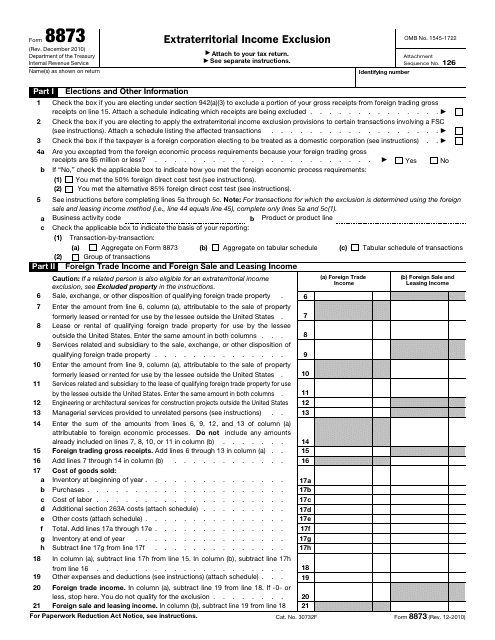

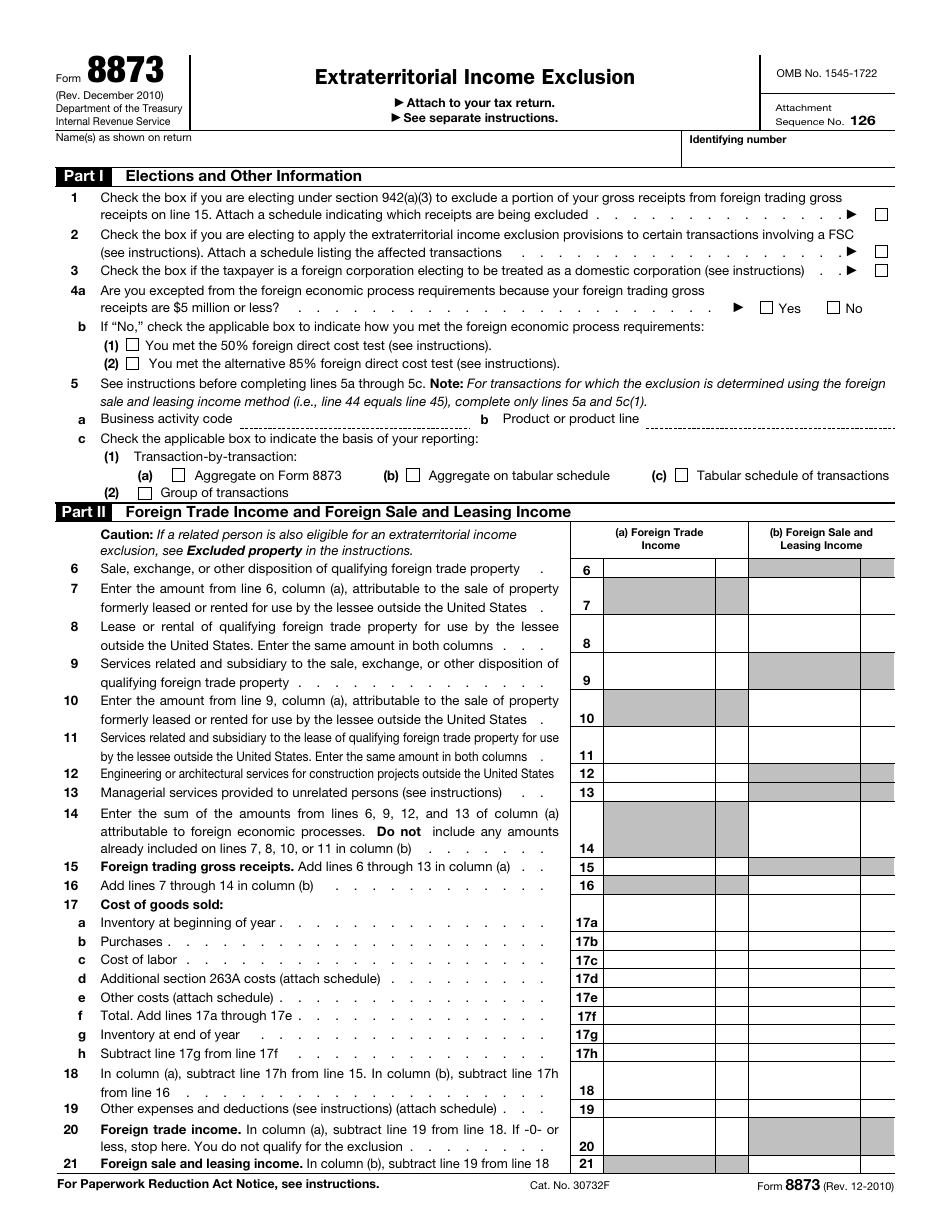

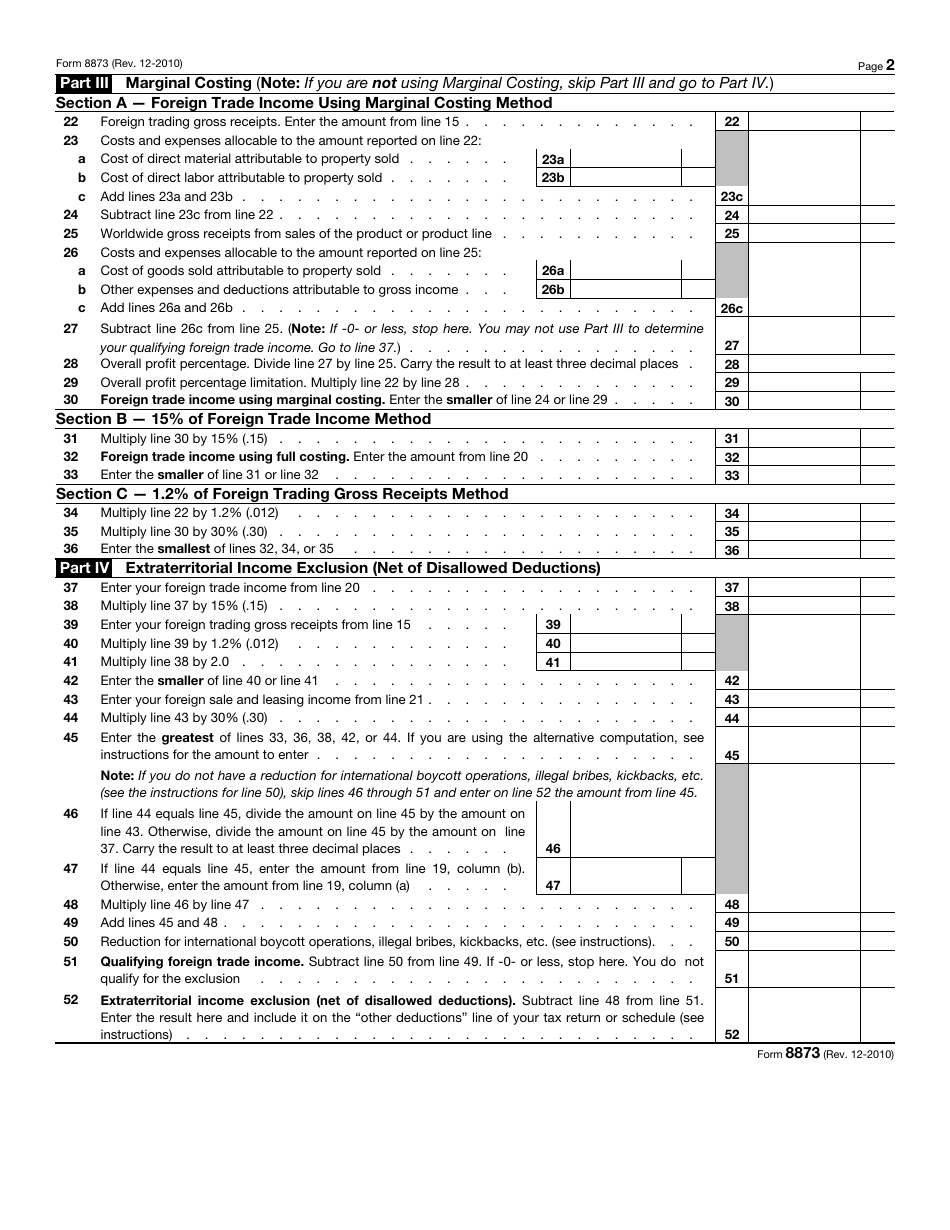

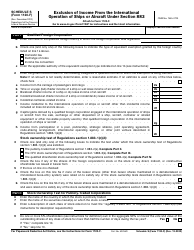

IRS Form 8873 Extraterritorial Income Exclusion

What Is IRS Form 8873?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2010. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8873?

A: IRS Form 8873 is a form used to claim the Extraterritorial Income Exclusion.

Q: What is the Extraterritorial Income Exclusion?

A: The Extraterritorial Income Exclusion is a provision that allows eligible U.S. taxpayers to exclude income earned from certain foreign sales.

Q: Who can claim the Extraterritorial Income Exclusion?

A: U.S. taxpayers engaged in qualifying activities can claim the Extraterritorial Income Exclusion.

Q: What are qualifying activities?

A: Qualifying activities include the manufacture, production, growth, or extraction of certain property within the United States.

Q: How do I file IRS Form 8873?

A: You can file IRS Form 8873 along with your annual income tax return.

Q: Is the Extraterritorial Income Exclusion available to all taxpayers?

A: No, the Extraterritorial Income Exclusion is only available to eligible U.S. taxpayers engaged in qualifying activities.

Q: Are there any limitations on the Extraterritorial Income Exclusion?

A: Yes, there are certain limitations on the amount of income that can be excluded under the Extraterritorial Income Exclusion.

Q: Can I claim the Extraterritorial Income Exclusion if I do not engage in qualifying activities?

A: No, the Extraterritorial Income Exclusion is only available to taxpayers engaged in qualifying activities.

Q: What documentation do I need to support my claim for the Extraterritorial Income Exclusion?

A: You may be required to provide documentation such as sales receipts, contracts, or other records to support your claim for the Extraterritorial Income Exclusion.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8873 through the link below or browse more documents in our library of IRS Forms.