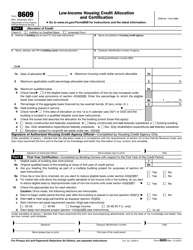

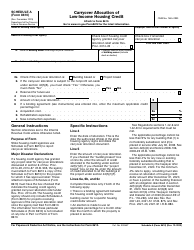

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8609-A

for the current year.

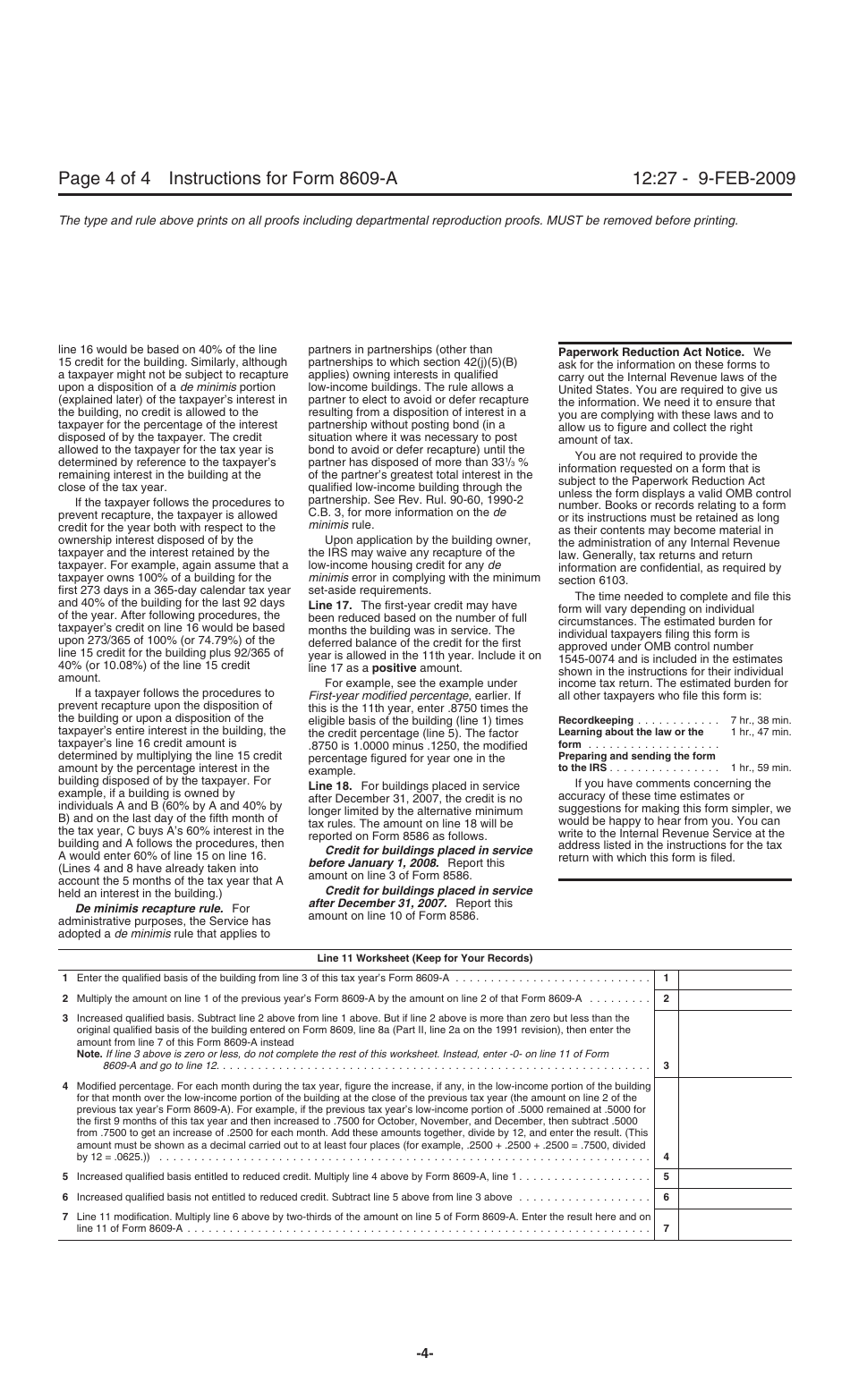

Instructions for IRS Form 8609-A Annual Statement for Low-Income Housing Credit

This document contains official instructions for IRS Form 8609-A , Annual Statement for Low-Income Housing Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8609-A is available for download through this link.

FAQ

Q: What is IRS Form 8609-A?

A: IRS Form 8609-A is the Annual Statement for Low-Income Housing Credit.

Q: Who needs to file IRS Form 8609-A?

A: Owners or investors of low-income housing properties need to file IRS Form 8609-A.

Q: What is the purpose of IRS Form 8609-A?

A: The purpose of IRS Form 8609-A is to report the low-income housing credits claimed by the property owner.

Q: When is IRS Form 8609-A due?

A: IRS Form 8609-A is due by the 15th day of the 7th month following the end of the property's fiscal year.

Q: What are the penalties for not filing IRS Form 8609-A?

A: Failure to file IRS Form 8609-A may result in penalties and interest charges.

Q: Are there any exceptions to filing IRS Form 8609-A?

A: There are no exceptions to filing IRS Form 8609-A for eligible low-income housing properties.

Q: Can IRS Form 8609-A be e-filed?

A: No, IRS Form 8609-A cannot be e-filed and must be filed by mail.

Q: Do I need to attach any supporting documents with IRS Form 8609-A?

A: Yes, you may need to attach certain supporting documents such as financial statements and rent rolls.

Q: Does IRS Form 8609-A apply to both residential and commercial properties?

A: IRS Form 8609-A only applies to low-income housing properties intended for residential use.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.