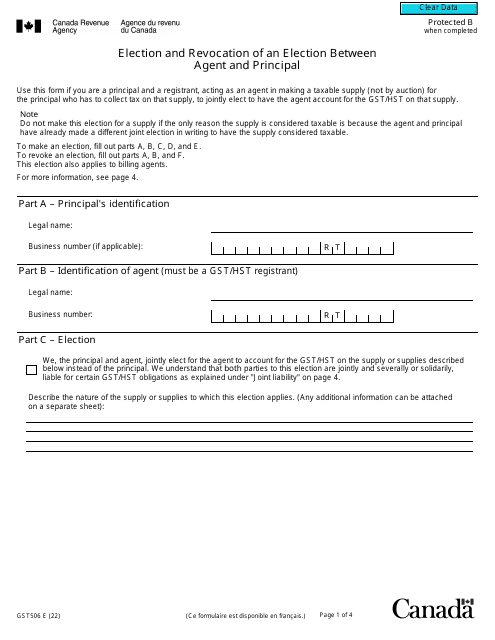

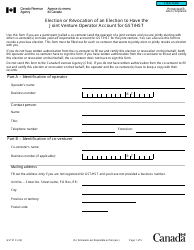

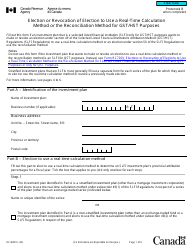

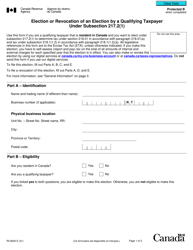

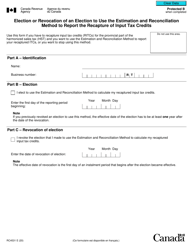

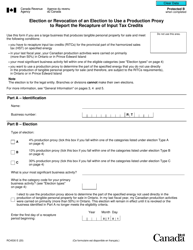

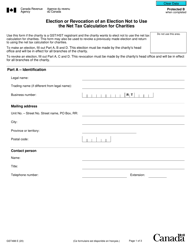

Form GST506 Election and Revocation of an Election Between Agent and Principal - Canada

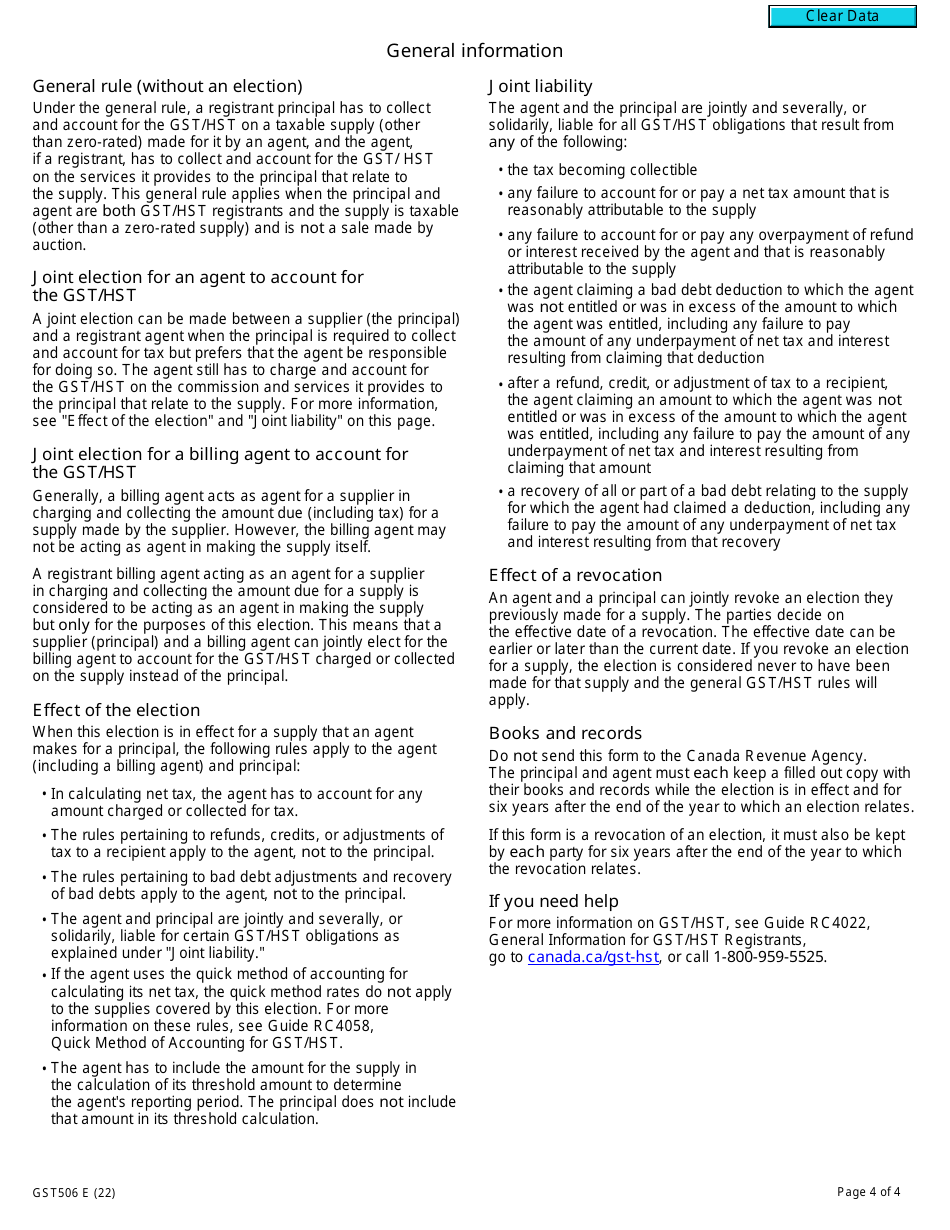

Form GST506 Election and Revocation of an Election Between Agent and Principal in Canada is used to establish or terminate an election that allows an agent to act on behalf of a principal for certain Goods and Services Tax (GST) purposes.

The Form GST506 is filed by both the agent and the principal in Canada.

Form GST506 Election and Revocation of an Election Between Agent and Principal - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST506?

A: Form GST506 is a form used to make an election or revoke an election between an agent and a principal in Canada.

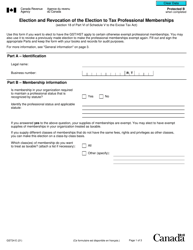

Q: Who can use Form GST506?

A: Both the agent and the principal can use Form GST506 to make or revoke an election.

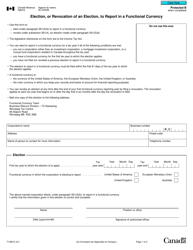

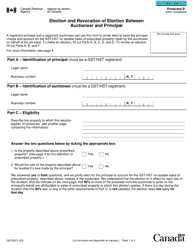

Q: What is an election between an agent and a principal?

A: An election between an agent and a principal is a formal agreement where the agent agrees to calculate and remit the GST/HST on behalf of the principal.

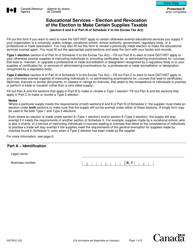

Q: Why would someone make an election using Form GST506?

A: Someone might make an election using Form GST506 to simplify the process of calculating and remitting the GST/HST.

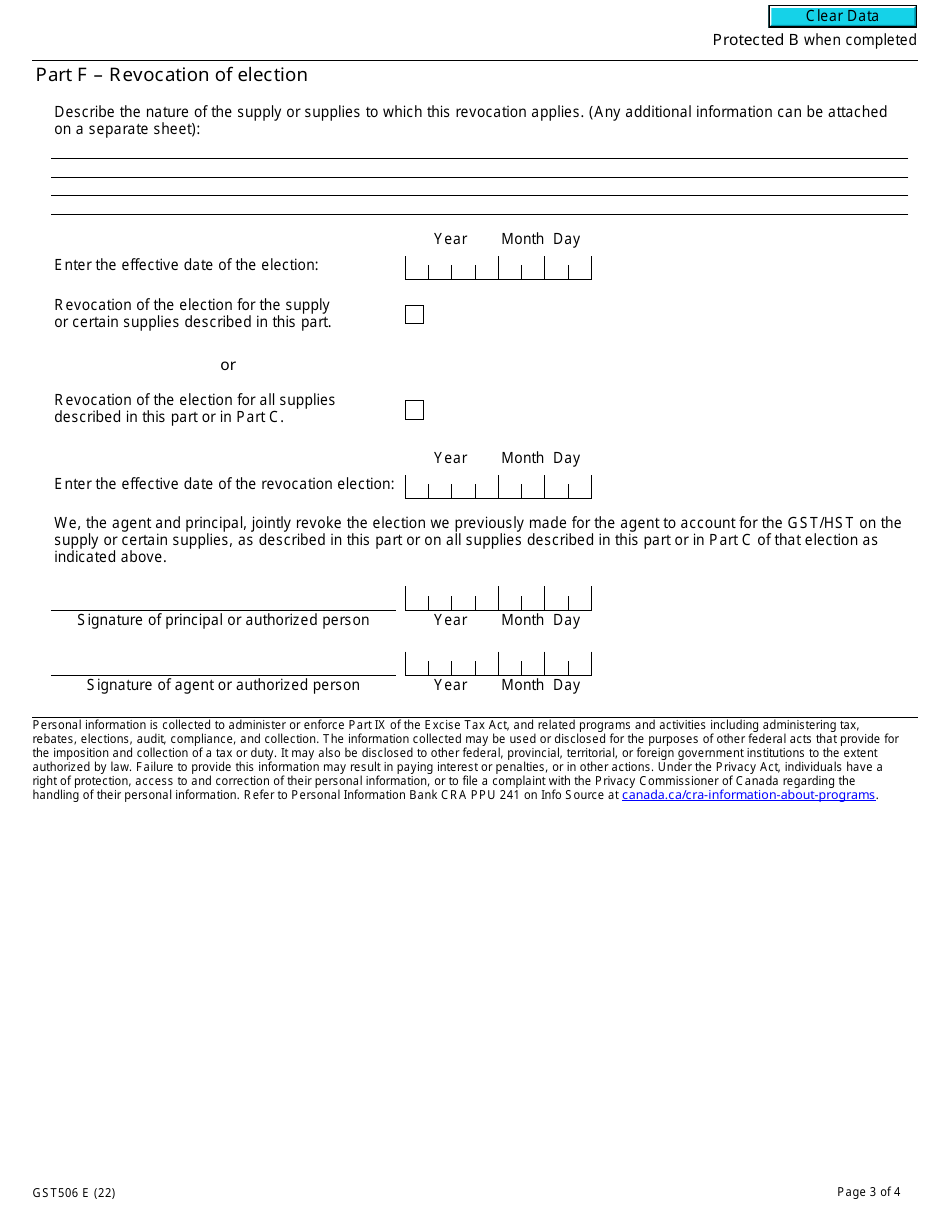

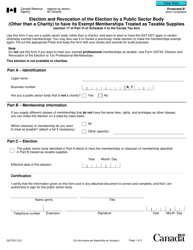

Q: Can I revoke an election made using Form GST506?

A: Yes, you can revoke an election made using Form GST506 by completing and filing a new Form GST506.

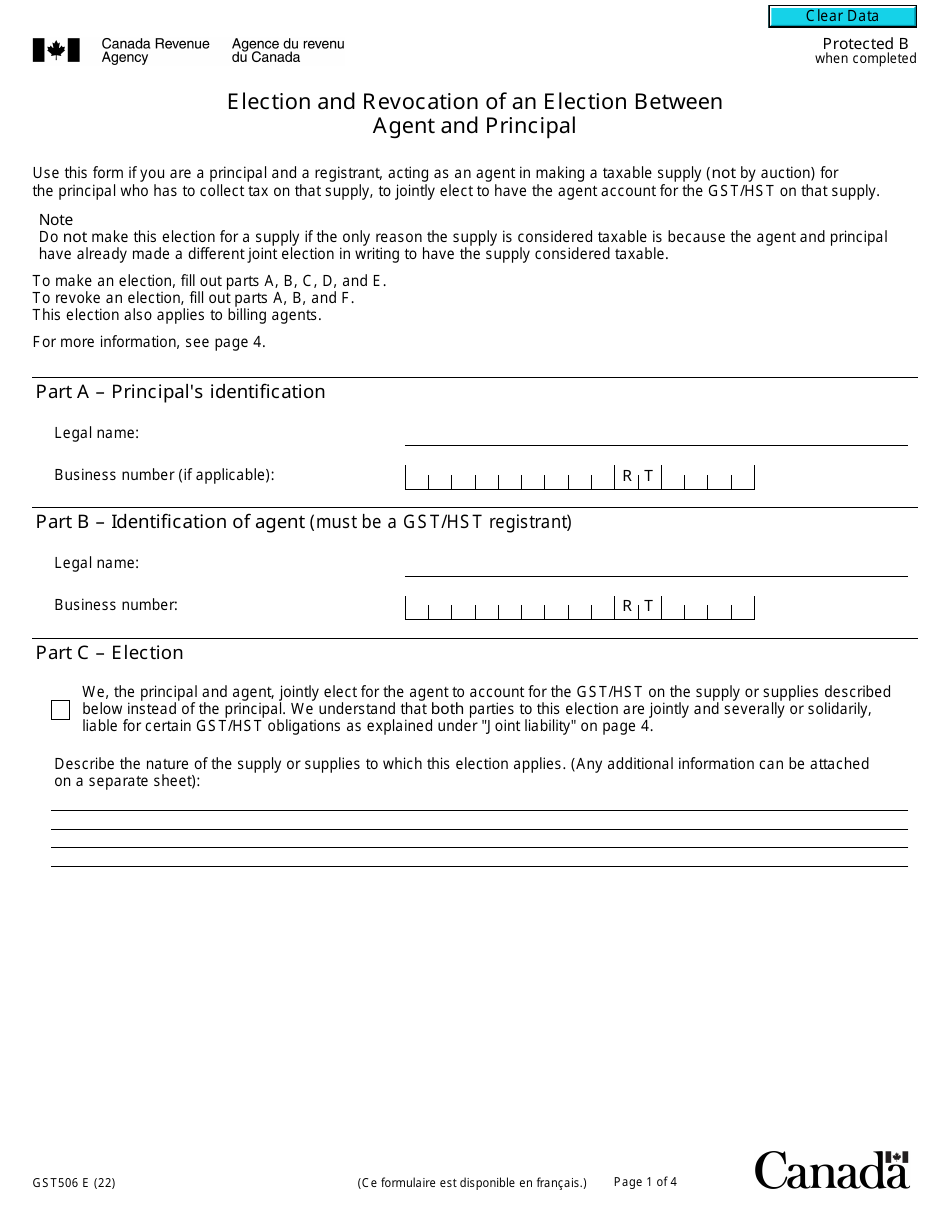

Q: Are there any specific requirements for making an election using Form GST506?

A: Yes, there are specific requirements outlined on the form itself, such as both the agent and the principal must agree to the election.