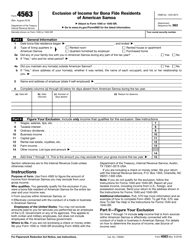

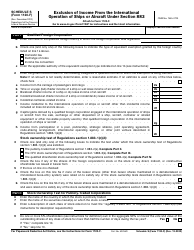

Instructions for IRS Form 8873 Extraterritorial Income Exclusion

This document contains official instructions for IRS Form 8873 , Extraterritorial Income Exclusion - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8873 is available for download through this link.

FAQ

Q: What is IRS Form 8873?

A: IRS Form 8873 is a form used to claim the Extraterritorial Income Exclusion (ETIE) for individuals.

Q: What is the Extraterritorial Income Exclusion (ETIE)?

A: The Extraterritorial Income Exclusion (ETIE) is a provision that allows certain U.S. citizens or residents to exclude qualifying foreign income from their taxable income.

Q: Who is eligible to claim the ETIE?

A: U.S. citizens or residents who meet certain requirements, such as owning or working for a qualifying foreign corporation, may be eligible to claim the ETIE.

Q: What is the purpose of Form 8873?

A: Form 8873 is used to calculate and report the amount of extraterritorial income exclusion that a taxpayer is entitled to.

Q: What information do I need to complete Form 8873?

A: To complete Form 8873, you will need information about your foreign business activities, qualifying foreign income, and other relevant details.

Q: When is the deadline to file Form 8873?

A: The deadline to file Form 8873 is usually the same as the deadline to file your individual income tax return, which is April 15th.

Q: Are there any penalties for not filing Form 8873?

A: Yes, failure to file Form 8873 or reporting incorrect information can result in penalties and potential legal consequences.

Q: Can I claim the ETIE if I live and work in the United States?

A: No, the Extraterritorial Income Exclusion is specifically for income earned outside the United States.

Q: Can I claim the ETIE if I am a non-U.S. citizen?

A: No, the Extraterritorial Income Exclusion is only available to U.S. citizens or residents.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.