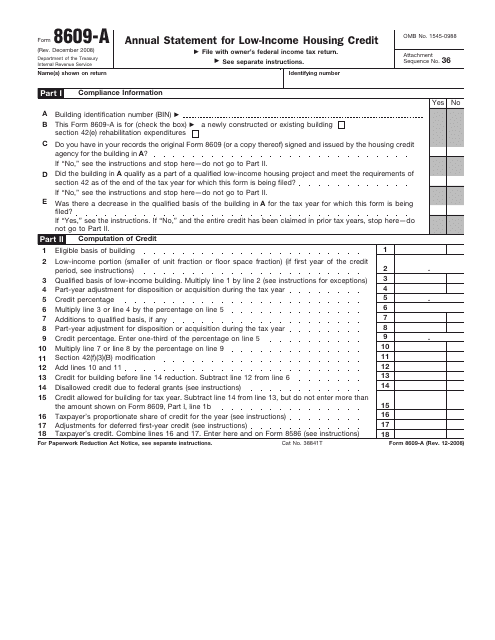

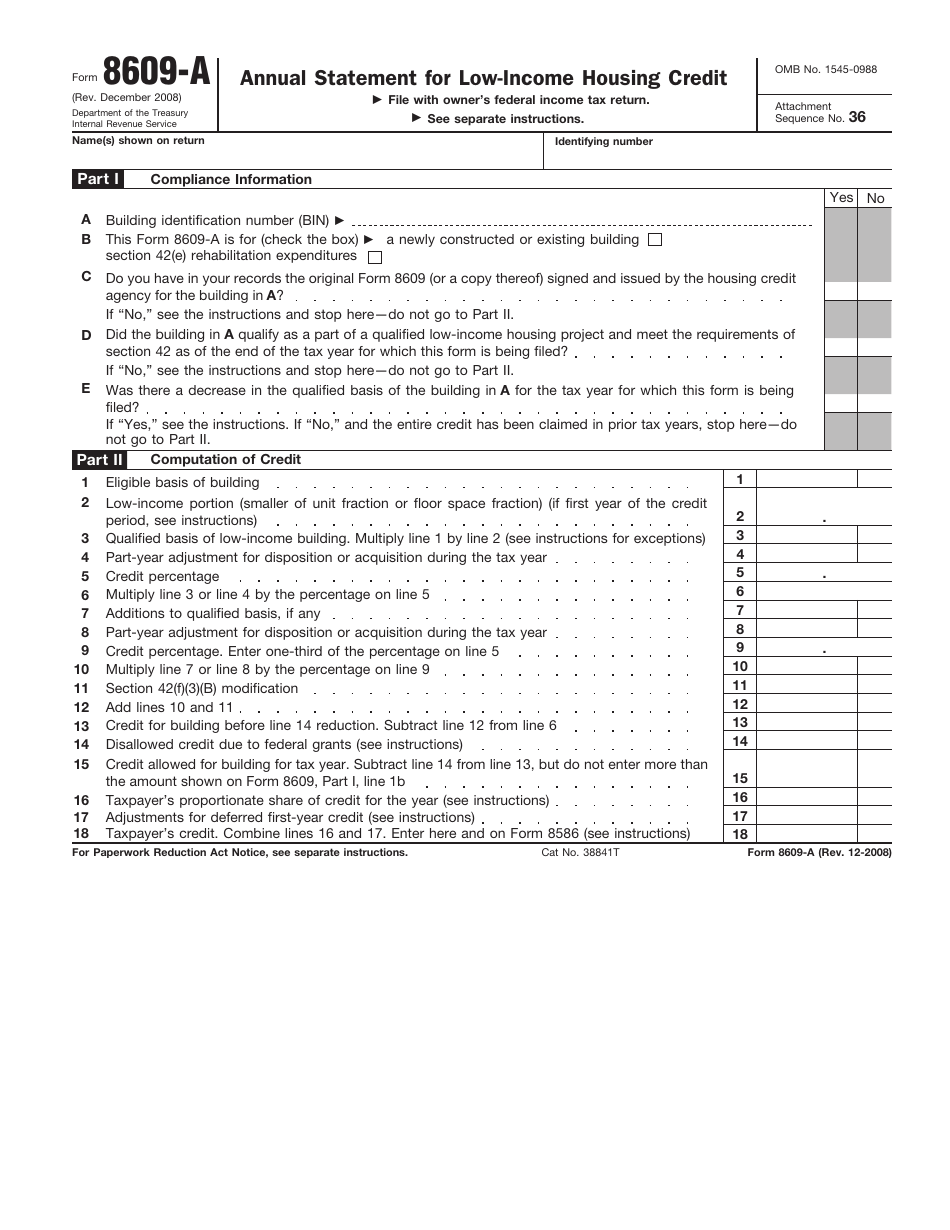

IRS Form 8609-A Annual Statement for Low-Income Housing Credit

What Is IRS Form 8609-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2008. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8609-A?

A: IRS Form 8609-A is the Annual Statement for Low-Income Housing Credit.

Q: Who needs to fill out IRS Form 8609-A?

A: Owners of low-income housing projects that have been allocated the Low-Income Housing Credit need to fill out this form.

Q: What is the purpose of IRS Form 8609-A?

A: The purpose of Form 8609-A is to report certain information about the low-income housing project and to claim the Low-Income Housing Credit.

Q: When is IRS Form 8609-A due?

A: Form 8609-A is generally due on the 28th day of the 6th month after the close of the project's tax year.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8609-A through the link below or browse more documents in our library of IRS Forms.