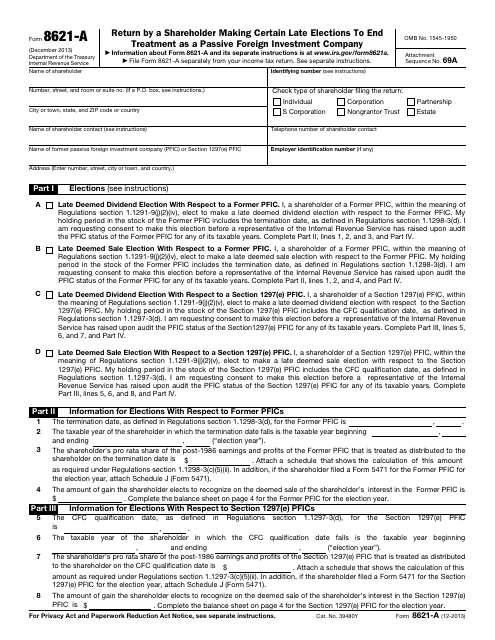

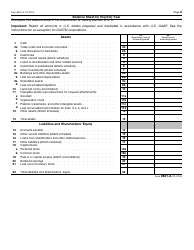

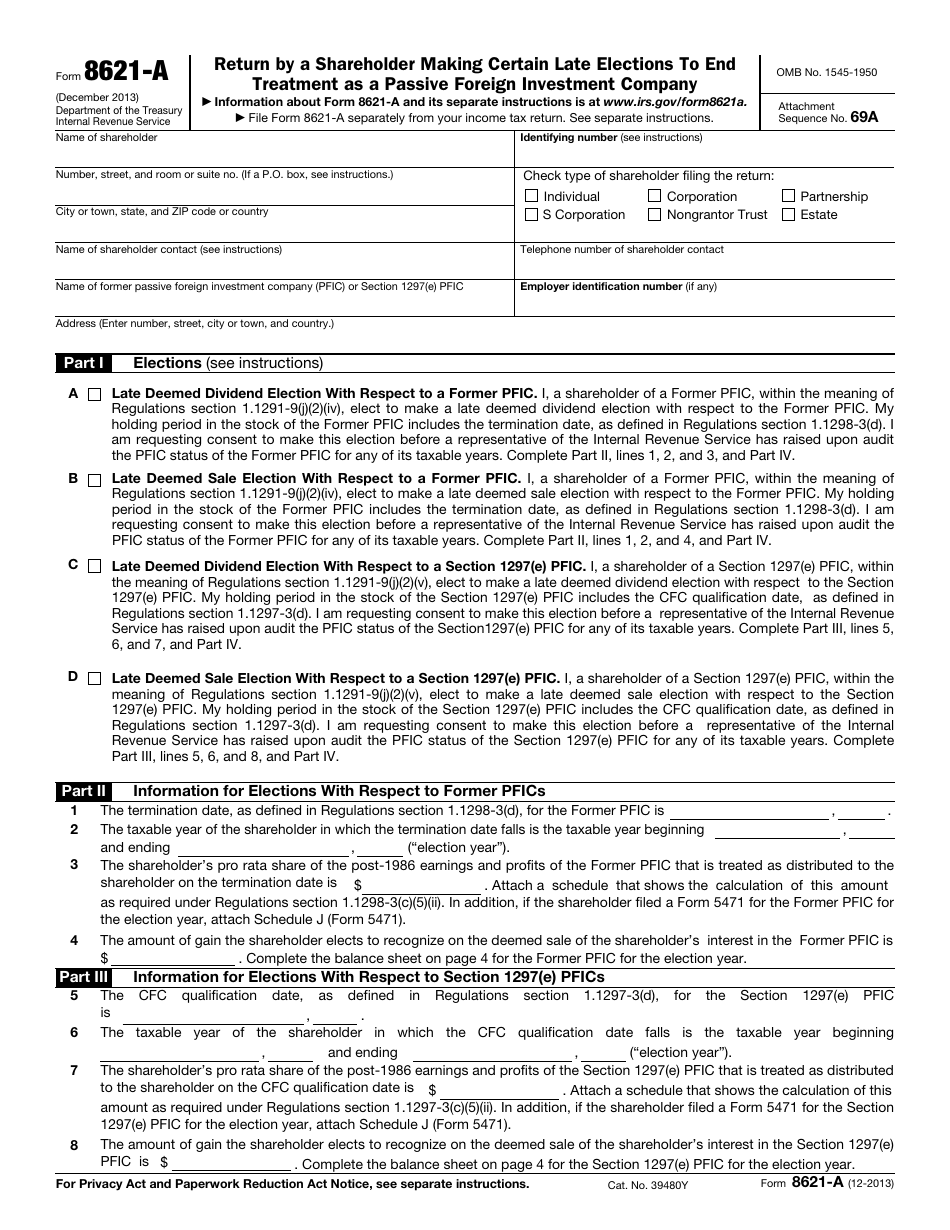

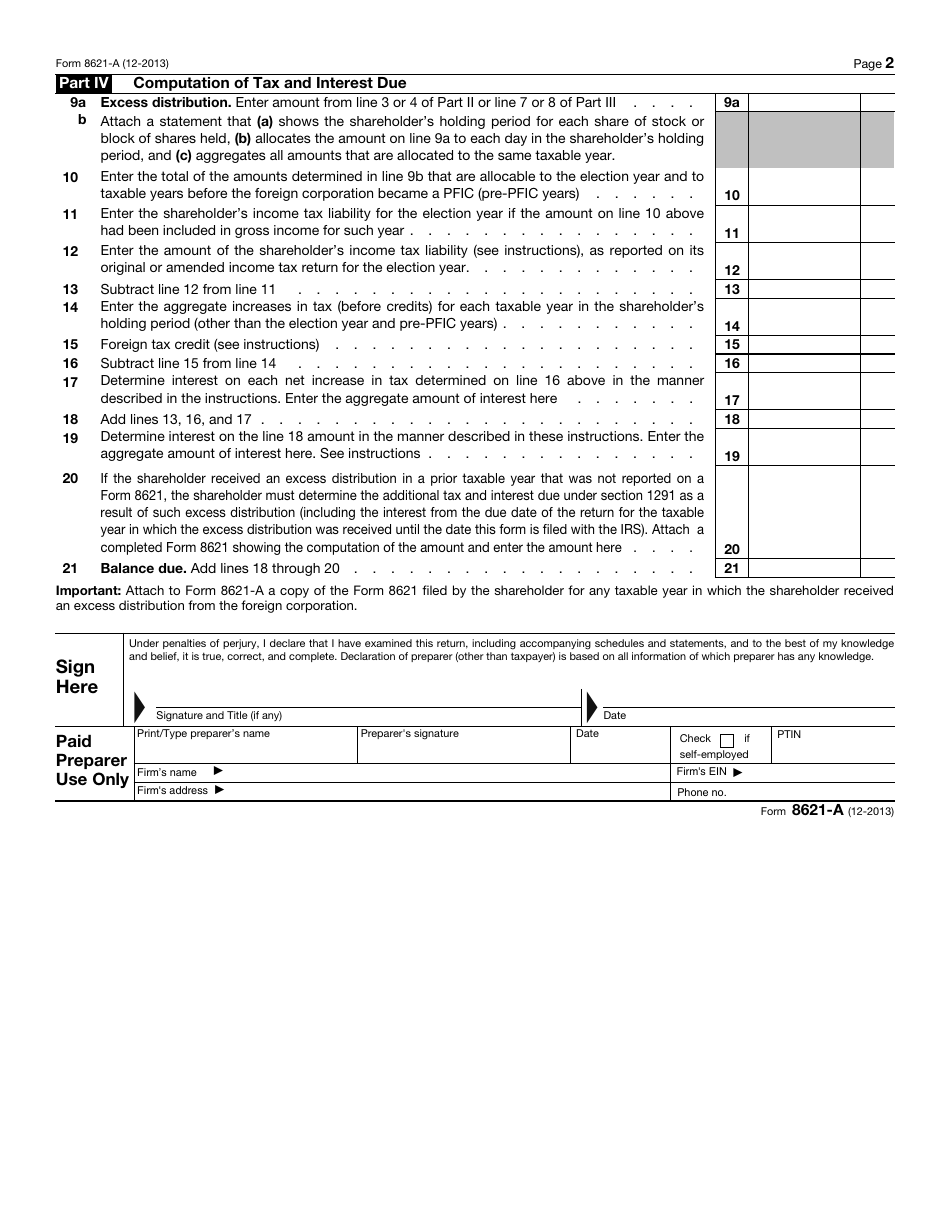

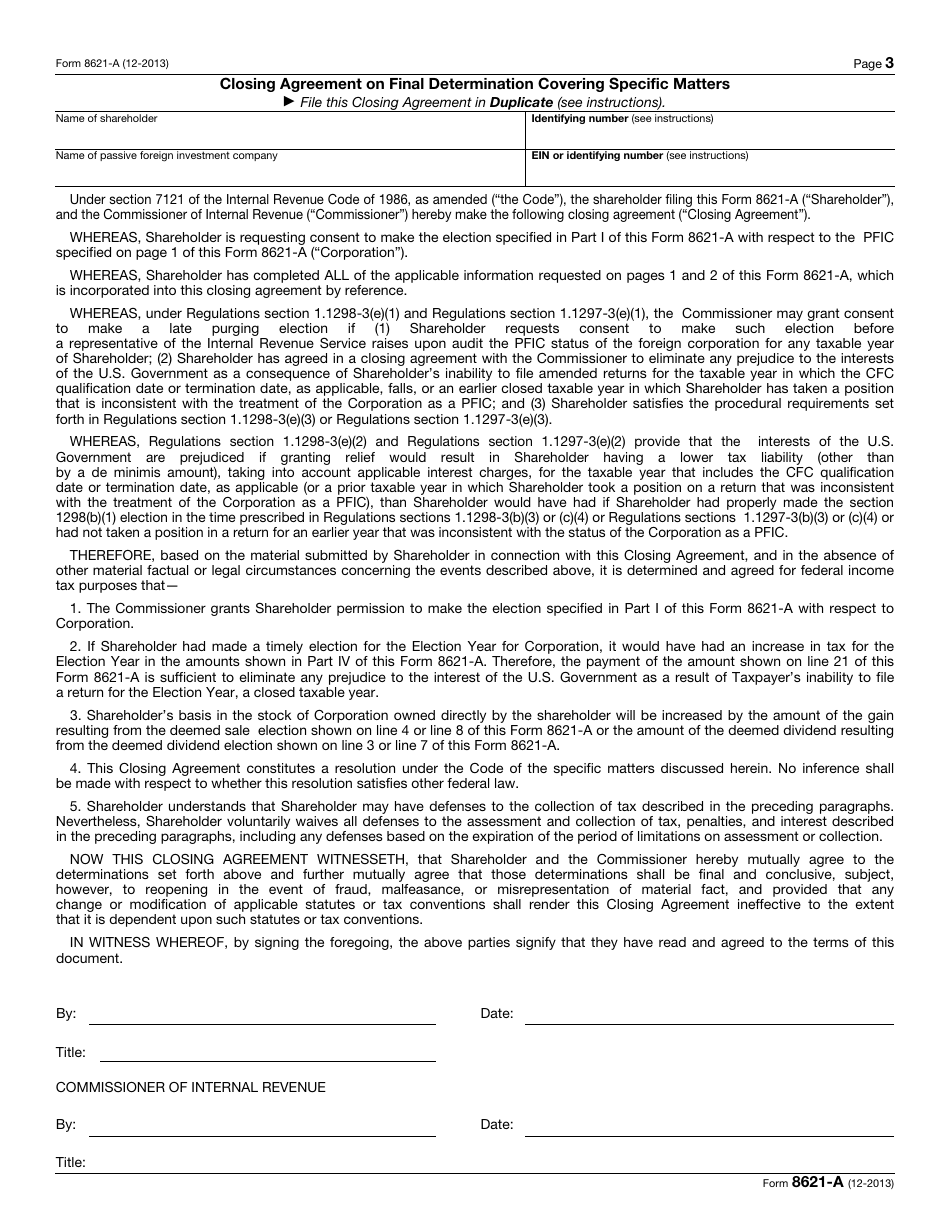

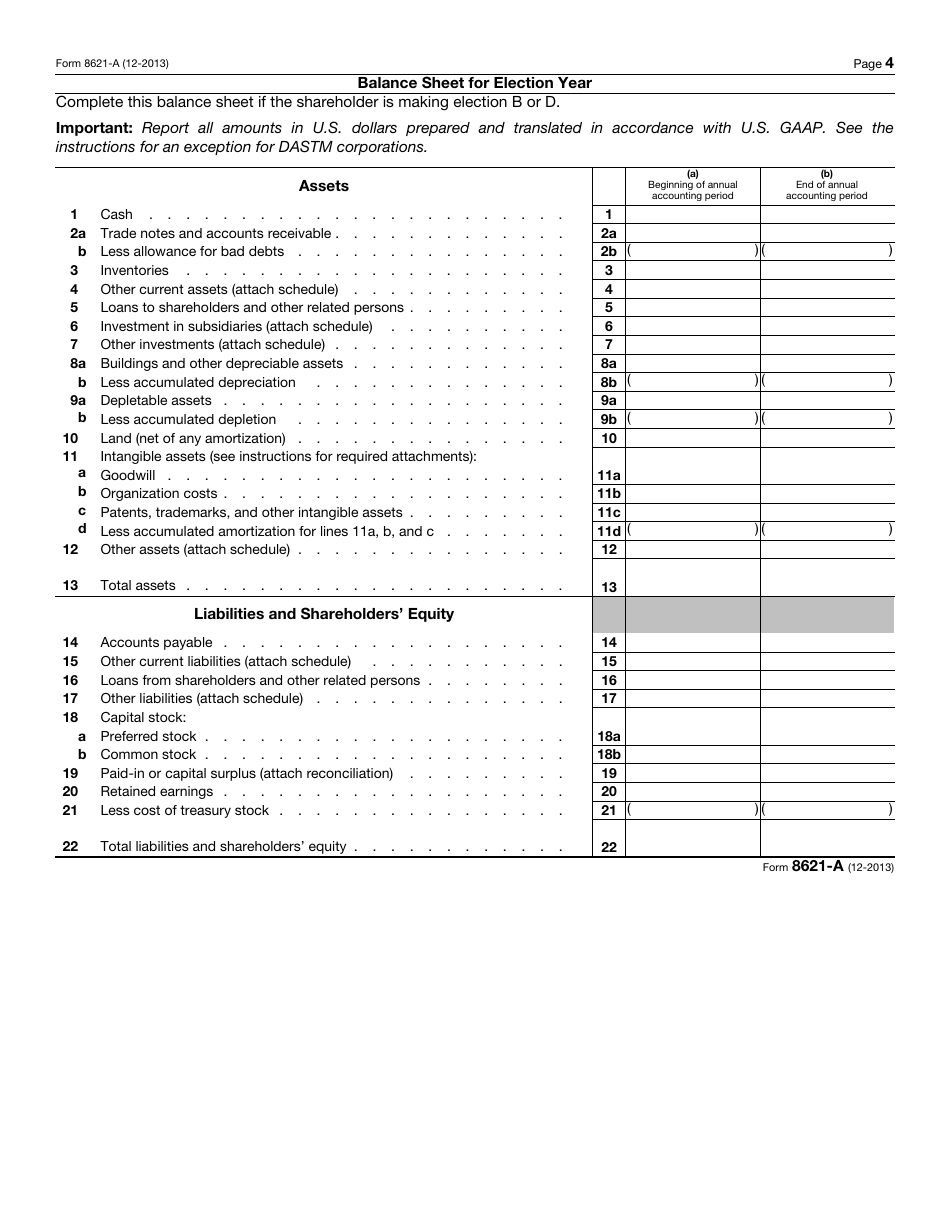

IRS Form 8621-A Return by a Shareholder Making Certain Late Elections to End Treatment as a Passive Foreign Investment Company

What Is IRS Form 8621-A?

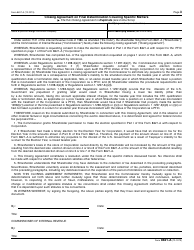

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2013. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8621-A?

A: IRS Form 8621-A is a form used by shareholders to make certain late elections to end treatment as a passive foreign investment company.

Q: Who needs to file IRS Form 8621-A?

A: Shareholders who want to make certain late elections to end treatment as a passive foreign investment company need to file IRS Form 8621-A.

Q: What is a passive foreign investment company?

A: A passive foreign investment company (PFIC) is a foreign corporation that meets certain criteria related to its income and assets.

Q: Why would a shareholder want to end treatment as a PFIC?

A: Ending treatment as a PFIC can have tax advantages for the shareholder, such as avoiding certain tax reporting requirements and potentially reducing tax liabilities.

Q: Is there a deadline for filing IRS Form 8621-A?

A: Yes, there is a deadline for filing IRS Form 8621-A. The specific deadline may depend on the shareholder's individual circumstances, so it is important to consult the instructions for the form or seek professional tax advice.

Q: Are there any penalties for not filing IRS Form 8621-A?

A: There can be penalties for not filing IRS Form 8621-A, especially if the shareholder was required to file the form under the applicable tax laws. It is important to comply with the necessary tax filing requirements to avoid any potential penalties.

Form Details:

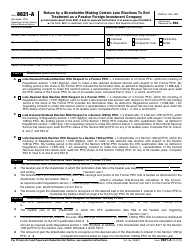

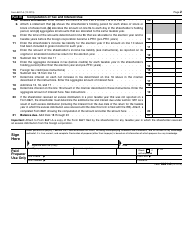

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8621-A through the link below or browse more documents in our library of IRS Forms.