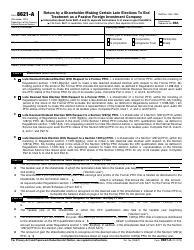

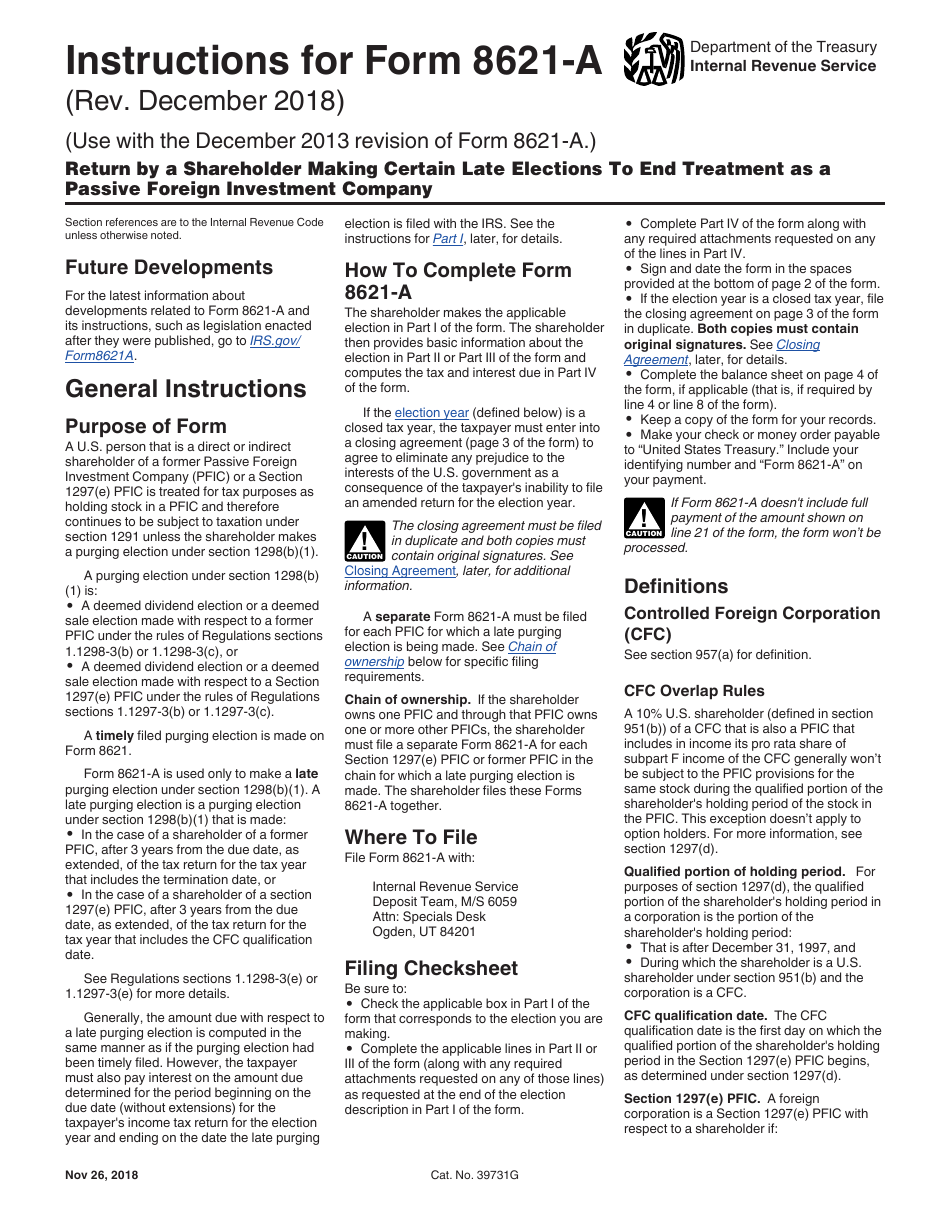

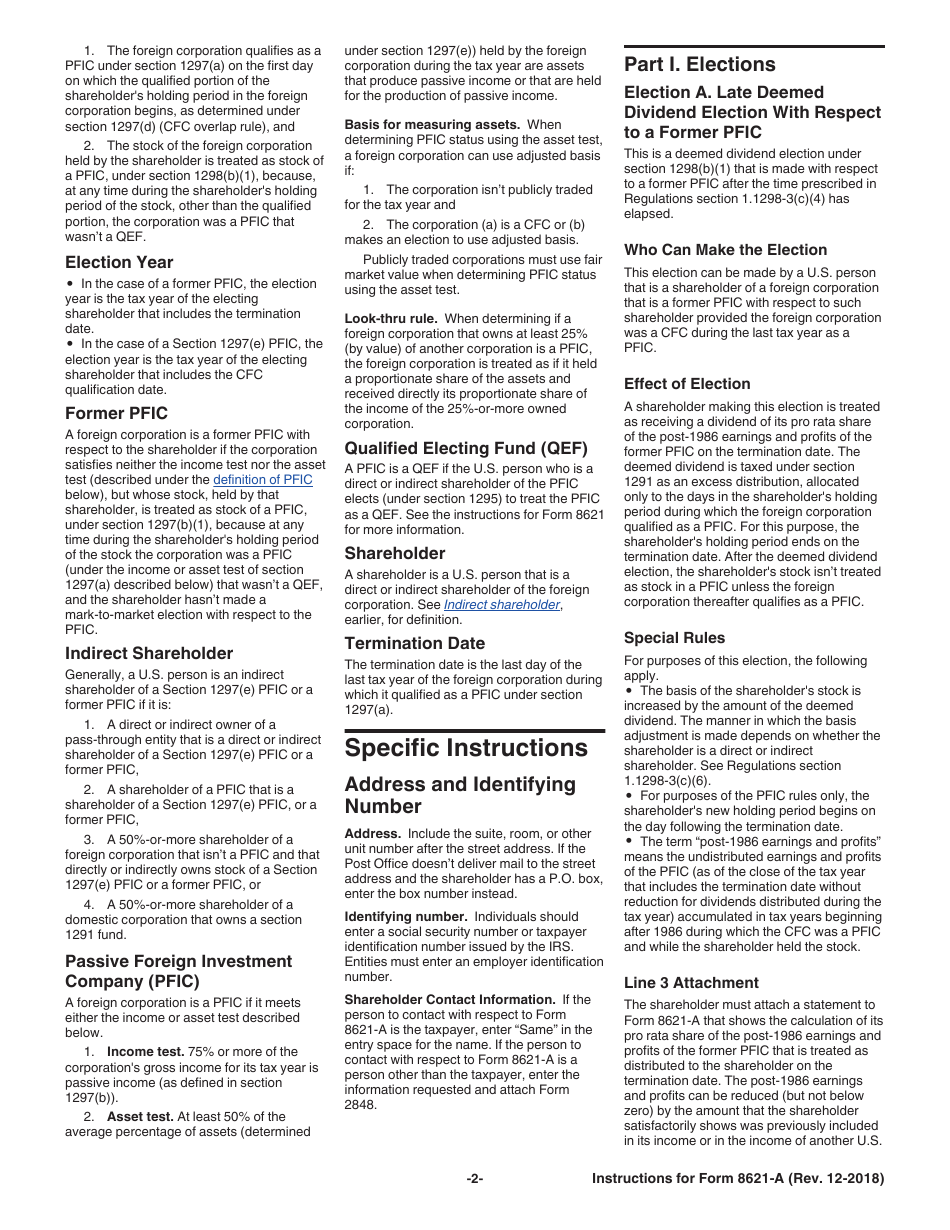

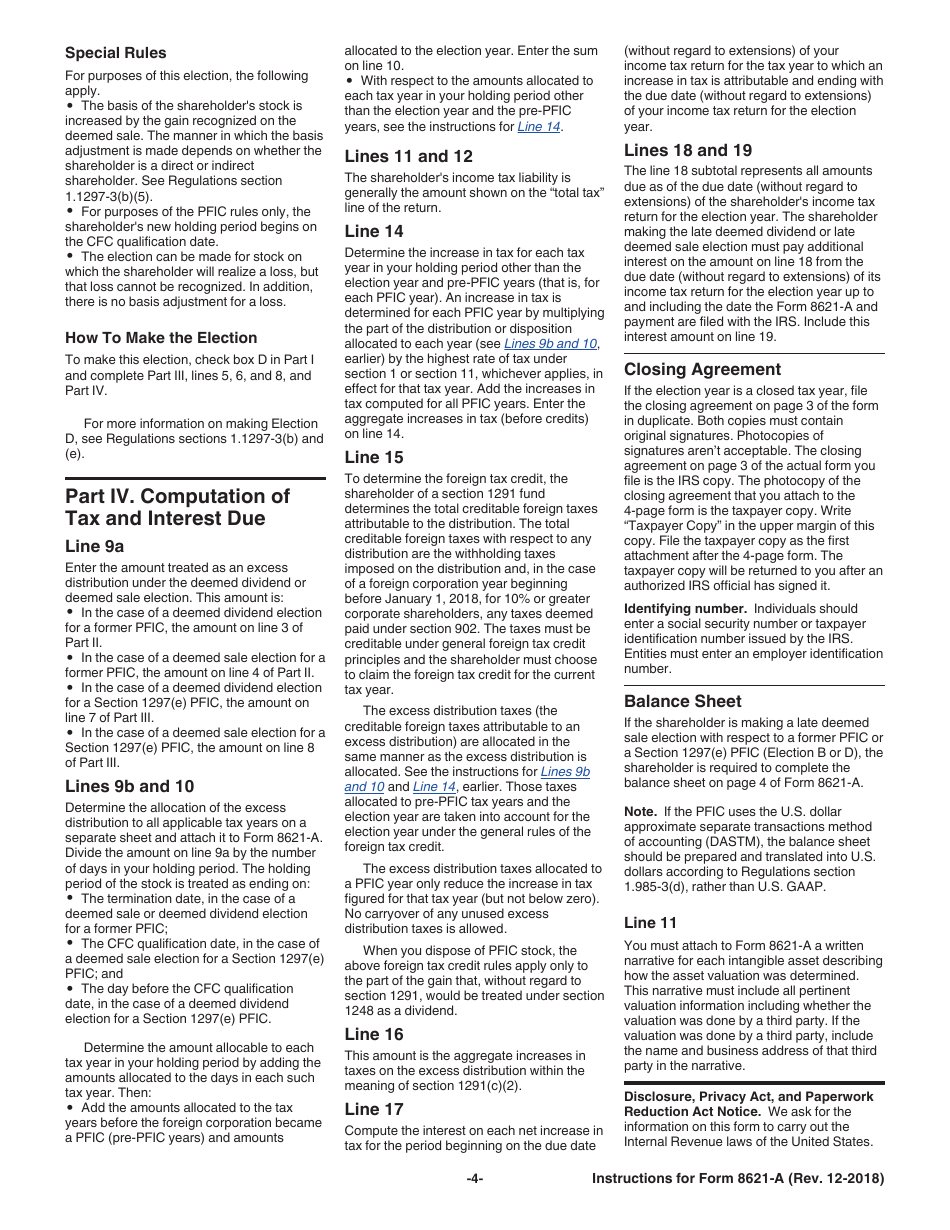

Instructions for IRS Form 8621-A Return by a Shareholder Making Certain Late Elections to End Treatment as a Passive Foreign Investment Company

This document contains official instructions for IRS Form 8621-A , Return by a Shareholder Making Certain Late Elections to End Treatment as a Passive Foreign Investment Company - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8621-A is available for download through this link.

FAQ

Q: What is IRS Form 8621-A?

A: IRS Form 8621-A is a form used by shareholders to make certain late elections to end treatment as a Passive Foreign Investment Company (PFIC).

Q: Who needs to file IRS Form 8621-A?

A: Shareholders who are making late elections to end treatment as a PFIC need to file IRS Form 8621-A.

Q: Why would someone need to make a late election to end treatment as a PFIC?

A: There may be various reasons why someone would make a late election to end treatment as a PFIC, such as changes in their investment situation or realizing the potential tax consequences.

Q: What are the consequences of not filing IRS Form 8621-A?

A: Not filing IRS Form 8621-A may result in penalties and potential tax liabilities.

Q: Are there any specific instructions for filling out IRS Form 8621-A?

A: Yes, there are specific instructions provided by the IRS for filling out IRS Form 8621-A. These instructions should be carefully followed to ensure accurate completion of the form.

Q: When is the deadline for filing IRS Form 8621-A?

A: The deadline for filing IRS Form 8621-A is typically the same as the deadline for filing the individual's tax return, which is April 15th.

Q: Can I file IRS Form 8621-A electronically?

A: No, IRS Form 8621-A cannot be filed electronically and must be mailed to the IRS.

Q: What other documents may be required to accompany IRS Form 8621-A?

A: Depending on the individual's situation, other documents may be required to accompany IRS Form 8621-A, such as financial statements or supporting documentation for late elections.

Q: Is it advisable to seek professional assistance when filing IRS Form 8621-A?

A: Yes, it is often advisable to seek professional assistance, such as a tax advisor or accountant, when filing IRS Form 8621-A to ensure accuracy and compliance with tax laws and regulations.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.