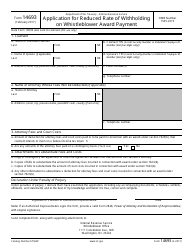

Instructions for IRS Form 8804-C Certificate of Partner-Level Items to Reduce Section 1446 Withholding

This document contains official instructions for IRS Form 8804-C , Certificate of Partner-Level Items to Reduce Section 1446 Withholding - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8804-C is available for download through this link.

FAQ

Q: What is IRS Form 8804-C?

A: IRS Form 8804-C is a certificate used to reduce Section 1446 withholding.

Q: What is Section 1446 withholding?

A: Section 1446 withholding is the withholding tax on effectively connected income of foreign partners in a partnership.

Q: Who needs to file Form 8804-C?

A: Partnerships that have foreign partners who qualify for a reduced withholding rate need to file Form 8804-C.

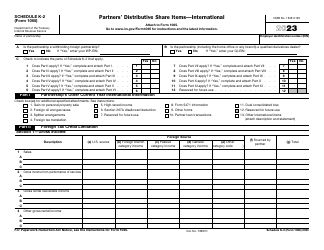

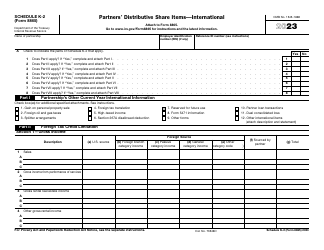

Q: What information is required on Form 8804-C?

A: Form 8804-C requires information about the partnership and its foreign partners, as well as the reduced withholding rate being claimed.

Q: When is the deadline for filing Form 8804-C?

A: The deadline for filing Form 8804-C is typically the same as the partnership's tax return due date, including extensions.

Q: What is the purpose of filing Form 8804-C?

A: The purpose of filing Form 8804-C is to provide the partnership's foreign partners with a reduced withholding rate on their share of effectively connected income.

Q: Are there any penalties for not filing Form 8804-C?

A: Yes, failure to file Form 8804-C may result in penalties imposed by the IRS.

Q: Can Form 8804-C be e-filed?

A: No, Form 8804-C cannot be e-filed and must be filed on paper.

Q: What should I do if I made an error on Form 8804-C?

A: If you made an error on Form 8804-C, you should file an amended Form 8804-C to correct the error.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.