This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form SS-8

for the current year.

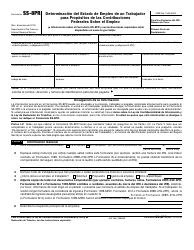

Instructions for IRS Form SS-8 Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding

This document contains official instructions for IRS Form SS-8 , Determination of Federal Employment Taxes and Income Tax Withholding - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form SS-8?

A: IRS Form SS-8 is a form used to officially request a determination of a worker's status for federal employment taxes and income tax withholding purposes.

Q: Who should use IRS Form SS-8?

A: Both employers and workers can use IRS Form SS-8 to request a determination of worker status.

Q: Why would someone need to use IRS Form SS-8?

A: IRS Form SS-8 is used to resolve questions about the classification of a worker as an employee or an independent contractor for tax purposes.

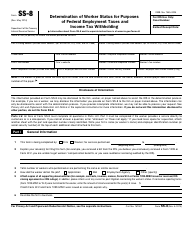

Q: What information is required when filling out IRS Form SS-8?

A: When filling out IRS Form SS-8, you will need to provide detailed information about the worker, the work performed, and the relationship between the worker and the employer.

Q: What happens after I submit IRS Form SS-8?

A: After you submit IRS Form SS-8, the IRS will review the information provided and make a determination regarding the worker's employment status.

Q: Can the determination made on IRS Form SS-8 be appealed?

A: Yes, if either the employer or the worker disagrees with the determination made on IRS Form SS-8, they can appeal the decision.

Q: Are there any fees involved with submitting IRS Form SS-8?

A: No, there are no fees required to submit IRS Form SS-8.

Q: Is assistance available for completing IRS Form SS-8?

A: Yes, you can seek assistance from the IRS or a qualified tax professional when completing IRS Form SS-8.

Q: Is there a deadline for submitting IRS Form SS-8?

A: There is no specific deadline for submitting IRS Form SS-8, but it is recommended to submit it as soon as possible when there are questions about a worker's employment status.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.