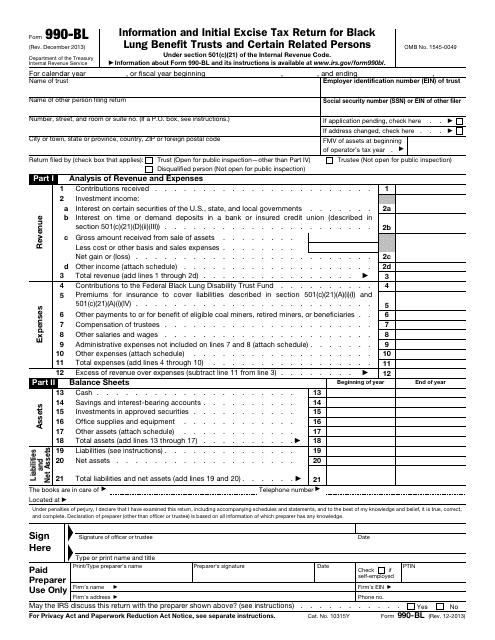

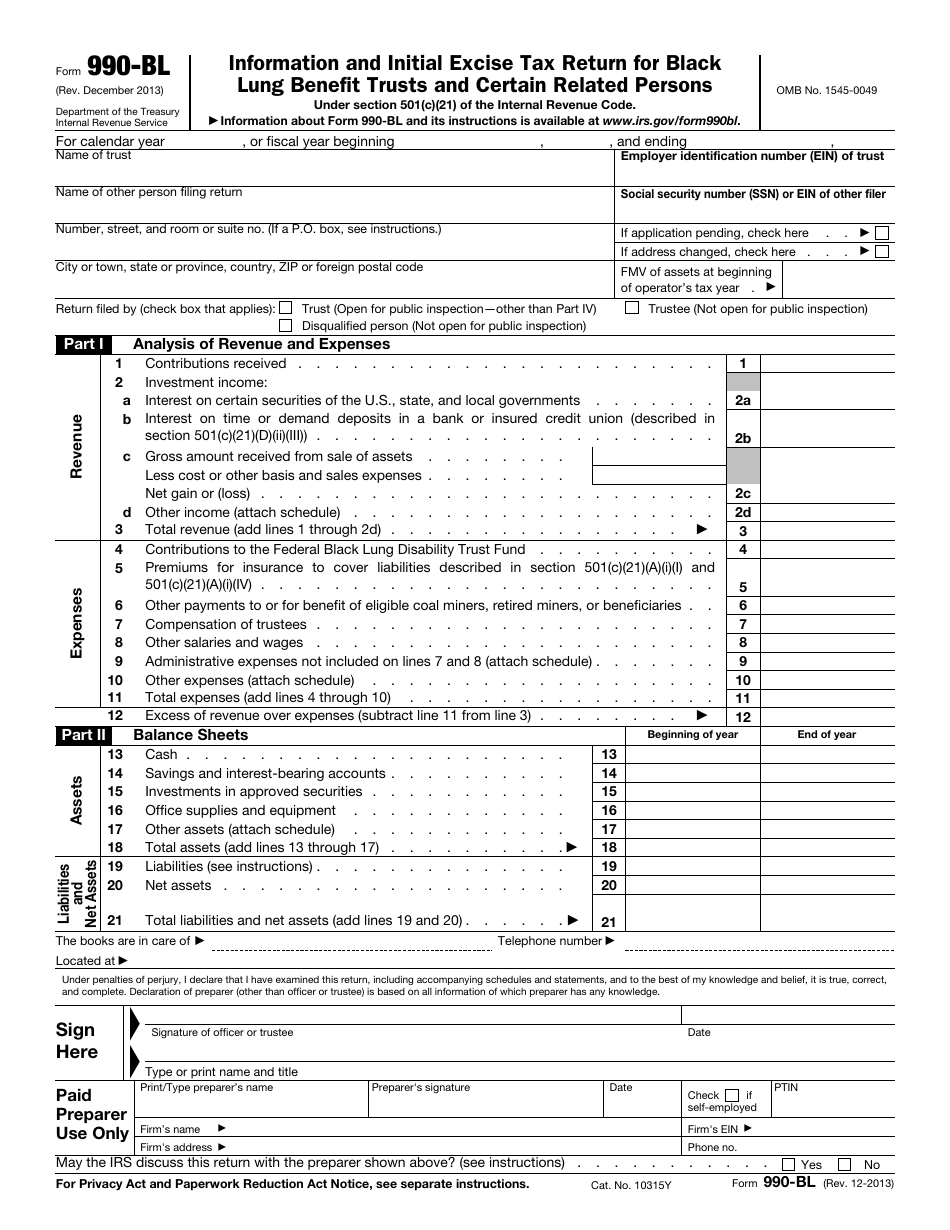

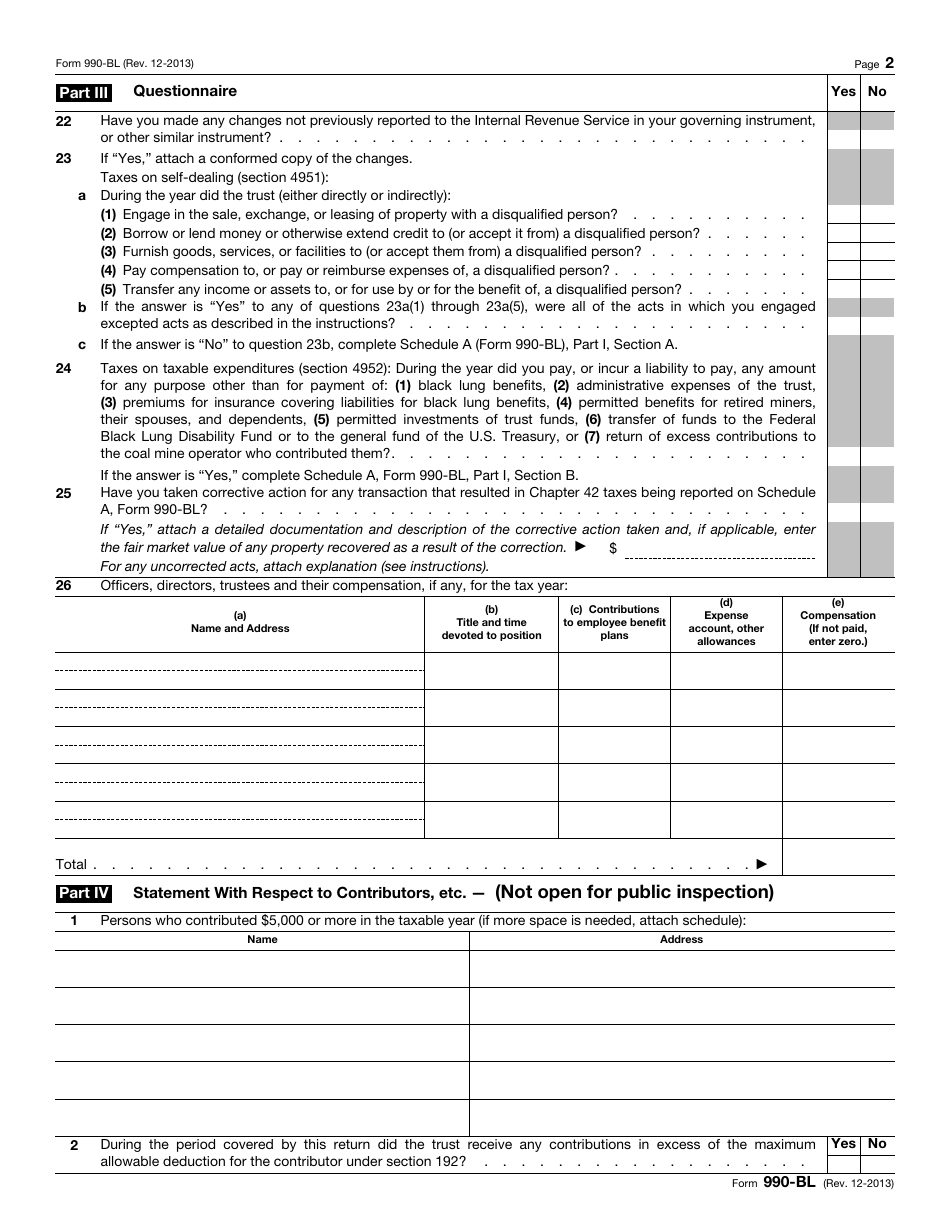

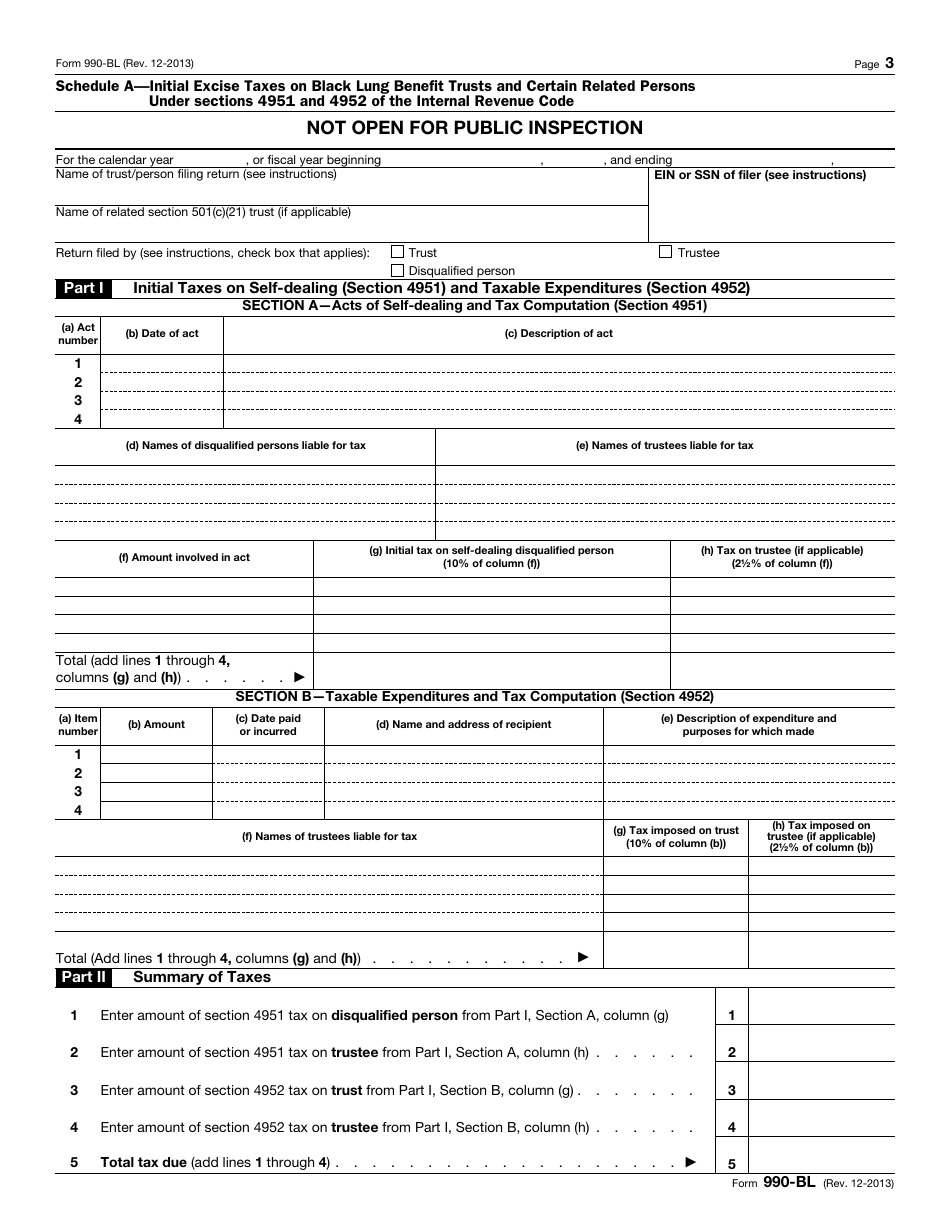

IRS Form 990-BL Information and Initial Excise Tax Return for Black Lung Benefit Trusts and Certain Related Persons

What Is IRS Form 990-BL?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2013. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990-BL?

A: IRS Form 990-BL is a form used for reporting information and paying the initial excise tax for Black Lung Benefit Trusts and certain related persons.

Q: Who needs to file IRS Form 990-BL?

A: Black Lung Benefit Trusts and certain related persons are required to file IRS Form 990-BL.

Q: What information needs to be reported on IRS Form 990-BL?

A: IRS Form 990-BL requires the reporting of information related to Black Lung Benefit Trusts and certain related persons, as well as payment of the initial excise tax.

Q: When is the deadline for filing IRS Form 990-BL?

A: The deadline for filing IRS Form 990-BL is generally the 15th day of the 5th month after the end of the trust's taxable year.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990-BL through the link below or browse more documents in our library of IRS Forms.