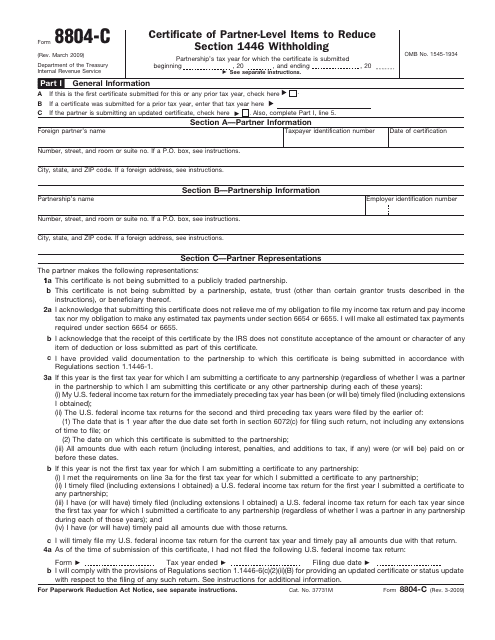

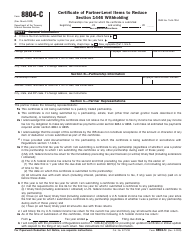

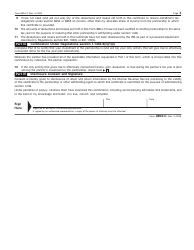

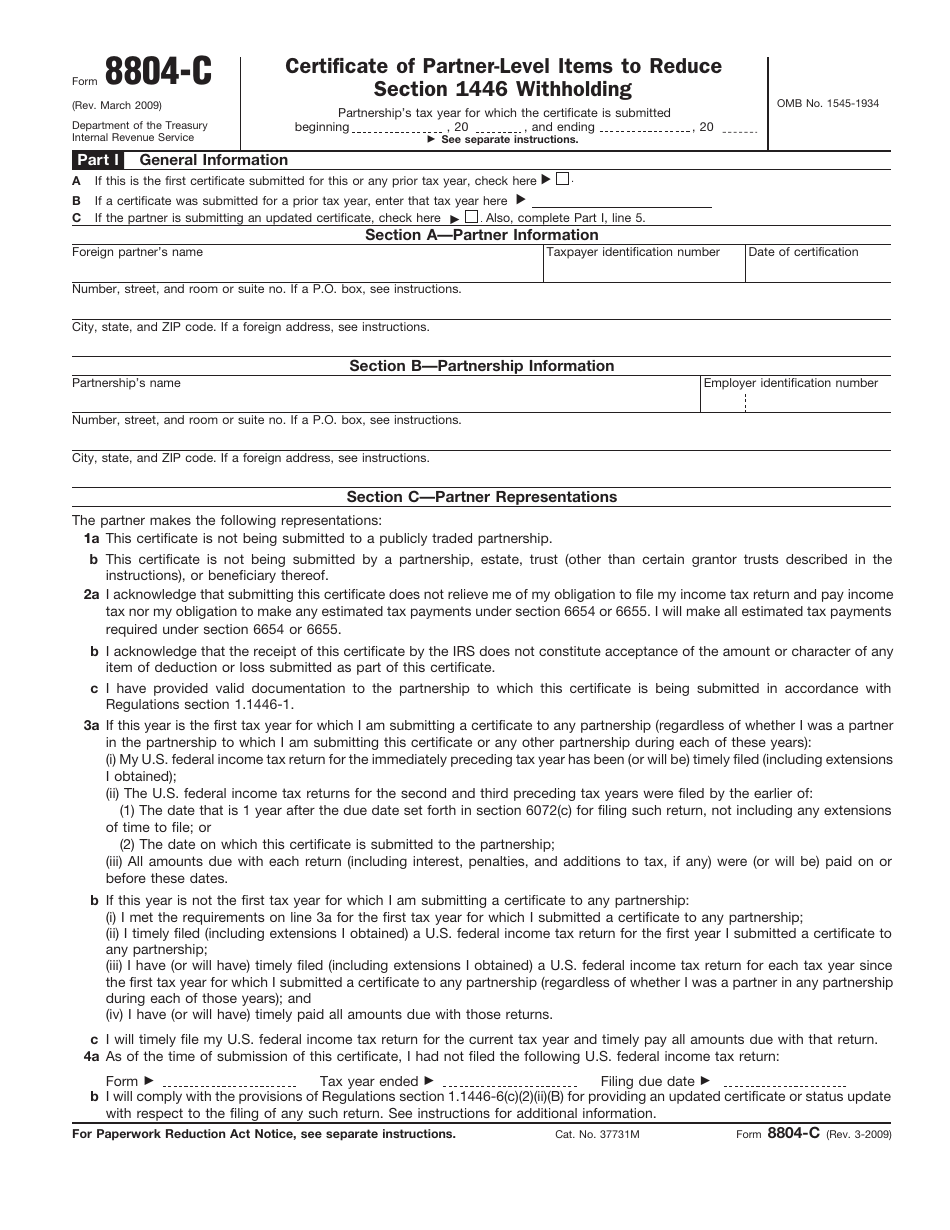

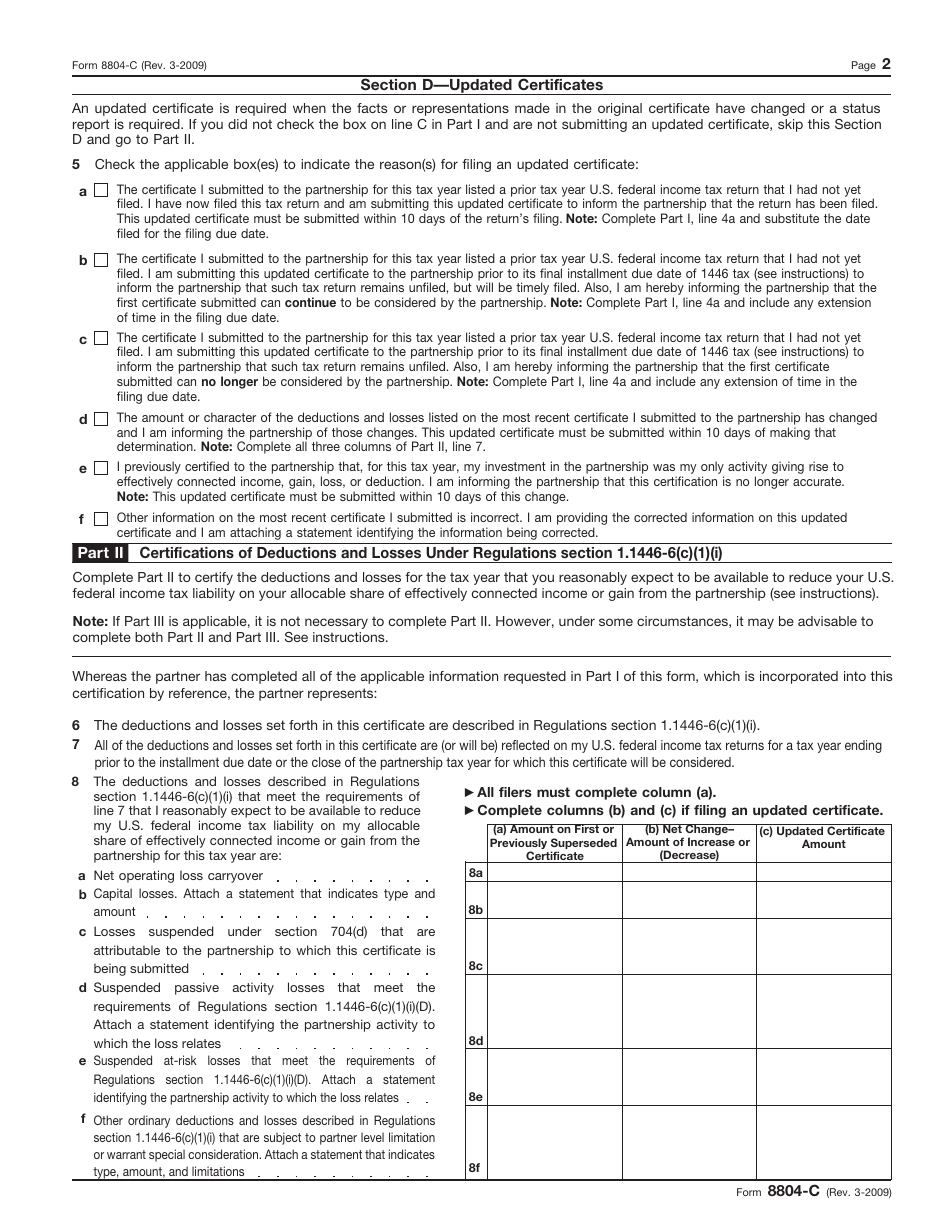

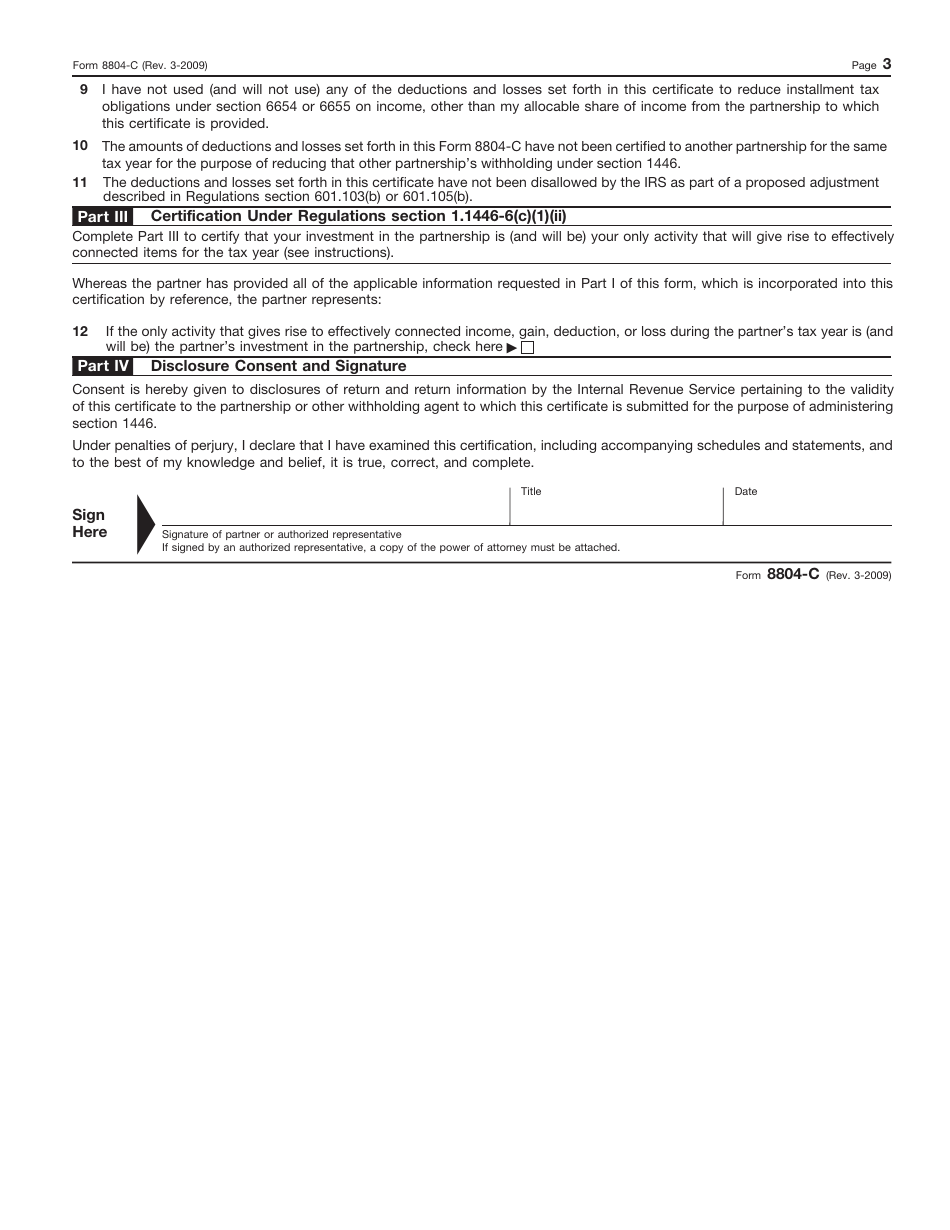

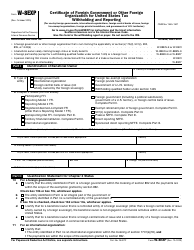

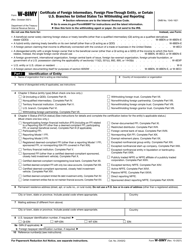

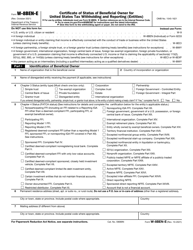

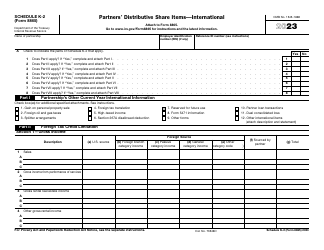

IRS Form 8804-C Certificate of Partner-Level Items to Reduce Section 1446 Withholding

What Is IRS Form 8804-C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2009. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8804-C?

A: IRS Form 8804-C is the Certificate of Partner-Level Items to Reduce Section 1446 Withholding.

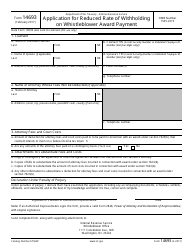

Q: Who needs to file IRS Form 8804-C?

A: Partners in a partnership that want to reduce their section 1446 withholding need to file IRS Form 8804-C.

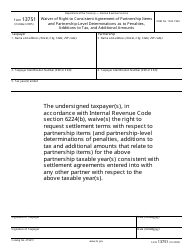

Q: What is section 1446 withholding?

A: Section 1446 withholding refers to the withholding of income tax on foreign partners' share of effectively connected income from a partnership.

Q: What is the purpose of IRS Form 8804-C?

A: The purpose of IRS Form 8804-C is to provide information about partners' distributive share items that are necessary to calculate the reduced withholding under section 1446.

Q: When should IRS Form 8804-C be filed?

A: IRS Form 8804-C should be filed with the partnership's Form 8804 for each partner who wants to reduce their section 1446 withholding.

Q: Are there any penalties for not filing IRS Form 8804-C?

A: Yes, there may be penalties for failing to file IRS Form 8804-C, so it's important to comply with the applicable filing requirements.

Q: What other forms may be required to be filed along with IRS Form 8804-C?

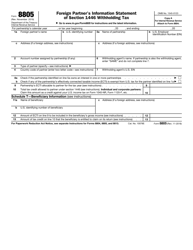

A: Partners may also need to file other forms, such as Form 8805, to report their distributive share of effectively connectedtaxable income and tax withheld.

Q: Can I electronically file IRS Form 8804-C?

A: Yes, the IRS allows electronic filing of Form 8804-C through the Modernized e-File (MeF) system, but certain requirements must be met.

Q: Who should I contact for further assistance regarding IRS Form 8804-C?

A: For further assistance with IRS Form 8804-C, you can contact the IRS or seek help from a tax professional.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8804-C through the link below or browse more documents in our library of IRS Forms.