This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990-BL

for the current year.

Instructions for IRS Form 990-BL Information and Initial Excise Tax Return for Black Lung Benefit Trusts and Certain Related Persons

This document contains official instructions for IRS Form 990-BL , Information and Initial Excise Tax Return for Black Lung Benefit Trusts and Certain Related Persons - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990-BL is available for download through this link.

FAQ

Q: What is IRS Form 990-BL?

A: IRS Form 990-BL is a form used for reporting information and paying initial excise tax for Black Lung Benefit Trusts and certain related persons.

Q: Who needs to file IRS Form 990-BL?

A: Black Lung Benefit Trusts and certain related persons need to file IRS Form 990-BL.

Q: What information is required to be reported on Form 990-BL?

A: Form 990-BL requires information about the trust, the trust's activities, and any related person transactions.

Q: What is the purpose of the initial excise tax?

A: The initial excise tax is used to fund the Black Lung Disability Trust Fund.

Q: When is Form 990-BL due?

A: Form 990-BL is generally due by the 15th day of the 5th month after the end of the trust's tax year.

Q: Are there any penalties for not filing Form 990-BL?

A: Yes, there may be penalties for not filing Form 990-BL or for filing an incomplete or inaccurate return.

Q: Can I file Form 990-BL electronically?

A: Yes, you can file Form 990-BL electronically using the IRS's e-File system.

Q: Is there a fee for filing Form 990-BL?

A: No, there is no fee for filing Form 990-BL.

Instruction Details:

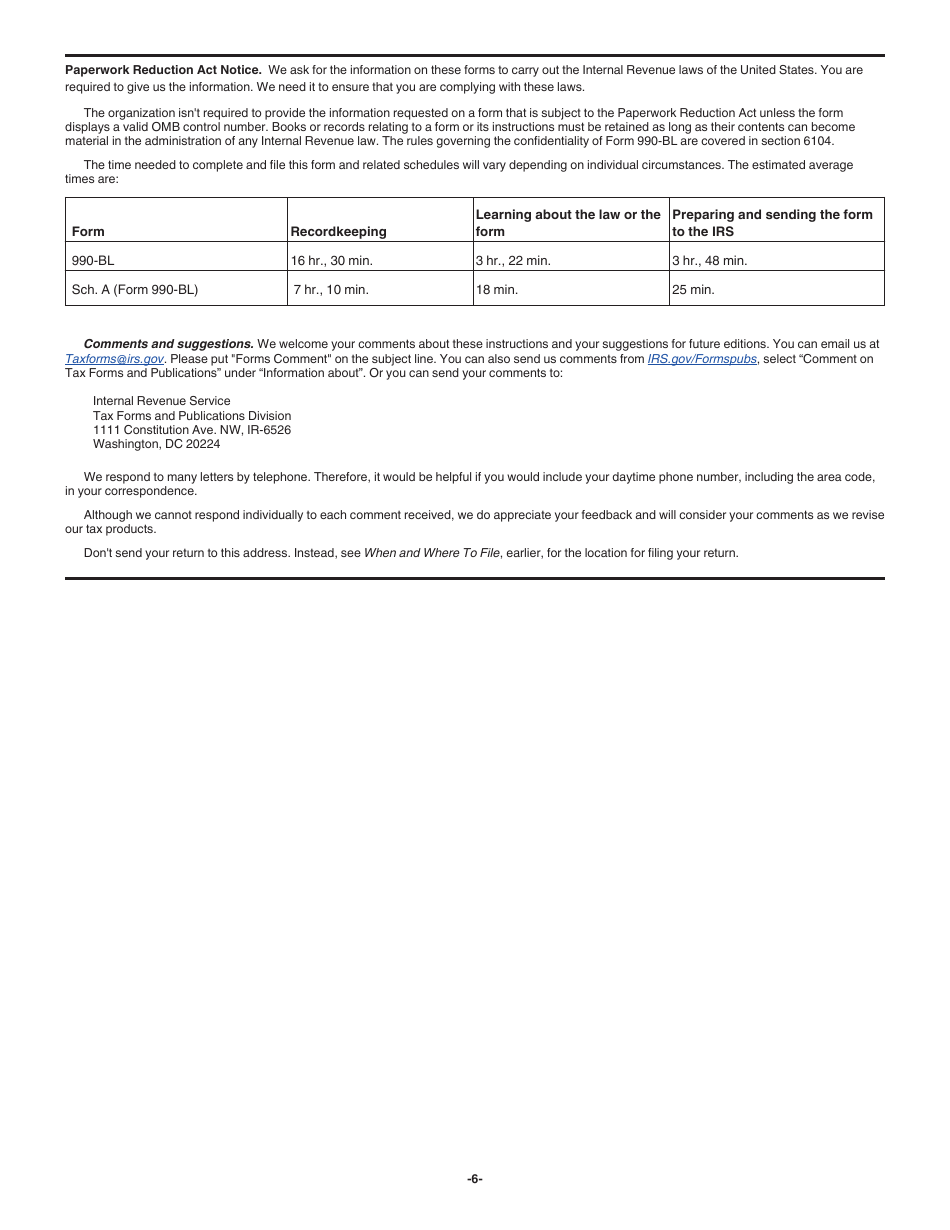

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.