This version of the form is not currently in use and is provided for reference only. Download this version of

Form BOE-58-AH

for the current year.

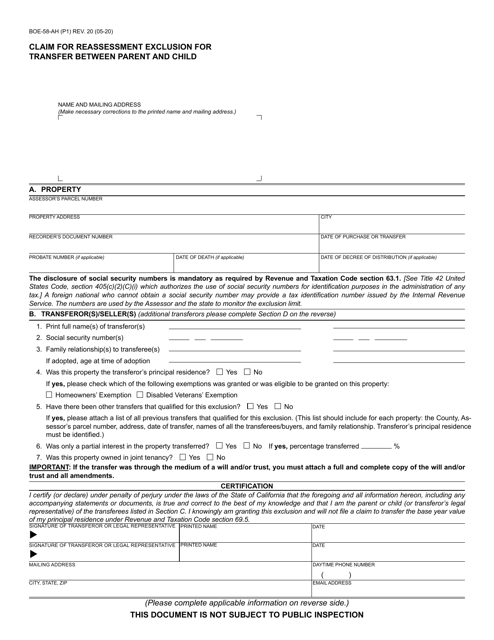

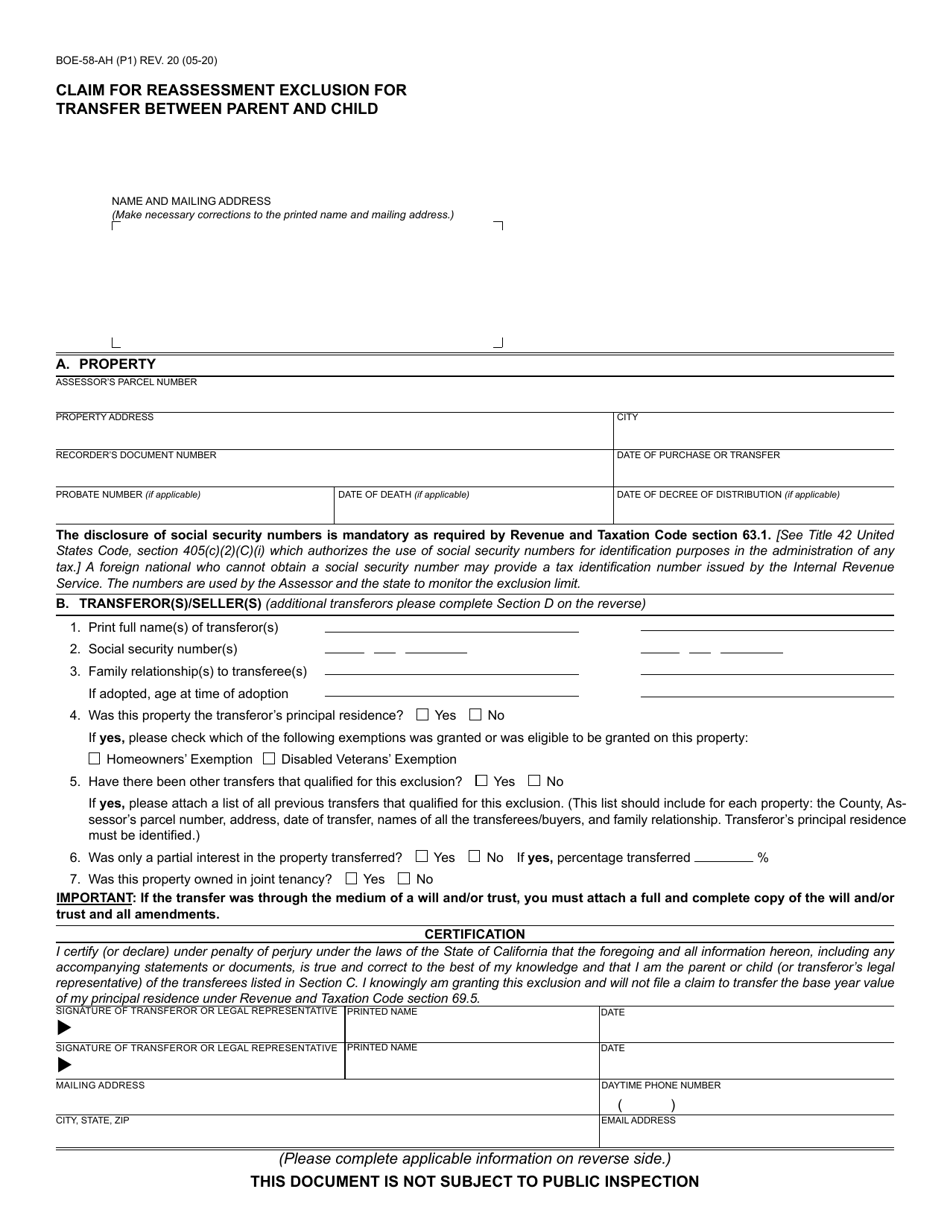

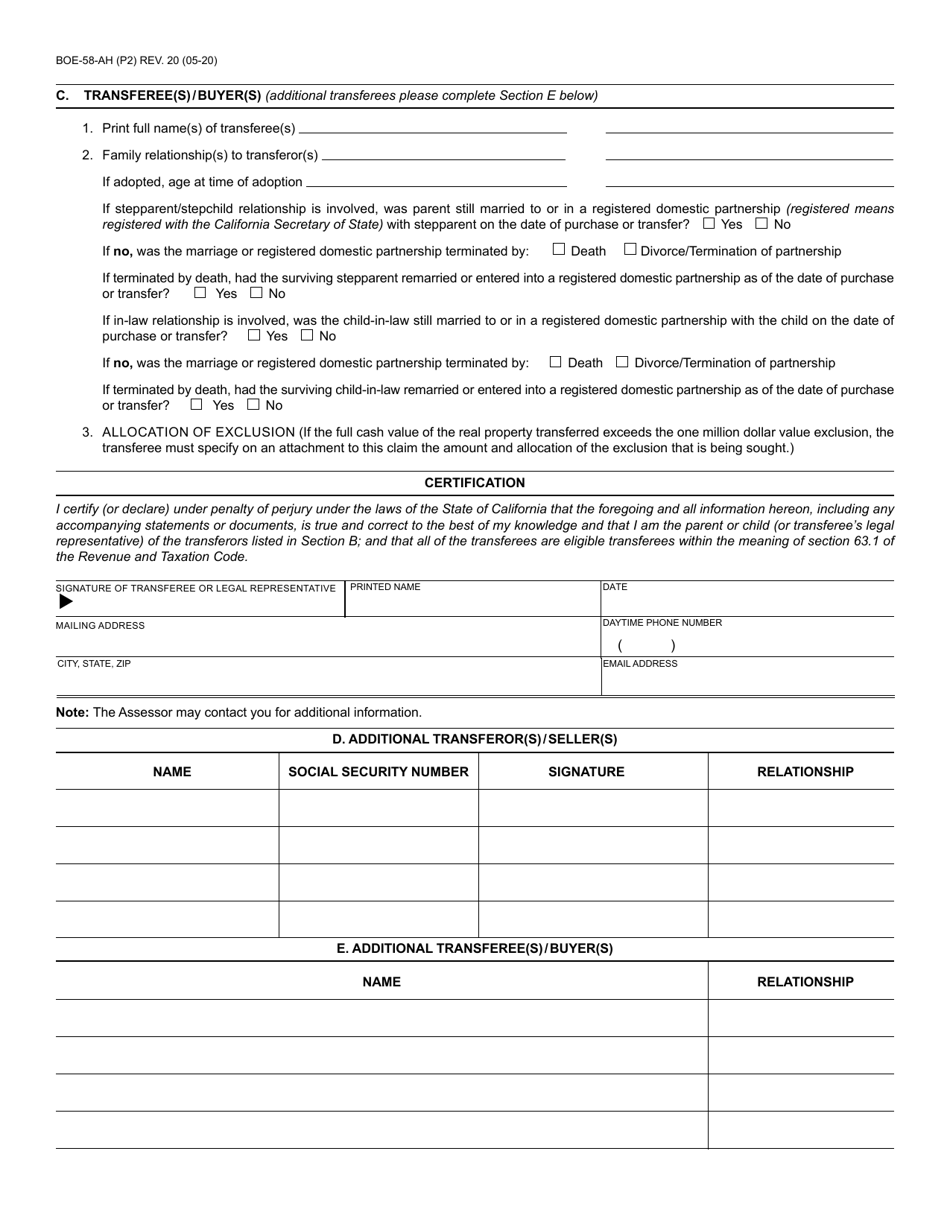

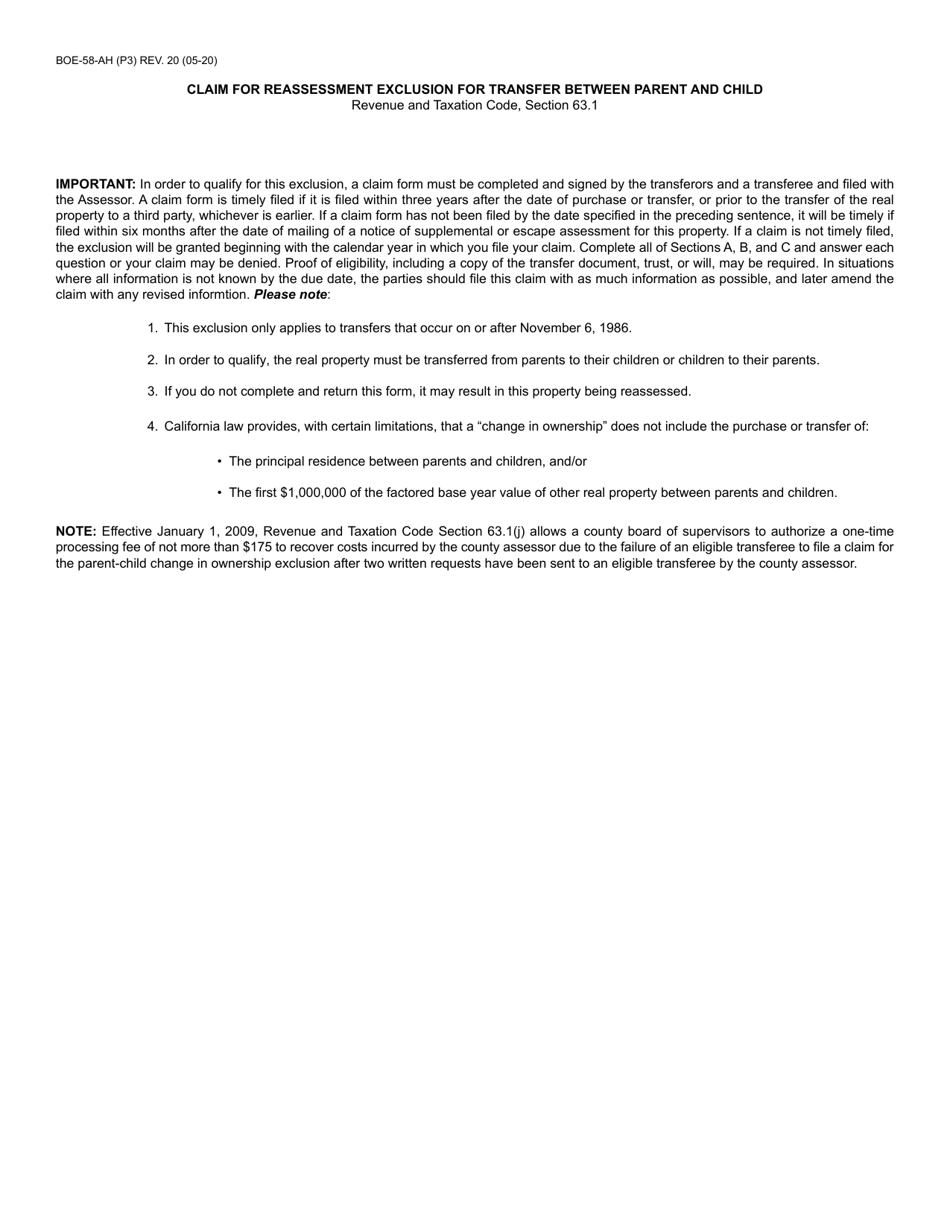

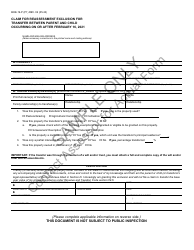

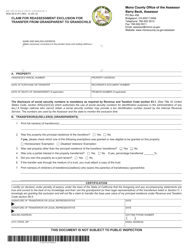

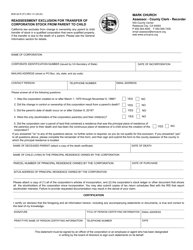

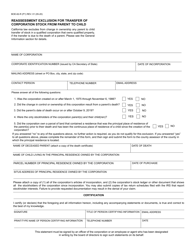

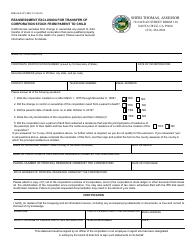

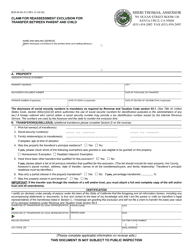

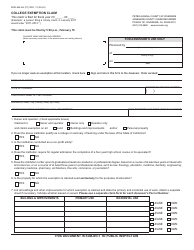

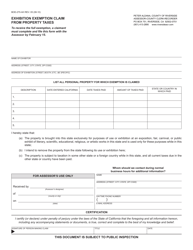

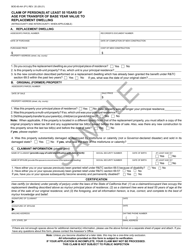

Form BOE-58-AH Claim for Reassessment Exclusion for Transfer Between Parent and Child - California

What Is Form BOE-58-AH?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

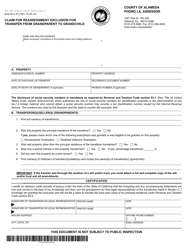

Q: What is Form BOE-58-AH?

A: Form BOE-58-AH is a claim for reassessment exclusion for transfer between parent and child in California.

Q: What is the purpose of Form BOE-58-AH?

A: The purpose of Form BOE-58-AH is to exempt certain transfers of real property between parents and children from reassessment for property tax purposes.

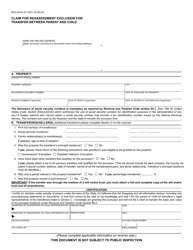

Q: Who is eligible to file Form BOE-58-AH?

A: The transfer must be between a parent and child, and the child must be either the child of the parent or the child of the parent's spouse or domestic partner.

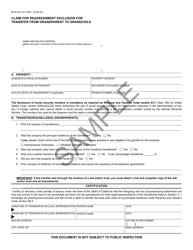

Q: What are the benefits of filing Form BOE-58-AH?

A: Filing Form BOE-58-AH can help to prevent a reassessment of the property's value, which may result in lower property tax bills for the child who receives the property.

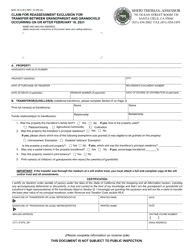

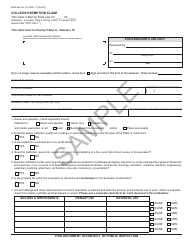

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-58-AH by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.