This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8582-CR

for the current year.

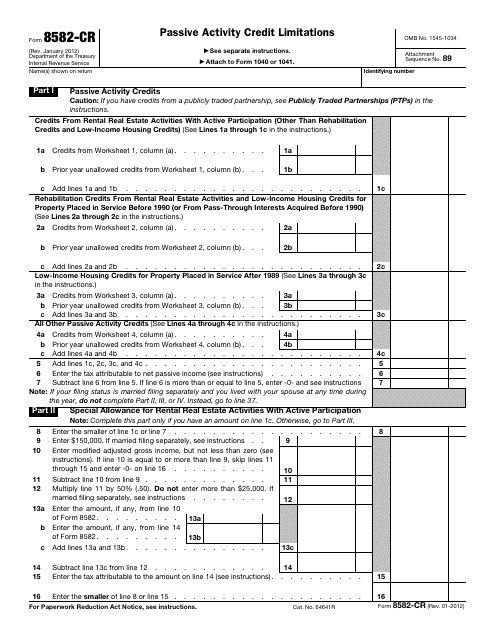

IRS Form 8582-CR Passive Activity Credit Limitations

What Is IRS Form 8582-CR?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2012. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8582-CR?

A: IRS Form 8582-CR is a form used to calculate the passive activity credit limitations.

Q: What are passive activity credit limitations?

A: Passive activity credit limitations are restrictions on the amount of passive activity credits you can claim.

Q: Who needs to file Form 8582-CR?

A: Individuals, estates, and trusts who have passive activity credit carryovers from previous years need to file Form 8582-CR.

Q: How do I fill out Form 8582-CR?

A: You need to follow the instructions provided by the IRS and enter the relevant information regarding your passive activities and credits.

Q: Can Form 8582-CR be filed electronically?

A: Yes, you can file Form 8582-CR electronically if you are using tax software or a tax professional.

Q: What happens if I don't file Form 8582-CR?

A: If you have passive activity credit carryovers and don't file Form 8582-CR, you may not be able to claim those credits in the current or future years.

Q: When is Form 8582-CR due?

A: Form 8582-CR is generally due on the same date as your regular income tax return, which is usually April 15.

Q: Can I claim passive activity credits if I don't have any passive activity losses?

A: No, you can only claim passive activity credits if you have passive activity losses to offset.

Q: What is the purpose of the passive activity credit?

A: The passive activity credit is designed to encourage investment in certain activities that generate passive income.

Form Details:

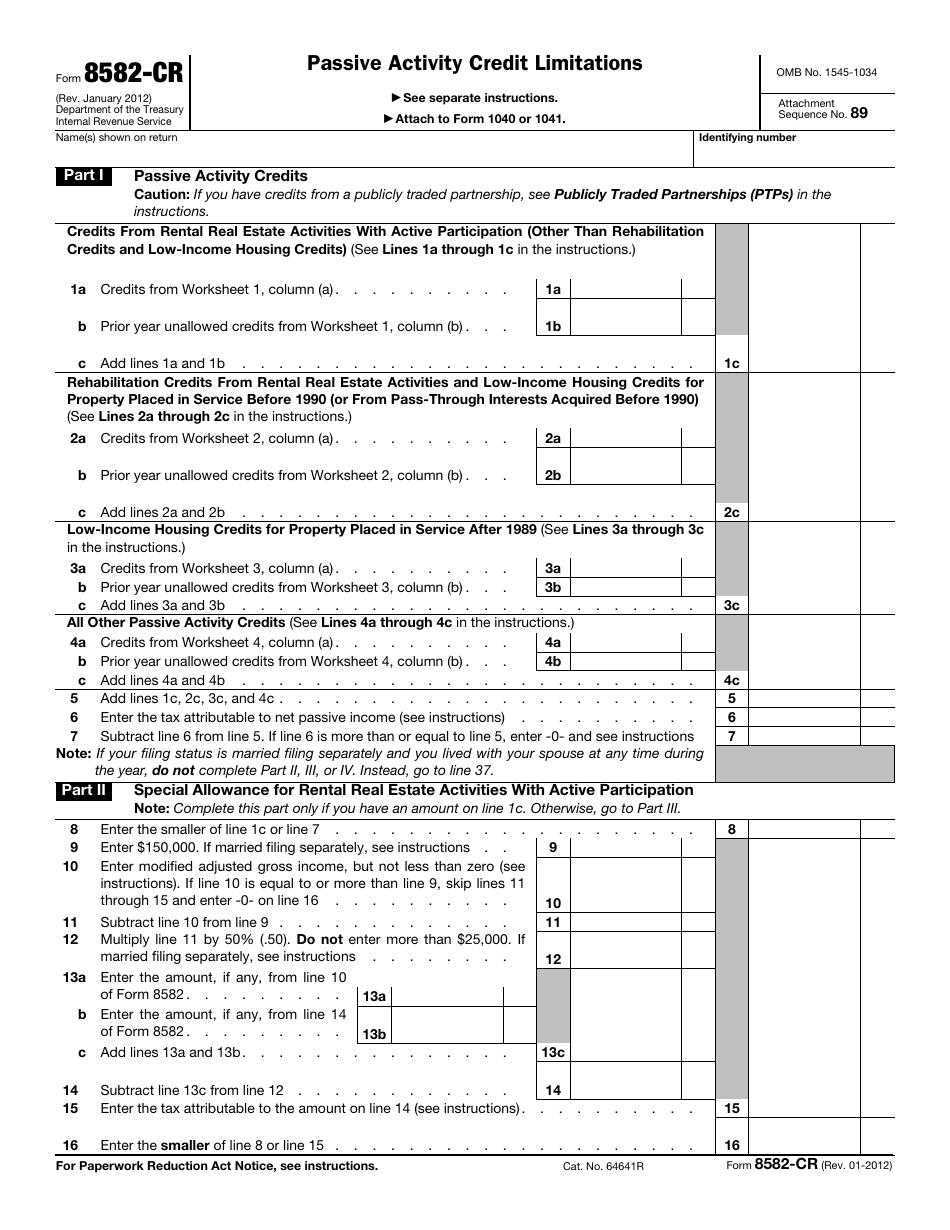

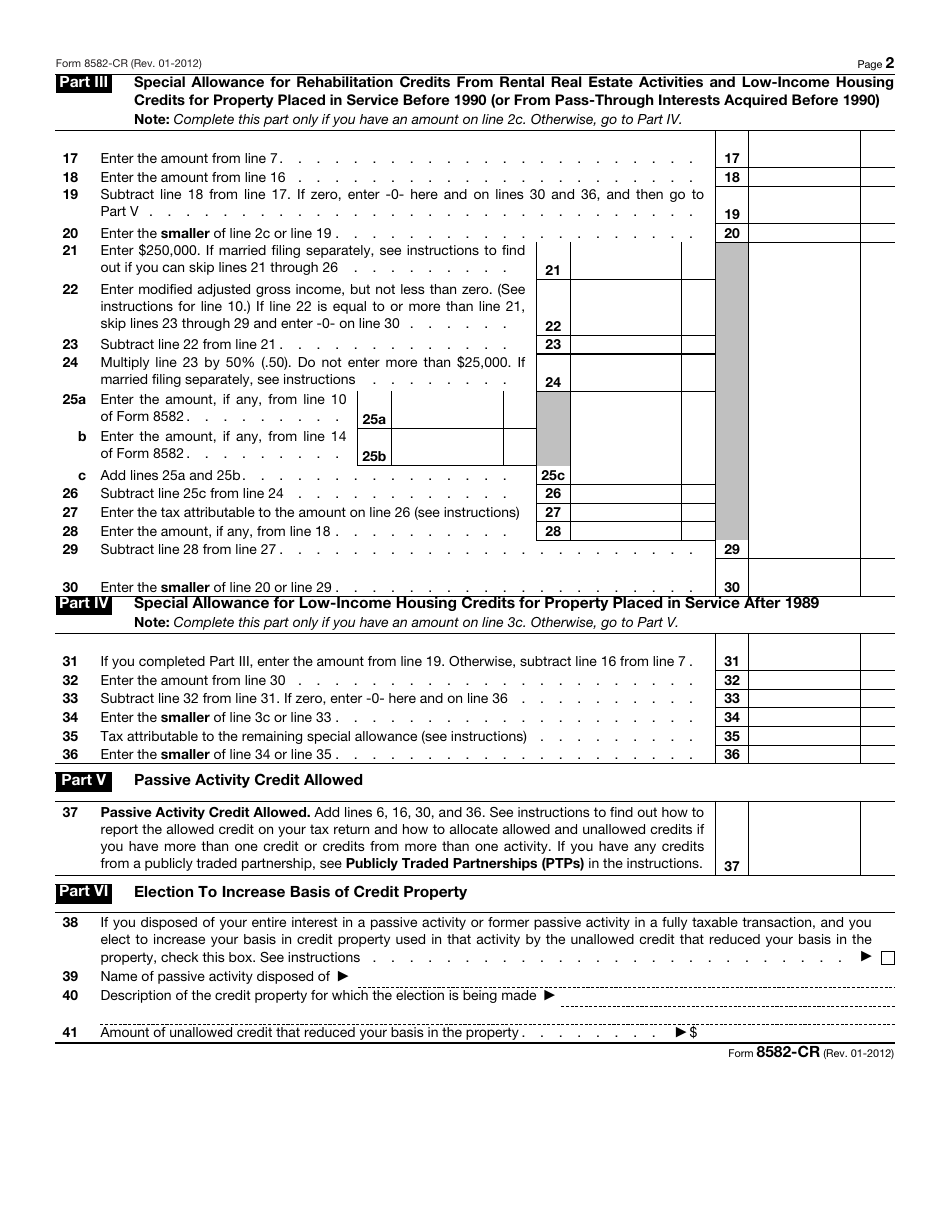

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8582-CR through the link below or browse more documents in our library of IRS Forms.