This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8582-CR

for the current year.

Instructions for IRS Form 8582-CR Passive Activity Credit Limitations

This document contains official instructions for IRS Form 8582-CR , Passive Activity Credit Limitations - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8582-CR is available for download through this link.

FAQ

Q: What is Form 8582-CR?

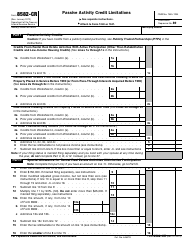

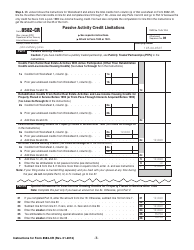

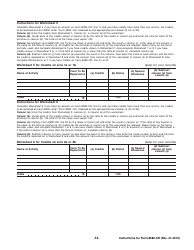

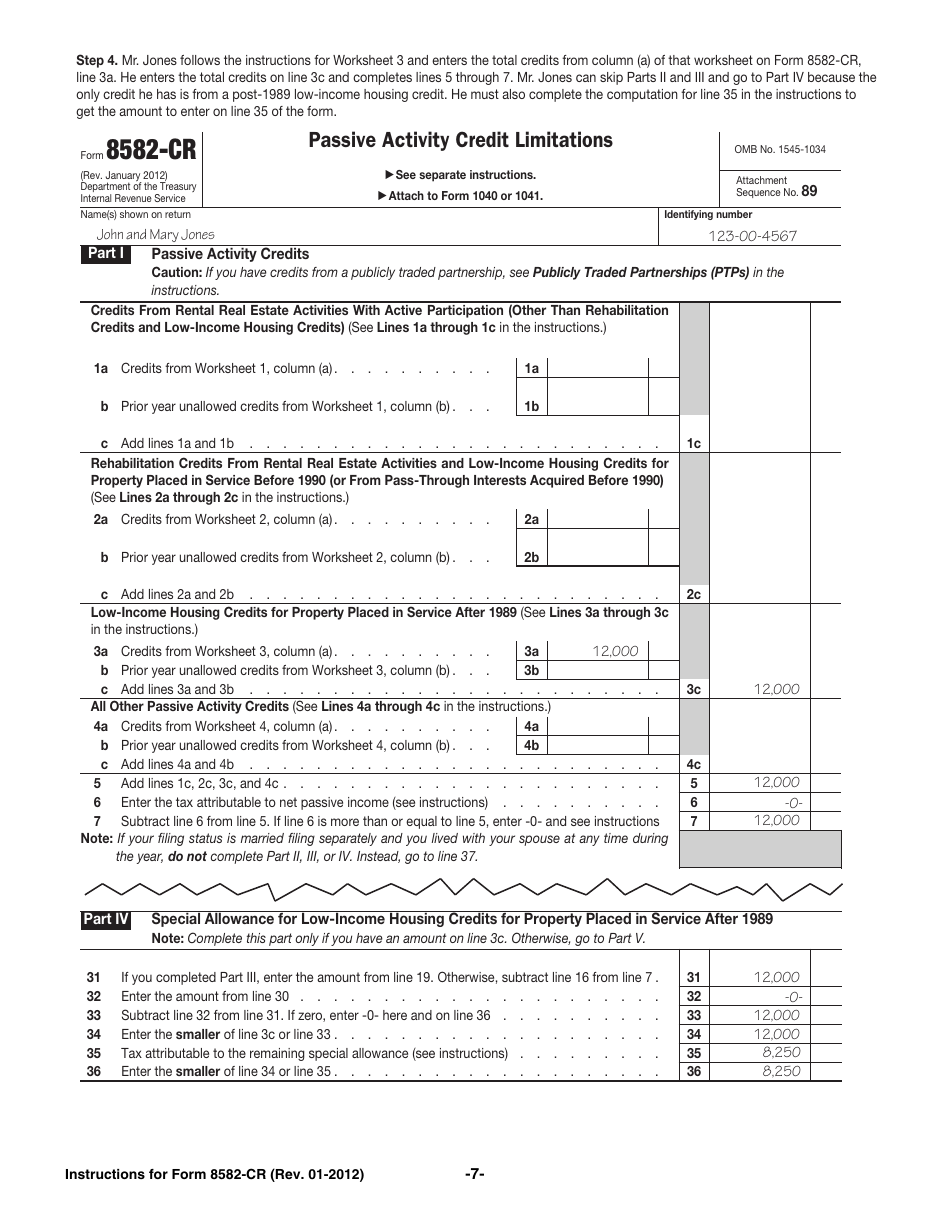

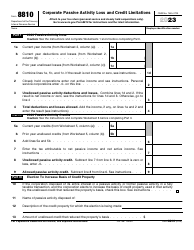

A: Form 8582-CR is used to calculate the passive activitycredit limitations.

Q: What are passive activity credits?

A: Passive activity credits are tax credits that are earned from certain types of passive investments or activities.

Q: Why are there limitations on passive activity credits?

A: There are limitations on passive activity credits to prevent taxpayers from using these credits to offset income from non-passive sources.

Q: Who needs to file Form 8582-CR?

A: Individuals, estates, and trusts that have passive activity credits or losses need to file Form 8582-CR.

Q: Are there any exceptions to the passive activity credit limitations?

A: Yes, there are certain exceptions to the limitations, such as credits from low-income housing, historic rehabilitation, and renewable energy investments.

Q: How do I fill out Form 8582-CR?

A: You need to complete Part I to determine your allowed passive activity credits, and then carry them over to your tax return.

Q: When is the deadline to file Form 8582-CR?

A: Form 8582-CR is typically filed with your tax return, so the deadline will coincide with the deadline for filing your tax return.

Q: What happens if I don't file Form 8582-CR?

A: If you have passive activity credits or losses and don't file Form 8582-CR, you may not be able to claim those credits or losses on your tax return.

Instruction Details:

- This 16-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.