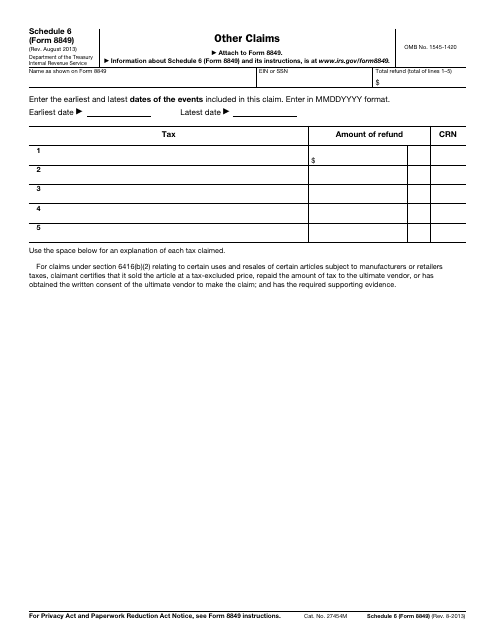

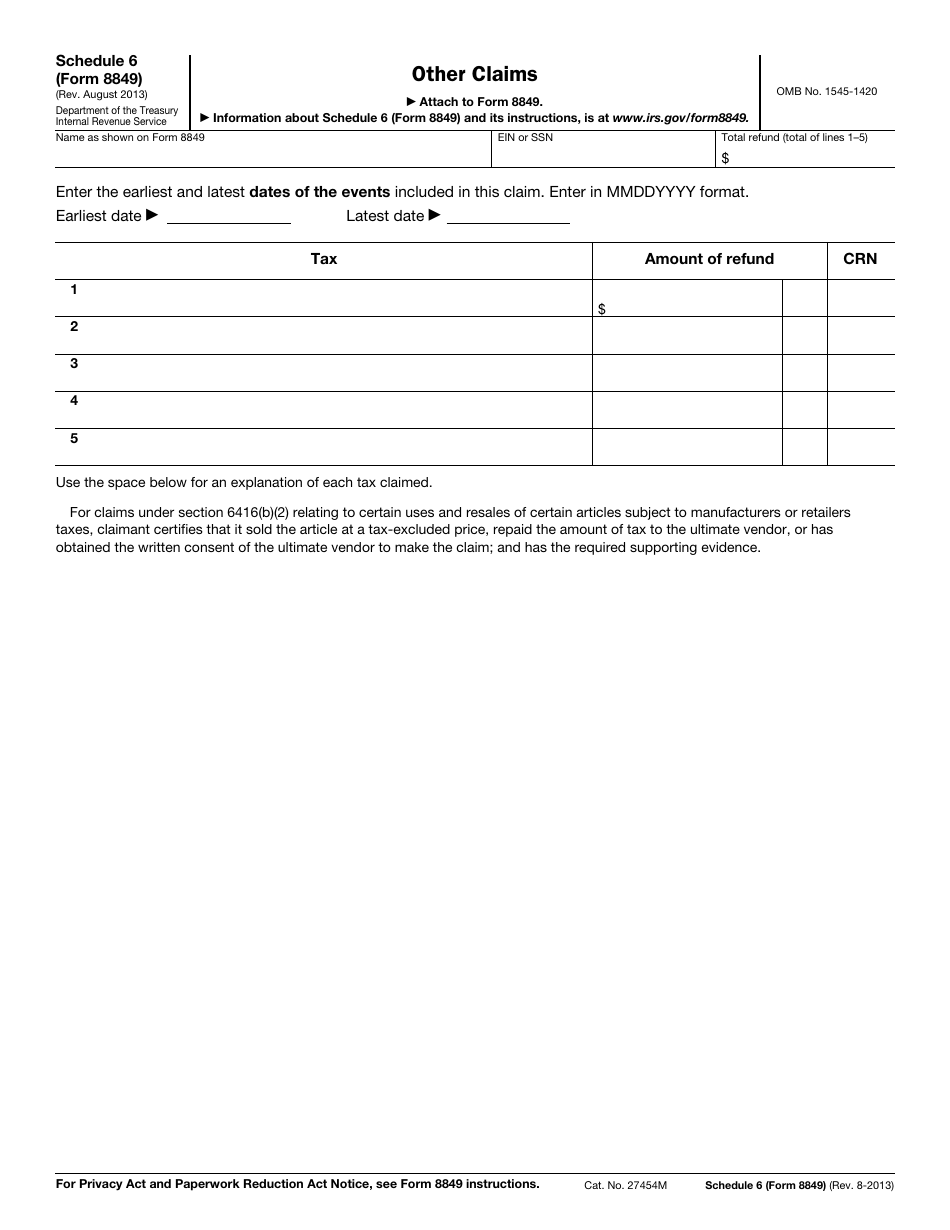

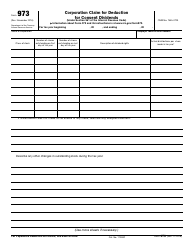

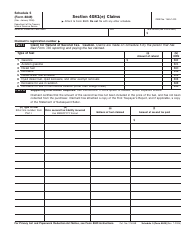

IRS Form 8849 Schedule 6 Other Claims

What Is IRS Form 8849 Schedule 6?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on August 1, 2013. The document is a supplement to IRS Form 8849, Claim for Refund of Excise Taxes. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8849 Schedule 6?

A: IRS Form 8849 Schedule 6 is a form used to claim other types of tax credits or refunds.

Q: What can I use IRS Form 8849 Schedule 6 for?

A: You can use IRS Form 8849 Schedule 6 to claim credits or refunds for certain excise taxes, including certain fuel-related taxes.

Q: How do I file IRS Form 8849 Schedule 6?

A: You can file IRS Form 8849 Schedule 6 by mail or electronically through the IRS e-file system.

Q: What documentation do I need to file IRS Form 8849 Schedule 6?

A: You will need supporting documentation, such as receipts or other proof of payment, to support your claim on IRS Form 8849 Schedule 6.

Q: When is the deadline for filing IRS Form 8849 Schedule 6?

A: The deadline for filing IRS Form 8849 Schedule 6 depends on the type of claim being made. It is important to check the specific instructions for the form or consult a tax professional.

Q: Can I claim a refund for past years using IRS Form 8849 Schedule 6?

A: No, IRS Form 8849 Schedule 6 can only be used to claim credits or refunds for the current tax year.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8849 Schedule 6 through the link below or browse more documents in our library of IRS Forms.