This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 5329

for the current year.

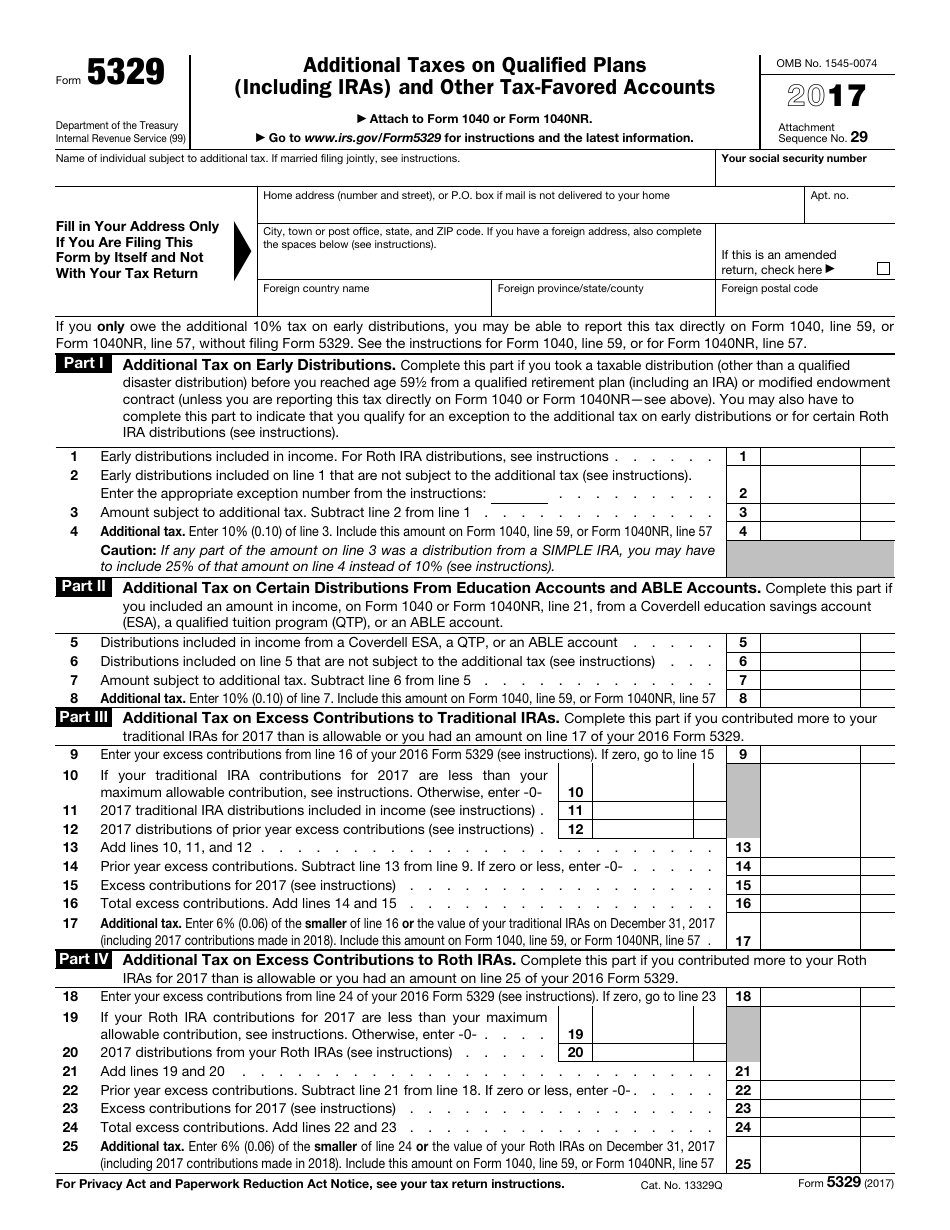

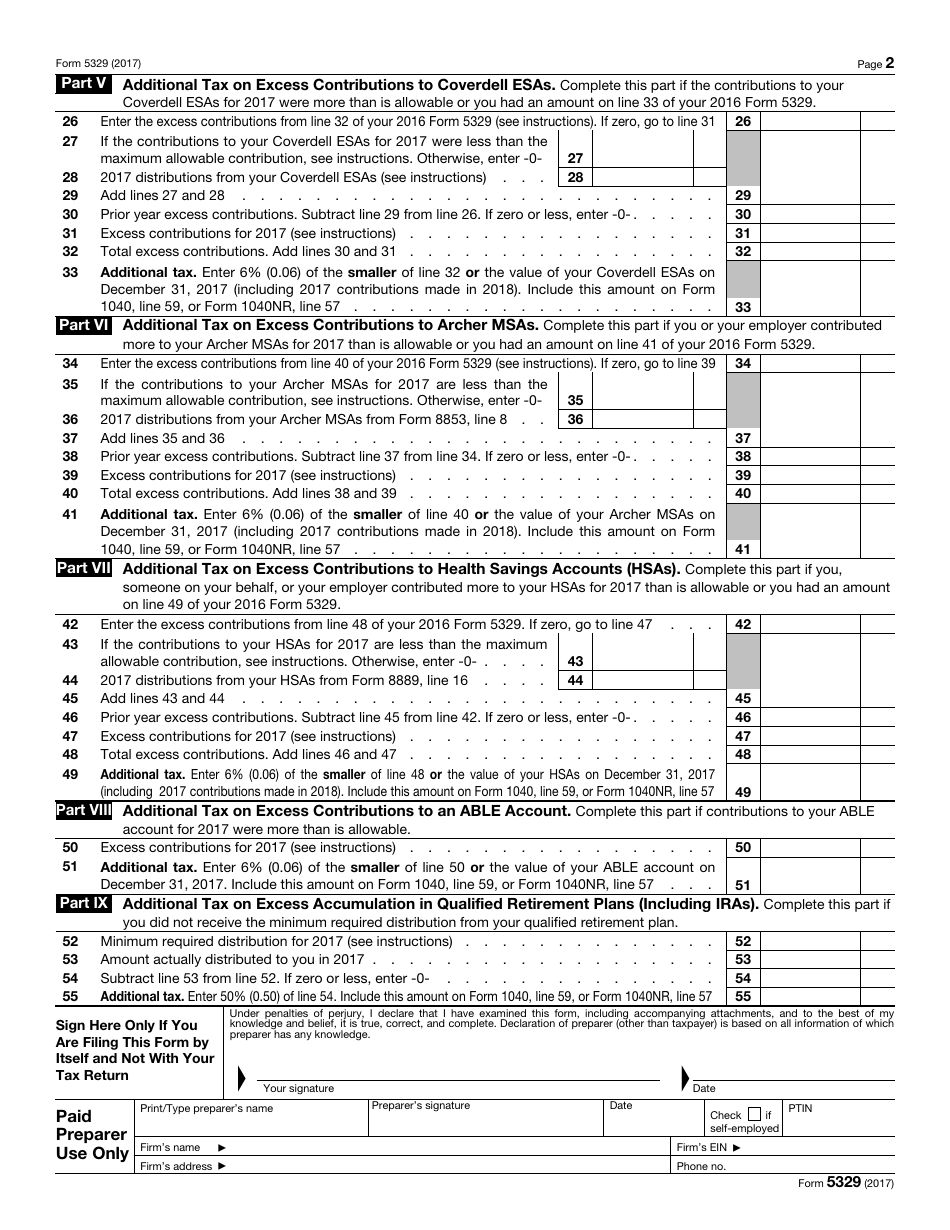

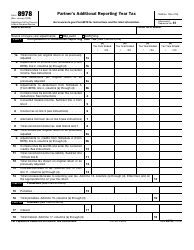

IRS Form 5329 Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts

What Is IRS Form 5329?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 5329?

A: Form 5329 is a tax form used to report and pay additional taxes on qualified plans and other tax-favored accounts.

Q: What types of accounts does Form 5329 cover?

A: Form 5329 covers qualified plans, such as 401(k)s and IRAs, as well as other tax-favored accounts like Health Savings Accounts (HSAs) and Coverdell Education Savings Accounts.

Q: Why would I need to file Form 5329?

A: You may need to file Form 5329 if you owe additional taxes on distributions or contributions made to your qualified plans or tax-favored accounts.

Q: What are some common reasons for owing additional taxes on Form 5329?

A: Some common reasons include early withdrawals from retirement accounts, excess contributions to IRAs, and failure to take required minimum distributions.

Q: Are there any penalties for not filing Form 5329?

A: Yes, if you are required to file Form 5329 and fail to do so, you may be subject to penalties and interest on the additional taxes owed.

Q: Can I e-file Form 5329?

A: Yes, you can e-file Form 5329 along with your federal income tax return.

Q: When is the deadline to file Form 5329?

A: Form 5329 is typically due on the same deadline as your federal income tax return, which is usually April 15th.

Q: Can I request an extension to file Form 5329?

A: Yes, you can request an extension to file Form 5329 by filing Form 4868 and indicating that you need additional time to file your tax return.

Q: Do I need to include any supporting documents with Form 5329?

A: You generally do not need to include supporting documents when filing Form 5329, but you should keep them in your records in case of an audit.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5329 through the link below or browse more documents in our library of IRS Forms.