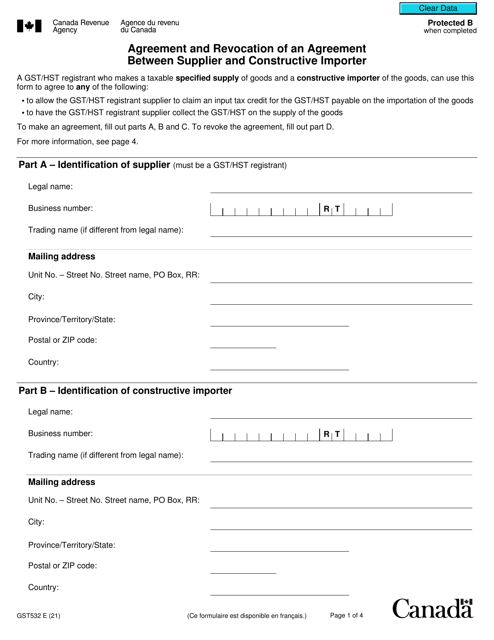

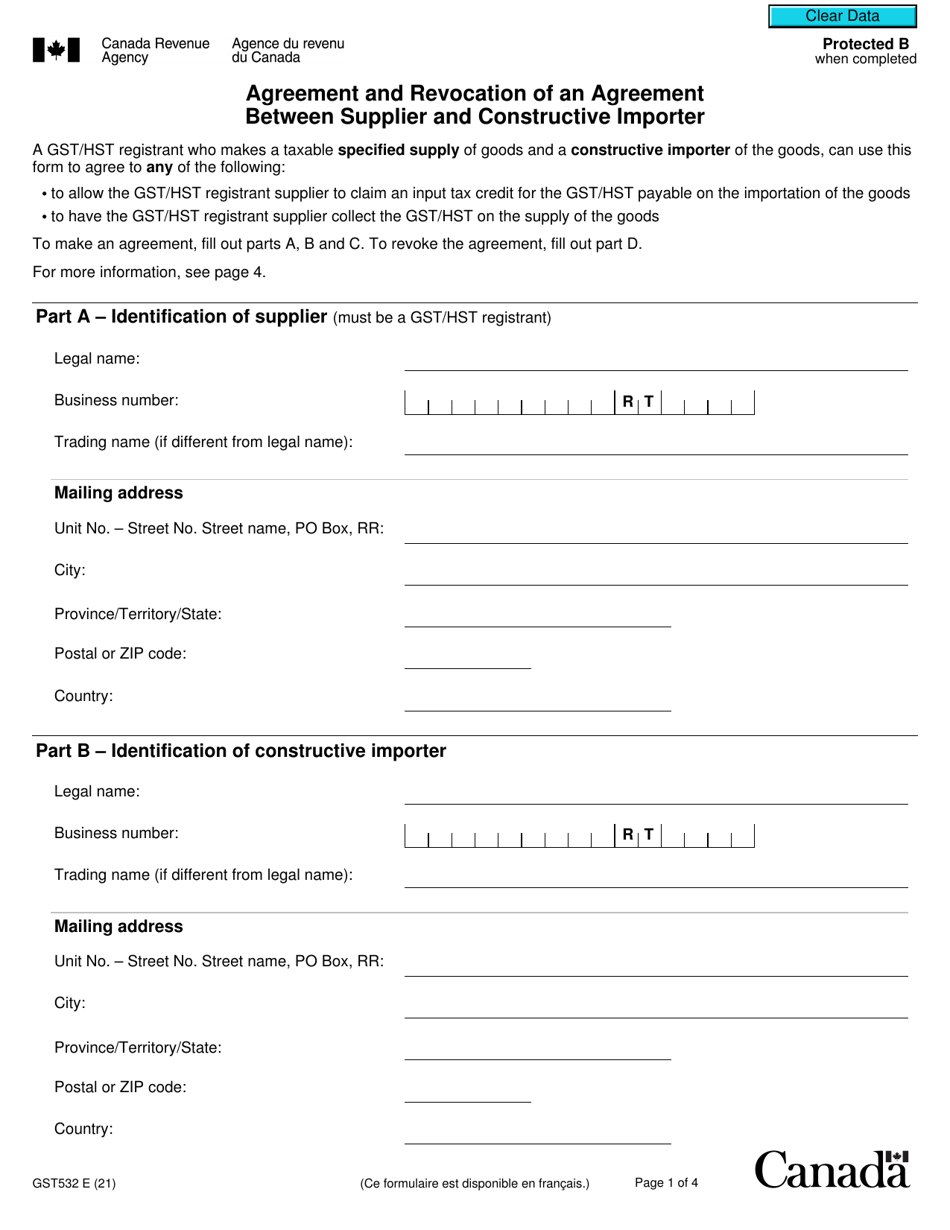

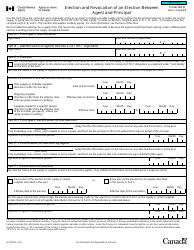

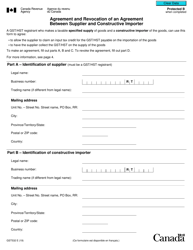

Form GST532 Agreement and Revocation of an Agreement Between Supplier and Constructive Importer - Canada

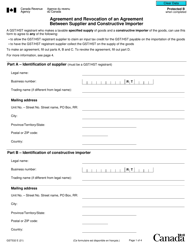

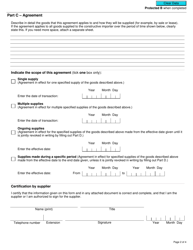

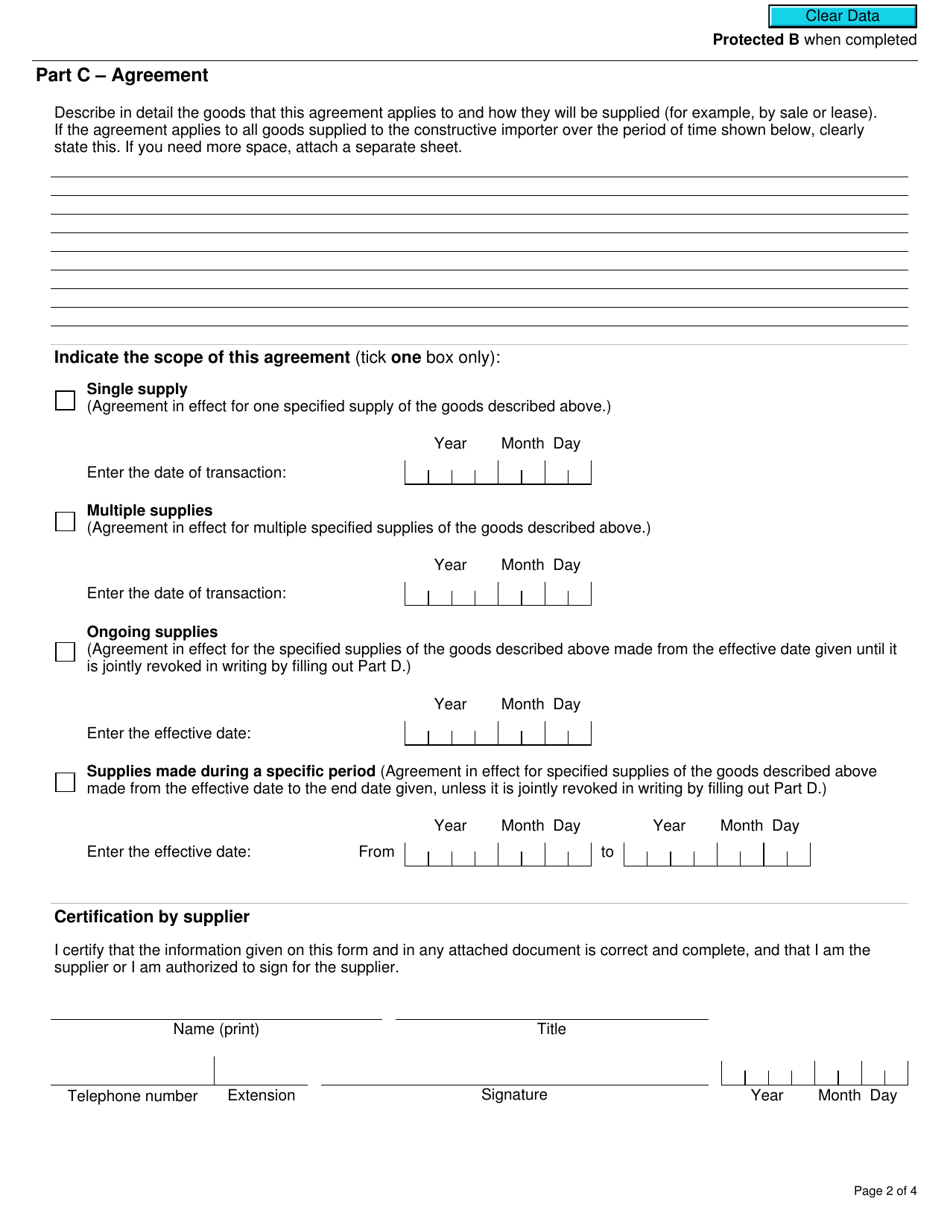

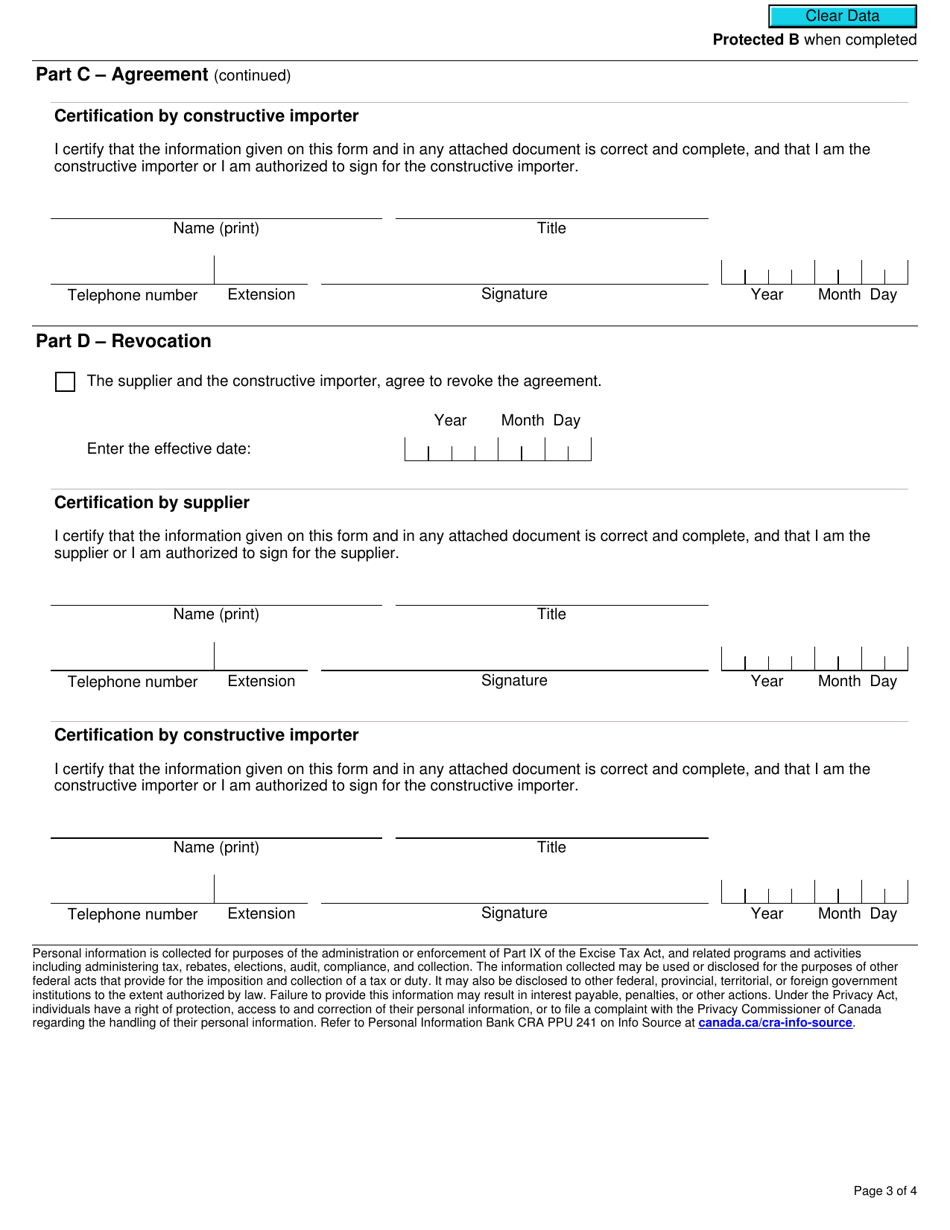

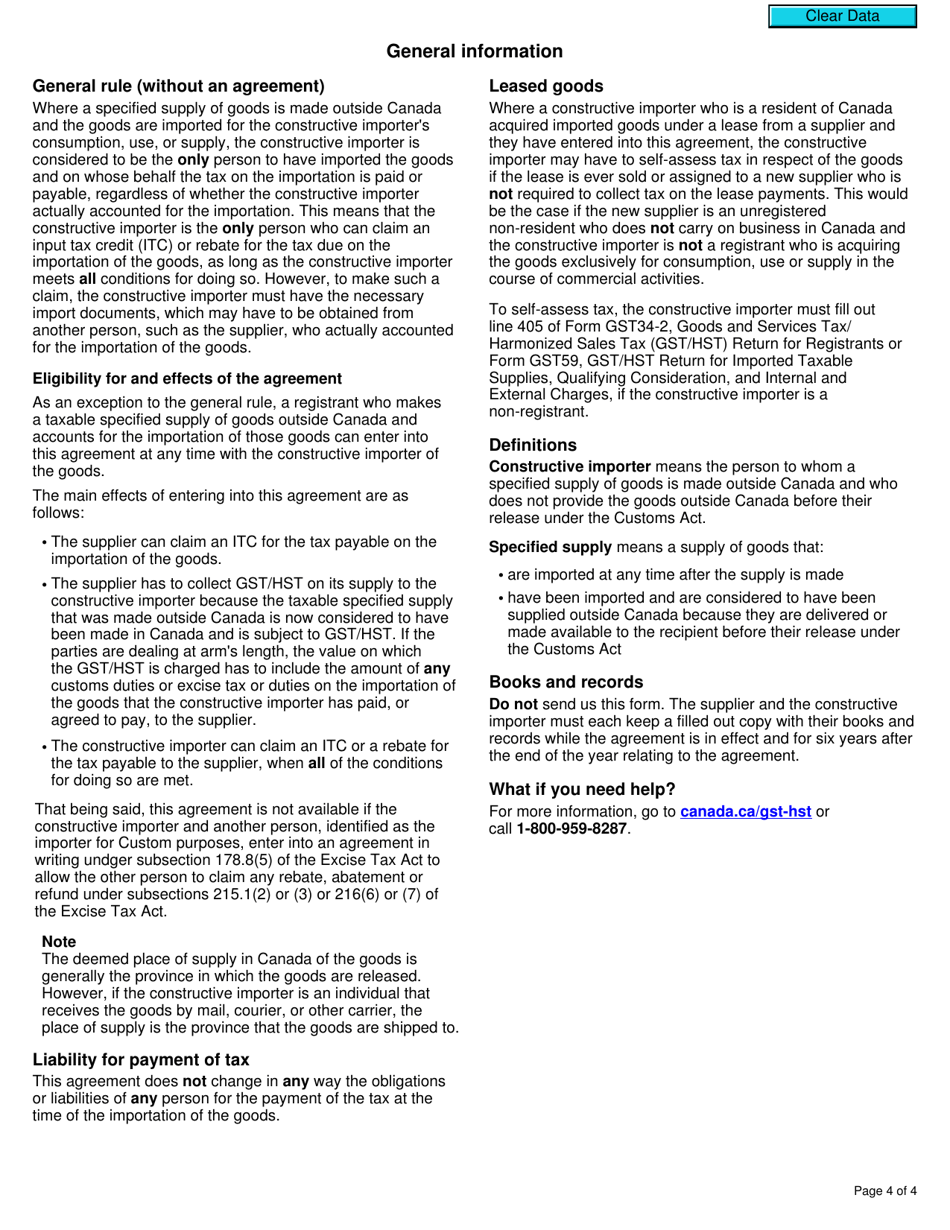

The Form GST532 Agreement and Revocation of an Agreement Between Supplier and Constructive Importer in Canada is used for formalizing agreements between a supplier and a constructive importer. This form outlines the terms and conditions of the agreement and can also be used to revoke or cancel such agreements.

Form GST532 Agreement and Revocation of an Agreement Between Supplier and Constructive Importer - Canada - Frequently Asked Questions (FAQ)

Q: What is GST532?

A: GST532 is a form used in Canada to create or cancel an agreement between a supplier and a constructive importer.

Q: What is a constructive importer?

A: A constructive importer is a business that does not physically import goods into Canada but is deemed to be the importer for GST purposes.

Q: What is the purpose of the GST532 form?

A: The GST532 form is used to establish an agreement between a supplier and constructive importer for the purposes of the Goods and Services Tax (GST) in Canada.

Q: What information is included in the GST532 form?

A: The form includes details about the supplier and constructive importer, as well as information about the goods being supplied.

Q: Can I revoke an agreement made using the GST532 form?

A: Yes, the GST532 form can also be used to revoke an existing agreement between a supplier and constructive importer.

Q: Are there any specific requirements for completing the GST532 form?

A: Yes, it is important to carefully review the instructions provided with the form to ensure all necessary information is included.

Q: Is the GST532 form applicable in the United States?

A: No, the GST532 form is specific to Canada and is not applicable in the United States.

Q: What is the importance of the agreement between a supplier and constructive importer?

A: The agreement helps clarify the responsibilities and obligations of both parties regarding the collection and remittance of GST in Canada.