This version of the form is not currently in use and is provided for reference only. Download this version of

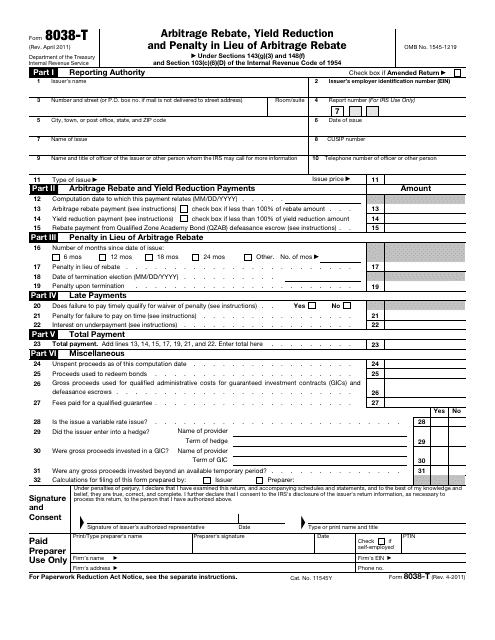

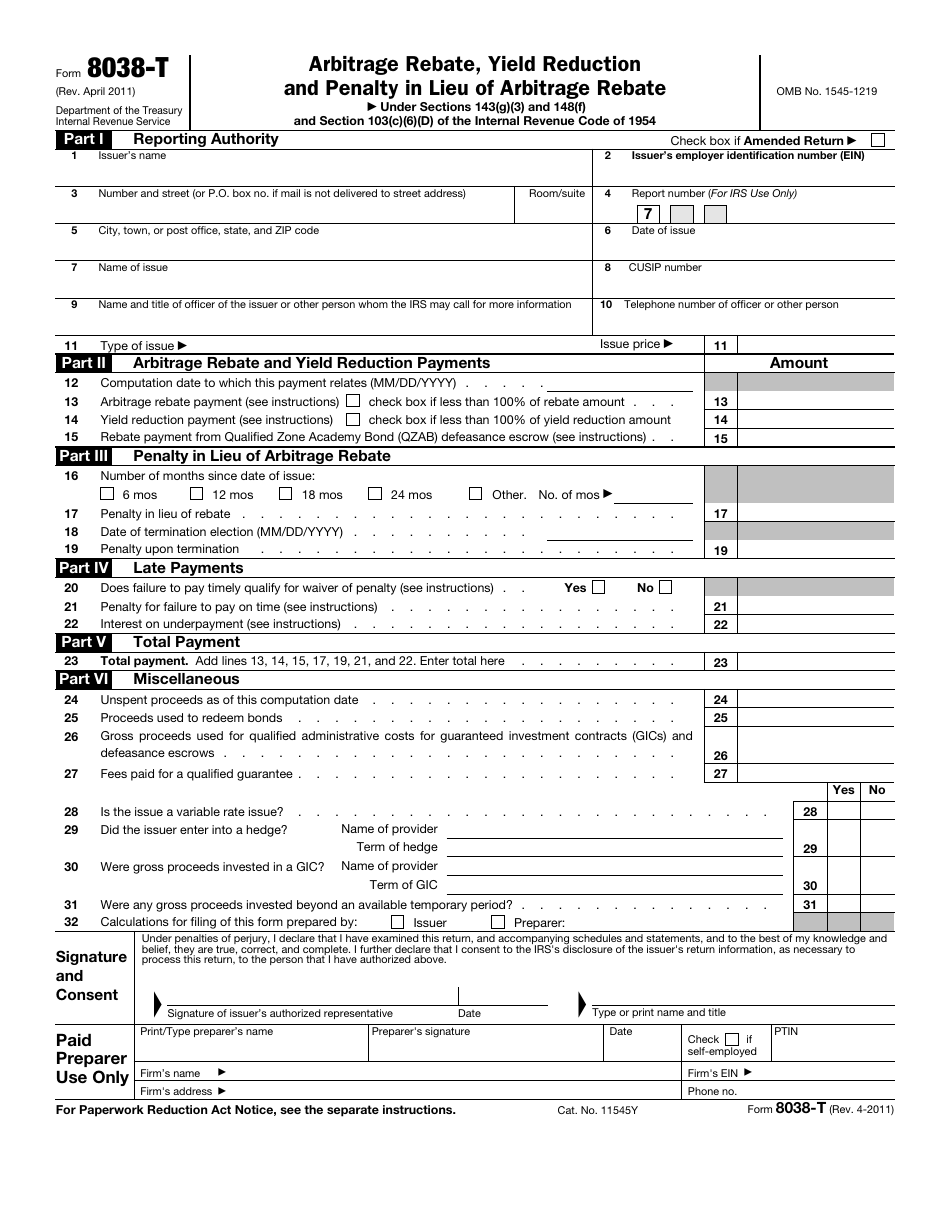

IRS Form 8038-T

for the current year.

IRS Form 8038-T Arbitrage Rebate, Yield Reduction and Penalty in Lieu of Arbitrage Rebate

What Is IRS Form 8038-T?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2011. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8038-T?

A: IRS Form 8038-T is a form used to report arbitrage rebate, yield reduction, and penalty in lieu of arbitrage rebate.

Q: What is arbitrage rebate?

A: Arbitrage rebate is the payment a municipality or issuer of tax-exempt bonds may have to make to the IRS if they earn arbitrage on the invested bond proceeds.

Q: What is yield reduction?

A: Yield reduction refers to the reduction in the yield on investments made with tax-exempt bond proceeds to avoid generating excess earnings subject to arbitrage rebate.

Q: What is penalty in lieu of arbitrage rebate?

A: Penalty in lieu of arbitrage rebate is an alternative payment that may be required if a municipality or issuer does not meet certain requirements for arbitrage rebate calculations.

Q: Who needs to file IRS Form 8038-T?

A: Municipalities or issuers of tax-exempt bonds who are subject to arbitrage rebate or yield reduction requirements need to file IRS Form 8038-T.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8038-T through the link below or browse more documents in our library of IRS Forms.