This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8038-T

for the current year.

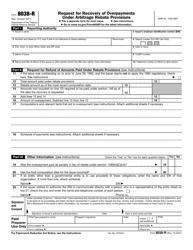

Instructions for IRS Form 8038-T Arbitrage Rebate, Yield Reduction and Penalty in Lieu of Arbitrage Rebate

This document contains official instructions for IRS Form 8038-T , Arbitrage Rebate, Yield Reduction and Penalty in Lieu of Arbitrage Rebate - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8038-T is available for download through this link.

FAQ

Q: What is IRS Form 8038-T?

A: IRS Form 8038-T is a form used to report arbitrage rebate, yield reduction, and penalty in lieu of arbitrage rebate.

Q: What is arbitrage rebate?

A: Arbitrage rebate refers to the payment made to the IRS to compensate for any investment earnings on tax-exempt bonds.

Q: What is yield reduction?

A: Yield reduction is a reduction of the bond yield resulting from the use of certain investment strategies.

Q: Who should file IRS Form 8038-T?

A: Anyone who has issued tax-exempt bonds and engaged in arbitrage, yield reduction, or penalty in lieu of arbitrage rebate must file this form.

Q: What are the penalties for not filing IRS Form 8038-T?

A: The penalties for not filing this form can include monetary fines and possible loss of tax-exempt status for the bonds.

Q: When is the deadline for filing IRS Form 8038-T?

A: The deadline for filing this form is determined by the specific instructions provided with the form and can vary depending on your situation.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.