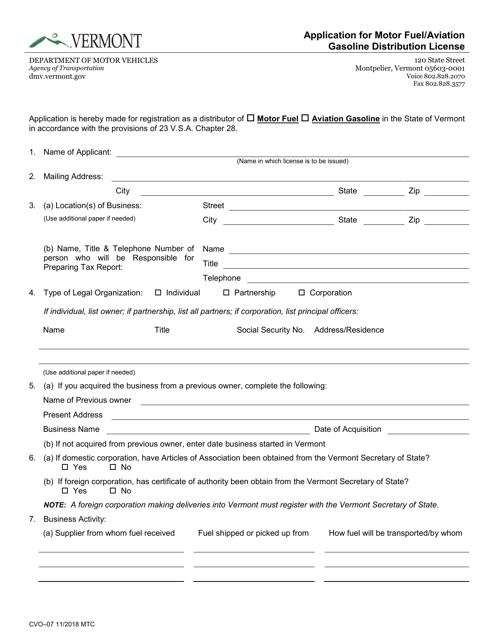

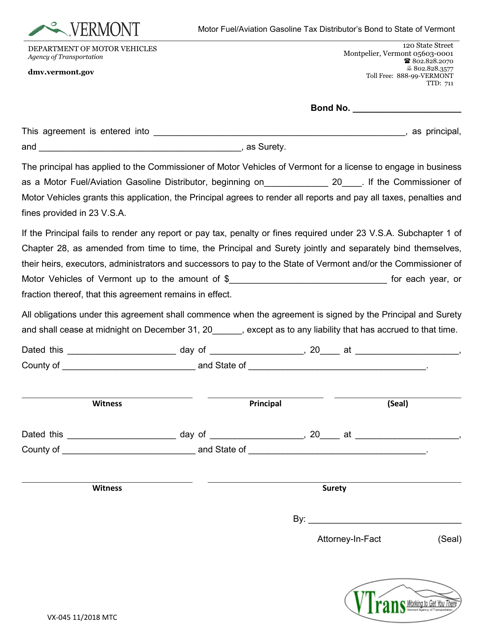

This form is used for applying for a license to distribute motor fuel or aviation gasoline in Vermont.

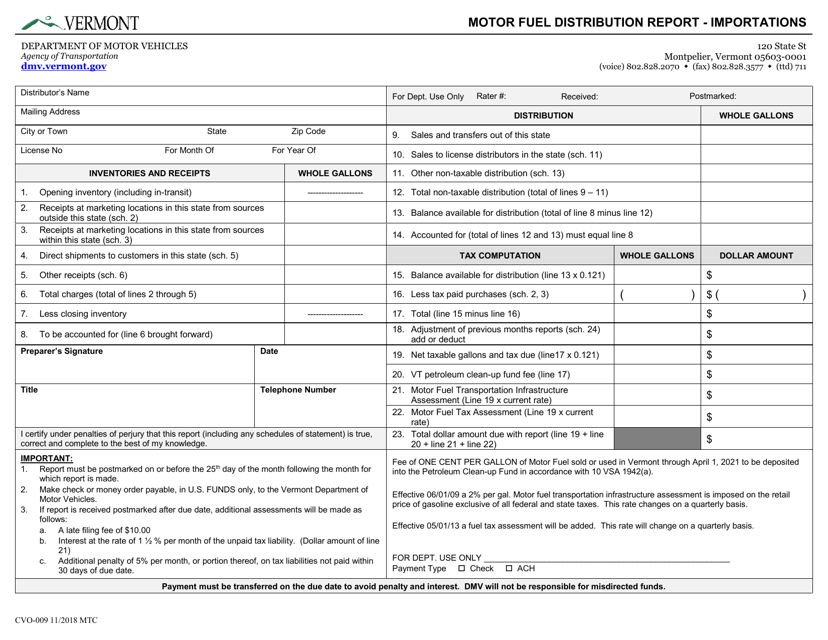

This form is used for reporting motor fuel importations in the state of Vermont. It is a document that helps track the distribution of motor fuel in the state.

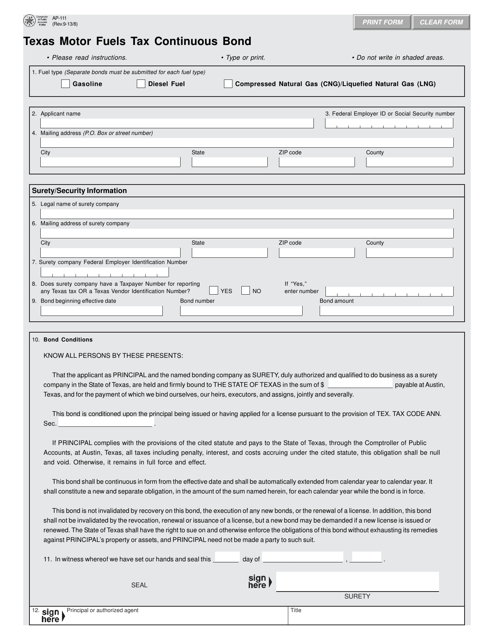

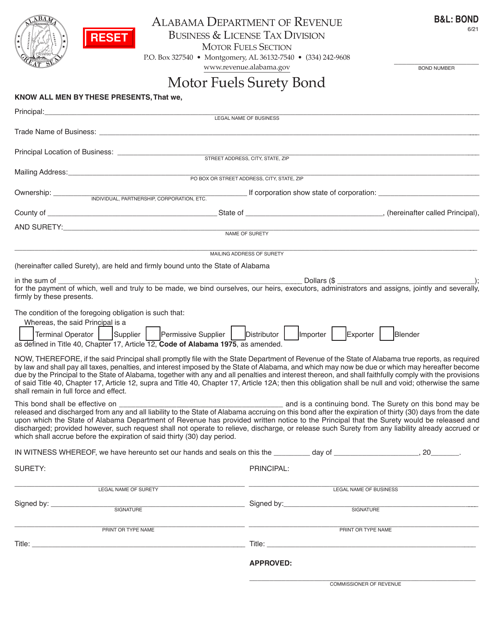

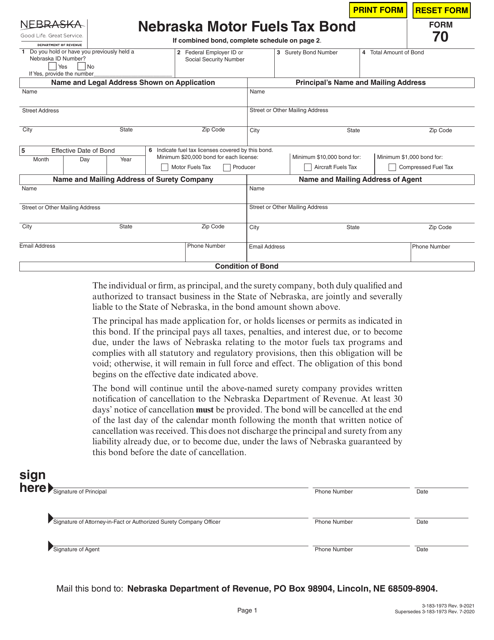

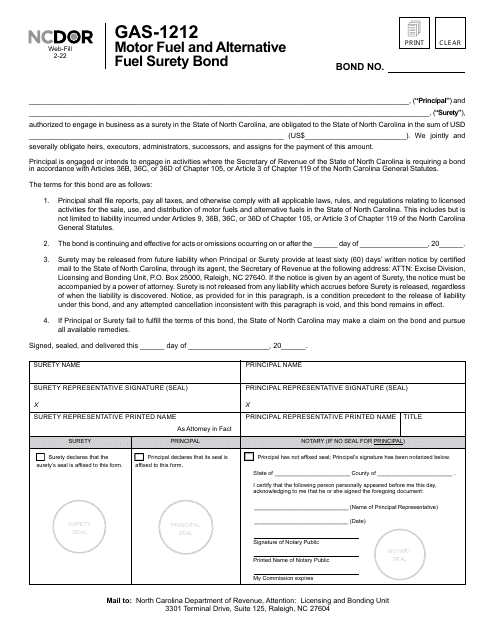

This form is used for Texas businesses to apply for a continuous bond required to comply with motor fuels tax regulations in the state.

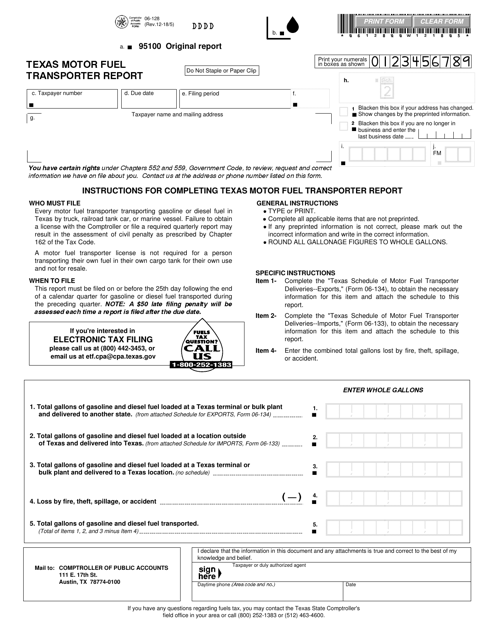

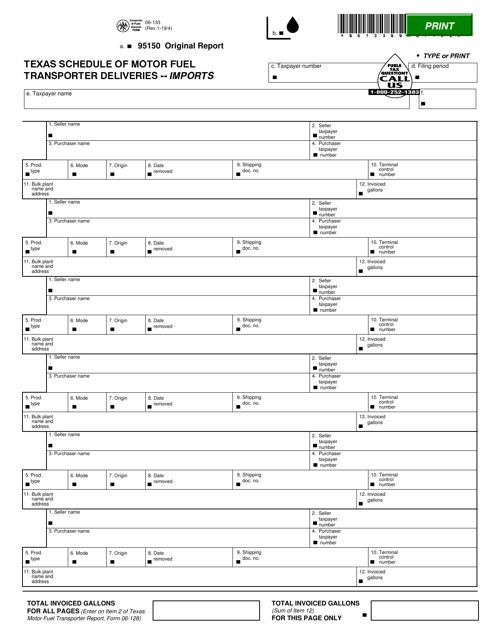

This form is used for reporting fuel transportation activity in the state of Texas. It is specifically for motor fuel transporters to submit their information.

This Form is used for filing a Motor Fuel/Aviation Gasoline Tax Distributor's Bond to the State of Vermont. It is a requirement for businesses involved in the distribution of motor fuel or aviation gasoline in Vermont to secure this bond to ensure compliance with tax laws and regulations.

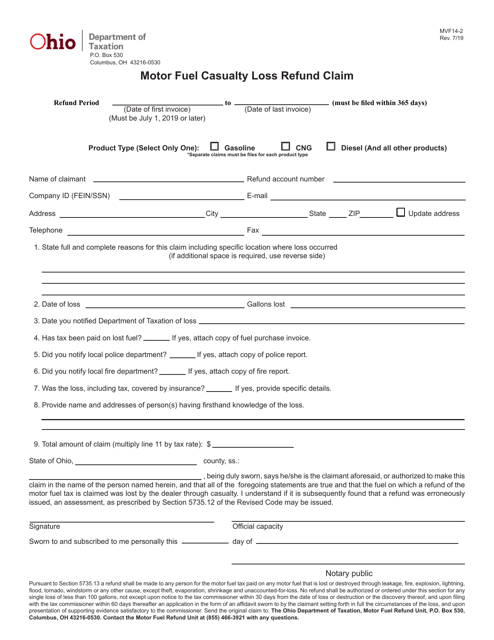

This form is used for filing a motor fuel casualty loss refund claim in the state of Ohio.

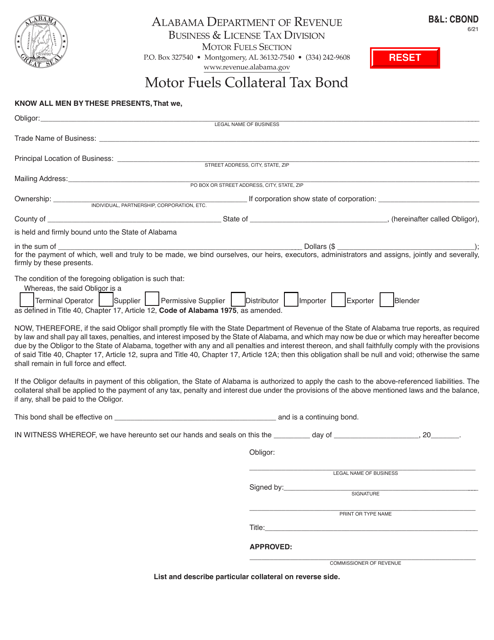

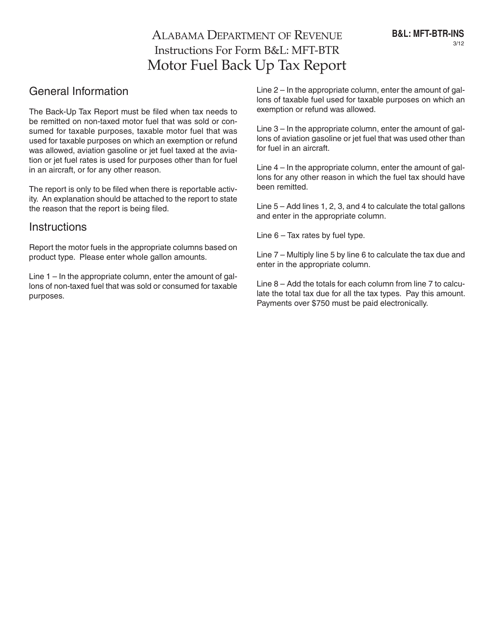

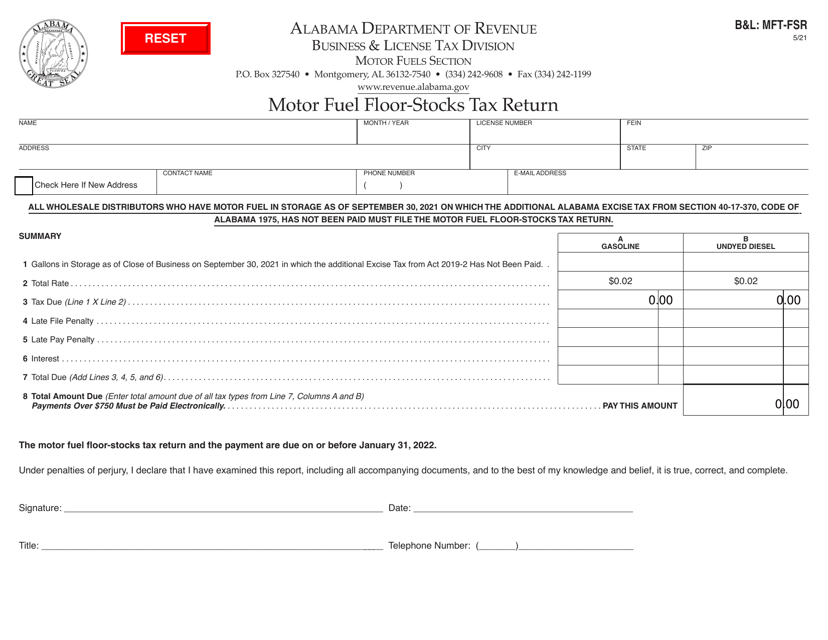

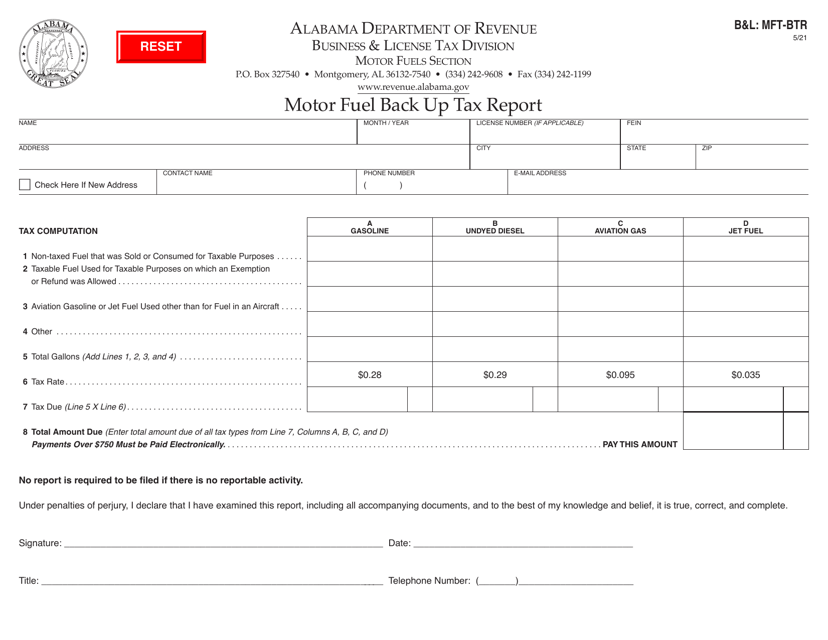

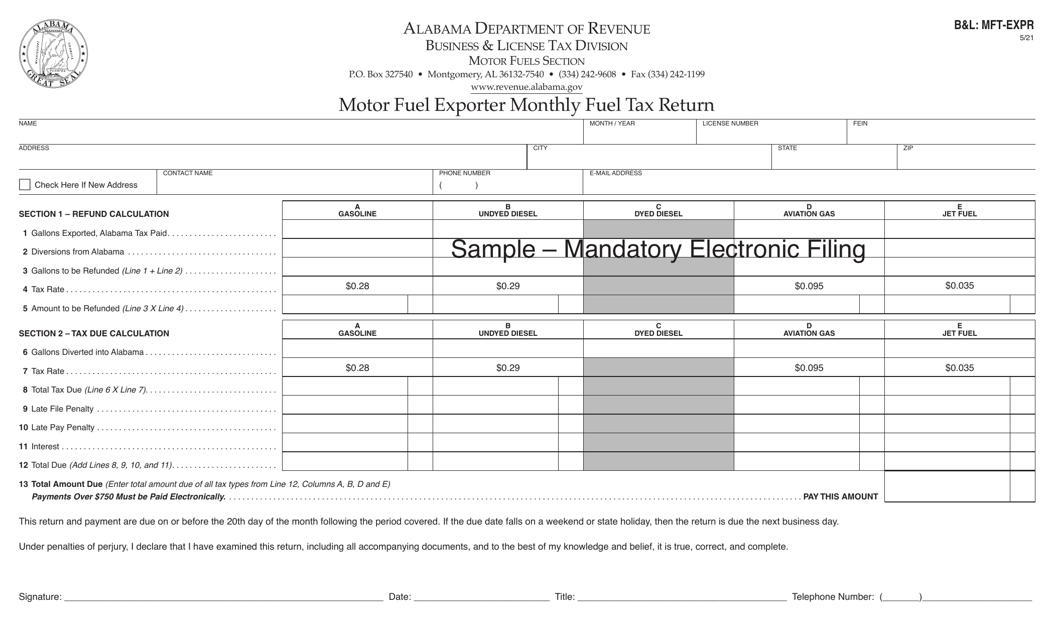

This form is used for reporting motor fuel back up tax in the state of Alabama. It provides instructions for filling out Form B&L: MFT-BTR.

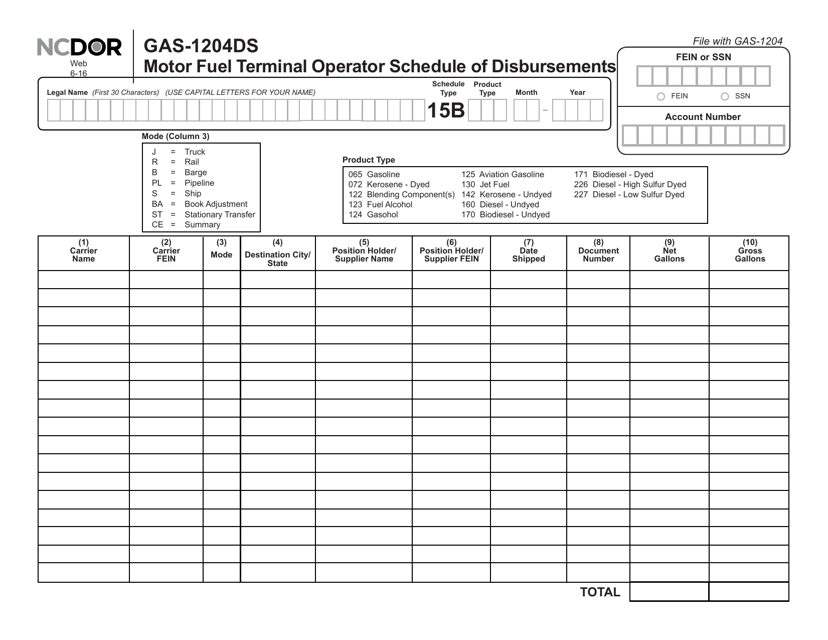

This form is used for reporting the schedule of disbursements made by motor fuel terminal operators in North Carolina.

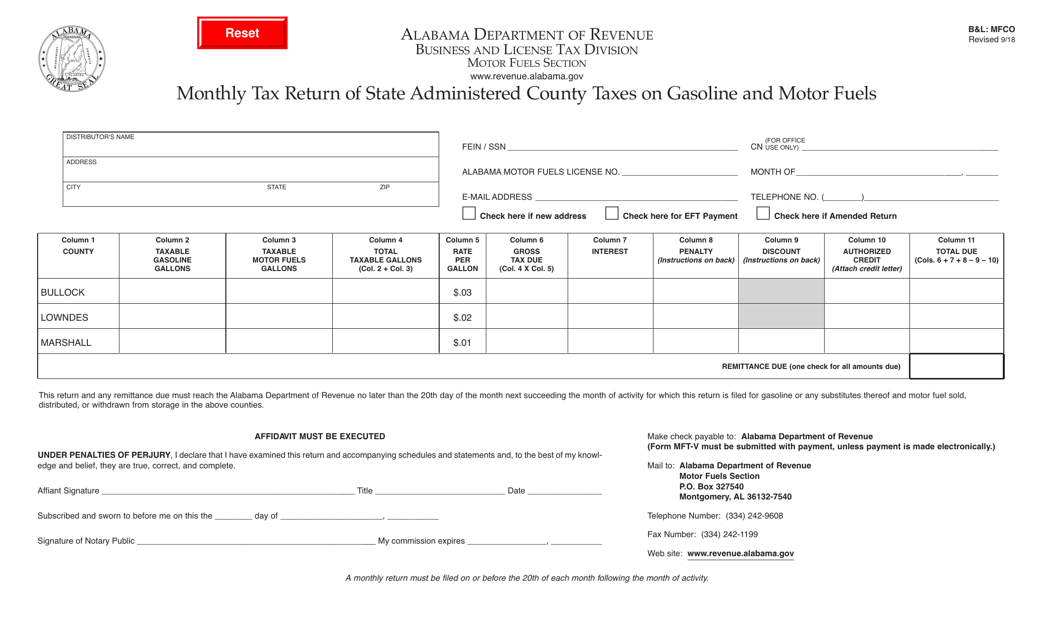

This form is used for filing the monthly tax return for state-administered county taxes on gasoline and motor fuels in Alabama.

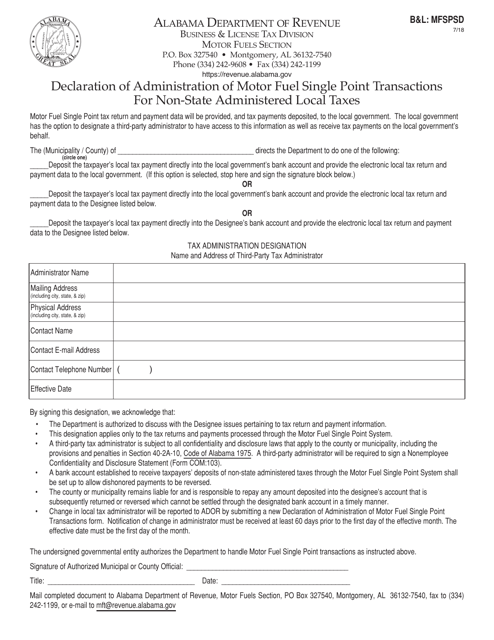

This Form is used for declaring the administration of motor fuel single point transactions for non-state administered local taxes in Alabama.

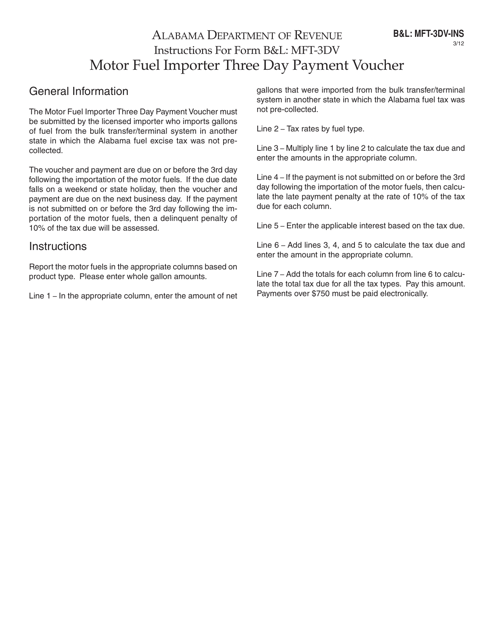

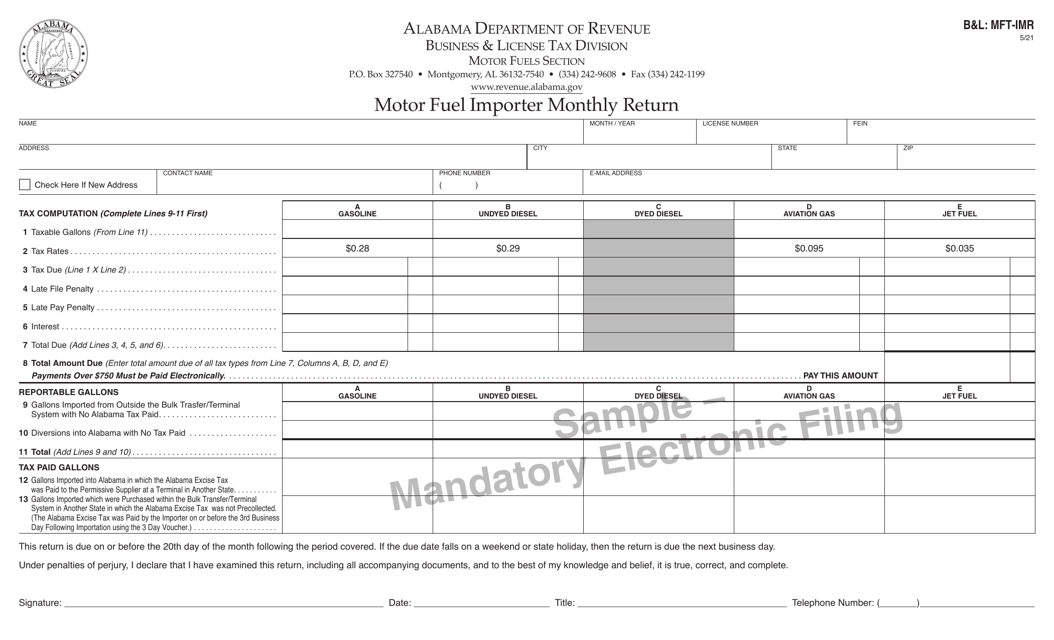

This Form is used for making payment as a motor fuel importer in Alabama.

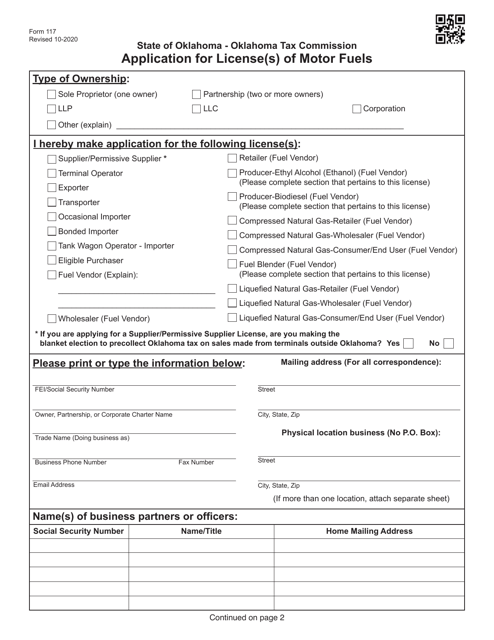

This type of document is used for calculating monthly tax for bonded motor fuel importers in Oklahoma.

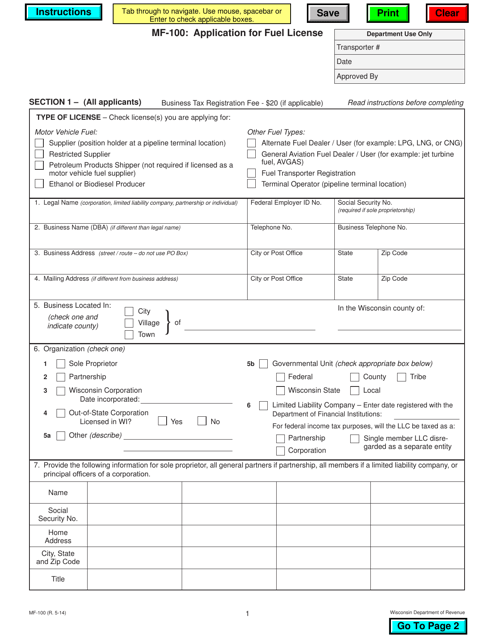

This Form is used for applying for a fuel license in the state of Wisconsin.

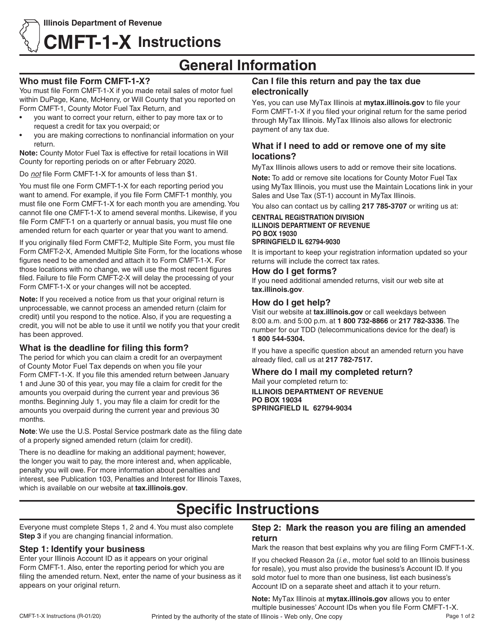

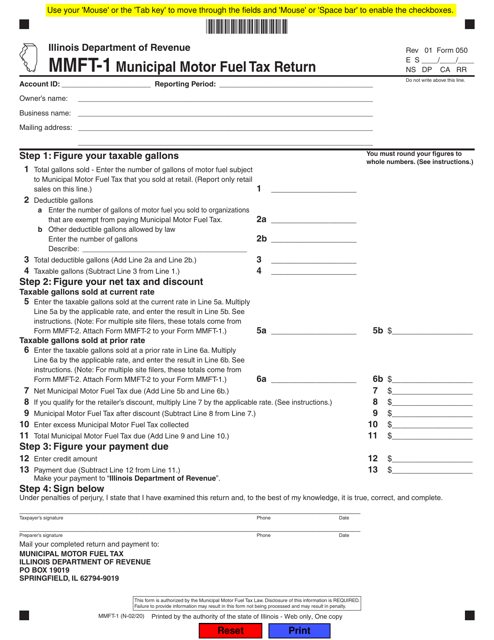

This Form is used for filing the Municipal Motor Fuel Tax Return in Illinois.

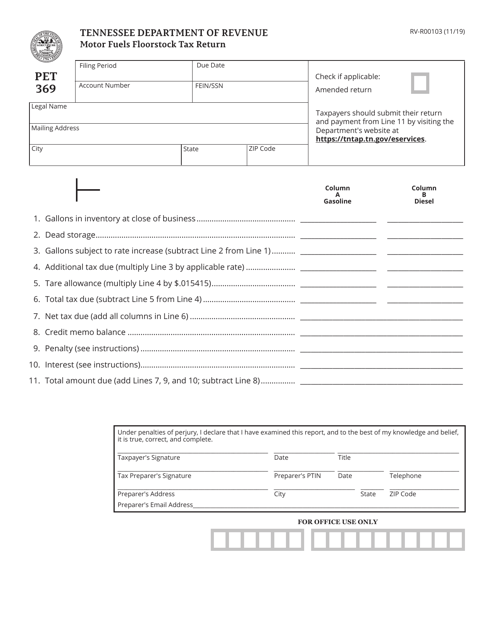

This Form is used for filing the Motor Fuels Floorstock Tax Return in Tennessee.