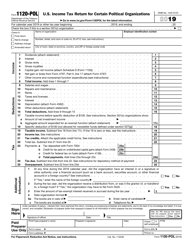

Instructions for IRS Form 8871 Political Organization Notice of Section 527 Status

This document contains official instructions for IRS Form 8871 , Political Organization Notice of Section 527 Status - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8871?

A: IRS Form 8871 is a form used by political organizations to notify the IRS of their Section 527 status.

Q: What is a political organization?

A: A political organization is a group that is organized primarily for the purpose of influencing political elections.

Q: What is Section 527 status?

A: Section 527 status refers to the tax-exempt status granted to certain political organizations under the Internal Revenue Code.

Q: Why do political organizations need to file Form 8871?

A: Political organizations need to file Form 8871 to provide notice to the IRS of their Section 527 status and to disclose certain information about their activities.

Q: What information is required on Form 8871?

A: Form 8871 requires political organizations to provide information such as their name, address, purpose, and financial activity.

Q: When does Form 8871 need to be filed?

A: Form 8871 needs to be filed within 24 hours of a political organization being established or within 30 days of a political organization changing its status.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.