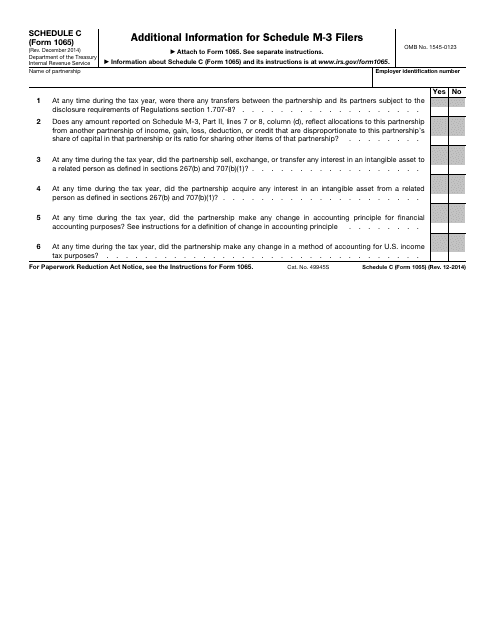

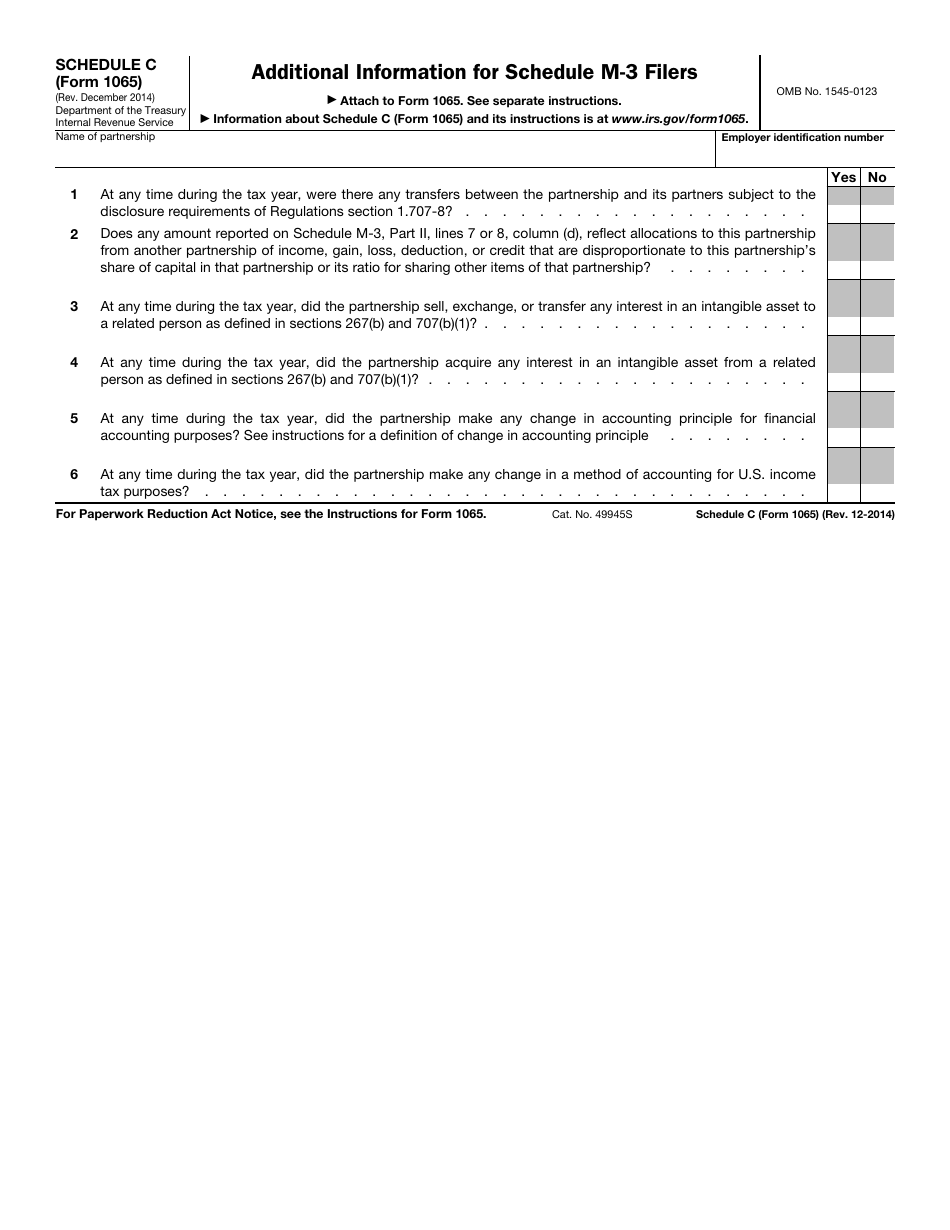

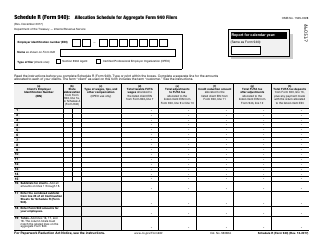

IRS Form 1065 Schedule C Additional Information for Schedule M-3 Filers

What Is IRS Form 1065 Schedule C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2014. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1065?

A: IRS Form 1065 is a tax return form used by partnerships to report their income, deductions, and other relevant information.

Q: What is Schedule C?

A: Schedule C is a supplemental form for Form 1065 used to report additional information for partnerships that are required to file Schedule M-3.

Q: What is Schedule M-3?

A: Schedule M-3 is an additional form used by partnerships to provide more detailed information about their financial activities.

Q: Who is required to file Schedule M-3?

A: Partnerships that meet certain financial thresholds are required to file Schedule M-3 along with their Form 1065.

Q: What is the purpose of Schedule C?

A: The purpose of Schedule C is to provide detailed information related to specific items reported on Schedule M-3.

Q: What kind of information is reported on Schedule C?

A: Schedule C requires partnerships to provide additional details about specific items such as guaranteed payments, capital contributions, and tax-exempt income.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1065 Schedule C through the link below or browse more documents in our library of IRS Forms.