This version of the form is not currently in use and is provided for reference only. Download this version of

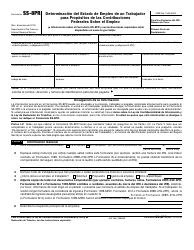

IRS Form SS-8

for the current year.

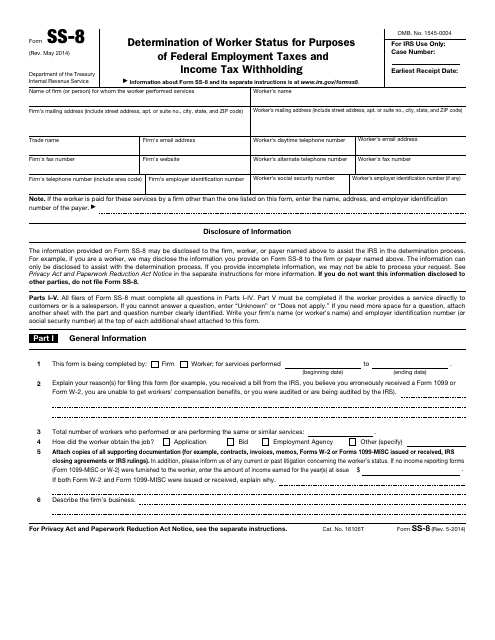

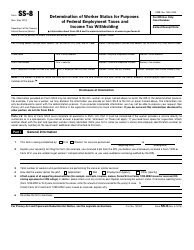

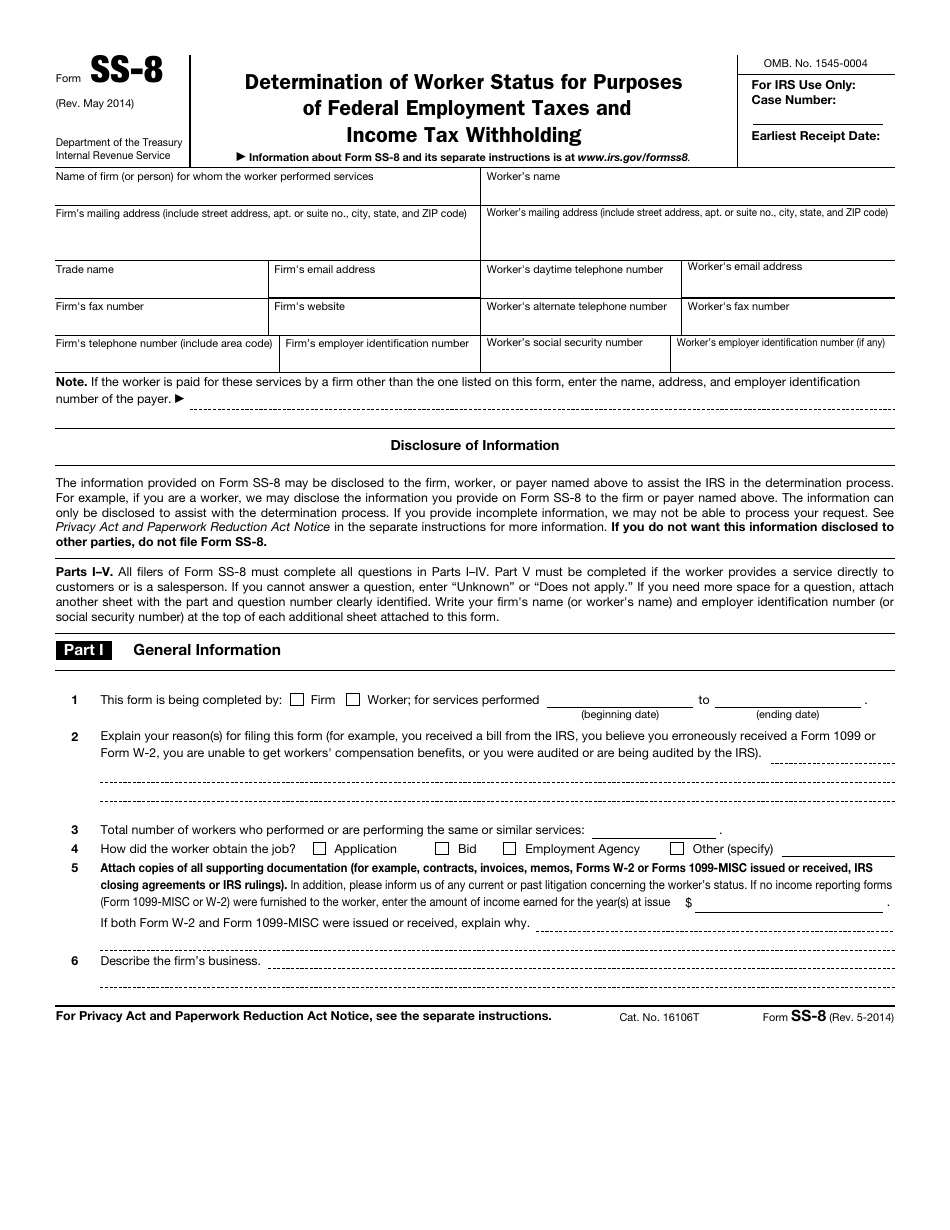

IRS Form SS-8 Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding

What Is IRS Form SS-8?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on May 1, 2014. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

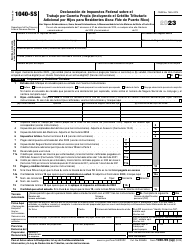

Q: What is IRS Form SS-8?

A: IRS Form SS-8 is used to determine the worker status for federal employment taxes and income tax withholding purposes.

Q: Who uses IRS Form SS-8?

A: Both workers and businesses use IRS Form SS-8.

Q: Why is IRS Form SS-8 important?

A: IRS Form SS-8 helps determine whether a worker is an employee or an independent contractor for tax purposes.

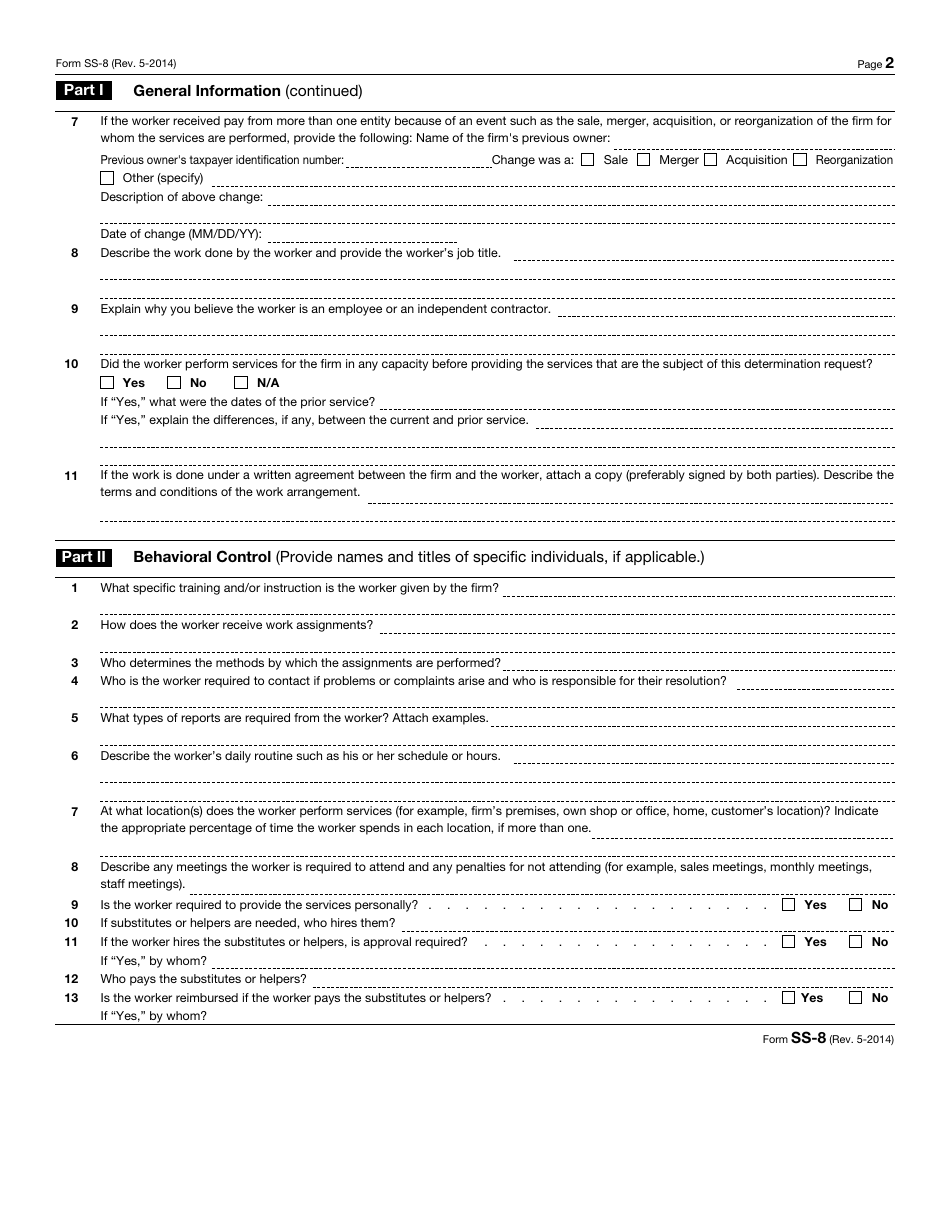

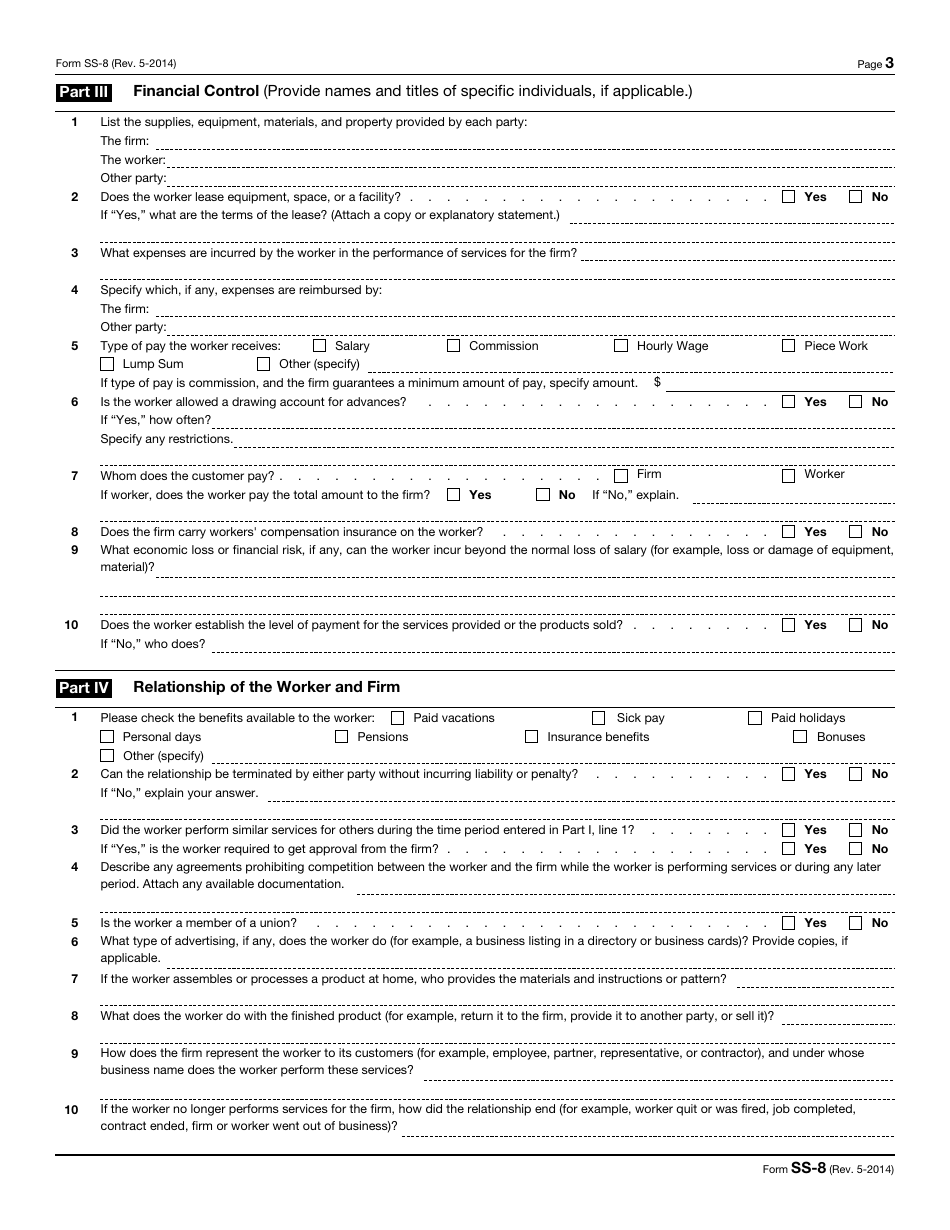

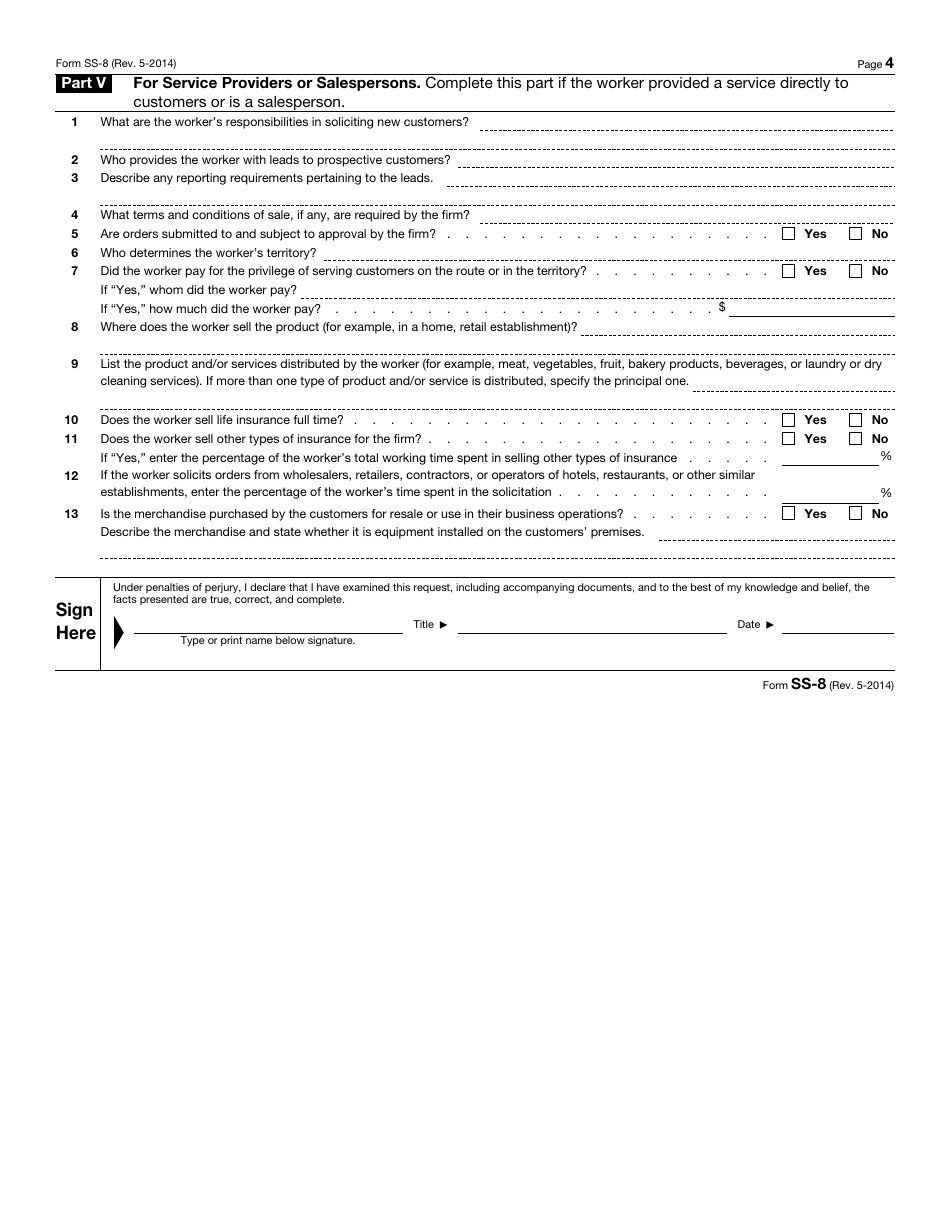

Q: How does the IRS determine worker status?

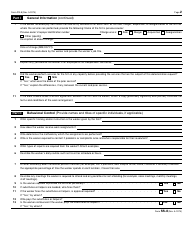

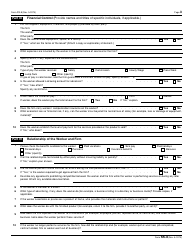

A: The IRS considers factors such as behavioral control, financial control, and the relationship between the worker and the business.

Q: What happens after filing IRS Form SS-8?

A: The IRS reviews the information provided and makes a determination on the worker's status.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form SS-8 through the link below or browse more documents in our library of IRS Forms.