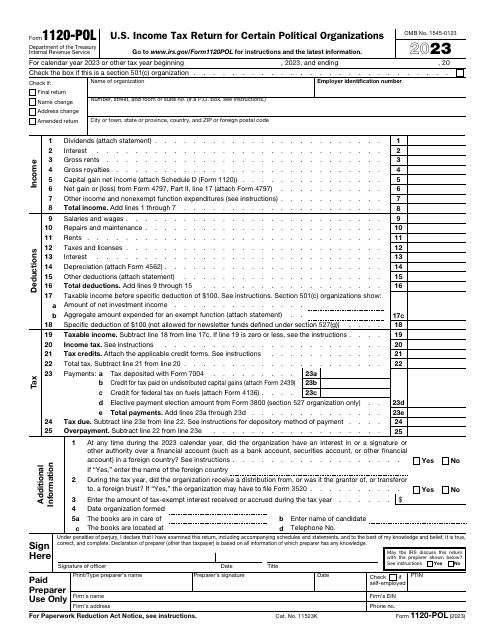

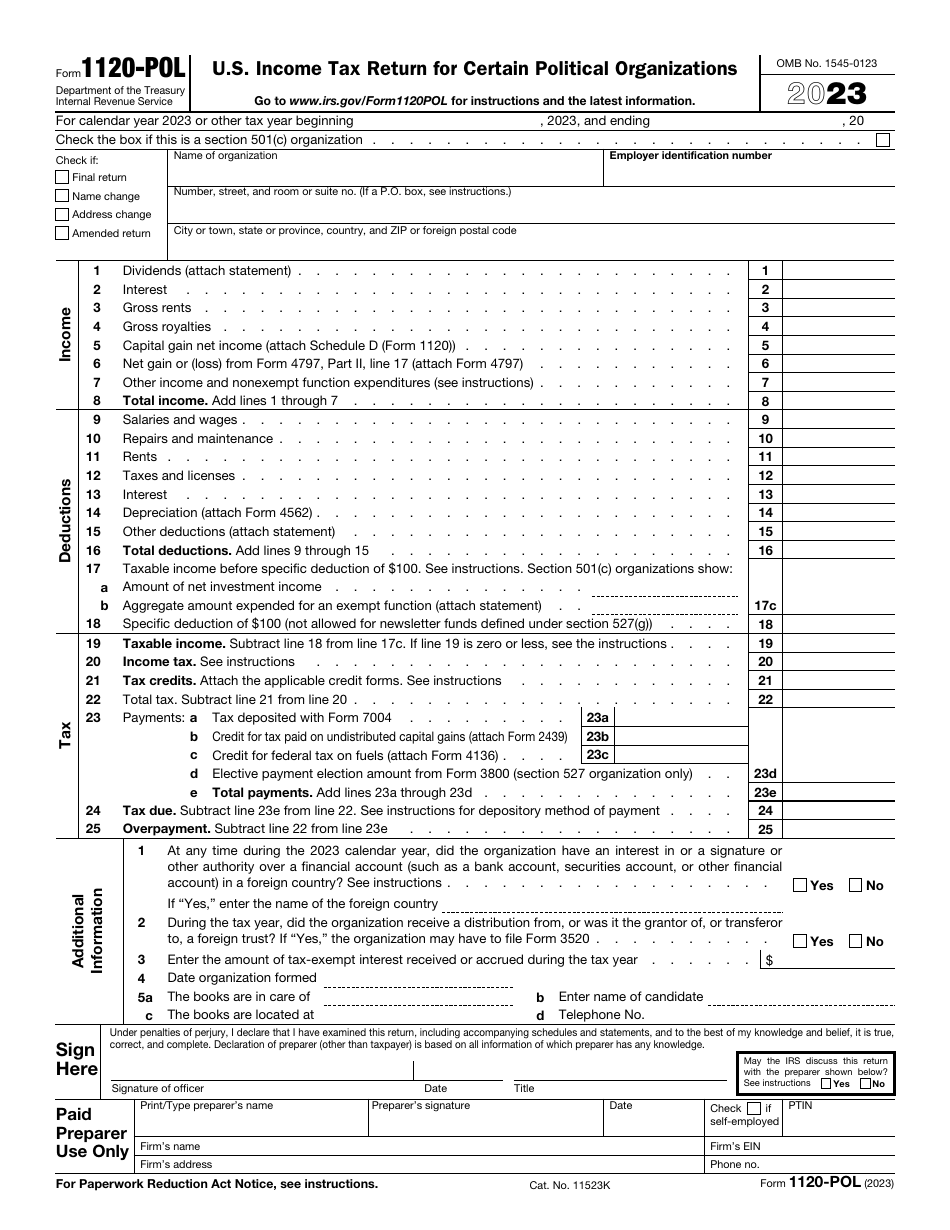

IRS Form 1120-POL U.S. Income Tax Return for Certain Political Organizations

What Is IRS Form 1120-POL?

IRS Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations , is a document used to provide information about a political organization's taxable income and tax liability according to Section 527.

The 1120-POL Form is a simple one-page form. It can be complemented with the Schedule D (Form 1120), Capital Gains and Losses. Fill out this schedule to report capital gains distributions not provided on the main form.

The document was issued by the Internal Revenue Service (IRS) and last revised in 2023 . Download the latest fillable Form 1120-POL through the link below.

IRS Form 1120-POL Instructions

Most fields of the IRS Form 1120-POL are self-explanatory. The detailed completion information is provided in the IRS instructions attached to the fillable form.

The general 1120-POL filing requirements are as follows:

- File this form if your political organization has any taxable income, whether or not it is considered as tax-exempt;

- Submit this form if you are not a political organization, but have political organization taxable income described in section 527(f)(1);

- The 1120-POL due date is the 15th day of the 4th month after the end of the tax year;

- If you cannot file the form by the due date, apply for the automatic extension via Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns;

- Fill out every applicable box. Do not enter "See attached" instead of filling out the box;

- Make sure you have provided the organization's name and employer organization number (EIN) on each attachment;

- If you applied for the EIN but have not received it by the time the return is due, enter "Applied for" and the application date in the appropriate field;

- Assembling the return, attach Form 4136 right after 1120-POL Form. Then, attach all the schedules in alphabetical, and other forms in numerical order;

- Mail the form and the attachments to the following address: Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201;

- If the principal office or business of your organization is located in any of the United States possessions or in a foreign country, use the following address: Internal Revenue Service Center, PO Box 409101, Ogden, UT 84409.

If you do not file the form on time, you may be subject to a penalty of 5% of the unpaid tax for each month, unless you provide a reasonable cause for not meeting the deadline. Provide the explanations after receiving the notice about the penalty. Do not attach them to your return form. If your return is more than 60 days late, the minimum penalty is the tax due or $210, whichever is smaller.

IRS 1120-POL Related Forms:

- Form 990, Return of Organization Exempt From Income Tax. This form is a return filed by political organizations, tax-exempt organizations, and nonexempt charitable trusts;

- Form 990-EZ, Short Form Return of Organization Exempt from Income Tax. This is the short version of the abovementioned form;

- Form 1118, Foreign Tax Credit - Corporations. Calculate your foreign tax credit for taxes paid to foreign countries or the United States possessions on this form;

- Form 1128, Application to Adopt, Change or Retain a Tax Year. Use the form to request a change of a tax year;

- Form 3520, Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts. Report transactions with or gifts from foreign trusts and persons on this form;

- Form 3520-A, Annual Information Return of Foreign Trust with a U.S. Owner. The form is filed by a foreign trust to inform about the trust and its United States beneficiaries and owners;

- Form 3800, General Business Credit. Apply for business credits via this form;

- Form 8822-B, Change of Address or Responsible Party - Business. Use it to report the change of your organization's mailing address, location, or responsible party;

- Form 8834, Qualified Electric Vehicle Credit. Claim the electric vehiclepassive activity credits using this form;

- Instructions for IRS Form 8871, Political Organization Notice of Section 527 Status. Use this document to notify the IRS that your organization is to be treated as a section 527 organization;

- Form 8872, Political Organization Report of Contributions and Expenditures. Complete this form to inform about the expenditures made and the contributions received.