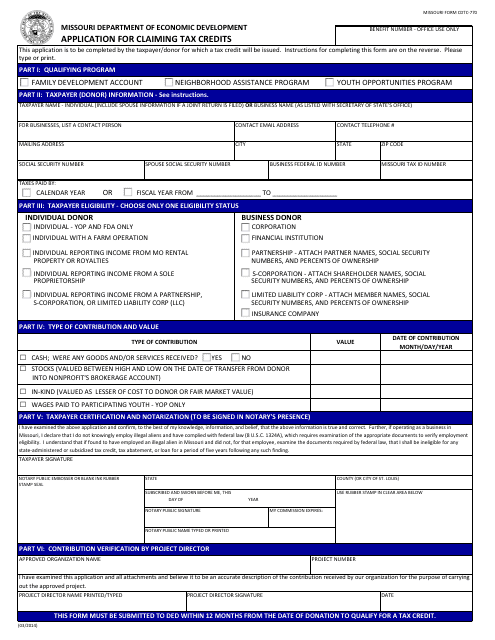

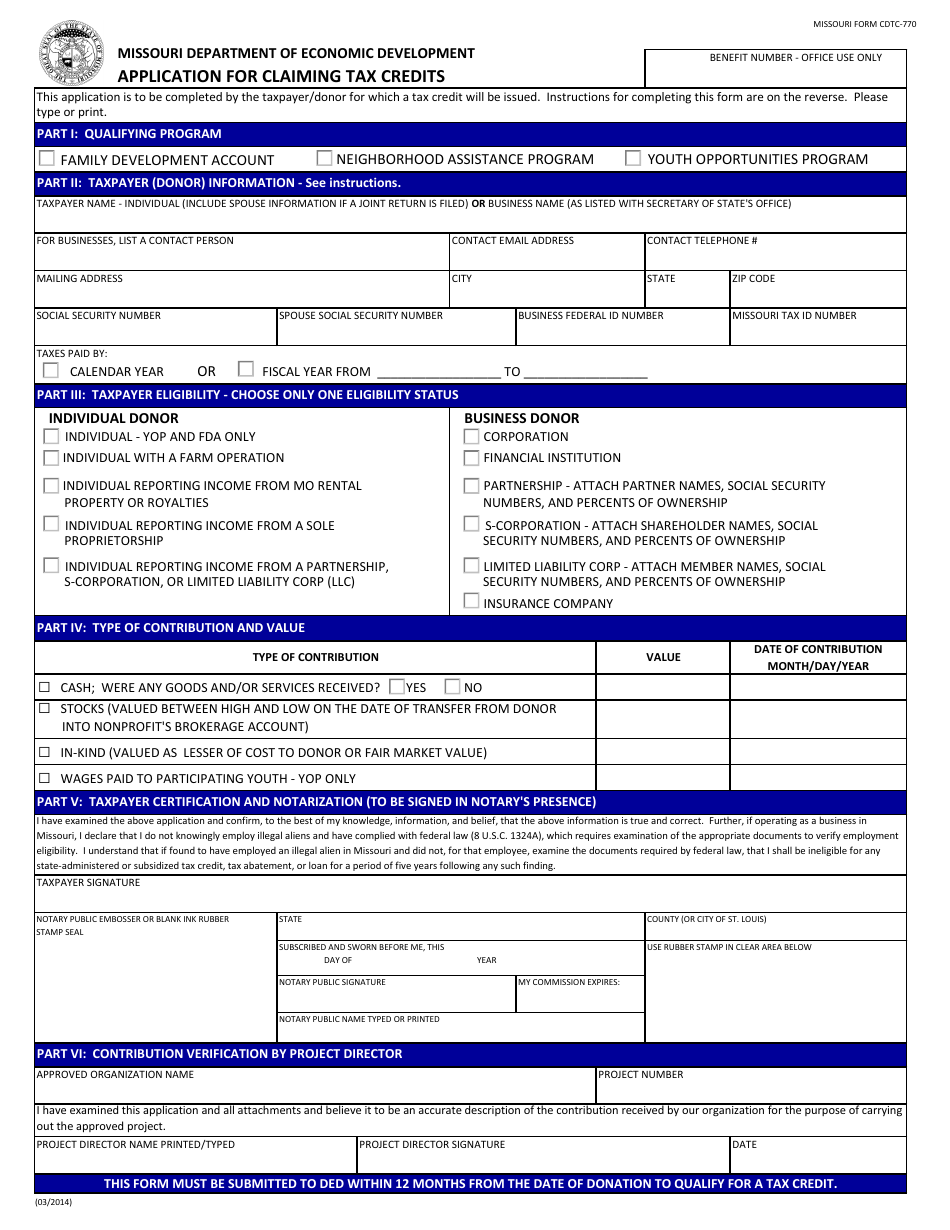

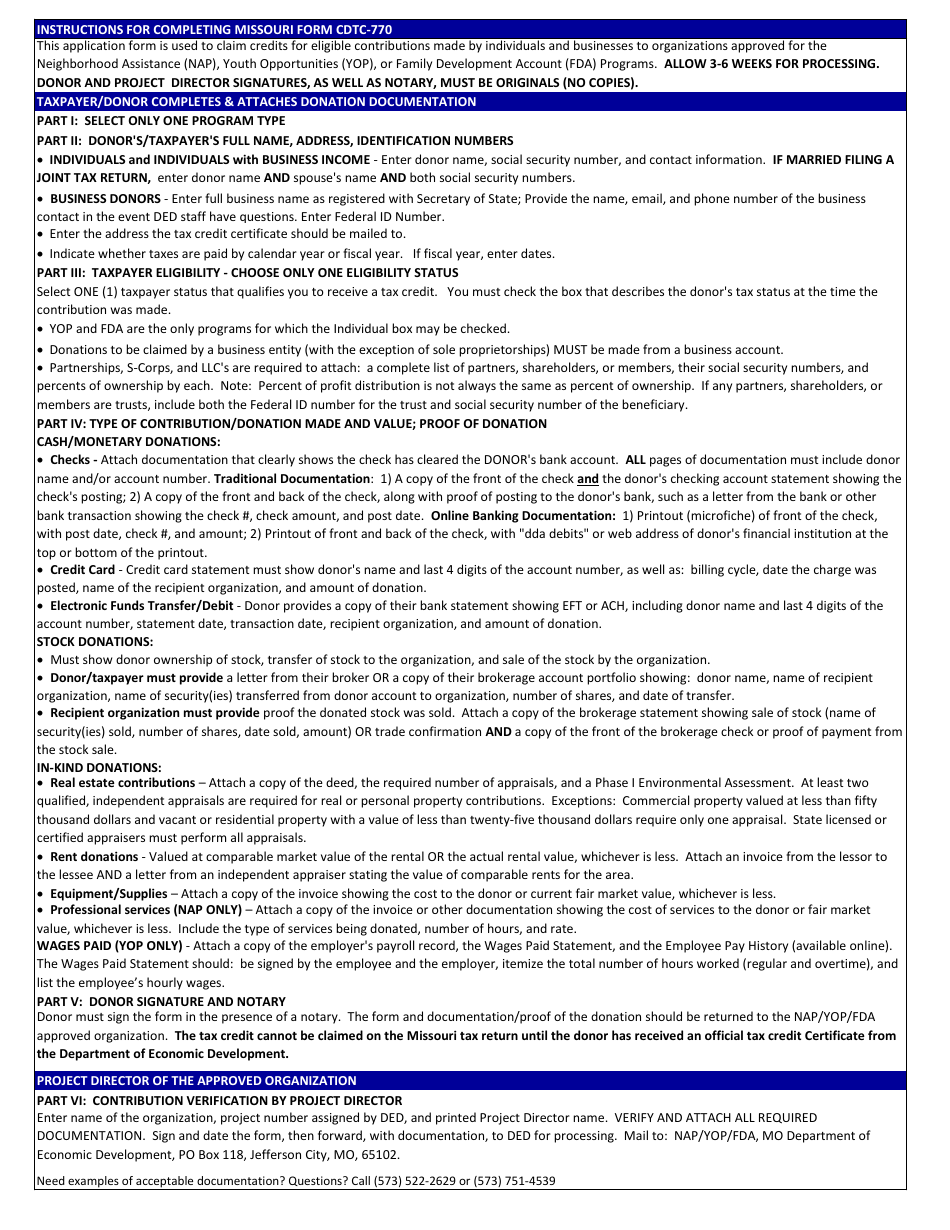

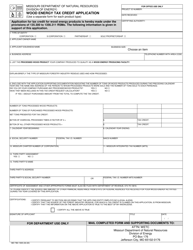

Form CDTC-770 Application for Claiming Tax Credits - Missouri

What Is Form CDTC-770?

This is a legal form that was released by the Missouri Department of Economic Development - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTC-770?

A: Form CDTC-770 is the application used for claiming tax credits in the state of Missouri.

Q: What does this form apply for?

A: This form applies for claiming tax credits.

Q: Who can use Form CDTC-770?

A: Any taxpayer who is eligible for tax credits in Missouri can use this form.

Q: What information do I need to provide on this form?

A: You will need to provide your personal information, details about the tax credit you are claiming, and any supporting documentation.

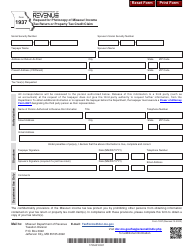

Q: When is the deadline for filing this form?

A: The deadline for filing Form CDTC-770 varies based on the specific tax credit being claimed. It is important to check with the Missouri Department of Revenue for the applicable deadline.

Q: Is there a fee for filing this form?

A: No, there is no fee for filing Form CDTC-770.

Q: What should I do if I need help filling out this form?

A: If you need help filling out Form CDTC-770, you can seek assistance from a tax professional or contact the Missouri Department of Revenue.

Form Details:

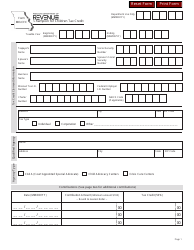

- Released on March 1, 2014;

- The latest edition provided by the Missouri Department of Economic Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CDTC-770 by clicking the link below or browse more documents and templates provided by the Missouri Department of Economic Development.