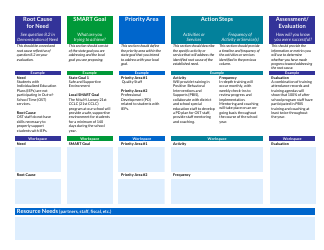

Retirement Needs Worksheet Template - Charles Schwab

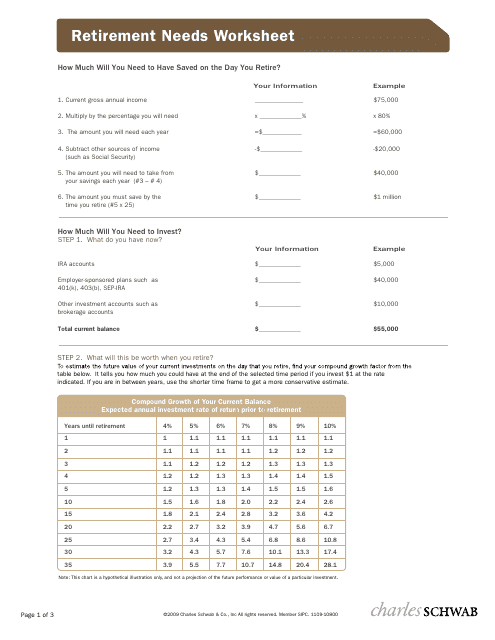

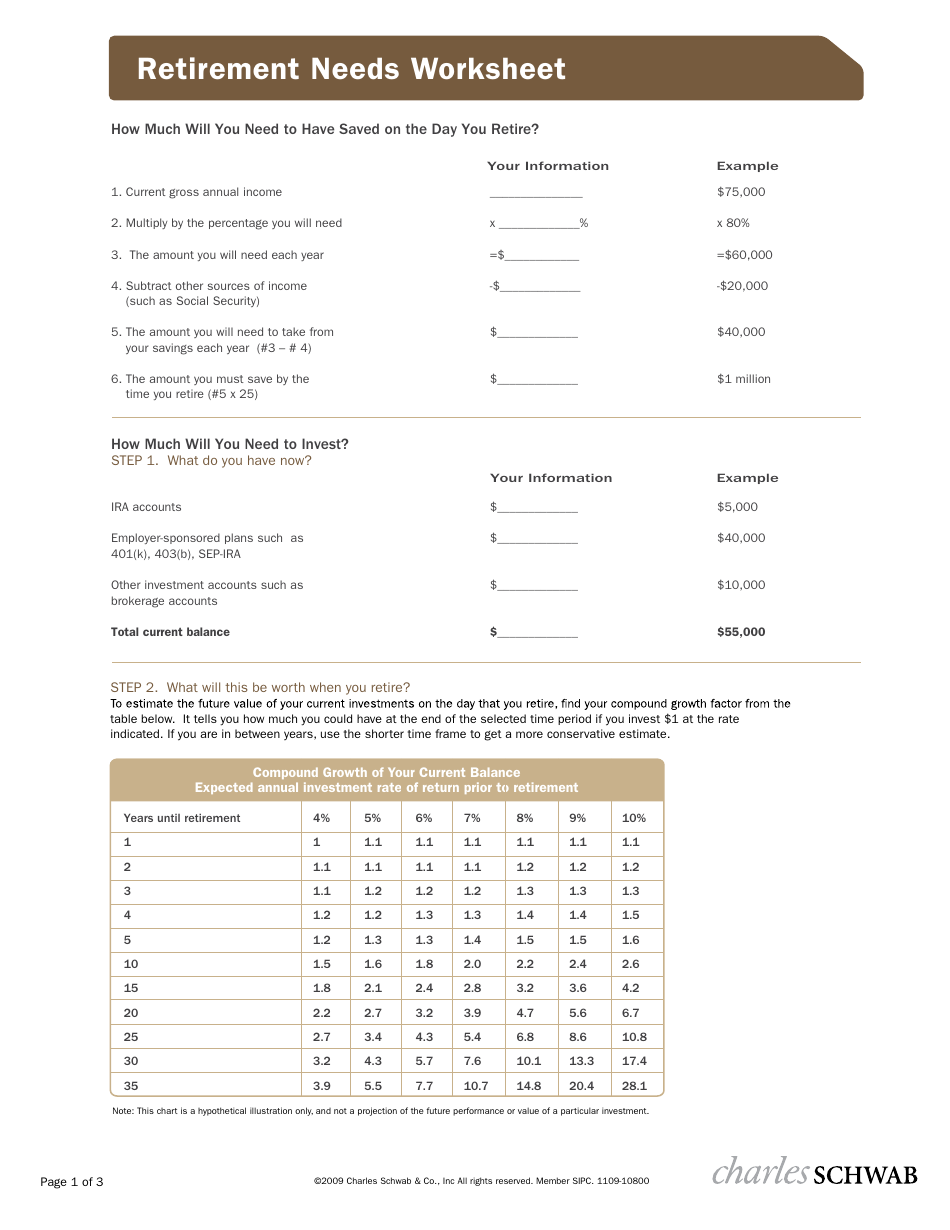

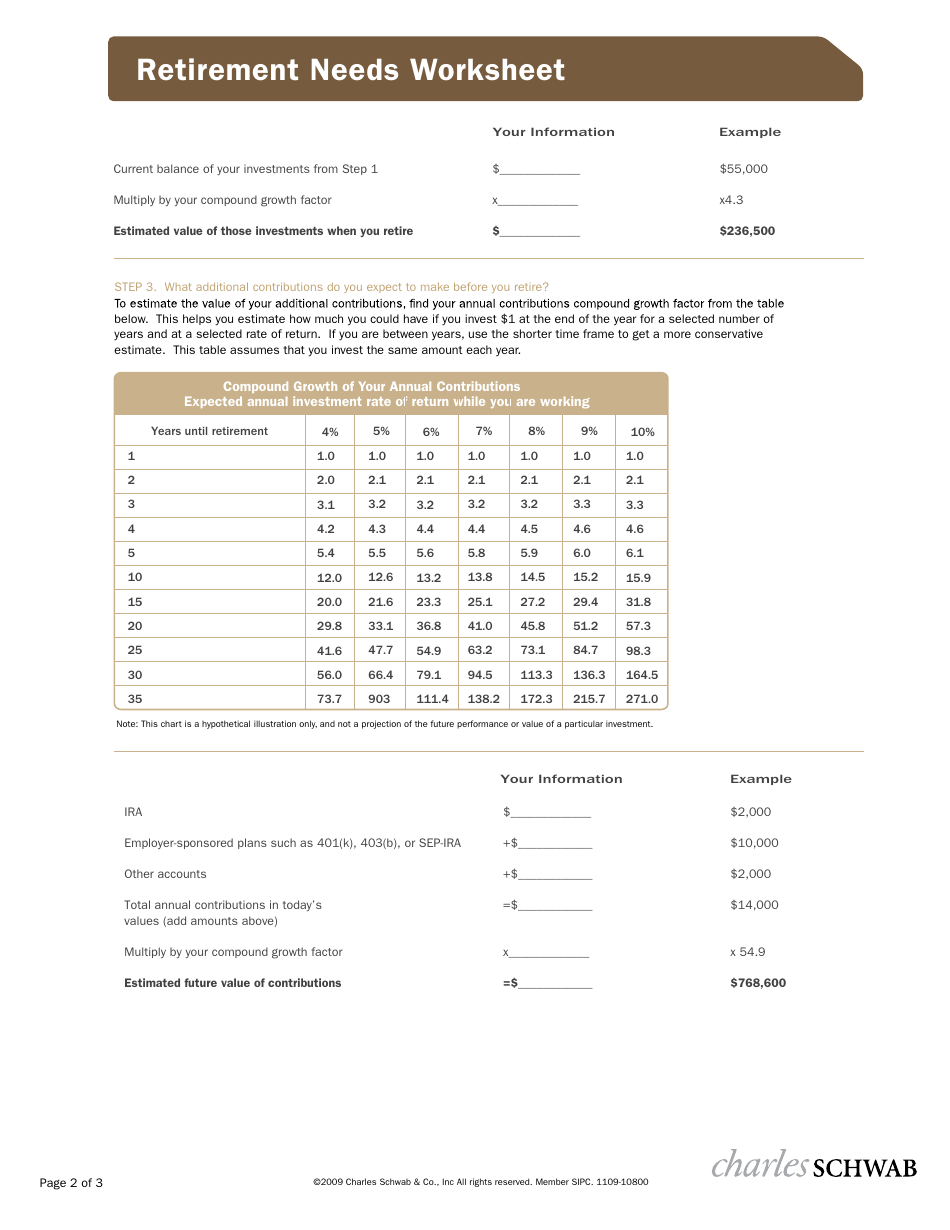

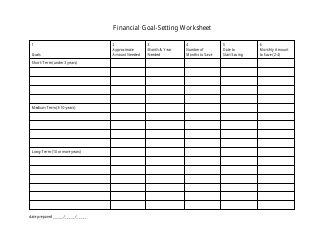

The Retirement Needs Worksheet Template provided by Charles Schwab is a tool that helps individuals assess their financial needs and goals for retirement. It enables them to evaluate their current savings, expenses, and future income sources to plan for a financially secure retirement.

FAQ

Q: What is the Retirement Needs Worksheet?

A: The Retirement Needs Worksheet is a tool provided by Charles Schwab to help individuals estimate their retirement expenses and income needs.

Q: What does the Retirement Needs Worksheet help determine?

A: The Retirement Needs Worksheet helps determine how much money you will need to save for retirement based on your desired lifestyle and expected expenses.

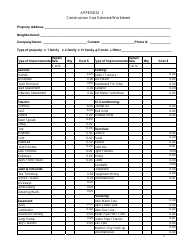

Q: What are some categories of expenses included in the Retirement Needs Worksheet?

A: Some categories of expenses included in the Retirement Needs Worksheet are housing, healthcare, transportation, travel, and leisure activities.

Q: Can the Retirement Needs Worksheet account for inflation?

A: Yes, the Retirement Needs Worksheet can account for inflation by adjusting future expenses based on projected inflation rates.

Q: Is the Retirement Needs Worksheet personalized?

A: Yes, the Retirement Needs Worksheet can be personalized by inputting your specific financial information and goals.

Q: Can the Retirement Needs Worksheet help me determine my retirement income needs?

A: Yes, the Retirement Needs Worksheet can help you determine your retirement income needs by considering factors such as Social Security benefits and investment income.

Q: Is the Retirement Needs Worksheet free to use?

A: Yes, the Retirement Needs Worksheet is provided free of charge by Charles Schwab.

Q: Can the Retirement Needs Worksheet be used for both the US and Canada?

A: Yes, the Retirement Needs Worksheet can be used for individuals in both the US and Canada, although specific tax and benefit considerations may vary.

Q: Is the Retirement Needs Worksheet a guarantee of future investment performance?

A: No, the Retirement Needs Worksheet is not a guarantee of future investment performance and should be used as a general estimate.

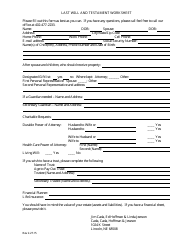

Q: What should I do after completing the Retirement Needs Worksheet?

A: After completing the Retirement Needs Worksheet, you may want to consult with a financial advisor to develop a comprehensive retirement plan based on your individual circumstances.